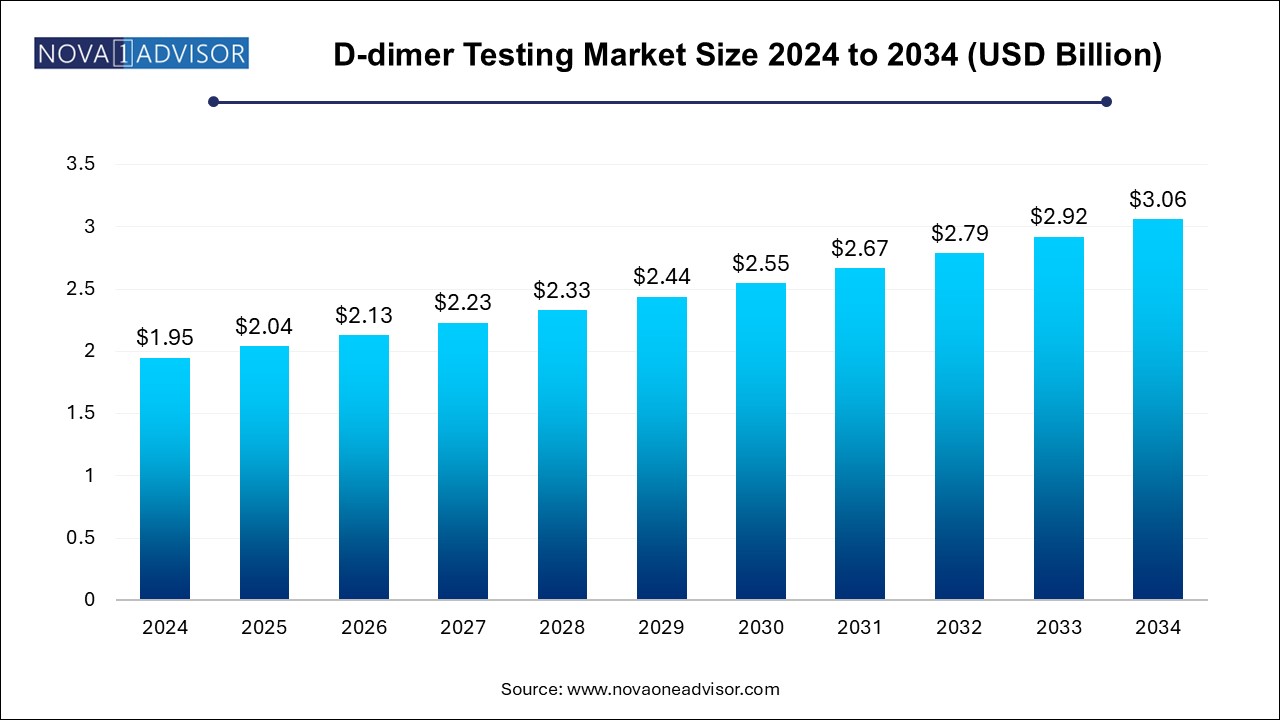

The D-dimer testing market size was exhibited at USD 1.95 billion in 2024 and is projected to hit around USD 3.06 billion by 2034, growing at a CAGR of 4.6% during the forecast period 2024 to 2034.

The D-dimer testing market plays a critical role in the global diagnostic landscape, serving as a primary tool for the detection and exclusion of thrombotic disorders such as deep vein thrombosis (DVT), pulmonary embolism (PE), and disseminated intravascular coagulation (DIC). D-dimer, a fibrin degradation product present in the blood after a clot dissolves, is a sensitive biomarker that helps clinicians assess thromboembolic activity and guide further diagnostic imaging or therapeutic intervention.

Over the past decade, the clinical significance of D-dimer testing has expanded beyond the traditional scope of venous thromboembolism (VTE) diagnostics. It is now commonly utilized in emergency care settings, oncology, cardiovascular disease assessment, and, more recently, infectious disease monitoring—including its notable use during the COVID-19 pandemic to assess coagulation dysfunction in severely ill patients. The pandemic notably highlighted the importance of rapid, high-throughput D-dimer assays and accelerated the integration of point-of-care (PoC) technologies for bedside testing.

As healthcare systems worldwide strive to enhance diagnostic accuracy, speed, and efficiency, D-dimer testing is increasingly embedded into standardized care pathways. Advanced immunoassay methods, such as ELISA and latex-enhanced immunoturbidimetric assays, have improved the sensitivity and specificity of D-dimer tests. Further, the development of compact analyzers and integrated PoC platforms is making D-dimer testing more accessible, particularly in outpatient clinics, intensive care units (ICUs), and remote or rural settings.

