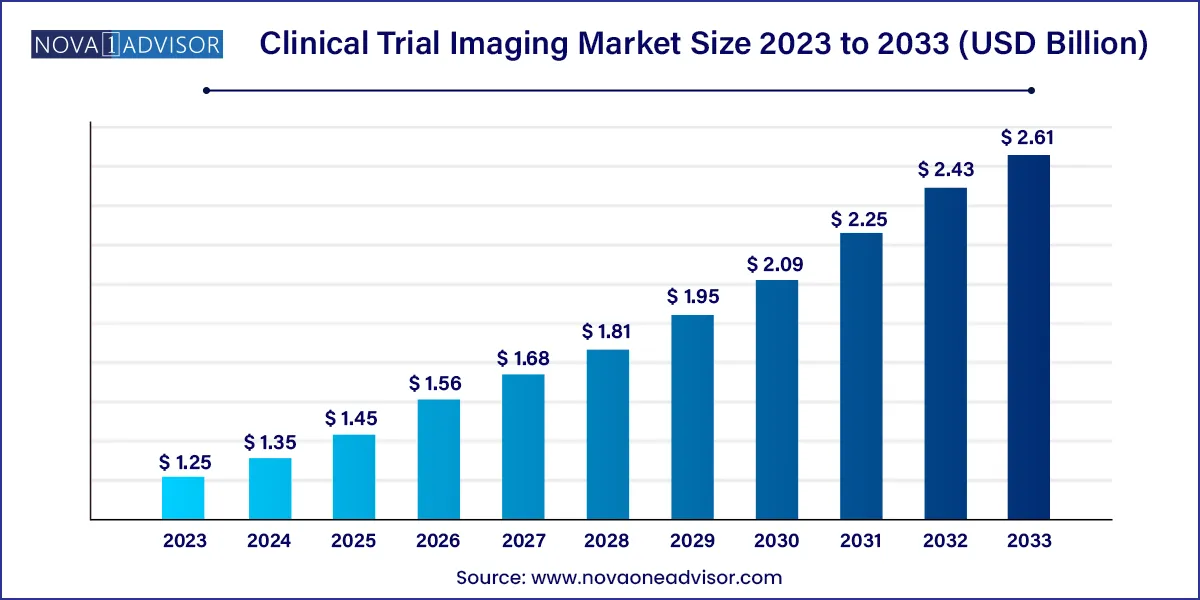

The global clinical trial imaging market size was exhibited at USD 1.25 billion in 2023 and is projected to hit around USD 2.61 billion by 2033, growing at a CAGR of 7.65% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.35 Billion |

| Market Size by 2033 | USD 2.61 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.65% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, Modality, Application, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | IXICO plc; Navitas Life Sciences; Resonance Health; ProScan Imaging; Radiant Sage LLC; Medpace; Biomedical Systems Corp; Cardiovascular Imaging Technologies; Intrinsic Imaging; BioTelemetry |

The market growth is anticipated to be fueled by the growing biotechnology and pharmaceutical sectors, coupled with rising investments in research and development for the creation of new drugs aimed at treating various diseases. Medical imaging plays a pivotal role in advancing the development of innovative life science products.

Despite the ever-changing nature of the medical imaging industry, the biotechnology and pharmaceutical industries are showing sustained growth. This is primarily due to the increased investment in medical imaging companies, as well as the occurrence of mergers and acquisitions that involve the incorporation of cutting-edge imaging technologies to facilitate clinical trials for medical devices.

Advancements in technology are bringing substantial improvements to the collection, evaluation, and submission of clinical trial imaging data. Technology-enabled imaging, especially image analysis software, provides various benefits to clinical studies, such as consistency, data accuracy, adaptability, and compliance. For instance, image analysis software is used to direct and manage a reader by analyzing imaging time points. In addition, the increased use of imaging technology, along with the enhanced power of computing, is expected to drive the usage of imaging in clinical trials. The Quantitative Imaging Biomarkers Alliance (QIBA) protocol has come up with standardized methods and imaging procedures with uniform procedures to be implemented for attaining statistical and precise endpoints in clinical trials.

