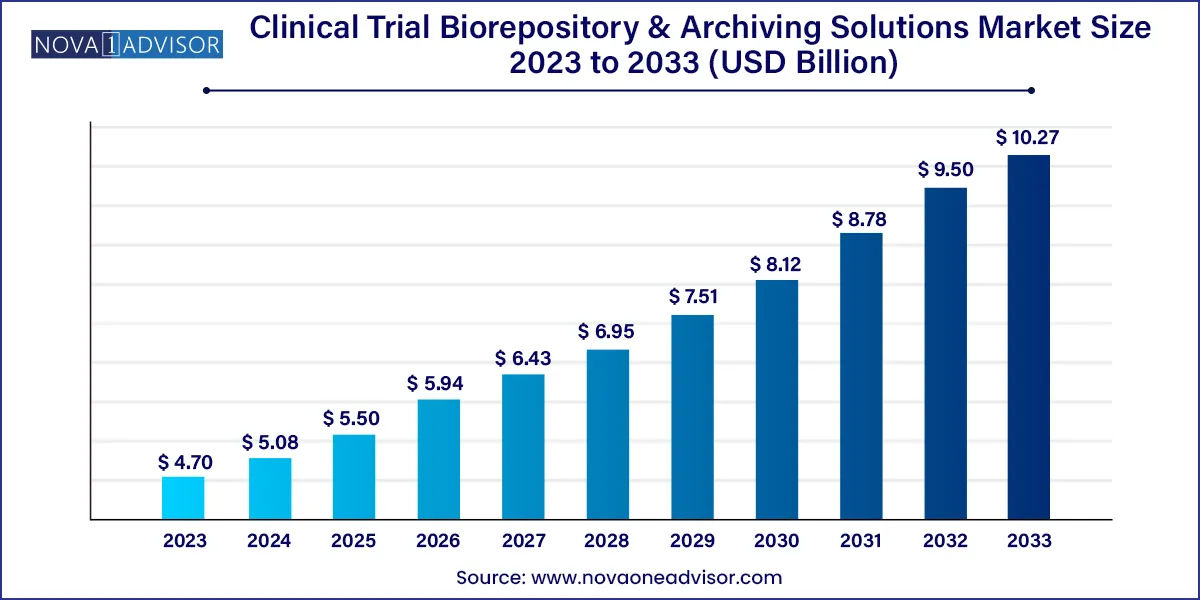

The global clinical trial biorepository & archiving solutions market size was exhibited at USD 4.70 billion in 2023 and is projected to hit around USD 10.27 billion by 2033, growing at a CAGR of 8.13% during the forecast period 2024 to 2033.

Major pharmaceutical companies are focusing on outsourcing R&D activities to enhance their core competencies, which is expected to drive overall market growth. Furthermore, the economic benefits of outsourcing in comparison to investing in cold storage equipment and other related supplies are also expected to boost the demand over the forecast period. Maintaining pace with the growing storage and transportation technology, global regulatory requirements, and current bio-storage trends can immensely cost time and effort.

CROs are witnessing major revenue growth owing to rising R&D expenditure and increasing focus of pharmaceutical companies on novel drug development with reduced cost. Biopharmaceutical companies are increasingly outsourcing their clinical trials to CROs to reduce product development time and cost. This trend is expected to continue in the future due to an increase in the capabilities of CROs to perform complex research, which is expected to reduce additional efforts by biopharmaceutical companies to monitor complex processes of clinical trials. Collaborations between biopharmaceuticals and CROs are expected to have a positive impact on the global market, as it will ensure consistent clinical trials.

Furthermore, surge in the number of biotechnology & pharmaceutical companies is compelling manufacturers to provide effective and advanced drugs, leading to an increase in the number of clinical trials, as these companies are focusing on novel drug discoveries, thereby driving the overall market growth. Moreover, increase in the number of drug discoveries by pharmaceutical companies is promoting advancements in drug development technologies and increasing their adoption worldwide, which is fueling the demand for clinical trial biorepository & archiving solutions services, thereby propelling market growth over the forecast period.