Growth in the D-dimer testing market is further supported by a confluence of factors including the rising global prevalence of cardiovascular disorders, increasing geriatric population, expanding healthcare infrastructure in emerging economies, and continuous technological advancements in diagnostic instrumentation. As precision medicine and early intervention gain prominence, D-dimer testing is expected to become a cornerstone in the evolving paradigm of personalized healthcare.

Rising Prevalence of Thrombotic Disorders: Increasing incidence of DVT, PE, and cardiovascular diseases is driving higher demand for D-dimer testing.

Shift Toward Point-of-Care Diagnostics: Portable D-dimer testing platforms are gaining adoption in emergency departments, ambulances, and remote clinics.

Multiplex Diagnostic Platforms: Integration of D-dimer tests with other coagulation or inflammation markers in a single panel is enhancing clinical utility.

Automation and AI in Laboratories: Automated analyzers with AI-driven interpretation are reducing manual errors and expediting turnaround times.

Use of D-dimer in Non-thrombotic Conditions: Growing application in sepsis, trauma care, and cancer prognosis is broadening the clinical landscape.

Post-COVID Surveillance Demand: Ongoing monitoring of coagulopathies in post-acute COVID syndrome patients has sustained market momentum.

Cost Containment in Diagnostics: Healthcare providers are seeking faster, more cost-effective assays without compromising accuracy.

Expansion in Emerging Markets: Governments and private sectors in Asia Pacific and Latin America are investing in diagnostic infrastructure, including coagulation testing.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.04 Billion |

| Market Size by 2034 | USD 3.06 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 4.6% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Test Type, Method, Application, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd; Siemens Healthcare; Abbott; BIOMÉRIEUX; WERFEN; HORIBA, Ltd.; QuidelOrtho Corporation; Diazyme Laboratories; Biomedica Diagnostics; SEKISUI Diagnostics |

Global Rise in Thromboembolic and Cardiovascular Conditions

One of the primary drivers of the D-dimer testing market is the global surge in thromboembolic disorders, which are often life-threatening if undiagnosed. Conditions like DVT and PE are increasingly common, especially among aging populations, individuals with sedentary lifestyles, and those with underlying conditions such as cancer or obesity. According to the Centers for Disease Control and Prevention (CDC), VTE affects up to 900,000 people annually in the U.S. alone.

In such cases, D-dimer testing serves as a vital early diagnostic tool due to its high sensitivity in detecting abnormal clotting. It enables physicians to rule out VTE in low to moderate risk patients, thereby reducing the need for expensive imaging procedures such as CT pulmonary angiography or venous Doppler ultrasounds. Moreover, the test's value in rapidly assessing patients with suspected PE in emergency care settings has contributed to widespread adoption. As the prevalence of thrombotic risk factors continues to rise globally, D-dimer testing is poised to become increasingly indispensable in frontline and preventive diagnostics.

False Positives and Limited Specificity

While D-dimer testing is renowned for its high sensitivity, its limited specificity remains a significant market restraint. Elevated D-dimer levels can result from numerous non-thrombotic conditions including inflammation, infection, pregnancy, surgery, trauma, liver disease, and malignancies. This predisposition to false-positive results often necessitates follow-up imaging or additional blood tests to confirm or rule out VTE, increasing the overall cost and complexity of diagnostics.

Additionally, variations in assay methodology and cutoff thresholds across manufacturers and healthcare institutions can lead to inconsistent interpretations. Without standardized calibration and interpretation protocols, physicians may encounter challenges in decision-making, especially in borderline cases or when managing high-risk patients. These limitations underscore the need for clinical correlation and judicious use, which may restrict broader adoption in resource-limited or low-expertise environments.

Expansion of Point-of-Care D-dimer Testing

The transition toward decentralized diagnostics and rapid triage is unlocking significant opportunities for point-of-care (PoC) D-dimer testing. PoC devices offer quicker turnaround times (often under 15 minutes), portability, and ease of use—making them particularly valuable in emergency departments, ICUs, rural clinics, and even ambulatory settings. During the COVID-19 pandemic, PoC D-dimer testing was extensively used for rapid coagulation assessment in hospitalized patients and has since gained clinical traction.