The Covid-19 pandemic has adversely impacted the healthcare system in most countries, leading to a disruption in medical studies, and research activities, and reduced sponsorship for research involving clinical trials. The pandemic hampered the clinical trial timeline as numerous ongoing studies were delayed and planned studies were cancelled. Unfavorable changes in regulations and guidelines, supply chain disruption, recruitment challenges for clinical trials, fear of viral spread, and shutting down of most manufacturers during lockdown have adversely impacted the market. However, introducing virtual imaging trials during the COVID-19 pandemic is expected to open new avenues for adopting these devices. The development of advanced computational models helps better assess CT and radiography images, which are expected to help in the early diagnosis of COVID-19 patients. The market has witnessed a bounce back by 2022 Q2 due to increased R&D activities and improvement in supply and distribution channels.

Many patents have been filed in the realm of enhancing image evaluation and capturing. In addition, imaging core lab provider’s offer patented technologies that are anticipated to assist pharmaceutical companies in reducing their development timelines. As an example, IXICO provides a diagnostic tool called Assessa, which enhances decision-making in clinical trials for conditions related to memory, including schizophrenia, Parkinson's, and Alzheimer's disease, as well as neurological disorders such as dementia and cognitive impairment.

However, the high cost of machinery and their installation, and the enormous cost of clinical trials may limit the market growth during the forecast periods. Advancements in technology are bringing substantial improvements to the collection, evaluation, and submit clinical trial imaging data. Technology-enabled imaging especially image analysis software provides various benefits to clinical studies such as consistency, data accuracy, adaptability as well as compliance. For instance, image analysis software is used to direct and manage a reader via analysis of imaging time points.

Market growth stage is medium, and pace of the market growth is accelerating. The global market is characterized by a higher degree of innovation owing to the rise in the number of biotechnology and pharmaceutical companies is necessitating manufacturers to provide the best possible medicines and/or drugs. Pharmaceutical and biotechnology companies majorly depend on preclinical imaging to evaluate the safety and efficacy of drug candidates before moving into clinical trials. Moreover, increase in the number of drug discoveries by pharmaceutical companies is promoting developments in medical imaging and increasing their adoption worldwide, which in turn is fuelling the demand for implementation of imaging in clinical trial studies.

The market is majorly concentrated and highly competitive owing to the presence of market players working constantly to expand their global footprint by establishing partnerships, collaborations, and acquisitions to access new markets and regions. Collaborations with research institutions and healthcare providers, such as the Mayo Clinic and academic medical centres, are becoming more common to access expertise and test their technologies in real-world clinical settings.

The degree of innovation in the market has been increasing rapidly. With the rise of digital imaging technologies, there has been a significant shift towards more efficient, cost-effective, and accurate clinical trial imaging solutions. Advances in artificial intelligence and machine learning have also contributed to developing more sophisticated imaging techniques, such as image recognition and analysis. Overall, the market is poised for continued innovation as technology advances and new applications are discovered.

The level of merger and acquisition activities in the market is significantly high as many companies are looking to consolidate their position in the market and gain a competitive edge by acquiring complementary technologies or expertise. This trend is expected to continue as the market grows and becomes more competitive. Advances in technology and the increasing demand for more efficient and accurate clinical trial imaging solutions are likely to drive further consolidation and M&A activity in the market.

Regulatory authorities have a significant impact on the market. The market is heavily regulated, and companies must comply with strict regulations to ensure the safety and efficacy of their products. These regulations can also affect the duration of new imaging technologies being developed and brought to market. In addition, regulatory authorities play a critical role in ensuring that clinical trial data is accurately collected and analysed.

Product substitutes in the market can include alternative imaging technologies or methods that can replace traditional imaging techniques. For example, instead of using MRI or CT scans, companies may explore the use of ultrasound or optical imaging technologies. In addition, some companies may opt to use software-based analysis tools that can provide similar results to traditional imaging techniques but more cost-effectively. These product substitutes can offer benefits such as reduced cost, increased speed, or improved patient comfort.

The market is witnessing a significant rise in regional expansion efforts, particularly in emerging markets. With the increasing demand for clinical trial imaging services, companies want to expand their presence in new regions to tap into growing markets. In addition, the rise of precision medicine and personalized treatments is expected to drive the market growth. As a result, companies are investing in new technologies and partnerships to expand their offerings and better serve their global customer base.

