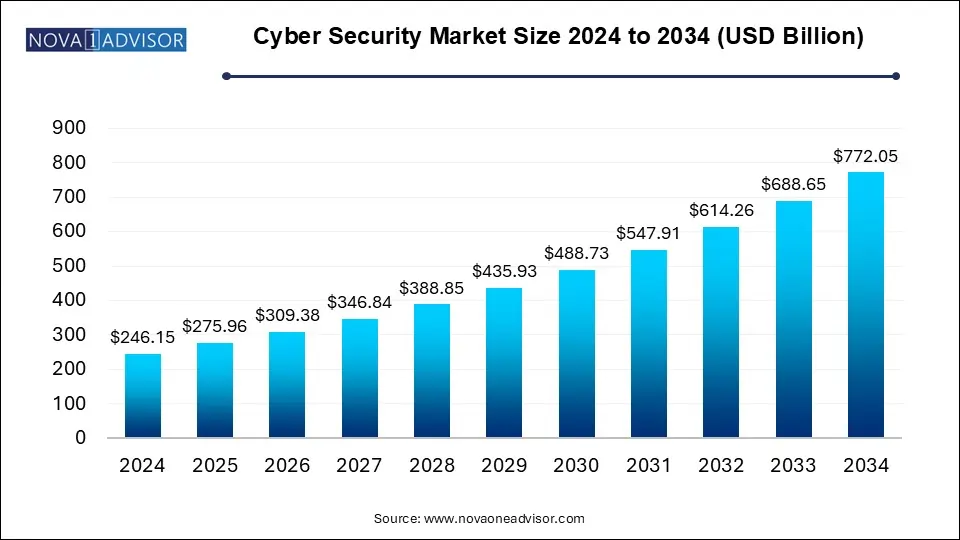

The cyber security market size was exhibited at USD 246.15 billion in 2024 and is projected to hit around USD 772.05 billion by 2034, growing at a CAGR of 12.11% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 275.96 Billion |

| Market Size by 2034 | USD 772.05 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 12.11% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Offering, Security, Deployment, Organization Size, Solution, End Use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Fortinet, Inc.; IBM Corporation; Microsoft; BAE Systems Plc; Broadcom, Inc.; Centrify Corporation; Check Point Software Technology Ltd.; Palo Alto Networks, Inc.; Proofpoint, Inc.; Sophos Ltd. |

A growing number of cyber-attacks owing to the proliferation of e-commerce platforms, emergence of smart devices, and deployment of cloud are some key factors propelling market growth. Moreover, increasing usage of devices equipped with the Internet of Things (IoT) and intelligent technologies is expected to increase cases of cyber threats. As such, end-user organizations are anticipated to integrate advanced cyber security solutions to mitigate cyber-attack risk, supporting the cyber security industry growth.

With the cyber environment emerging as a highly integrated system, the need for an adaptive, multi-layered, self-learning security system has become imperative. In addition, factors such as the emergence of mobile-networked devices, prevalence of electronic communications, the growth of social media, and an increasing reliance on Big Data have created a need for the defense cybersecurity system to be updated with the changing cyber threat scenario. Governments have increased their spending on cybersecurity solutions to protect devices and confidential data from cyberattacks, supporting market growth.

Advancements in emerging technologies, such as AI in cyber security, Machine Learning (ML), big data analytics, IoT, 5G, edge computing, and cloud computing, are allowing market players to introduce new solutions based on these technologies, attract potential business clients, and expand their revenue streams. For instance, in June 2021, Broadcom Inc. launched Adaptive Protection, a new security solution, as a part of Symantec’s Endpoint Security Solution. The solution is powered by ML technology and provides customized and automated enhanced security on cyber-attacks while saving customers' overhead costs by leveraging the power of AI to customize the endpoint security.

Globally, several employees are expected to continue working from remote premises or homes. Choose Your Own Device (CYOD) and Bring Your Own Device (BYOD) models allow employees to access business information through cloud platforms, making them vulnerable to data theft. Traditional cyber security solutions cannot protect devices from all forms of Advanced Persistent Threats (APT) or malware attacks, fueling demand for advanced cyber security solutions. Moreover, the cyber security training market is booming, driven by the ever-increasing threat of cyberattacks. Businesses of all sizes are realizing the importance of investing in cybersecurity training for their employees, as even a single cyber-attack can have devastating consequences.

