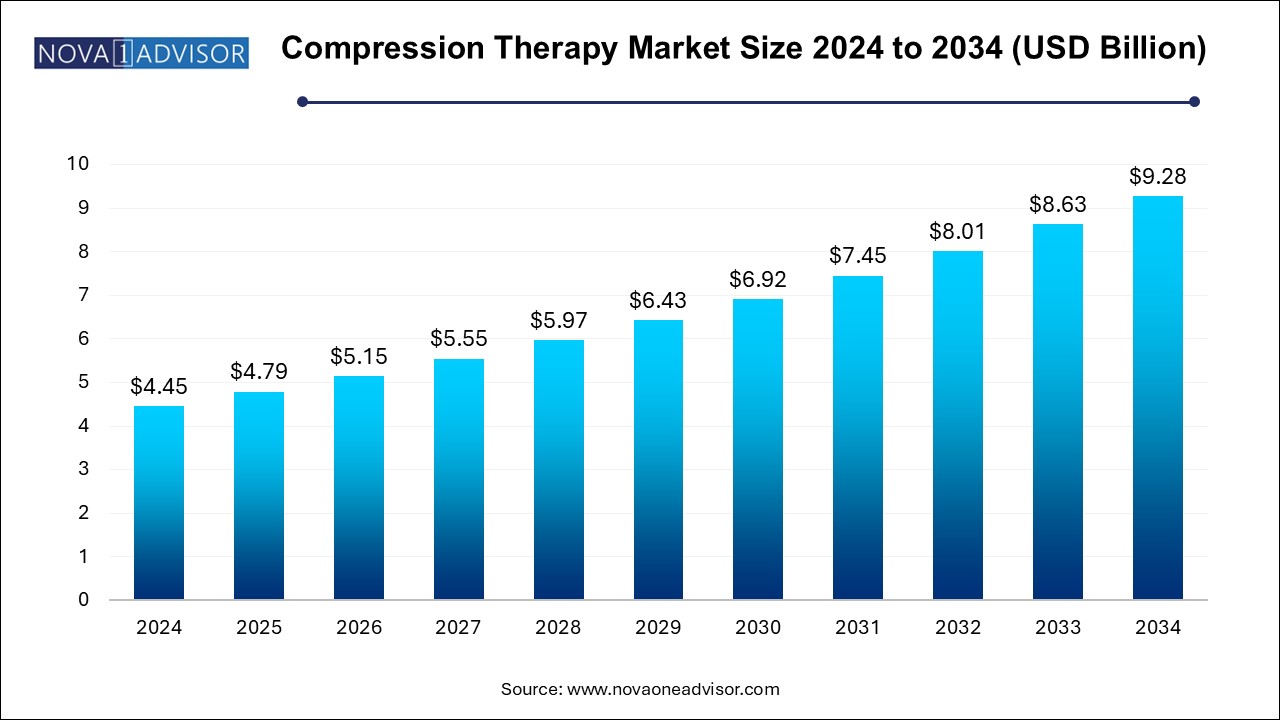

The global compression therapy market size was valued at USD 4.45 billion in 2024 and is anticipated to reach around USD 9.28 billion by 2034, growing at a CAGR of 7.63% from 2024 to 2034.

