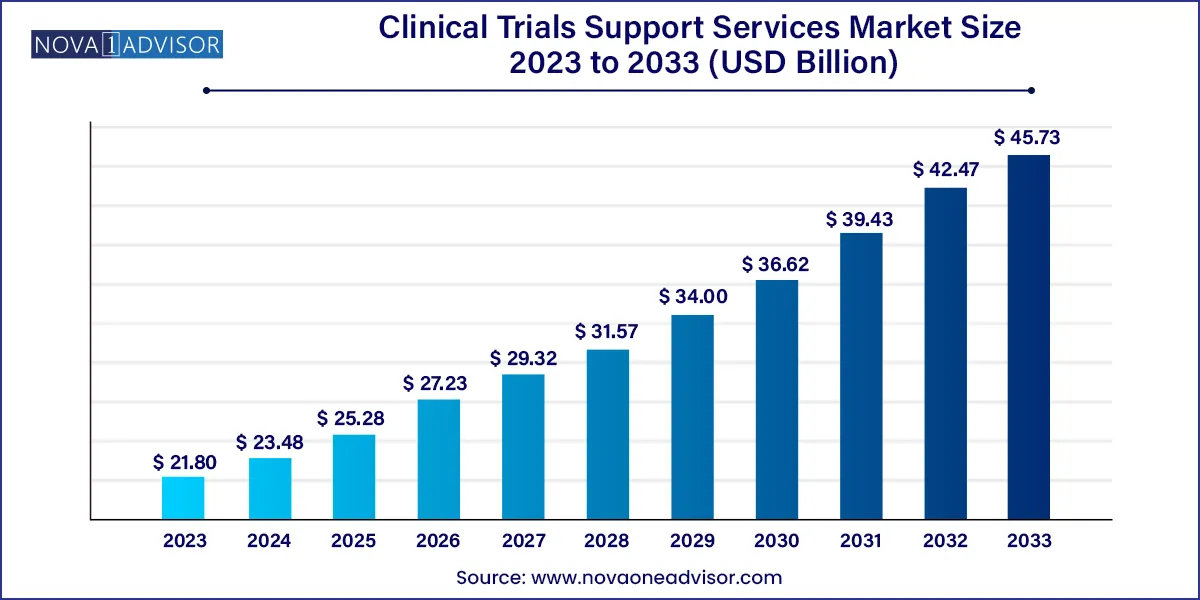

The global clinical trials support services market size was exhibited at USD 21.80 billion in 2023 and is projected to hit around USD 45.73 billion by 2033, growing at a CAGR of 7.69% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 23.48 Billion |

| Market Size by 2033 | USD 45.73 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.69% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, Phase, Sponsor, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Charles River Laboratories International, Inc.; Wuxi Apptec, Inc; Iqvia Holdings, Inc; Syneos Health, Inc.; Eurofins Scientific; Ppd, Inc. (Pharmaceutical Product Development); Icon Plc; Laboratory Corporation Of America Holdings (Labcorp); Alcura; Parexel International Corporation |

The global market is projected to expand rapidly due to the rising demand for trials in emerging economies, rising R&D investment, and an increasing number of contract research organizations (CROs). The pharmaceutical firms’ (R&D) venture has been steadily increasing every year, largely due to patent expirations. An ordinary patent terminates after 20 years; in the pharmaceutical area, there is an arrangement that provides for the entry of a generic version of the medication into the market following a time of 10 years. Thus, firms are boosting their R&D interests to speed the advancement of drugs, subsequently extending the whole market.

Clinical trials support services are quite useful in the event of a drug, assay design, and clinical testing. It also covers tasks such as strengthening clinical test locations, securing and storing research medicines, drug dosage calculation, and kit handling. Preclinical groundwork and research are provided by clinical test support services, which include clinical test site assistance, obtaining and storing study drugs, blinding of study drugs, patient recruiting, coordination, and reconciliation of returned medications.

The clinical trial sector underwent significant changes in 2021. With the introduction of COVID-19 vaccines, numerous clinical trials that had been halted due to the pandemic were re-initiated. In the first quarter of 2021, around 44% more clinical trials commenced compared to the first quarter of 2020. Although in-person clinical trials were once again viable, adoption of new technologies remained high, with 74% of sponsors adopting remote monitoring and 77% of sites using eRegulatory software.