The hardware segment led the market in 2024, accounting for over 56.0% of the global revenue as several organizations are implementing cybersecurity platforms and upgrading their existing platforms. Security vendors are developing cyber security solutions based on artificial intelligence and machine learning, which necessitate high-end IT infrastructure. With a notable increase in cyber threats from several anonymous networks, various end-user businesses and Internet Service Providers (ISPs) are anticipated to deploy advanced security hardware, such as encrypted USB flash drives, as Intrusion Prevention Systems (IPS).

The services segment is predicted to foresee significant growth in the coming years.Strong preference of organizations for deploying suitable cyber security solutions based on organizational structure is driving the adoption of cyber security services across several industries and sectors. Small and Medium-sized Enterprises (SMEs) have limited budgets due to which these organizations prefer consulting before implementing any solutions, supporting segment growth in the market. Several organizations are subscribing to cyber security services as part of their efforts to build a robust security structure for mitigating cyberattacks.

The infrastructure protection segment accounted for the largest market revenue share in 2024. Infrastructure protection helps in ensuring stability, security, and resilience of critical organization systems that support the functioning of an organization. Infrastructure protection systems help in securing physical and virtual assets including transportation networks, communication systems, and in-house operational assets. The market is witnessing greater collaboration among government agencies, private enterprises, and security professionals, developing comprehensive and adaptive protection frameworks to identify and respond to risks in a rapidly evolving threat environment.

The cloud security segment is expected to experience substantial growth in the coming years due to the increasing adoption of cloud-based solutions across industries. As organizations migrate their data, applications, and workloads to the cloud, the need for robust security measures to protect sensitive information becomes paramount. Rising incidences of data breaches, sophisticated cyberattacks, and compliance requirements are further driving investments in advanced cloud security solutions. Moreover, the proliferation of remote work and hybrid environments has heightened the demand for secure access to cloud resources. Innovations in technologies such as Zero Trust Architecture, Secure Access Service Edge (SASE), and cloud-native security tools are also boosting the segment's growth, enabling organizations to safeguard their digital assets effectively.

The cloud segment accounted for the largest market revenue share in 2024. The surge in remote work and hybrid operating models has accelerated cloud adoption, necessitating advanced security measures to safeguard sensitive data and applications. Rising concerns about data breaches, ransomware attacks, and regulatory compliance have further driven demand for cloud-based security solutions. Cloud-native capabilities, such as automated threat detection, real-time monitoring, and scalable security architectures, are attracting organizations seeking robust protection. Additionally, the integration of AI and machine learning in cloud security enhances threat prediction and response, making cloud deployment a preferred choice for securing digital assets.

The on-premises segment is anticipated to witness significant growth in the coming years.Organizations in industries like finance, healthcare, and government, which handle highly sensitive information, prefer on-premises solutions to maintain full control over their cybersecurity infrastructure. Growing concerns over data sovereignty, regulatory compliance, and third-party access risks further drive the adoption of on-premises deployment. Additionally, enterprises with legacy systems and complex IT environments often opt for on-premises solutions to ensure seamless integration and customization. The segment is also benefiting from advancements in technologies such as endpoint security, firewalls, and intrusion detection systems, enabling organizations to safeguard critical assets with tailored and robust on-site protection.

The large enterprises segment accounted for the largest market revenue share in 2024.Increased spending by large enterprises on IT infrastructure to strengthen digital security to protect the large volumes of data storage is driving the market growth. Furthermore, large enterprises possess several servers, storage equipment, endpoints, & networks, which make them vulnerable to substantial monetary losses due to cyber-attacks. To avoid such issues, large enterprises are focusing on adopting cyber security solutions to secure their data, supporting market growth.

The SMEs segment is anticipated to exhibit the highest CAGR over the forecast period. Due to budget constraints, SMEs are more vulnerable to cyber-attacks owing to their low level of security. Moreover, a lack of security policies and employee skills also makes them prone to cyber-attacks. To overcome these challenges, SMEs resort to cyber security insurance as it protects them from financial losses caused by malicious software attacks and data breaches, supporting the segment's growth.

