The clinical trial supplies market size was exhibited at USD 3.55 billion in 2023 and is projected to hit around USD 8.49 billion by 2033, growing at a CAGR of 9.11% during the forecast period 2024 to 2033.

.webp)

The Globalization, and rise in the number of biologics & biosimilar drugs in clinical trials are among the major factors expected to drive the market growth. Rapid adoption of a supply chain management system to surmount R&D expenditure pressure and increase operational efficiency, as clinical trial supplies account for a large share of the total R&D expenditure of biopharmaceutical companies, is anticipated to propel market growth in near future. There has been a significant rise in biologics and temperature-sensitive drugs in clinical trials.

Most clinical trials are currently being conducted in developing economies. The increasing cost of clinical trials and complications in the recruitment of patients have encouraged biopharmaceutical companies to outsource clinical trials to regions such as Asia Pacific, Latin America, Central & Eastern Europe, and the Middle East. Disease variation in developing economies further aids biopharmaceutical companies in performing clinical trials on rare diseases. Some regions, such as Asia Pacific, also provide greater economic benefits to biopharmaceutical companies, as governments in Singapore and China allocate funds to promote biomedical research. In Latin America, patient recruitment is easy due to reduced language barriers, which can help obtain informed consent easily, resulting in a faster clinical trial process.

There has been a significant investment in supply chain management software by clinical trial supply providers. Growing complexity in clinical trials and increased competition among market players are factors responsible for adopting new technologies in supply chain management. The need for software for inventory management, supply chain planning, and ancillary supply chain management is expected to grow, owing to industry players' increasing adoption of new technologies. For instance, in pharmaceutical manufacturing, the application of digital twin technology facilitates the expedited development of drugs, which is achieved by using real-world data to generate simulations within a laboratory setting, enabling scientists to anticipate responses to biological processes under specific circumstances.

The U.S clinical trial supplies Market is valued at USD 1.38 Billion in 2023 and is projected to reach a value of USD 3.35 Billion by 2033 at a CAGR (Compound Annual Growth Rate) of 8.77% between 2024 and 2033.

.webp)

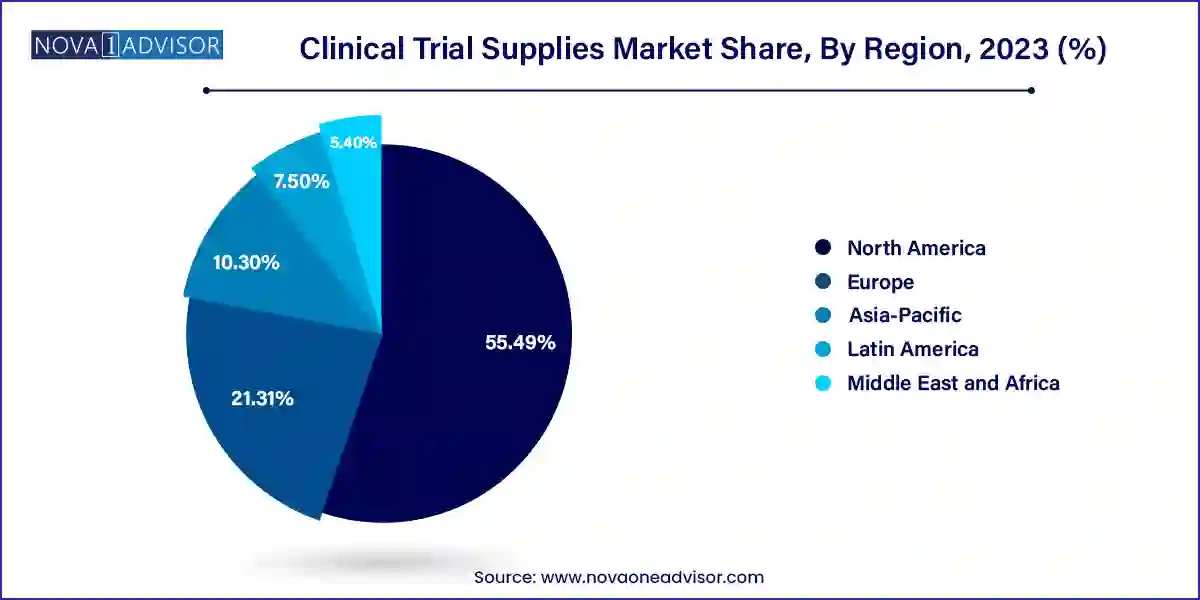

North America accounted for the largest market share of 55.49% in 2023. The region conducts the maximum number of clinical trials amongst all, which is a major driver for clinical trial supplies industry growth. Moreover, presence of key players, coupled with advanced technology penetration are major factors responsible for the dominance of this region.