Based on service, the project and data management services segment held the market with the largest revenue share of 28.73% in 2023. Clinical trials that utilize imaging often require comprehensive data management and seamless coordination among multiple stakeholders. These services encompass various aspects, including operational expertise, the development of trial workflows, project tracking, the conversion of scans into digital images, regulatory oversight, quality assurance, real-time reporting on trial progress, establishment and oversight of MRI centres, data management, and handling reporting and issue resolution. Furthermore, the U.S. government has approved a cloud-based server to safeguard all medical imaging records, including annotated and base images, while ensuring protection against natural disasters. This system allows for faster and easier retrieval of these critical medical records.

The operational imaging services segment also led the market with significant revenue share and are projected to grow the fastest CAGR of 7.32% from 2024 to 2033. These operational imaging services encompass a range of imaging modalities, including MRI, CT, ultrasound, OCT, PET, and SPECT, which are applied in various therapeutic areas such as neurology, oncology, cardiovascular diseases, gastroenterology, musculoskeletal disorders, and medical device research for conducting clinical trials. Imaging techniques are crucial in clinical trials by providing essential evidence for informed decision-making. The Food and Drug Administration Modernization Act (FDAMA) of 1997 paved the way for using imaging modalities as valuable tools in developing medical devices and pharmaceuticals during clinical trials. This legislation permits data generated through imaging modalities to be included in regulatory submissions, further enhancing their role in the evaluation and approval process.

Based on modality, the computed tomography scanners segment led the market with the largest revenue share of 29.13% in 2023. Computed tomography (CT) systems have been used widely in clinical trial imaging due to their ability to provide detailed and accurate images of the body's internal structures. CT scans use X-rays and computer processing to create detailed cross-sectional images of the body, allowing doctors and researchers to identify and measure changes in tissues and organs over time. CT systems are non-invasive and relatively easy to use as CT scans do not require the injection of contrast agents or radioactive materials. This makes them safer and more convenient for both patients and researchers. In addition, CT scanners are preferred by researchers since CT systems can produce large amounts of data in a very short time interval, where researchers need to collect and analyse large amounts of data from multiple patients to identify trends and patterns.

The ultrasound segment is expected to grow at a fastest CAGR of 8.01% from 2024 to 2033. Ultrasound devices are widely used in the global market due to their non-invasive nature and ability to produce real-time images of internal organs and tissues. These devices are particularly useful in studying cardiovascular diseases, oncology, and obstetrics. Ultrasound devices are preferred over other imaging modalities due to their safety and lack of harmful radiation. In addition, ultrasound machines are portable, affordable, and easy to use, making them ideal for clinical trial imaging. Some examples of ultrasound machines used in clinical trial imaging include the GE Healthcare LOGIQ E10, Philips Epiq Elite, and Siemens Healthineers ACUSON Sequoia.

In terms of application, the oncology segment held the market with the largest revenue share of 28.98% in 2023. The factors such as high prevalence of cancer cases and constant need for new and innovative therapies to treat various types of cancer are expected to fuel the market growth. Oncology trials often involve complex imaging requirements due to the need to assess tumour size, response to treatment, and disease progression. Various imaging modalities, such as CT scans, MRI, PET scans, and others, are used to evaluate the effectiveness of cancer treatments. This complexity results in a larger share of the market being dedicated to oncology. Advances in imaging technologies, such as PET-CT, molecular imaging, and functional MRI, have significantly improved the ability to visualize and assess tumours and their response to treatment. These advances have made imaging an integral part of oncology trials. The global cancer burden continues to increase, leading to a growing number of oncology clinical trials. This trend is expected to drive the dominance of the oncology segment in the global market.

The non-alcoholic steatohepatitis is expected to grow at the fastest CAGR of 9.75% during the forecast period. The growing burden of NASH due to increasing prevalence of the disease is expected to drive segment growth. Studies suggest that the global prevalence of NASH is 25.24% with highest in Middle East and South America and lowest in Africa. Prevalence for the same is expected to increase to 63.0% till 2033, driving the need for its treatment. Therefore, to meet the demand, companies are focusing on enhancing clinical trial studies to assess the effectiveness of therapies used for NASH. Market players, such as ICON, follow a data-driven approach to developing strategies that can cut the cost and time for trials.

