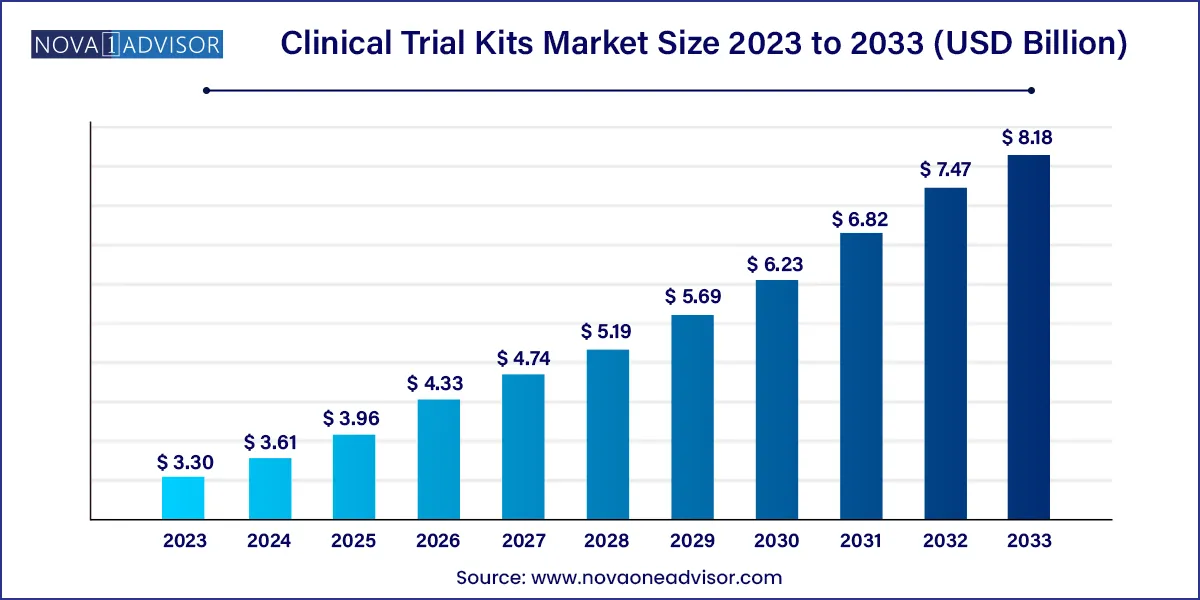

The global clinical trial kits market size was exhibited at USD 3.30 billion in 2023 and is projected to hit around USD 8.18 billion by 2033, growing at a CAGR of 9.5% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.61 Billion |

| Market Size by 2033 | USD 8.18 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, Phase, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Brooks life science; Q2 solutions; Patheon (Thermo fisher scientific); LabCorp drug development; Charles river laboratories; LabConnect; Almac group; Precision medicine group; Cerba research; Alpha laboratories; Marken; Clinigen |

The market is projected to expand rapidly due to increasing R&D investment, the rising number of clinical trials, and rapid technological evolution. In the last few years, the area of home diagnostics has experienced tremendous innovation and progress especially after the outbreak of COVID-19 disease. The growing use of home testing has allowed essential clinical research to continue remotely. As remote testing and observation become more affordable, and precise, it can reduce the pressure on healthcare practitioners who are already dealing with high workloads, especially when it comes to regular testing and patient monitoring. Professionals are increasingly using virtual technology and remote testing to enhance clinical research.

The Covid-19 has also resulted in increased use of sample collection kits due to the enhanced focus on patient safety and continuity of clinical trials. Though the coronavirus outbreak has delayed development and damaged clinical trial quality, the introduction of decentralized clinical trials has paved the way for the continuation of clinical studies. The COVID-19 pandemic has shown that patient-centric sampling can be adopted rapidly and provide enhanced safety for patients and healthcare workers while enabling large-scale diagnostic and public-health data collecting. This experience can accelerate the implementation of patient-centric sampling strategies in clinical trials. Similarly, highly customized kits enable patients to collect and submit their own biological samples directly to laboratories for testing, eliminating the need for doctors to oversee sample preparation, packaging, and shipping.

