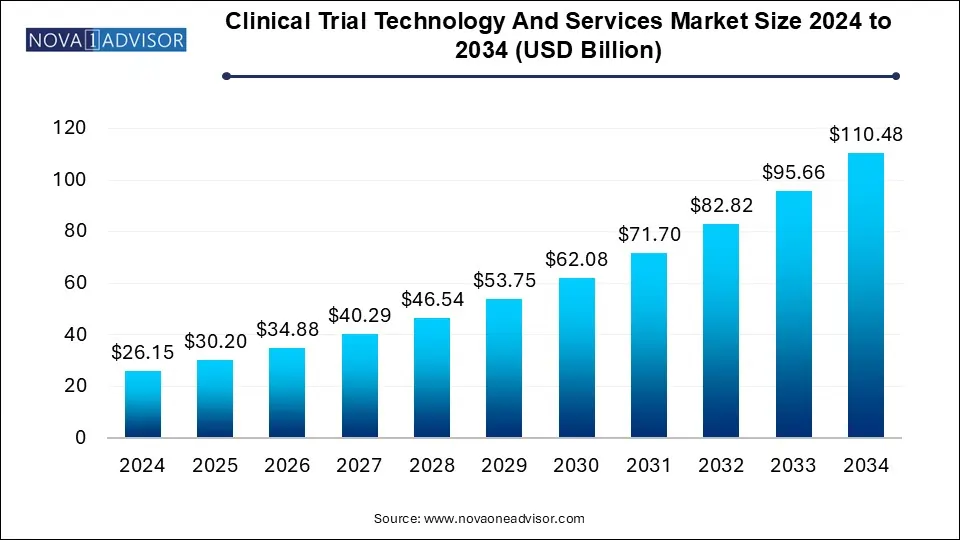

The clinical trial technology and services market size was exhibited at USD 26.15 billion in 2024 and is projected to hit around USD 110.48 billion by 2034, growing at a CAGR of 15.5% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 30.20 Billion |

| Market Size by 2034 | USD 110.48 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 15.5% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Technology Solutions, Clinical Trials Phases, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | IQVIA, Inc., Medidata (Dassault Systèmes), Oracle, DATATRAK International, Inc., Veeva Systems, Koninklijke Philips N.V., Cognizant, Allscripts Healthcare LLC, Optum Inc.Aris Global LLC, Clinevo Technologies, MasterControl Solutions, Inc., Ennov, Accenture, IBM, Capgemini, Clinquest Group B.V., (Linical Americas), Medidata Solutions, Inc., Calyx, ICON PLC, PPD, Inc. (Acquired by Thermo Fisher Scientific, Inc.), McKesson Corporation, Epic Systems Corporation, Experian Information Solutions, Inc. |

Several key factors include the increasing complexity of clinical trials, the growing adoption of digital health technologies, the need for more efficient patient recruitment, and regulatory support promoting innovation. These drivers collectively enhance the speed, accuracy, and overall efficiency of clinical trials, improving trial outcomes and patient experiences. In addition, regulatory frameworks and government initiatives support integrating digital solutions in clinical trials.

As clinical trials become more intricate due to the incorporation of advanced methodologies and diverse patient populations, there is a need for efficient patient recruitment strategies. According to statistics published by Antidote Technologies, Inc., in January 2024, approximately 80% of clinical trials failed to meet their enrollment timelines. This complexity matches software that quickly analyzes vast datasets to identify suitable candidates. The ability to streamline this process not only enhances operational efficiency but also reduces costs associated with prolonged trial durations.

As protocols become more complex, unexpected costs and delays during trials may occur. Modifications and deviations lead to the need for enrollment suspension, extra approvals, and additional oversight before restarting. According to the Central Sterile Supply Department (CSSD), each modification to a Phase III clinical trial protocol results in unexpected direct expenses exceeding $535,000, extending the implementation period by three additional months. The prompt identification and resolution of data trends are essential to avoid substantial delays and extra costs, especially considering that the average duration for completing Phase III trials has increased from just over two years in 2010 to 3.5 years in 2022. In addition, any delay in a trial can escalate overall expenses by approximately USD 0.6 million to USD 8 million per day.