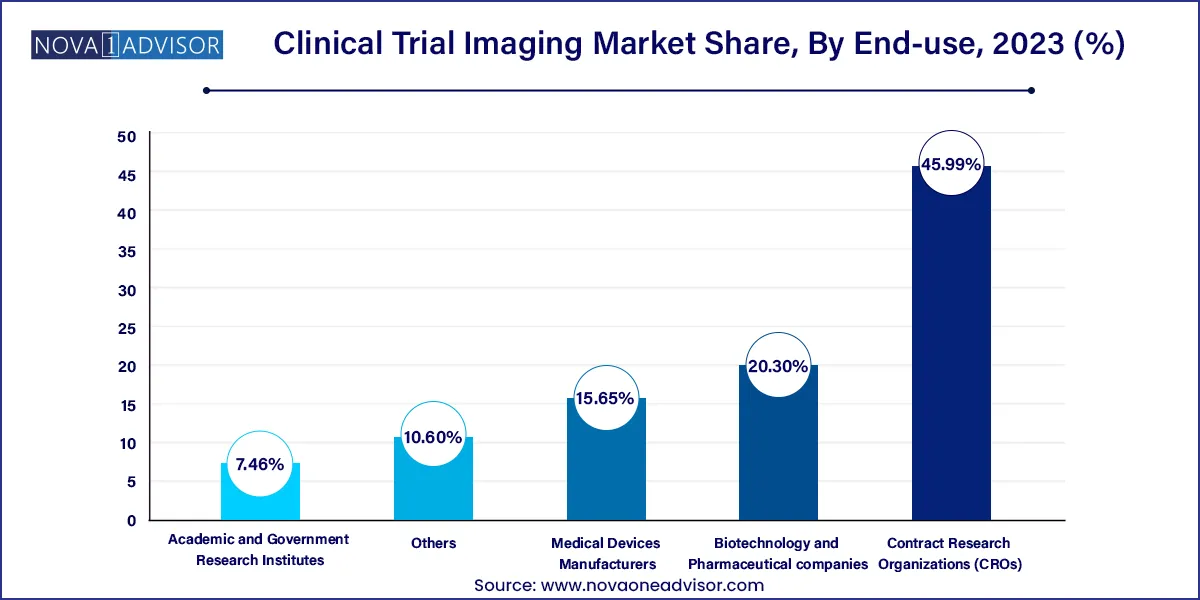

Based on end-use, the contract research organizations (CROs) segment led the market with the largest revenue share of 45.99% in 2023. This significant market share can be attributed to the snowballing cost of drug development along with the increased research & development activities. In addition, mounting demand by the biotechnology and pharmaceutical companies for the outsourcing of research and development activities to reduce expenses is driving the market growth. Also, contract research outsourcing collaborations offer cutting-edge services. Therefore, government organizations prefer the handover of projects to the CROs.

The biotechnology and pharmaceutical segment is expected to grow the fastest CAGR of 7.97% over the forecast period. The factor attributing to the fast growth of this segment is the need to develop new drugs and therapies to cure chronic diseases. The rise in the number of biotechnology and pharmaceutical companies is making it necessary for manufacturers to provide the best possible medicine/drug to the end-user as competition is striking the companies. Many innovative drug discoveries are being made by biotechnology and pharmaceutical companies, and the need for clinical trial imaging is expected to increase, ultimately fueling the market growth.