Besides, growing demand for biologics, biosimilars, personalized medicine, adaptive trial designs, orphan drugs, and companion diagnostics is estimated to boost the demand for clinical trial biorepository & archiving solutions services. As biopharmaceutical companies explore new frontiers, the accelerating requirement to adhere to continuously evolving regulations drives the demand for specialized service providers. Furthermore, stringent regulatory requirements mandate the appropriate archiving of clinical trial data and samples, safeguarding their integrity & compliance. This expansion in the pharmaceutical and biotech sectors impelled the need for advanced biorepository and archiving solutions, promoting market growth. The adoption of cutting-edge technologies for sample storage, management, & retrieval further enhances the efficiency and reliability of these solutions, accelerating industry growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.08 Billion |

| Market Size by 2033 | USD 10.27 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.13% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, Product, Phase, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Azenta U.S., Inc.; Thermo Fisher Scientific Inc. (Patheon); Precision for Medicine, Inc.; Medpace; LabCorp Drug Development; ATCC; Q2 Solutions; Labconnect; Charles River Laboratories; Cell&Co. |

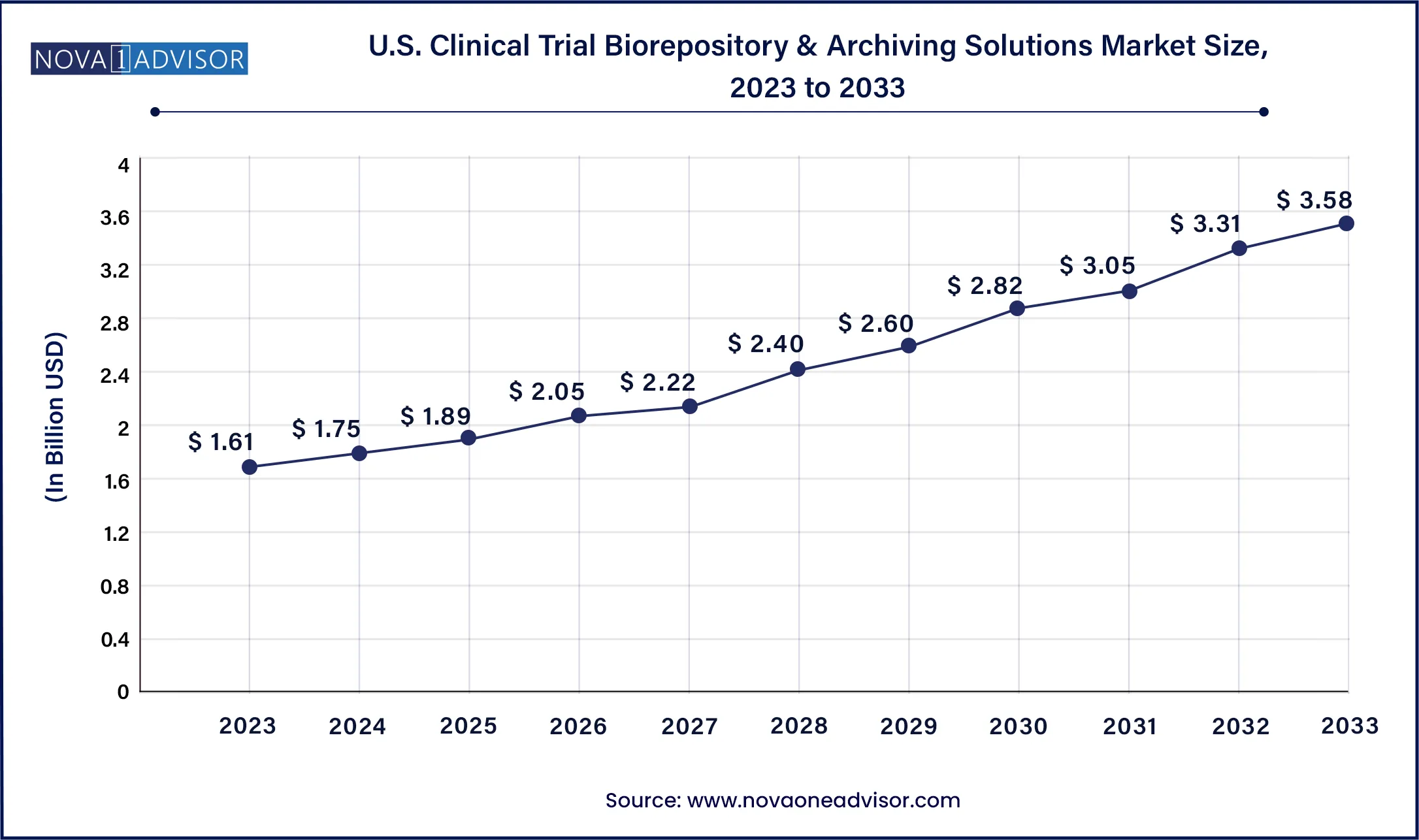

The U.S. clinical trial biorepository & archiving solutions market size was valued at USD 1.61 billion in 2023 and is anticipated to reach around USD 3.58 billion by 2033, growing at a CAGR of 8.3% from 2024 to 2033.

