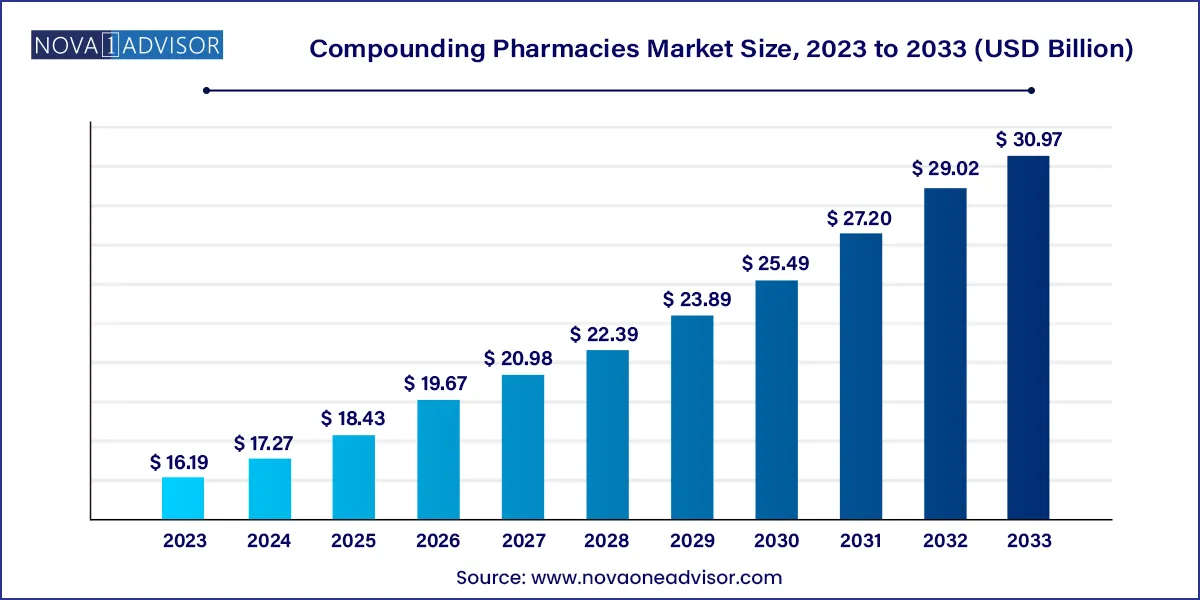

The global compounding pharmacies market size was valued at USD 16.19 billion in 2023 and is anticipated to reach around USD 30.97 billion by 2033, growing at a CAGR of 6.7% from 2024 to 2033.

Compounding pharmacies play a critical role in modern healthcare by providing customized medication solutions to meet individual patient needs. Unlike conventional pharmaceutical manufacturing, compounding involves the preparation of personalized medication by mixing, combining, or altering ingredients based on a prescription from a licensed practitioner. This customization can range from modifying dosage forms, flavoring oral medications for pediatric use, to excluding allergens or harmful additives for sensitive patients. The global compounding pharmacies market has gained significant traction due to the increasing demand for such personalized therapeutic solutions, especially in cases where standard drugs are unavailable or unsuitable.

The rising prevalence of chronic diseases, the growing geriatric population, and increasing awareness of personalized medicine are key forces propelling market expansion. Additionally, factors like drug shortages, the need for pediatric-specific formulations, and demand for bioidentical hormone replacement therapies (HRT) have cemented the importance of compounding pharmacies. The COVID-19 pandemic further underscored the relevance of compounding, as pharmacies were relied upon to fill critical drug gaps and offer tailored solutions amid supply chain disruptions.

While the market holds immense potential, regulatory inconsistencies across countries and concerns about the quality and standardization of compounded drugs continue to pose challenges. Nonetheless, technological advancements, digital health integration, and increased collaboration between physicians and compounding pharmacists are expected to transform this space in the years ahead.

Rising Demand for Bioidentical Hormone Replacement Therapy (BHRT): Increased awareness about natural alternatives to synthetic hormones is driving the adoption of BHRT, particularly among menopausal women and aging males.

Increased Pediatric and Geriatric Applications: Customized medications for children and elderly populations, who often face difficulty swallowing pills or require altered dosages, are becoming more common.