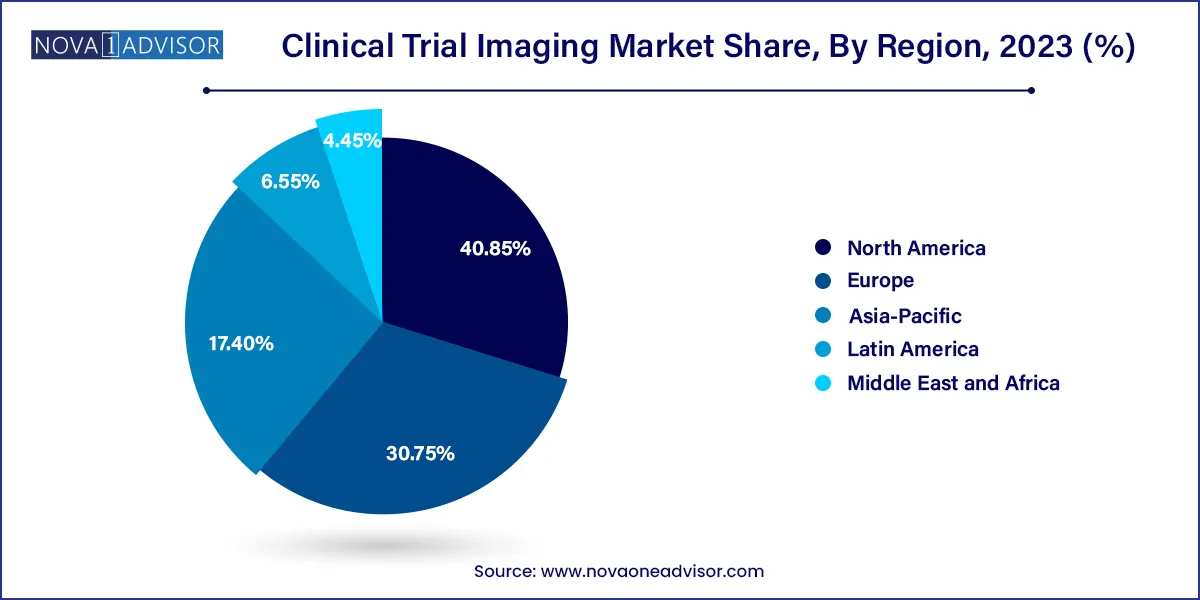

North America dominated the market with a revenue share of 40.85% in 2023. This dominance is primarily due to several factors, including the presence of major outsourcing companies and a notable uptick in research and development activities within the region. Furthermore, the market in North America is driven by factors such as the rising elderly population and the increasing prevalence of chronic diseases. North America leads in terms of the sheer number of clinical trials conducted, and it is also the primary source of outsourcing activities in this field. The cost factor plays a significant role in the decision to outsource clinical trials to external research organizations.

The U.S. market has captured the highest shares of the North America market owing to the factors such as increasing demand for advanced medical imaging technologies in clinical research, the presence of a large number of pharmaceutical and biotechnology companies in the region and increasing fundings for the clinical trials. Clinical trial funding comes from various entities, such as government, private investors, charities, universities, and other research institutions. However, most funding typically comes from the pharmaceutical company with the highest financial interest in completing the trial, which enables them to create and promote products for which they hold intellectual property rights.

The Europe market is experiencing growth propelled by several key factors. These include the rapidly expanding elderly population and the rising prevalence of chronic conditions like Parkinson's, Huntington's, and Alzheimer's. These factors are prompting an increased adoption of clinical trials in the region. In addition, research laboratories are actively seeking ways to reduce operational expenses, which has led to the integration of imaging techniques in clinical trials. It's noteworthy that approximately 4,000 medicine-related clinical trials receive approval within the European Union (EU) each year. While most of these trials take place in Western European countries, there is a noticeable decline in the number of such trials in the region.

The UK market has captured the largest market shares based on revenue in the Europe market in 2023 owing to technological advancements and rising prevalence of chronic disorders. However, according to the Association of British Pharmaceutical Industry It has been observed that drug companies are conducting their clinical trials more frequently in countries like Spain and Australia instead of the UK. As a result, the UK has slipped down the world rankings for phase III industry clinical trials, dropping from fourth place in 2017 to tenth position in 2021.

The France market is expected to grow at a fastest CAGR during the forecast period owing to the factors such as growing adoption of technologically advanced medical imaging products and increasing geriatric population. Elderly population is prone to develop chronic disorders. National Institute of Statistics and Economic Studies published a data in January 2022, In France, nearly 6.1% population is of age between “60 to 64” and around 5.75% population is of age between 65 and 69. The study also found that the geriatric population will surpass 24.1% of the total population to reach around 16.09 million by 2033. The rising geriatric population is expected to create a positive impact on the market growth of France.