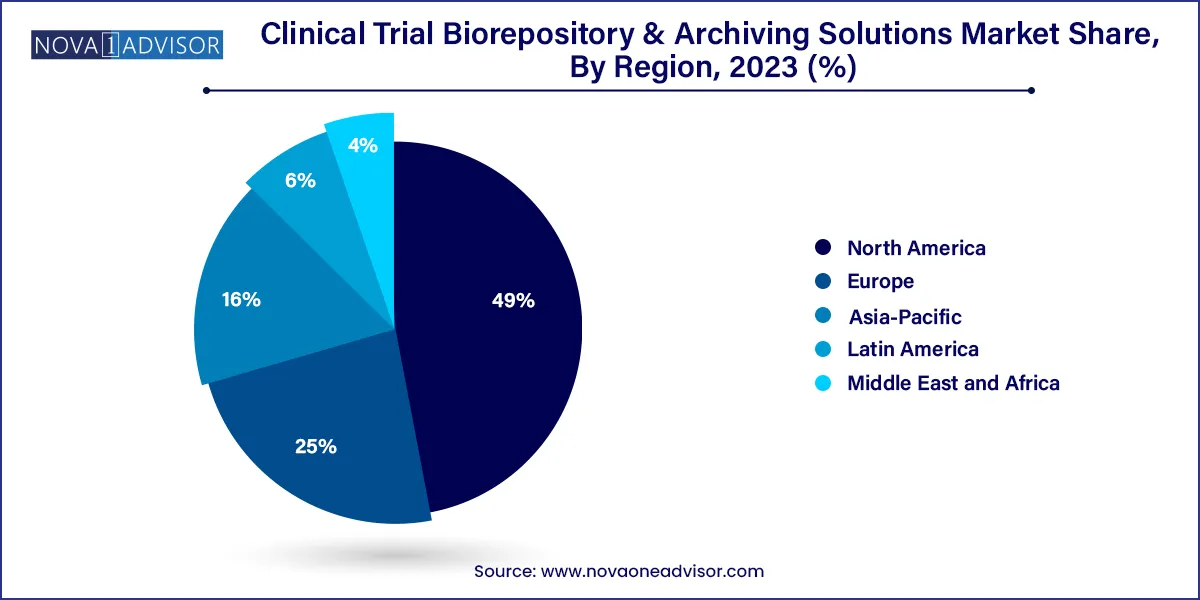

The North America region dominated the global industry in 2023 and accounted for the maximum share of more than 49.0% of the overall revenue. The region is projected to expand further at a significant growth rate maintaining its dominant industry position throughout the forecast period. A rise in the number of clinical trials, the presence of a large number of industry participants, and the availability of modern technology in the region are among the primary factors driving the market growth in North America.

On the other hand, the Asia Pacific regional market is anticipated to register the fastest growth rate during the forecast period. The rapid expansion of the market in the Asia Pacific region can be mainly attributed to the tremendous growth in clinical research. Other prominent factors, such as the presence of a diverse group of patients that are easy to recruit and low cost per patient in developing countries in the Asia Pacific, are also projected to contribute to the growth of the regional market during the forecast period.

In terms of service, the biorepository services segment dominated the industry and accounted for the largest share of 66.6% in 2023. Biorepository services mainly include sample collection, processing, storage & distribution, and other related services. Stringent regulations, such as Health Insurance Portability and Accountability Act (HIPAA), Right to Withdraw, European Union General Data Protection Regulation, and other regulations regarding sample custody & ownership, human tissues & informed consent, and access to biospecimens, are anticipated to improve data protection and patient privacy.

The archiving solution services segment is also expected to have significant growth over the forecast period. Rising clinical trial expenses and patient recruiting issues in some industrialized nations have prompted biopharmaceutical companies to outsource clinical studies to different areas. Clinical trials are expected to be used more frequently, which will raise the demand for a variety of archiving solutions, such as material indexing, tracking options, real-time material management systems, and multi-site archiving options; thus, favorably influencing the growth of this segment.