The Identity and Access Management (IAM) segment accounted for the largest market revenue share in 2024. IAM solutions mitigated identity theft through risk-based programs with features that focus on implementing entitlement management and logical access control. Increasing spending on security solutions by large-scale enterprises and government bodies to adhere to regulatory compliance and control identity theft is anticipated to boost segment growth. Growing unauthorized access is impelling various end-use companies to adopt IAM to mitigate digital security risks and provide a secure platform for sharing information within the organization.

The risk and compliance management solution segment is anticipated to witness significant growth in the cybersecurity market due to increasing regulatory requirements and the need for proactive risk mitigation strategies. As organizations face heightened scrutiny from regulatory bodies, solutions that help ensure compliance with standards like GDPR, HIPAA, and CCPA are in high demand. The rising complexity of cyber threats and vulnerabilities has further emphasized the importance of risk assessment and management tools to prevent financial losses and reputational damage. Additionally, the adoption of digital transformation initiatives has exposed businesses to new risks, driving investments in integrated solutions that offer real-time monitoring, reporting, and analytics. These tools enable organizations to stay ahead of evolving risks while maintaining regulatory compliance.

The IT and telecommunications segment accounted for the largest market revenue share in 2024.With the rise of cloud computing, IoT devices, and software-defined networks, the sector faces heightened risks of sophisticated cyberattacks targeting critical infrastructure, sensitive customer data, and intellectual property. Additionally, the growing adoption of remote work and virtual collaboration tools has expanded the attack surface, necessitating robust cybersecurity solutions. Regulatory mandates for data protection and privacy, along with the need to maintain uninterrupted service delivery, are further driving investments in advanced security measures. Emerging technologies like AI-driven threat detection and secure access frameworks are bolstering cybersecurity efforts within this dynamic sector.

The healthcare segment is anticipated to exhibit the highest CAGR over the forecast period. The sector is a prime target for cyberattacks due to the sensitivity and value of patient data, making robust cybersecurity solutions essential. Rising incidents of ransomware attacks and data breaches in healthcare facilities have heightened the need for advanced threat detection and response mechanisms. Regulatory requirements, such as HIPAA, demanding stringent data protection measures, are also driving investments in cybersecurity. Additionally, the integration of AI and machine learning in healthcare security solutions enables real-time monitoring, anomaly detection, and protection of critical infrastructure against evolving cyber threats.

North America cyber security market dominated with a revenue share of over 35.0% in 2024. The North America cyber security market is expanding progressively in line with continued advances in latest technologies, such as big data and the Internet of Things (IoT). Furthermore, a proliferation of IT companies and their diversified businesses in the region is creating a need for protection of endpoint devices. Governments are also pursuing various initiatives to increase awareness about cyber security among organizations and to encourage and support them in adopting adequate cyber security measures. Thus, the above-mentioned factors are expected to drive the North America cyber security market.

U.S. Cyber Security Market Trends

The U.S. cyber security market segment is expected to see significant growth in the cybersecurity industry due to the increasing frequency and sophistication of cyberattacks targeting critical infrastructure, businesses, and government agencies. As one of the most digitally advanced economies, the U.S. faces heightened risks from ransomware, phishing, and advanced persistent threats. Regulatory frameworks, such as the Cybersecurity Maturity Model Certification (CMMC) and other federal initiatives, are driving organizations to adopt robust security measures.

Europe Cyber Security Market Trends

The Europe cyber security industry is expected to witness significant growth over the forecast period. The growth in the cyber security industry in Europe is driven by the increasing development of IT infrastructure, growing internet penetration, and proliferation of connected devices and numerous endpoints. Furthermore, UK cyber security market is rapidly growing in the owing to the fast-paced adoption of digital technologies and connected devices and the use of endpoint devices connected to large organizational networks.

Asia Pacific Cyber Security Market Trends

The cyber security industry in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. The growth of Asia Pacific cyber security market can be attributed to a growing number of data centers, increasing adoption of cloud technologies, growing cyber security jobs, and proliferation of IoT devices. Furthermore, several organizations in Asia have created cyber security solutions with built-in capabilities to detect any potential vulnerabilities which is also creating a favorable environment for Asia Pacific cyber security market growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the cyber security market

By Offering

By Security

By Deployment

By Organization Size

By End Use

By Regional