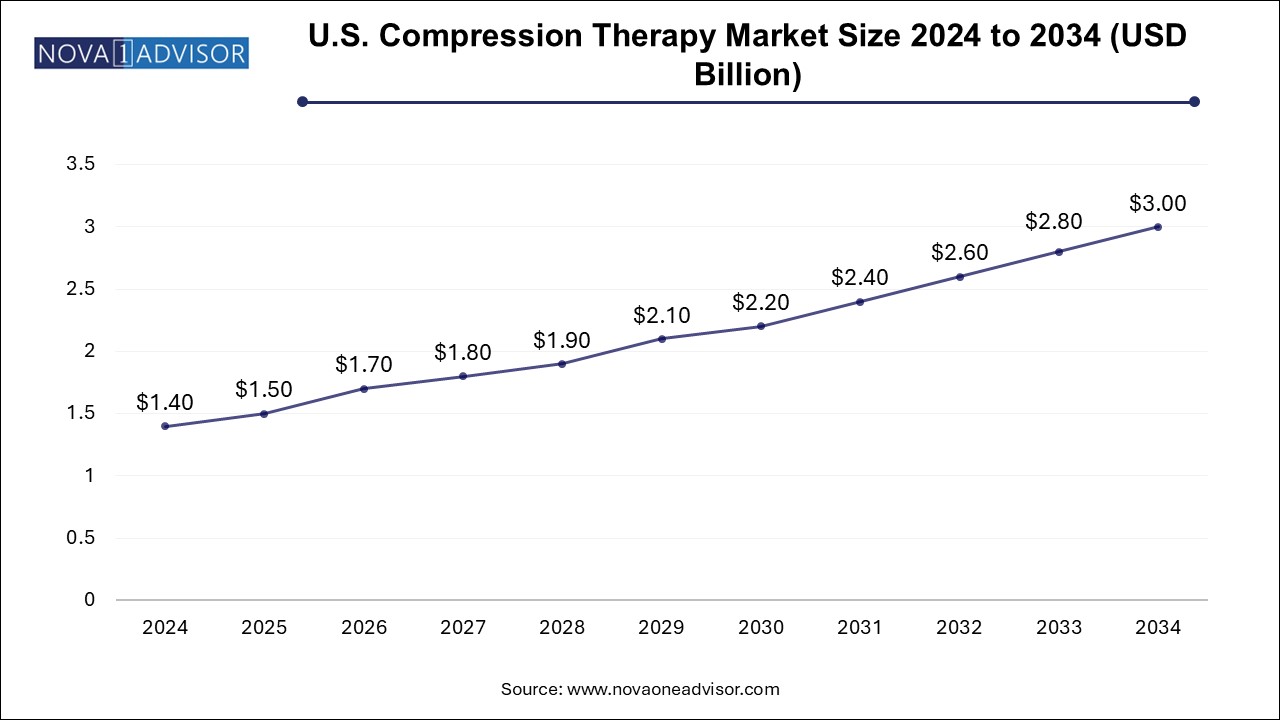

The U.S. compression therapy market size is evaluated at USD 1.4 billion in 2024 and is projected to be worth around USD 3.0 billion by 2034, growing at a CAGR of 7.11% from 2024 to 2034.

North America remains the dominant region in the global compression therapy market, fueled by advanced healthcare infrastructure, high adoption of post-surgical and chronic disease management solutions, and robust reimbursement systems. The U.S. accounts for the largest share due to its aging population, prevalence of lifestyle-related disorders, and early adoption of wearable medical devices. Companies like Tactile Medical and 3M have deep penetration in the region, and the presence of strong clinical research institutions supports innovation and new product validation.

Asia-Pacific is the fastest-growing region, driven by increasing healthcare access, awareness about vascular health, and growing surgical volumes. Countries like China, India, and South Korea are witnessing rising demand for compression therapy, particularly in urban centers. Improvements in hospital infrastructure, expanding middle-class income, and government focus on preventive healthcare are driving adoption. Local manufacturers are also entering the market, offering cost-effective compression garments for the mass market. The expanding base of diabetic and aging populations in this region makes it a strategic priority for global players.

The compression therapy market is a critical segment of the global healthcare industry, primarily focused on the treatment and management of venous and lymphatic disorders. It involves the use of garments or devices that apply controlled pressure to specific body areas—most commonly the limbs—to improve blood circulation, reduce swelling, and support muscle and vascular function. With growing incidences of chronic venous insufficiency (CVI), lymphedema, deep vein thrombosis (DVT), and varicose veins, compression therapy has emerged as a frontline conservative treatment.

This market spans across both preventive care and post-operative recovery, offering a wide range of products—from compression stockings and bandages to pneumatic compression pumps. The rising geriatric population, who are more susceptible to vascular and circulatory issues, is significantly contributing to market growth. In addition, increased awareness of sports recovery, diabetes-related complications, and occupational health hazards (e.g., prolonged standing or sitting) is expanding the target population.