Rising burden of chronic disorders along with the growing adoption of technologically advanced imaging devices, and increasing initiatives and investments from the public and private sectors are the key factors fuelling the market growth in Germany. For instance, According to The Global Cancer Observatory, a total of 628519 new cases of cancer were estimated in Germany in 2020.

The Asia Pacific market is anticipated to grow at the fastest CAGR of 7.93% during the forecast period. This can be attributed to the rapid growth of the population, increased R&D activity in this region, and the growing need for improved therapies. According to Clinicaltrialsarena.com, in the period between 2017 and 2022, the Asia-Pacific (APAC) region experienced a remarkable growth rate of around 10% in clinical trials, surpassing the growth rate of other major regions such as the US, Europe, and RoW. This growth rate was significantly higher than the overall average growth rate of 5.3% yearly. Most clinical research conducted in all regions is attributable to Phase II clinical trials, which has been a consistent trend over the past five years. However, the number of Phase I trials in APAC is also increasing. Currently, APAC accounts for 57% of Phase I trials and 49% of Phase II trials worldwide as of 2022. While the geographical distribution of Phase III trials is more uniform across regions, APAC still dominates due to its larger urban population than the US and Europe. The aforementioned statistics emphasize the fastest CAGR during the forecast period.

The China market holds a dominant share in the Asia Pacific market owing to the increasing number of clinical trials being conducted in China, which has led to a surge in demand for imaging services. China has captured almost 27.7% share of the global clinical trials activity in 2022. Other factors include advancements in imaging technology, government initiatives to support clinical research, and strong healthcare infrastructure.

The Japan market is driven by growing demand for advanced imaging technologies and the emergence of several key players who are focused on developing innovative imaging solutions that can cater to the specific needs of clinical trials. The Japanese government is also taking initiatives to support the market growth, which is expected to boost the market in the forecast period. For instance, Hitachi Medical is a major player in the Japan market. The company is developing a range of imaging solutions, including Magnetic Resonance Imaging (MRI) and CT scanners, designed to meet the specific needs of clinical trials. Hitachi Medical is currently involved in several clinical trials in Japan, including neurology, oncology, and cardiology studies.

The Latin America market is growing steadily owing to the growing number of clinical trials conducted in the region, increasing demand for medical imaging technologies, and the availability of skilled healthcare professionals. For instance, Brazil accounted for over 9,000 clinical trial studies and dominated the other Latin America countries, followed by Mexico, accounting for nearly 5,000 clinical trials as of June 2023. In addition, the presence of emerging market players, such as BioClinica, Inc., Biocorp Clinical Laboratory, Inc., and Radiant Sage LLC is expected to witness an exhibiting CAGR in the forecast period.

Many pharmaceutical and biotech companies are conducting clinical trials in the Middle East and Africa due to the large patient pool and low costs. This has led to a rise in demand for imaging solutions to aid in diagnosing and monitoring diseases. Middle East and Africa accounted for an 11.2% share of global clinical trials activity in 2020. Key players in the Middle East and Africa market include Bioclinica, Inc., ICON plc, IXICO plc, Intrinsic Imaging LLC, and Radiant Sage LLC. These companies offer a range of imaging solutions and services to support clinical trials. In addition, IQVIA published a report named "Unearthing the Potential of the Clinical Trial Market in Middle East, Turkey & Africa (META) " in December 2019. According to this report, IQVIA suggests that major pharmaceutical companies prefer META countries to conduct clinical trials owing to certain benefits such as cost advantages and availability of a larger patient population. The META countries include nine countries such as Egypt, Lebanon, Saudi Arabia, UAE, Jordan, Tunisia, Algeria, Morocco, and Turkey. It has the potential to be the future clinical trial hub. Also, the report suggests changing the location can cause cost savings of up to 30% to 65% compared to the clinical trials conducted in the U.S. or Europe. This suggests the upcoming growth potential of the Middle East & Africa market.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global clinical trial imaging market.

Service

Modality

Application

End-use

By Region