Technology Integration in Compounding: Use of automated compounding systems and software tools for formulation accuracy and inventory management is streamlining operations and improving safety.

Focus on Allergen-Free and Sugar-Free Formulations: Growing health consciousness and allergy concerns are leading to increased demand for tailor-made formulations free from dyes, gluten, lactose, and sugar.

Rise in Demand for Non-Sterile Compounding: Topical gels, oral solutions, and transdermal creams are gaining popularity for their ease of administration and adaptability.

Emergence of Veterinary Compounding: There is a growing market for compounding medications specifically formulated for animal health, particularly in North America and Europe.

| Report Attribute | Details |

| Market Size in 2024 | USD 17.02 Billion |

| Market Size by 2033 | USD 26.70 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.13% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Therapeutic area, age cohort, compounding type, sterility, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Walgreens Co; JL Diekman and AQ Touchard (Fresh Therapeutics Compounding Pharmacy); Fagron; Albertsons Companies; The London Specialist Pharmacy Ltd. (Specialist Pharmacy); Galenic Laboratories Ltd. (Roseway Labs); Aurora Compounding MEDS Pharmacy; Apollo Clinical Pharmacy; Formul8; Fusion Apothecary |

One of the primary drivers of the compounding pharmacies market is the escalating prevalence of chronic health conditions such as cancer, diabetes, arthritis, and cardiovascular diseases. These conditions often require long-term and tailored medication regimens that mass-produced drugs may not adequately provide. Compounded medications can be customized to suit the unique pharmacological and physiological needs of these patients, offering flexibility in dosing and drug combinations. For instance, patients with diabetes may require sugar-free options, or individuals with kidney issues may need formulations without certain excipients. As a result, compounding pharmacies are increasingly seen as a solution to bridge the therapeutic gaps left by standard treatments, leading to sustained market demand.

Despite its potential, the compounding pharmacy sector faces significant regulatory scrutiny and variability. Unlike FDA-approved drugs that undergo rigorous testing, compounded medications do not always follow standardized manufacturing protocols. This has led to concerns regarding the efficacy, sterility, and safety of compounded products. High-profile incidents, such as the 2012 fungal meningitis outbreak in the U.S. traced back to a compounding pharmacy, have intensified calls for tighter regulation. Countries have inconsistent frameworks, and while the U.S. has introduced oversight through the Drug Quality and Security Act (DQSA), implementation varies. These regulatory hurdles pose entry barriers for new players and may limit expansion in regions lacking clear legislative guidance.

As global populations age, the demand for medications tailored to the complex needs of elderly patients is growing exponentially. Elderly individuals often struggle with swallowing large pills, experience drug sensitivities, or require polypharmacy — where multiple medications are taken simultaneously. Compounding pharmacies can adjust dosages, convert oral medications into topical or liquid forms, and even combine multiple drugs into a single, easy-to-administer formulation. This flexibility offers a major opportunity for compounding pharmacies to enhance medication adherence and patient outcomes. Moreover, the rising emphasis on personalized medicine aligns closely with compounding capabilities, opening avenues in long-term care facilities, assisted living homes, and geriatric hospitals.

Hormone Replacement Therapy (HRT) dominated the therapeutic area segment in 2024, accounting for a significant revenue share due to the growing demand for bioidentical hormones. HRT, particularly among women undergoing menopause or individuals undergoing gender transition treatments, has seen rising popularity. Patients are increasingly opting for customized hormone therapies compounded to match their body’s natural hormones more precisely. This trend has been further bolstered by distrust in some commercially available hormone therapies and an increased focus on wellness and anti-aging treatments.

On the other hand, Specialty Drugs emerged as the fastest-growing therapeutic area within compounding. These drugs cater to rare diseases, oncology, and immune-related conditions that often require complex, patient-specific treatments. The limited availability of commercially manufactured specialty drugs and the frequent need for dosage adjustments based on real-time patient responses have created a strong case for compounded solutions. Moreover, advances in pharmacogenomics are aiding pharmacists in creating even more targeted therapies.