The U.S. clinical trial supplies market is anticipated to witness significant growth rate over the forecast period. Major CROs such as Quintiles; Covance, Inc.; and PAREXEL International Corporation are situated in this region, which is also a driving factor for clinical trial supplies market growth. Demand for reducing R&D cost is changing the preference to emerging countries, thereby increasing demand for cost-effective supplies, which is anticipated to contribute to the growth of clinical trial supplies market in the U.S. The trend of shifting clinical trials sites outside the U.S is expected to continue due to the rising cost of R&D & patient recruitment.

Asia Pacific is expected to be one of the fastest-growing regions with tremendous growth in clinical research and is expected to drive growth of clinical trial supplies market in a region, thereby contributing to a growth of global clinical trial supplies market. Primary factors driving the growth of clinical research in these regions include low cost per patient in Asia Pacific countries and presence of a diverse group of patients that are easy to recruit.

China is one of the lucrative markets for clinical trial supplies players owing to its diverse pool of patients and growing pharmaceutical market. Logistics and supply chain is a major challenge in the country, which is discouraging major biopharmaceutical companies from conducting trials in China. The country accounts for over 27% of global clinical trials conducted as of 2023 and has exhibited lucrative growth in the past 5 years. Trend is driving entry of major players such as Catalent Pharma Solutions in China, which is expected to contribute to the growth of clinical supplies market in the country.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.87 Billion |

| Market Size by 2033 | USD 8.49 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Clinical Phase, Product & Service, End-use, Therapeutic Use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

| Key Companies Profiled | Almac Group; Biocair; Catalent Inc.; KLIFO; Movianto; PCI Pharma Services; Sharp Services, LLC; Thermo Fischer Scientific Inc.; Marken; PAREXEL International Corporation |

Phase III led the market and accounted for 52.75% of the global revenue in 2023. Phase III clinical trials are more complex when compared to other phases. The list of FDA-approved phase III drugs is comparatively smaller, and the complexity associated with this phase is the highest. The failure rate in this phase is also the highest as the sample size and study design require complex dosing at an optimum level. Loss associated with failure is with respect to human and financial issues, and most failures are due to non-compliance with safety & efficacy standards. Such a scenario is expected to surge the demand for efficient clinical trials supply and logistics, which, in turn, is expected to impact market growth positively.

Phase I clinical trials are anticipated to register the fastest CAGR of 7.0% during the forecast period. A small sample population and high capital investment are major factors responsible for outsourcing most clinical trials. Increase in the number of phase I clinical trials being outsourced and the globalization of clinical trials are expected to drive the market for phase I clinical trial supplies.

Supply chain management accounted for the largest market revenue share in 2023.This scenario exists in most regions worldwide, except in the U.S., wherein the manufacturing segment is also expected to grow at a lucrative rate. The recent COVID-19 pandemic led to a wide disruption in the supply chain along with its impact on the lives of the citizens. This propelled the U.S. to become even more self-reliant, eventually focusing more on manufacturing services. The product/service segment for the clinical trial supplies industry includes several processes, from drug development to logistics to distribution. Based on the type of products & services, the clinical trial supplies industry is divided into three major categories, which comprise all the aspects of clinical trial supplies. These include manufacturing, storage and distribution, and supply chain management.

The manufacturing segment is anticipated to witness significant growth at a CAGR of over 6.6% during the forecast period. Rise in number of clinical trials has resulted in high demand for material supplies, which further increases the demand for quality drugs. Complex molecules and high demand for biologics are expected to boost the manufacturing segment of this industry. Many material supplies are outsourced, which drives the demand for efficient clinical trial supplies. Outsourcing in manufacturing can be attributed to the introduction of new technologies to manufacture complex molecules and an increase in demand for developing cost-efficient products.

Oncology led the market in 2023 and is attributable to presence of a huge R&D pipeline. Majority of oncology drugs require temperature-sensitive distribution, which is expected to fuel the demand for cold chain distribution. Oncology clinical trials are designed to diagnose, manage, and treat cancer & associated symptoms. Clinical trial supplies in oncology include primary and secondary packaging. The primary objective of packaging is to improve patient compliance. Packaging must protect vials from leakage and gases from aerosolizing.