Clinical trial kits are essential components in ensuring that clinical studies are carried out in a uniform, compliant, and efficient manner. The design of the kit is important to ensure that all relevant supplies are available when needed and in the most practical and helpful way to enhance both clinical trial protocol compliance and investigator ease of use. Everything is combined in the kit for completeness and accessibility to guarantee that samples are gathered accurately, delivered safely and efficiently, and accompanied by all required paperwork.

Over the last 10-15 years, clinical trial sponsors have usually sought an all-in-one solution to lab kits. This universal approach, however, has constraints, notably due to temperature restrictions on pharmaceutical items. Several components, including various needle sizes, are required with the medication, particularly in the case of biologics. While the experimental drug may need temperature-controlled shipping and storage, ancillary supplies do not need them. Hence, including drug products and ancillary supplies in a single kit may significantly and unnecessarily drive up the costs of temperature-controlled shipping and storage.

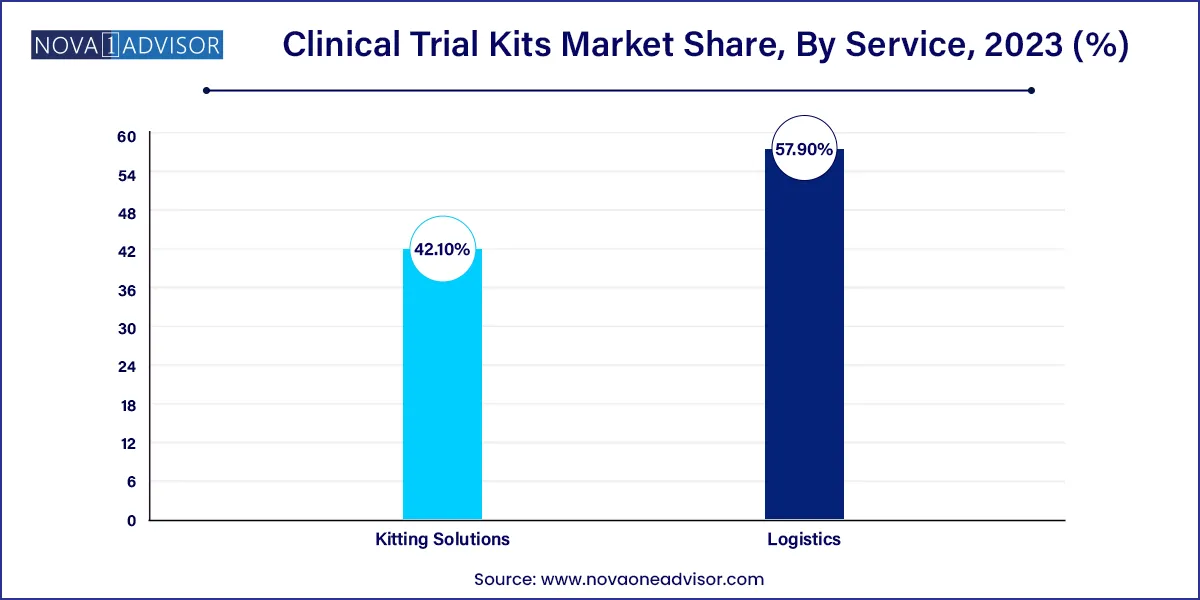

The logistics segment dominated the market for clinical trial kits and accounted for the largest revenue share of 57.9% in 2023. Clinical trial size continues to grow, causing a rippling effect on pharmaceutical packaging. Secondary package design is becoming more important in order to reduce the risk of product damage or activation during transportation. As authorities push the pharmaceutical sector to examine a bigger number of people, studies are growing bigger.

The logistic team's primary goal is to transfer samples to the analysis lab as fast and effectively as possible. It also offers both primary and secondary packaging services for a variety of container types. They also create patient kits and offer full kit labeling and printing services. The clinical trial logistics team is responsible for trial supply randomization, blinding and unblinding, and rescue medicine packing and labeling. They also offer a complete comparator sourcing service, as well as release testing, re-packaging, and labeling for clinical trial usage.