With ongoing innovation in lateral flow assays, microfluidics, and cartridge-based platforms, PoC D-dimer tests are becoming more reliable and easier to interpret. Integration with electronic health records (EHR) and AI-based decision support systems further enhances their value. Companies developing compact, accurate, and regulatory-compliant PoC D-dimer solutions are likely to benefit from increased adoption in outpatient and mobile diagnostic services, especially in markets with constrained healthcare infrastructure.

Reagents and consumables dominate the product segment, driven by the recurring need for test kits, calibrators, quality controls, and assay-specific cartridges. Hospitals and diagnostic labs perform frequent D-dimer tests for patient triage, VTE risk stratification, and therapy monitoring, which creates a continuous demand for high-quality reagents. Moreover, assay compatibility requirements and expiration timelines make replenishment frequent. Many leading manufacturers operate under reagent rental models, where instruments are placed at customer sites in exchange for long-term reagent purchases, further boosting this segment.

Analyzers are the fastest-growing segment, particularly due to the proliferation of automated and semi-automated systems that enhance diagnostic efficiency. Modern analyzers come equipped with integrated software, high-throughput capacity, and flexible assay menus, allowing for rapid, high-volume D-dimer testing. Portable analyzers are gaining momentum in outpatient and PoC settings, while benchtop analyzers are expanding in mid-sized labs and emergency departments. As diagnostic automation increases globally, analyzer sales are expected to rise steadily.

Clinical laboratory tests currently dominate the test type segment, reflecting the prevalence of D-dimer testing in centralized hospital and diagnostic laboratories. These settings favor high-throughput equipment, stringent quality controls, and experienced lab personnel—making them ideal for conducting ELISA or immunoturbidimetric-based D-dimer assays. Laboratory-based testing supports integrated workflows with other hematology and coagulation markers, ensuring a comprehensive patient profile.

Point-of-care (PoC) tests are the fastest-growing sub-segment, thanks to their portability, minimal sample processing, and rapid result turnaround. Demand surged during the COVID-19 crisis and remains strong in emergency medicine, ambulatory care, and community health outreach programs. As newer platforms deliver comparable sensitivity to lab-based systems, PoC testing is finding broader clinical acceptance, especially where immediate decisions are critical.

Latex-enhanced immunoturbidimetric assays dominate the methodology landscape, offering a balance between sensitivity, automation, and scalability. These assays are widely used in high-throughput settings like hospitals and reference labs. Their ability to provide real-time quantitative analysis with minimal manual input makes them a preferred choice in busy clinical workflows. Many diagnostic companies have standardized their systems around this method due to its reliability and efficiency.

Fluorescence immunoassays are the fastest-growing segment, driven by their superior sensitivity and applicability in PoC settings. With advancements in microchip technology and compact fluorescence detectors, these assays are being adopted in portable analyzers used in emergency care and mobile units. They offer enhanced analytical performance, especially in critical care situations where accuracy and speed are paramount.

Deep vein thrombosis (DVT) holds the largest market share, as D-dimer testing is routinely used to exclude DVT in patients with low to moderate clinical risk. It supports rapid decision-making and reduces unnecessary imaging. With increasing global awareness of VTE, clinicians are integrating D-dimer testing into initial patient assessments, particularly in orthopedic surgery, oncology, and long-haul travel scenarios.

Pulmonary embolism (PE) is the fastest-growing application, as PE often presents with non-specific symptoms that require urgent evaluation. D-dimer testing plays a pivotal role in PE diagnostic algorithms, especially when paired with clinical scoring systems like Wells or Geneva criteria. Given the potentially fatal nature of untreated PE, timely D-dimer screening is critical, especially in emergency and outpatient triage.