Patient recruitment is the most significant cost factor in clinical trials, accounting for about 30% of total expenses. Approximately 80% of clinical trials fail to meet their enrollment targets within the planned timelines, with an average dropout rate of 30%. Poor enrollment forecasting is a key reason for trial discontinuation, costing the industry an estimated USD 40 billion. To effectively find and engage the right patient populations, data-driven strategies are essential for better targeting and retention.

Furthermore, technological advancements such as artificial intelligence (AI), machine learning (ML), and big data analytics are transforming clinical trial management. These technologies allow for more precise patient matching by analyzing vast amounts of data from electronic health records (EHRs) and other sources. Incorporating these innovations into the market increases efficiency and enhances the quality of data collected, leading to accurate and reliable trial outcomes.

Regulatory agencies worldwide are focused on speeding up drug development to introduce new therapies into the market at a faster rate. Programs such as the FDA’s Breakthrough Therapy Designation expedite the review of promising drugs. Hence, sponsors face pressure to enhance their trial designs and recruitment approaches. This growing demand for efficiency calls for clinical trial technology & services to help organizations meet regulatory requirements while ensuring immediate patient enrollment.

The data collection and analytics segment held the largest revenue share of 66.54% in 2024 in the market due to the growing need for accurate, real-time insights. Key drivers include the increasing complexity of trials, the need for personalized medicine, and the shift toward data-driven decision-making. Electronic data capture (EDC) and artificial intelligence (AI) enhance data quality, reduce errors, and expedite analysis. Instances include using AI for patient recruitment predictions and analyzing trial data in real time to optimize outcomes. These advancements streamline operations, improve efficiency, and reduce costs, driving the segment's growth.

The trial management segment is expected to register a significant CAGR over the forecast period. Factors include the demand for real-time monitoring and the need for centralized, automated systems to manage recruitment, scheduling, and compliance tasks. Cloud-based platforms and advanced project management tools facilitate seamless collaboration and reduce delays. Instances include using trial management software to track patient enrollment and ensure regulatory compliance, improving trial timelines and costs. These solutions provide better oversight, ensuring more effective and efficient clinical trials.

The phase III segment held the largest revenue share of 53.39% in 2024 due to its critical role in determining the safety and efficacy of new treatments. This phase involves large-scale trials with diverse patient populations, requiring advanced data management, monitoring, and compliance solutions. Drivers include increased investment in late-stage drug development, the growing complexity of trials, and the need for faster market access. Instances include using technology for real-time data analysis, patient recruitment, and regulatory adherence. These technologies help optimize trial operations, reduce costs, and accelerate the time-to-market for new therapies, growing the segment’s dominance.

The phase I segment is expected to grow at the fastest CAGR of 16.4% over the forecast period. This growth is attributed to increasing investment in early-stage drug development and the need for efficient safety assessments. As the first step in testing new treatments, phase I trials focus on safety, dosing, and side effects, requiring precise data collection and monitoring. Key drivers include advancements in biomarker technologies, patient-centric approaches, and the rising use of digital tools for real-time data analysis. Instances include wearable devices to monitor patient vitals and AI-powered systems to track adverse reactions, enhancing trial efficiency and speeding up drug development.

The healthcare companies segment dominated the market with the largest revenue share of 44.0% in 2024 due to their substantial involvement in clinical research and drug development. These companies rely on clinical trial matching software to streamline patient recruitment, reduce trial costs, and ensure regulatory compliance. Drivers include the increasing complexity of clinical trials, the need for faster time-to-market for new drugs, and the demand for personalized medicine. Pharmaceutical companies leverage AI-driven platforms to efficiently match patients with appropriate trials, accelerating their clinical development pipeline while enhancing trial accuracy and success rate.