The phase III segment dominated the market for clinical trial kits and accounted for the largest revenue share of 53.3% in 2023 and is likely to remain dominant in the coming future. The major factor that influences the market for phase III is the purpose of testing pharmaceutical products in humans to validate the therapeutic efficacy observed in Phase II on a large number of patients with a specific disease. This is the transition period from chemical to drug state. Many phase II clinical trials concluding with a successful outcome do not survive in phase III, frequently owing to significant side effects of therapeutic efficacy, thus it is important to undertake wider studies.

The objective of phase III is to demonstrate the new medicine's or vaccine's safety and efficacy in the average patient who will use it, confirm effective dosage levels, and discover adverse effects or reasons why the therapy should not be given to persons with another illness. The failure rate is highest in this phase due to the sample size and research design need complicated dosing at an optimal level. The failure causes both human and financial damage, and the majority of failures are caused by non-compliance with safety and effectiveness requirements.

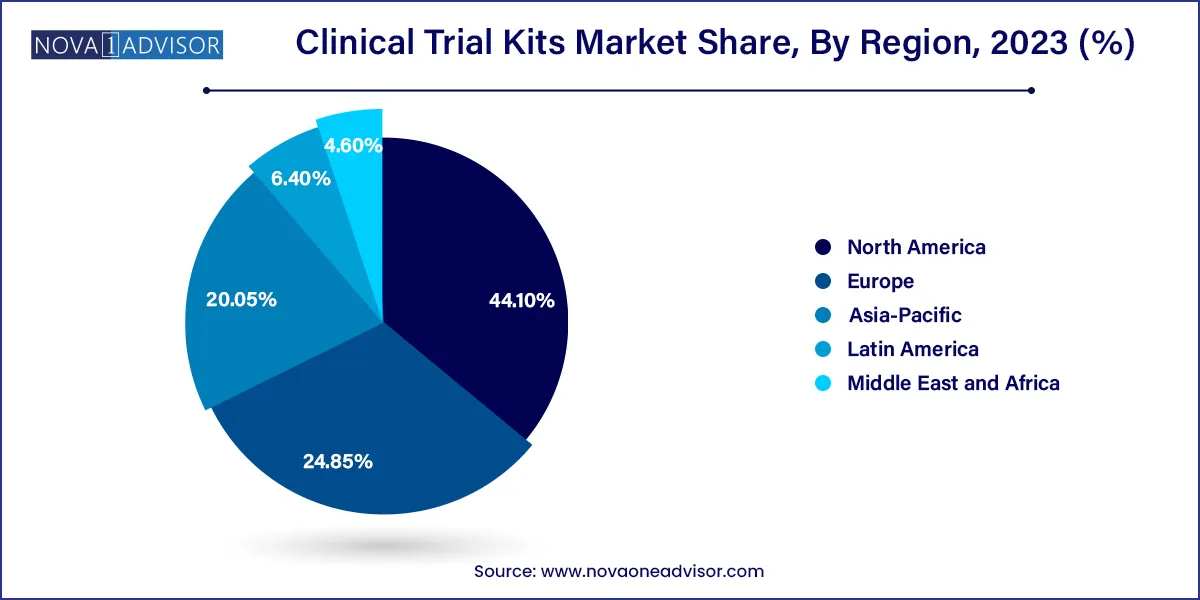

North America dominated the clinical trial kits market and accounted for the largest revenue share of 44.1% in 2023. Most pharmaceutical businesses located in the U.S. perform the majority of their business in this region. Favorable government efforts and the existence of a large number of companies offering technologically advanced services such as at-home clinical trial services in the U.S. are driving market expansion.

In Asia Pacific, the market for clinical trial kits is projected to witness the fastest CAGR of 9.9% over the forecast period. Asia Pacific has been and continues to be one of the world's fastest-growing pharmaceutical marketplaces. With more than 60.0% of the world's population, Asia Pacific has a vast patient pool; the majority remains treatment-naive due to restricted access to inexpensive medical alternatives. Hence, this is likely to generate more demand for related products and services in the region.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global clinical trial kits market.

Service

Phase

By Region