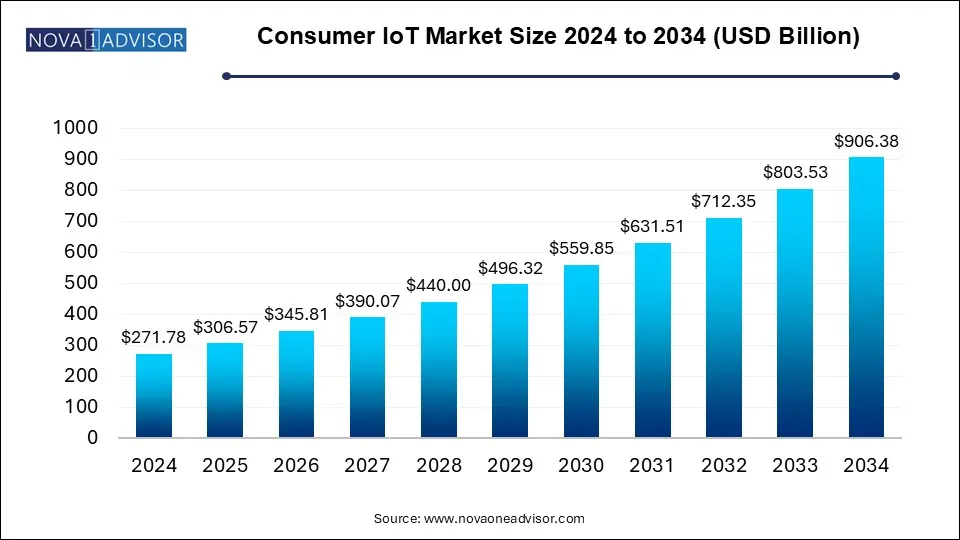

The consumer IoT market size was exhibited at USD 271.78 billion in 2024 and is projected to hit around USD 906.38 billion by 2034, growing at a CAGR of 12.8% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 306.57 Billion |

| Market Size by 2034 | USD 906.38 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 12.8% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Component, Connectivity Technology, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Alphabet Inc.; Amazon.com, Inc.; Apple Inc.; AT&T, Cisco Systems, Inc.; Honeywell International Inc.; IBM Corp.; Intel Corp.; LG Corp.; Microsoft; Samsung; Schneider Electric; Sony Corp.; Texas Instruments; TE Connectivity |

The growth can be credited to the growing popularity of technologically advanced devices and home appliances. Consumer internet of things (IoT) devices are integrated with multiple microcontrollers and wireless technologies, making it easier to share data without direct interaction between the users or the computer. Consumer IoT refers to an interconnected system of digital and physical objects, such as smartphones, smart wearables, and smart home devices, designed for the consumer markets.

In the past few years, such devices have quickly become an integral part of day-to-day lives. A prominent example of these developments is Echo, a Bluetooth device by Amazon.com, Inc. It is powered by the company’s voice assistant Alexa, which is compatible with various smart home devices. The increasing demand for such devices is expected to create opportunities for the market of consumer internet of things in the coming years. The industry growth is further propelled by the increased adoption of personal wearables for monitoring health parameters.

Consumer IoT applications are playing a vital role in improving personal healthcare through IoT wearables that transmit data to patients and their doctors. In addition, their application is emerging as a common practice in various sports. Many consumer IoT devices help monitor heart rate, sleep, blood sugar, and other variables, thereby positively influencing the overall industry statistics.

The COVID-19 pandemic opened up new growth avenues for the overall market as the global health crisis created a greater need for solutions that can help obtain patient care remotely. The wearable devices, such as smartwatches and biosensors, helped healthcare professionals remotely monitor the ongoing health conditions of the patients, allowing observation and treatment that was earlier possible only in hospitals and clinics. The rising product adoption encouraged the industry players to develop new wearables to fulfill the increased consumer demand during the pandemic. For instance, in May 2020, Koninklijke Philips N.V. received CE marking and FDA approval for its wireless wearable biosensor designed for monitoring patients affected by the coronavirus.

On the basis of components, the global industry has been further categorized into hardware, services, and software. The hardware component segment accounted for the maximum revenue share of more than 38.85% in 2024 owing to the increasing demand for IoT devices. These devices comprise actuators, sensors, gadgets, machines, and appliances that are programmed for specific applications and can transmit data over networks.

Moreover, the ongoing technological developments are expected to favor segmental growth over the forecast period. The services component segment is expected to record the fastest growth rate from 2025 to 2034 on account of the growing need for solutions that support the functioning of consumer IoT devices. The service providers deliver end-to-end software development solutions for consumer IoT, from project planning and testing to deployment. In addition, they also provide consulting services, such as architectural engineering, IoT tech stack, software audit, etc.

The wireless connectivity technology segment is expected to record the fastest growth rate of more than 13.60% from 2025 to 2034, owing to the greater scalability offered by these networks. They do not require hardware installations and can be extended with ease without considering the obstructions in the facility. Most wireless sensors comprise nodes that can be extended by adding extra nodes whenever required. In addition, they are more cost-effective as their prices have reduced due to the ongoing advancements in wireless technology and an increasing number of manufacturers.

The wired connectivity technology segment also accounted for a significant revenue share in 2024 and will expand further at a steady pace as this mode of connectivity is still very popular among consumers. The wired network typically employs Ethernet for network connectivity, making them highly reliable. They are less likely to observe dropped connections. Moreover, they offer a greater data transmission speed as they are not affected by the distance and placement of devices. In addition, wired networks are more secure as they are deployed with a LAN firewall.

The consumer electronics segment accounted for the largest share of more than 38.0% of the overall revenue in 2024, owing to the increasing consumer inclination toward incorporating smart consumer electronics devices in residential spaces. The advent of technologies, such as sensors, digital assistants, advanced networking, and cloud computing, have made home automation possible in day-to-day life. According to credible reports, nearly 15% of homes across the globe are expected to install a smart home appliance by 2024.

The wearable segment is estimated to register the fastest CAGR from 2025 to 2034 owing to the increasing internet penetration, rising disposable incomes, and lower average selling prices of these devices. In addition, wearable devices provide several benefits for healthcare providers as well as patients as they help in glucose monitoring, hand hygiene monitoring, heart-rate monitoring, Parkinson’s disease monitoring, depression monitoring, etc. Thus, the rising adoption of wearable consumer IoT devices for health monitoring is expected to create lucrative growth opportunities for the market.

North America accounted for the largest share of more than 24.0% of the overall revenue in 2024 and is expected to grow significantly during the forecast period. This can be credited to the increased product demand, especially fitness tracking devices, in the region. According to a 2024 survey conducted by ValuePenguin on over 1,500 consumers, while 45% of Americans are already using smartwatches such as Fitbits and Apple Watches, 69% of respondents are willing to use a fitness tracker to get discounts on health insurance. Asia Pacific is expected to record a substantial CAGR from 2025 to 2034 with the growing popularity of smart home solutions in the region.

According to 2021 data released by the China Business Industry Research Institute, the smart home market in China expanded from USD 40.96 billion in 2016 to USD 91.08 billion in 2021. Moreover, the IoT developments across the Middle East and Africa (MEA) region, attributed to the government-initiated smart city projects to leverage long-term sustainability, are expected to propel the growth of the market across the MEA region. The regional market is estimated to grow at a significant rate during the forecast period.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the consumer IoT market

By Component

By Connectivity Technology

By Application

By Regional