Many software tools for data management are referred to as “Clinical Data Management” (CDM) systems. Multicentric trials require CDM systems to handle massive volumes of data. The majority of CDM systems utilized by pharmaceutical companies are commercial, but there are a few free-source tools accessible as well. Oracle Clinical, Clintrial, Oracle Clinical, Macro, RAVE, and eClinical Suite are common CDM tools. Maintaining an audit record of data management actions is important in regulatory submission studies. These CDM tools help ensure the audit trail and manage discrepancies. The CDM activities include data collection, CRF tracking, CRF annotation, database design, data entry, medical coding, data validation, discrepancy management, and database lock.

Clinical trial site management includes site recruitment, retention, and monitoring. It accounted for the largest market share of 44.5% in 2023 and CAGR at 8.9%. The rising number of clinical trials, high prevalence of chronic diseases, and the increase in the number of CROs offering services are key factors anticipated to drive the market in the coming years. Site monitoring accounts for 9% to 14%, and site retention accounts for 9% to 16%. Thus, clinical trial site management accounts for around 29% to 59% of the entire cost of a trial.

Proper site management by the sponsor and/or CRO is crucial for trial execution and trial success. A sufficient degree of site administration and monitoring enables facilities to efficiently recruit, treat, and retain subjects while maintaining regulatory compliance, protocol adherence, subject rights protection, subject safety, and overall management of screened and recruited subjects.

The phase III segment dominated the market with the largest share of 54.1% in 2023. This growth can be attributed to the fact that phase III clinical trials are the most expensive ones and involve a significant number of subjects. The failure rate in this phase is the highest due to the sample size, and the study design requires complex dosing at an optimum level. The loss associated with failure is both human & financial, and the majority of the failures occur due to noncompliance with safety & efficacy standards.

The phase I segment is anticipated to register the fastest CAGR 9.0% during the forecast period. Clinical trial support services for phase I include sample collection management, early phase patient screening, data management, and assay redesign & others. The U.S., Europe, and China, followed by Canada & Australia, are thus recognized as crucial centers for registering and conducting substantial phase-I clinical trials. As a result, there is a significant market for clinical trial management services in these countries.