The healthcare providers’ segment is expected to register the fastest CAGR over the forecast period. This is attributed to the increasing adoption of digital solutions, rising clinical trial complexity, and the need for improved patient recruitment and data management. Hospitals, research institutions, and specialty clinics are integrating advanced technology solutions such as electronic data capture (EDC), remote monitoring, and AI-powered analytics to enhance trial efficiency.

For instance, major healthcare providers are leveraging decentralized clinical trial (DCT) platforms to enable remote patient participation, reducing site visit burdens and expanding trial accessibility. In addition, the rising volume of clinical trials for complex therapies like cell and gene therapies necessitates robust trial management solutions, further driving demand.

North America's clinical trial technology and services industry is driven by advanced technological innovations and the increasing complexity of clinical trials. Integrating AI and machine learning is helping streamline patient recruitment and accelerate trial timelines. The region’s vital healthcare infrastructure and a supportive regulatory environment guided by the FDA and Health Canada encourage the adoption of digital solutions that improve trial efficiency and regulatory compliance. In addition, the growing emphasis on patient-centric trials and the widespread use of telemedicine contribute to the rise of the market, aligning with North America’s shift toward personalized medicine.

U.S. Clinical Trial Technology And Service Market Trends

The clinical trial technology and services industry in the U.S. is expanding, driven by the demand for faster and more efficient clinical trial processes. The FDA promotes innovation in clinical trial design and patient recruitment, accelerating the development of digital solutions for trial matching. A key trend is the growing use of real-world data (RWD) and artificial intelligence in recruitment, enhancing the speed and accuracy of matching patients to trials. In addition, the U.S. government’s investment in digital health technologies and initiatives, such as the 21st Century Cures Act, supported the market's growth.

Asia Pacific Clinical Trial Technology And Service Market Trends

Asia Pacific clinical trial technology and services industry is expected to witness rapid growth over the forecast period. A significant trend is the rising adoption of digital tools, particularly AI and machine learning, to streamline patient recruitment and data management in clinical trials. For instance, the region saw a surge in telemedicine, which increased the use of remote patient monitoring and trial-matching software. In addition, several countries in the area are implementing supportive regulatory frameworks that align with international standards, facilitating the growth of clinical trials in emerging markets. The intense interest in personalized medicine and patient-centric trial designs drives innovation in this space.

The clinical trial technology and services industry in China is seeing substantial expansion, supported by the country's growing pharmaceutical sector and a rapidly evolving regulatory environment. China became a global clinical trial hub due to its large patient population and cost-effective services. The government's commitment to regulatory reforms, such as implementing the China National Medical Products Administration (NMPA) guidelines, helps streamline clinical trial processes. Moreover, innovation in digital health technologies is gaining traction, with an increasing number of digital platforms being adopted to enhance patient recruitment and monitoring.

The clinical trial technology and services industry in India is experiencing significant growth, driven mainly by the country's expanding pharmaceutical and biotechnology sectors. An important factor contributing to this growth is the rapid adoption of advanced trial-matching software, supported by India's tech-savvy healthcare ecosystem. The government's role in global clinical trial outsourcing is crucial in market expansion, as international sponsors turn to India for cost-effective and high-quality clinical India services.

Europe Clinical Trial Technology And Services Market Trends

The clinical trial technology and services industry in Europe is experiencing significant innovation, integrating AI and machine learning to improve patient recruitment. Influenced by the European Medicines Agency (EMA) and GDPR, the regulatory environment plays a key role in shaping software development to ensure data privacy and compliance. For instance, the UK’s National Health Service (NHS) is embracing digital tools to simplify clinical trial participation, emphasizing a move toward more personalized medicine and patient-focused trials. This shift is supported by substantial government investments in healthcare IT infrastructure, which are expected to drive higher adoption rates in the coming years.