The adult cohort held the largest share in 2024, driven by widespread use of compounded therapies for pain management, dermatological treatments, hormone replacement, and chronic disease management. Adults are also more likely to seek alternative medication forms due to lifestyle preferences, allergies, or sensitivities. Moreover, the increase in awareness around preventive healthcare and wellness routines, particularly among health-conscious millennials and Gen X populations, has fueled demand for compounded nutritional supplements.

However, the pediatric cohort is projected to witness the fastest growth during the forecast period. Children often require specific dosages that are unavailable in standard pharmaceuticals, necessitating the customization of medication strengths, flavors, or forms (e.g., turning pills into liquids). The rise in pediatric asthma, ADHD, and infectious diseases has driven demand for more palatable and tolerable drug formulations, often facilitated by compounding pharmacies. Pediatricians are increasingly collaborating with compounders to ensure medication adherence and efficacy in younger populations.

Non-sterile compounding held the majority share, largely due to its application in dermatology, hormone therapy, and oral medications. These are easier to produce, more cost-effective, and cater to broader therapeutic areas. Common non-sterile compounded formulations include creams, gels, ointments, oral suspensions, and capsules. Given their lower production complexity and reduced regulatory constraints compared to sterile products, non-sterile compounding is highly prevalent.

In contrast, sterile compounding is the fastest-growing segment, driven by its necessity in oncology, ophthalmology, and parenteral nutrition therapies. With stringent safety and hygiene standards, sterile compounding requires specialized environments such as clean rooms and laminar airflow hoods. Growing demand for injectable therapies and intravitreal drug delivery has made sterile compounding essential in many specialty healthcare settings.

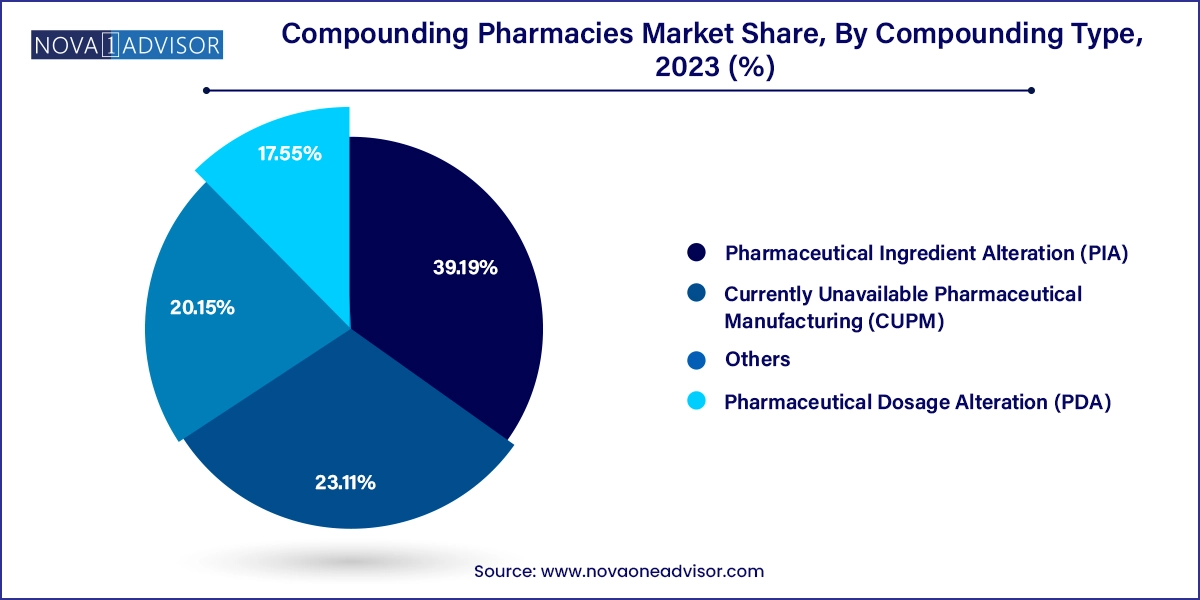

Pharmaceutical Ingredient Alteration (PIA) led the market by compounding type. This is due to the growing need for adjusting active pharmaceutical ingredients (APIs) to eliminate allergens, excipients, or ingredients that cause adverse reactions. This type of compounding is crucial for patients with rare allergies, metabolic disorders, or ingredient sensitivities, offering tailored solutions that standard pharmaceuticals cannot provide.