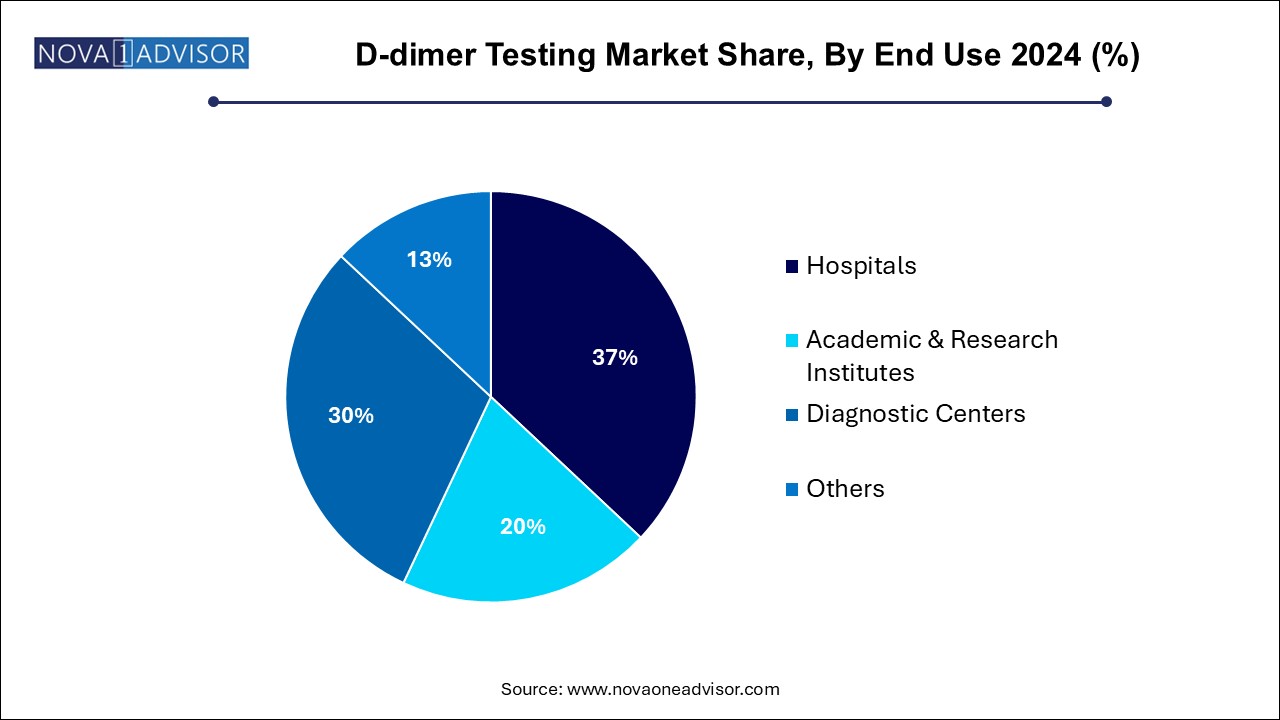

The hospitals segment led the market with a revenue share of 37.0% in 2024. In-patient departments, ICUs, and emergency rooms frequently rely on D-dimer results for anticoagulant therapy decisions, risk assessments, and surgical clearances. Hospital labs are also equipped with advanced automation systems that ensure accurate and rapid D-dimer measurements.

Diagnostic centers are projected to grow at the fastest CAGR of 5.0% over the forecast period. These centers often operate with advanced analyzers and cater to wellness screening programs, pre-surgical evaluations, and chronic disease monitoring. Their cost-effectiveness and operational agility make them increasingly popular among health-conscious consumers and insurers.

North America leads the global D-dimer testing market, supported by a robust healthcare infrastructure, widespread awareness of thrombotic conditions, and favorable reimbursement policies. The U.S., in particular, has integrated D-dimer testing into standard diagnostic protocols for suspected PE and DVT across emergency departments. Leading companies based in the region, such as Abbott Laboratories and Thermo Fisher Scientific, continue to innovate with new assay technologies and analyzer platforms. Moreover, the region saw extensive use of D-dimer testing during the COVID-19 pandemic, further embedding its role in clinical practice.

Asia Pacific is the fastest-growing region, owing to expanding healthcare access, increasing diagnostic investments, and the rising burden of chronic diseases. Countries like China, India, and South Korea are experiencing rapid adoption of laboratory and PoC diagnostics due to government initiatives, private sector growth, and international partnerships. The shift toward preventive healthcare, increasing cardiovascular disease prevalence, and the push for decentralized diagnostics are driving demand for D-dimer testing. Additionally, the affordability of test kits and the localization of reagent production are enhancing accessibility and affordability across the region.

January 2025: Roche Diagnostics launched a next-gen high-sensitivity D-dimer assay compatible with its cobas 8000 analyzer series, aimed at large hospital labs.

February 2025: Abbott Laboratories introduced a PoC D-dimer cartridge for its i-STAT Alinity platform, offering results in under 10 minutes.

March 2025: Sysmex Corporation announced CE-IVD approval for its new immunoassay system that includes D-dimer testing in multiplex coagulation panels.

April 2025: Siemens Healthineers expanded its Atellica Solution portfolio to include enhanced latex-based D-dimer reagents with automated calibration and quality control.

April 2025: HORIBA Medical launched a compact analyzer in Asia designed for small and medium diagnostic labs, featuring integrated D-dimer, CRP, and procalcitonin testing.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the D-dimer testing market

By Product

By Test Type

By Method

By Application

By End Use

By Regional