Based on product, the industry has been further categorized into preclinical and clinical products. The clinical products segment dominated the global industry in 2023 and accounted for the maximum share of more than 63.25% of the overall revenue. The segment is estimated to expand further at the fastest growth rate maintaining its dominant market position throughout the forecast period. The growth of this segment can be attributed to an increase in the number of clinical trial registrations in recent years.

As of January 2023, ClinicalTrials.gov reported that 437,544 trials had been registered in 219 countries, compared to around 399,509 in 2023 and nearly 362,490 in 2021. The preclinical products segment is also anticipated to witness substantial growth over the forecast period. This growth can be attributed to the increasing demand for novel treatments for diseases, such as COVID-19, Zika virus, and Ebola, along with the increasing prevalence of existing diseases, such as Cardiovascular Diseases (CVDs), cancer, and neurological diseases, which is boosting research & development activities, thereby augmenting the segment growth.

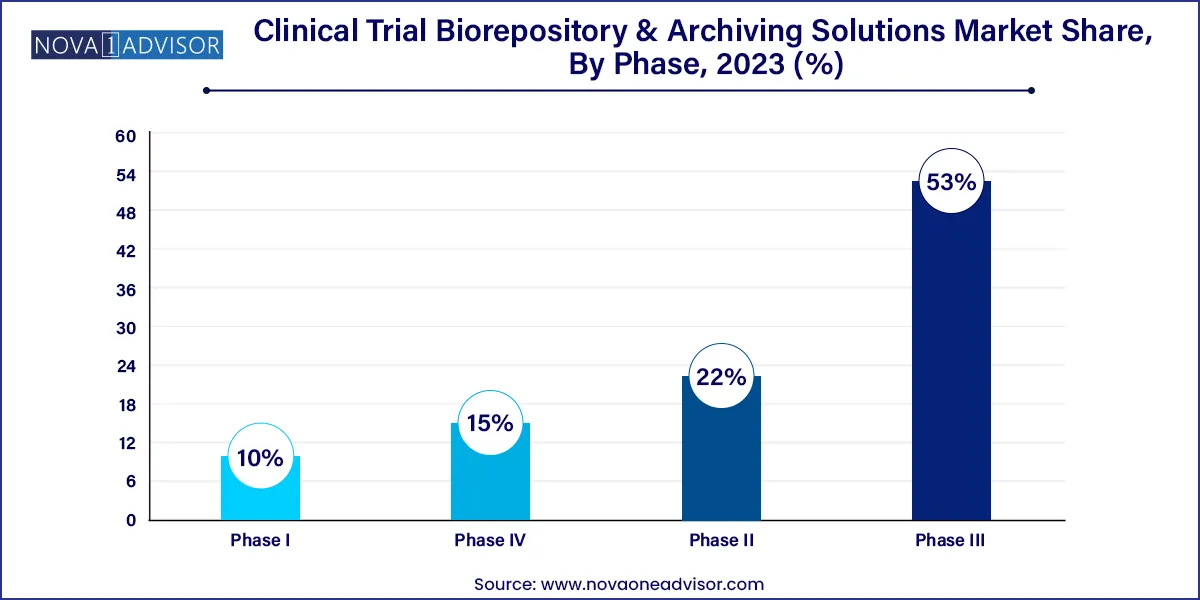

The phase III clinical trials segment dominated the global industry in 2023 and accounted for the largest share of more than 53.00% of the overall revenue. Researchers assess the safety and efficacy of the novel treatment in phase III clinical trials in comparison to the accepted practice. In most phase III clinical trials, there are many patients involved-at least several hundred. In addition, this phase is more likely to have unusual and long-lasting side effects due to the large participant pool and extended duration.

Given these considerations, phase III trials-which include storing a variety of samples and specimens for long-term research-are the ones most in need of clinical trial biorepository and archiving solutions services. Hence, this segment is likely to witness significant growth during the forecast period. The phase II segment is anticipated to register the fastest CAGR during the forecast period. This growth is due to the increasing investments in R&D by industry and non-industry sponsors. A high number of industry-sponsored & non-industry-sponsored clinical trials in phase II, the complexity associated with phase II clinical trials, and the globalization of clinical trials are expected to drive segment growth.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global clinical trial biorepository & archiving solutions market.

Service

Product

Phase

By Region