Currently Unavailable Pharmaceutical Manufacturing (CUPM) is the fastest-growing segment, particularly in regions facing drug shortages or supply chain disruptions. The ability to recreate discontinued or unavailable drugs whether due to market withdrawal, manufacturing issues, or regulatory changes allows compounders to fill crucial therapeutic gaps. During the COVID-19 pandemic, CUPM practices helped hospitals and clinics continue patient care when certain drugs were off the market.

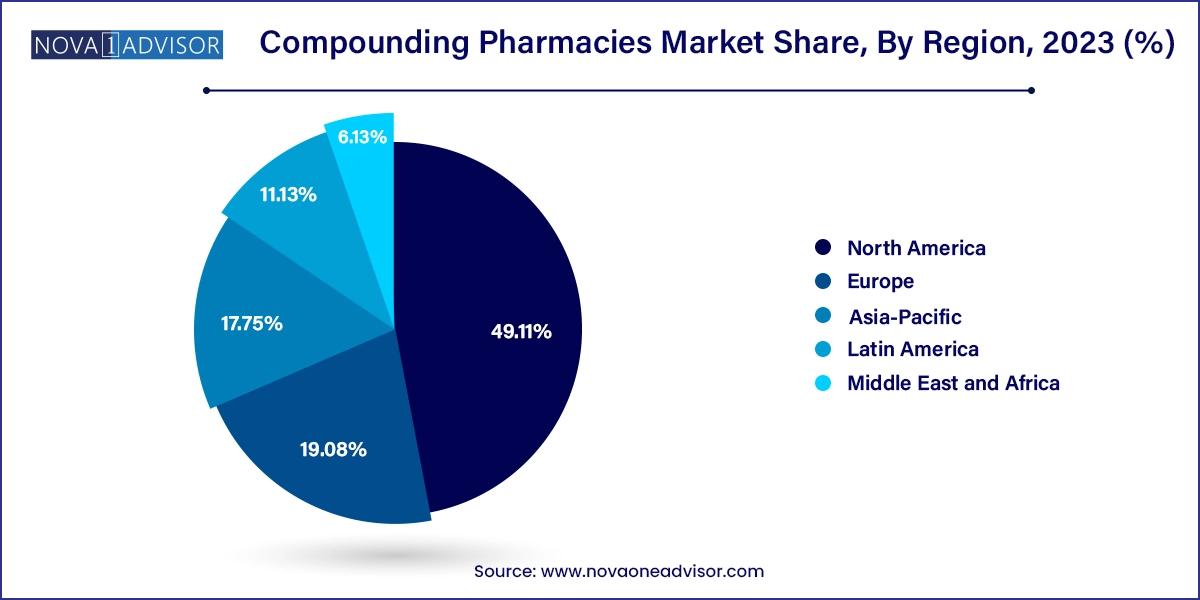

North America dominated the global compounding pharmacies market, primarily due to a mature healthcare infrastructure, supportive regulatory frameworks, and high awareness of customized medicine. The U.S. alone accounts for a major share, supported by the presence of numerous licensed compounding pharmacies and organizations such as the Pharmacy Compounding Accreditation Board (PCAB). The adoption of bioidentical HRT, wide use of pain management therapies, and increased prescriptions for veterinary and pediatric medications have all contributed to the region’s dominance. Additionally, the Drug Quality and Security Act (DQSA) implemented in 2013 enhanced regulatory clarity and boosted market credibility in the U.S.

Asia-Pacific is expected to exhibit the fastest growth during the forecast period. Countries like China, India, Japan, and South Korea are witnessing rising chronic disease prevalence, expanding middle-class populations, and growing investments in healthcare infrastructure. Additionally, cultural familiarity with personalized medicine including herbal and alternative medicine in some Asian countries aligns well with the principles of pharmaceutical compounding. The rapid expansion of private healthcare and medical tourism, especially in India and Thailand, also opens up new frontiers for compounding services.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Compounding Pharmacies market.

By Compounding Pharmacies Therapeutic Area

By Compounding Pharmacies Age Cohort

By Compounding Pharmacies Compounding Type

By Compounding Pharmacies Sterility

By Region