Technological advancements are transforming the market from simple static compression garments to digitally operated dynamic compression devices. Moreover, growing patient preference for at-home and self-administered treatments is creating demand for wearable, user-friendly solutions. With compression therapy being non-invasive, cost-effective, and widely recommended by healthcare professionals, its adoption continues to expand across hospitals, clinics, and home healthcare settings.

Increased Demand for Wearable Compression Devices: Portable, easy-to-use devices that allow compression therapy at home are gaining traction, particularly among elderly and post-surgical patients.

Integration of Smart Technologies: Devices with built-in sensors and app connectivity are enabling real-time monitoring and personalized therapy adjustments.

Growth in Sports Compression Products: Athletes are increasingly using compression garments for performance enhancement and faster recovery.

Shift Toward Preventive Care and Early Diagnosis: Preventive use of compression wear in patients at risk of venous disorders is rising, especially in diabetic and obese populations.

Rising Popularity of Adjustable Compression Stockings: Products that allow patients to control pressure levels are improving adherence and comfort.

E-commerce and Direct-to-Consumer Distribution: Online platforms are becoming important distribution channels for compression products, enabling easy access and price comparison.

Expansion into Emerging Markets: Increased healthcare access and awareness in Asia-Pacific and Latin America are driving growth beyond traditional Western markets.

Regulatory Focus on Product Quality and Reimbursement: Enhanced focus on quality standards and insurance coverage for compression therapy is positively influencing patient adoption.

| Report Attribute | Details |

| Market Size in 2025 | USD 4.79 Billion |

| Market Size by 2034 | USD 9.28 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 7.63% |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, end use, distribution channel, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Essity Aktiebolag (publ); Cardinal Health; Julius Zorn GmbH; Hartmann AG; Medi GmbH & Co.; SIGVARIS; BSN Medical GmbH; ArjoHuntleigh; 3M Health Care; Spectrum Healthcare; Bio Compression Systems, Inc.; Stryker; Gottfried Medical; Tactile Medical |

A major factor driving the global compression therapy market is the rising incidence of chronic venous diseases, lymphedema, and lifestyle-related circulatory issues. According to the CDC, nearly 900,000 people in the United States are affected by DVT each year, many of whom benefit from early compression therapy interventions. Similarly, conditions like varicose veins affect up to 30% of the population in industrialized nations, and compression garments serve as a first-line treatment.

Beyond venous diseases, the increasing global prevalence of diabetes and obesity contributes to poor circulation and edema, conditions commonly managed using compression. Additionally, long post-surgical recovery times and complications such as venous thromboembolism (VTE) have led to the routine application of compression garments in post-operative care. Together, these clinical trends underscore compression therapy as a core component of modern patient care, supporting its market growth.

One of the most significant restraints in the compression therapy market is poor patient compliance, often driven by discomfort or difficulty in application. Compression stockings and garments can be difficult to put on, especially for elderly or mobility-impaired patients. Improper sizing, excessive tightness, or prolonged use can lead to skin irritation, constriction marks, and reduced mobility.

This problem is especially pronounced in the management of chronic conditions like lymphedema, where long-term, consistent use is critical for success. Despite clinical recommendations, many patients abandon therapy due to physical discomfort or lack of perceived immediate benefit. Manufacturers are addressing this issue through design innovations, but adherence remains a challenge, particularly in developing markets where professional guidance and patient education are limited.

A compelling opportunity in the compression therapy market lies in the rapid advancement of dynamic compression technologies. Unlike traditional garments that apply constant pressure, dynamic compression devices use pneumatic systems to deliver intermittent pressure in controlled cycles. These devices are particularly effective for treating DVT, post-operative edema, and lymphatic drainage disorders.

Companies are now developing digitally controlled pumps with programmable settings, app-based tracking, and smart diagnostics. Such innovations not only enhance treatment efficacy but also improve patient comfort and compliance. With rising demand for home-based care, dynamic devices are becoming more compact, portable, and affordable—broadening their appeal beyond hospitals and clinics. This trend is expected to revolutionize compression therapy and significantly expand its adoption in both developed and emerging markets.