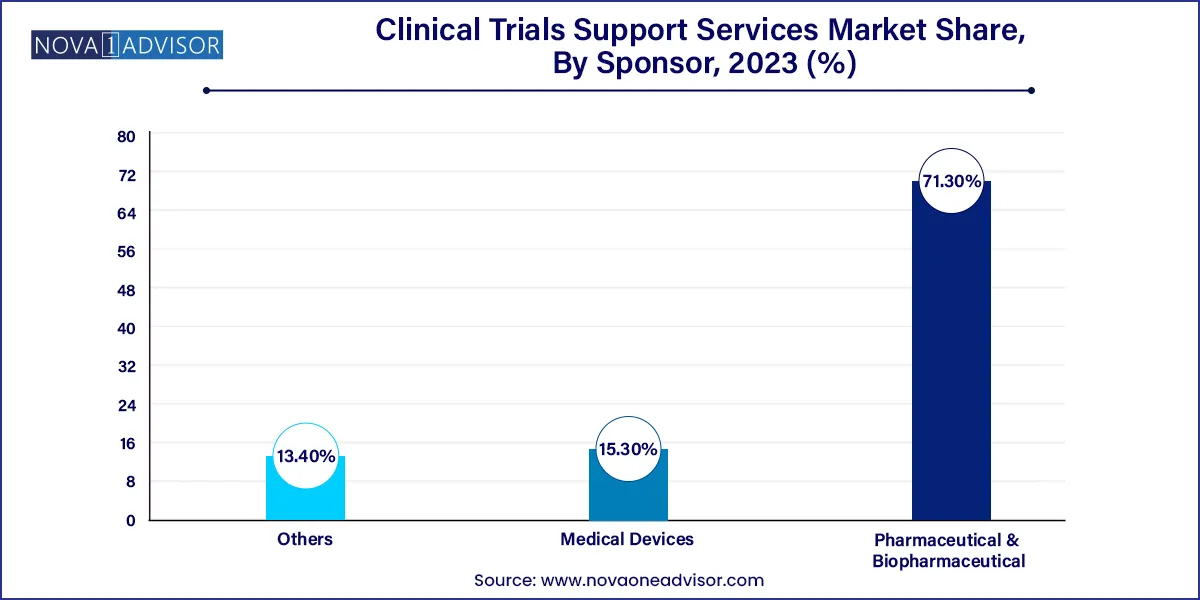

The pharmaceutical & biopharmaceutical companies' sponsor segment dominated the market with the largest revenue share of over 71.3% in 2023. The segment is also anticipated to witness the fastest CAGR from 2024 to 2033. This can largely be attributed to the increasing R&D investments and introduction of new drugs, which have increased in the past two decades. In 2019, the pharmaceutical industry spent USD 83 billion on R&D.

The medical device companies segment is anticipated to show lucrative growth CAGR 6.8% during the forecast period. In the clinical research industry, medical device manufacturers are minor customers, and clinical research sites generally focus on the more profitable sectors of biotechnology, pharmaceuticals, and fundamental research. However, as the FDA places an increasing focus on excellent clinical procedures, device makers will interact with this complicated business on a far more regular basis.

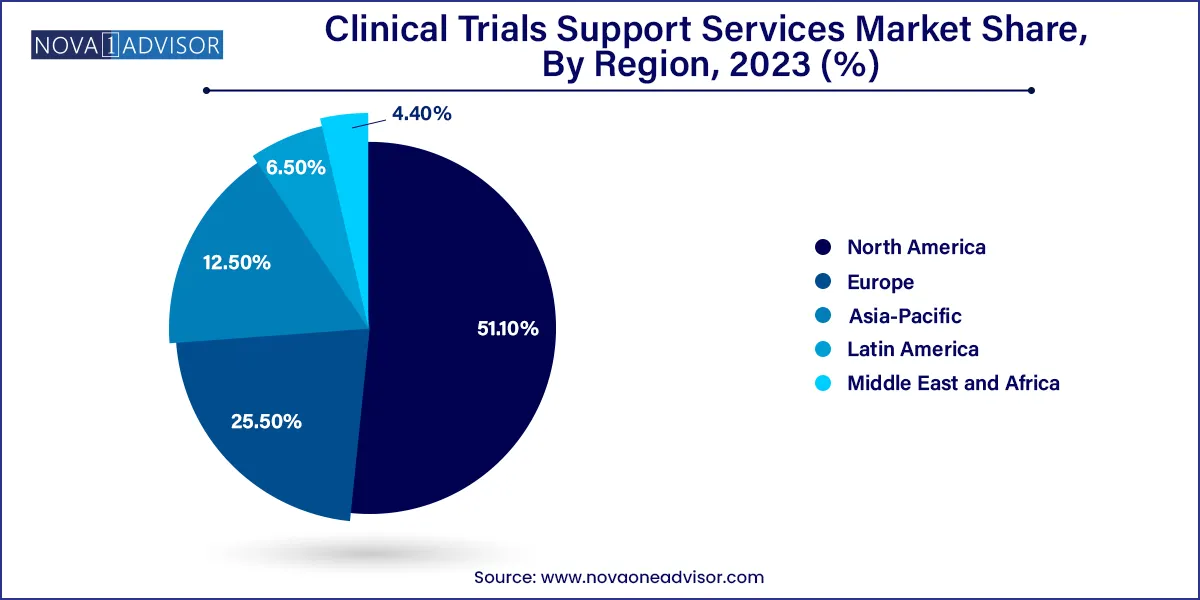

North America dominated the global market in 2023 with the largest share of 51.1%, as most of the pharmaceutical businesses located in the U.S. perform a majority of their business in this region. This market is likely to grow due to the high number of clinical trials being conducted in the region. Major R&D investments and government support for clinical trials are further promoting market growth. The presence of key CROs offering clinical trial support services and multinational pharmaceutical & biopharmaceutical companies making major investments in clinical research has contributed to market growth in North America.

Asia Pacific is anticipated to be the fastest-growing at CAGR 8.5% regional market during the forecast period. Factors driving the APAC market include a developing patient population, simplicity of administrative compliance, minimal expense of conducting studies, and the presence of a couple of top clinical organizations acting at sites.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global clinical trials support services market.

Service

Phase

Sponsor

By Region