Latin America Clinical Trial Technology And Services Market Trends

The clinical trial technology & services industry in Latin America is driven by the increasing demand for efficient trial processes and greater access to clinical research. The region’s regulatory landscape is evolving, with a growing focus on compliance with ICH-GCP standards. Governments are prioritizing improvements to clinical trial infrastructure to attract more international studies, which in turn is accelerating the adoption of trial technologies.

Middle East & Africa Clinical Trial Technology And Services Market Trends

The clinical trial technology & services industry in the Middle East and Africa is witnessing rapid expansion in usage. The growing investment in healthcare infrastructure and the rise of regional clinical trials drive innovation across the MEA region. There is a focus on addressing logistical challenges, especially in remote patient recruitment and monitoring areas with limited healthcare resources. The expansion of healthcare technology networks, emphasized by the rapid growth of telemedicine, is expected to increase the adoption of trial-matching software solutions throughout the region.

The following are the leading companies in the clinical trial technology and services market. These companies collectively hold the largest market share and dictate industry trends.

|

Sr.no |

Technology Solution Type |

Notable Market Players |

Market Penetration |

|

1 |

Clinical Trial Management Systems (CTMS) |

IQVIA, Inc. |

High Penetration |

|

Medidata (Dassault Systèmes) |

High Penetration |

||

|

Oracle |

Moderate to High Penetration |

||

|

DATATRAK International, Inc. |

Moderate to Low Penetration |

||

|

Veeva Systems |

High Penetration |

||

|

2 |

Randomization and Trial Supply Management (RTSM/IRT/IWSM) |

Oracle |

High Penetration |

|

Koninklijke Philips N.V. |

Medium Penetration |

||

|

Cognizant |

High Penetration |

||

|

Allscripts Healthcare LLC |

Medium Penetration |

||

|

Optum Inc. |

Medium Penetration |

||

|

3 |

Compliance/ETMF |

Oracle |

High Penetration |

|

Veeva Systems |

High Penetration |

||

|

Aris Global LLC |

Medium Penetration |

||

|

Clinevo Technologies |

Medium Penetration |

||

|

MasterControl Solutions, Inc. |

Medium Penetration |

||

|

Ennov |

Medium Penetration |

||

|

4 |

Safety/Pharmacovigilance (PV) |

Accenture |

High Penetration |

|

IQVIA Inc. |

High Penetration |

||

|

Cognizant |

High Penetration |

||

|

IBM |

Moderate to High Penetration |

||

|

Capgemini |

Moderate to High Penetration |

||

|

Clinquest Group B.V. (Linical Americas) |

Moderate to High Penetration |

||

|

5 |

Electronic Data Capture (EDC)/Electronic Patient-Reported Outcomes (ePRO)/Electronic Clinical Outcome Assessment (eCOA)/eSource |

IBM |

High Penetration |

|

IQVIA Inc. |

High Penetration |

||

|

Medidata Solutions, Inc. |

High to Moderate Penetration |

||

|

Oracle |

High to Moderate Penetration |

||

|

Calyx |

Moderate to Low Penetration |

||

|

6 |

Real-World Evidence (RWE) |

IQVIA Inc. |

High Penetration |

|

IBM |

High Penetration |

||

|

ICON plc |

High to Moderate Penetration |

||

|

Oracle |

High to Moderate Penetration |

||

|

PPD, Inc. (Acquired by Thermo Fisher Scientific, Inc.) |

Moderate to Low Penetration |

||

|

7 |

Patient Engagement |

Koninklijke Philips N.V. |

High Penetration |

|

McKesson Corporation |

High Penetration |

||

|

Epic Systems Corporation |

High Penetration |

||

|

Experian Information Solutions, Inc. |

Moderate to Low Penetration |

||

|

IBM |

High Penetration |

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the clinical trial technology and services market

By Technology Solutions

By Clinical Trial Phases

By End Use

By Regional