Static compression therapy dominated the market, owing to its widespread use in the treatment of chronic venous insufficiency, varicose veins, and post-operative edema. This category includes compression bandages, stockings, tapes, and other garments that exert constant pressure on the affected area. Among these, compression stockings hold the lion’s share due to their ease of use, availability in various pressure gradients, and prescription by physicians for long-term use. Many patients with chronic lower limb conditions rely on these garments daily to manage swelling and pain. Hospitals and home healthcare providers also prefer static therapy due to its affordability and simplicity.

Dynamic compression therapy is the fastest-growing segment, driven by the increasing application of compression pumps and sleeves in both clinical and home settings. These devices offer intermittent pressure cycles that more effectively stimulate blood flow and lymphatic drainage. Dynamic therapy is particularly favored in post-surgical recovery, sports medicine, and management of lymphedema. Companies like Tactile Medical and Bio Compression Systems have introduced innovative portable compression pumps with adjustable cycles, digital interfaces, and programmable settings. The superior efficacy of dynamic therapy, combined with growing awareness and demand for personalized care, is driving rapid expansion of this segment.

Hospitals continue to dominate the end-use segment, as they are the primary centers for surgical recovery, trauma care, and chronic disease management. Patients undergoing orthopedic surgeries, cardiac procedures, or vascular interventions often receive compression therapy as part of post-operative care. Hospitals also invest in advanced compression pumps and pressure garments to prevent hospital-acquired DVT and manage high-risk patients. Furthermore, the presence of trained healthcare staff ensures correct application and monitoring, making hospitals the cornerstone of compression therapy services.

Home healthcare is the fastest-growing end-use segment, spurred by the rising geriatric population, chronic disease burden, and the shift toward outpatient and decentralized care models. Portable compression pumps, easy-to-wear stockings, and wearable sleeves are being increasingly prescribed for at-home use. Patients recovering from surgery or managing lifelong conditions like lymphedema prefer home-based therapy for its convenience and cost savings. The proliferation of telemedicine and remote monitoring tools is further facilitating at-home compression therapy, making it a pivotal growth area for manufacturers and service providers alike.

Institutional sales dominate the distribution channel, with hospitals, specialty clinics, and nursing homes accounting for the bulk of compression therapy procurement. Institutional buyers often enter into bulk contracts with suppliers, ensuring consistent availability of compression products for inpatient and surgical care. Manufacturers like 3M, Smith & Nephew, and Cardinal Health focus heavily on institutional channels through medical supply distributors, GPOs (Group Purchasing Organizations), and hospital procurement networks.

Retail sales are expanding rapidly, largely due to the growth of e-commerce, pharmacies, and direct-to-consumer channels. Patients with chronic conditions are purchasing compression stockings, sleeves, and bandages from online platforms, drugstores, or specialty wellness outlets. Companies are also leveraging digital marketing and subscription models to reach end-users directly. Retail sales offer greater flexibility and convenience, particularly for patients managing long-term conditions at home.

April 2025 – 3M announced the launch of its Coban™ 2 Compression System in North America with enhancements for ease of application and extended wear, aiming to improve outcomes in lymphedema and venous leg ulcer treatment.

February 2025 – Tactile Medical reported FDA clearance for its next-generation Flexitouch® system, a portable pneumatic compression device tailored for home treatment of lower extremity lymphedema.

January 2025 – Essity expanded its JOBST® compression therapy line with a new range of adjustable compression wraps, designed for self-management by patients with chronic venous insufficiency.

December 2024 – Bio Compression Systems launched a compact digital compression pump with Bluetooth connectivity, allowing clinicians to remotely monitor patient adherence and adjust treatment protocols.

November 2024 – Smith & Nephew introduced a multi-layer compression bandage with antimicrobial properties under its PROFORE™ brand, targeting post-surgical wound care and venous ulcers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Compression Therapy market.

By Technology

By End-use

By Distribution Channel

By Region