On the other hand, cardiovascular disease trials is anticipated to register a 6.9% growth over the forecast period. Cardiovascular diseases are known to be the leading cause of death globally. According to the CDC, cardiovascular disease claims a life in the U.S. approximately every 33 seconds. In the year 2021, around 695,000 individuals died due to heart disease in the country, constituting 20% of all recorded deaths.

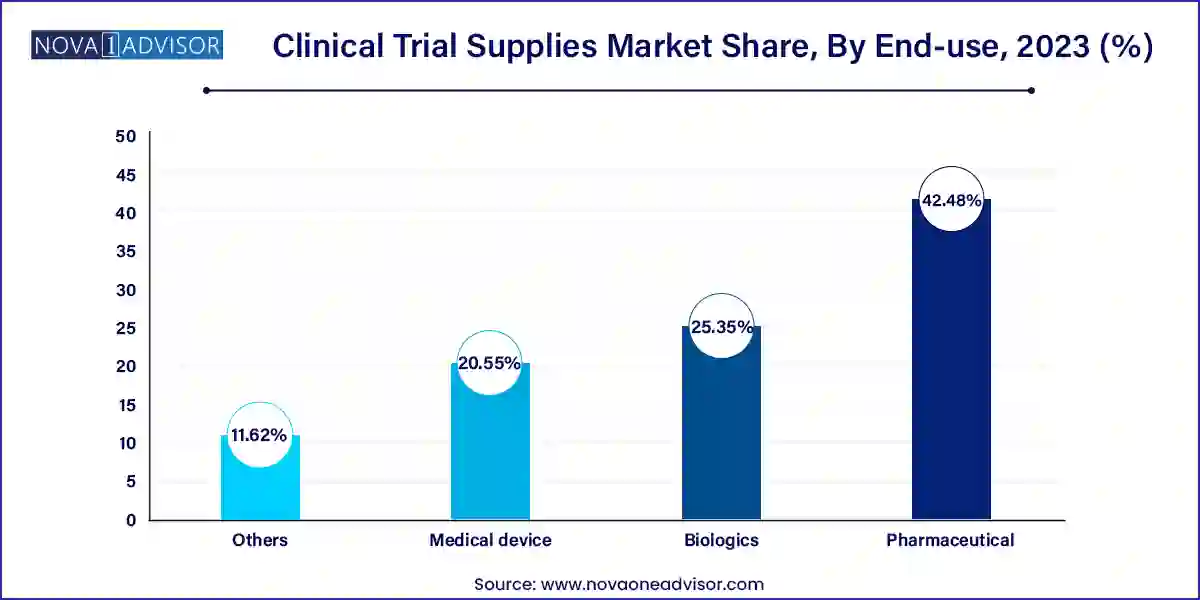

Pharmaceuticals accounted for the largest market share of 42.48% in 2023. Pharmaceutical companies spend substantial investments in R&D to create novel medications and treatments. To acquire information about the efficacy and safety of their products, clinical trials are an essential step in a drug development process. Therefore, based on end-use, clinical trial supplies industry is segmented into pharmaceuticals, biologics, medical devices, and others.

There has been a steady decrease in pharmaceutical drugs in the R&D pipeline as it has been substituted by biological drugs, which is expected to have a slightly negative impact on segment growth during the forecast period. Pharmaceutical drugs are slowly being replaced by biologics, especially in category of topmost innovative drugs. Although pharmaceutical drugs account for the highest number of drugs in clinical trial segment, growing number of biological drugs is likely to have an impact on this number. However, demand for safe, efficacious, and cost-effective medicines is expected to fuel the development of enhanced pharmaceutical drugs, thereby propelling segment’s growth.

Biologics is anticipated to register the fastest growth of 6.8% during the forecast period owing to increased demand for safe and efficacious drugs with lesser adverse effects. An increase in the incidence of cancer and chronic diseases is also expected to fuel the growth of biologics in clinical trials. In addition, increase in biologics in the clinical trial segment is further expected to drive the cold storage and distribution market. It is also expected to increase adoption of newer technologies for better supply chain management.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the clinical trial supplies market

Clinical Phase

Product & Services

End-use

Therapeutic Use

Regional