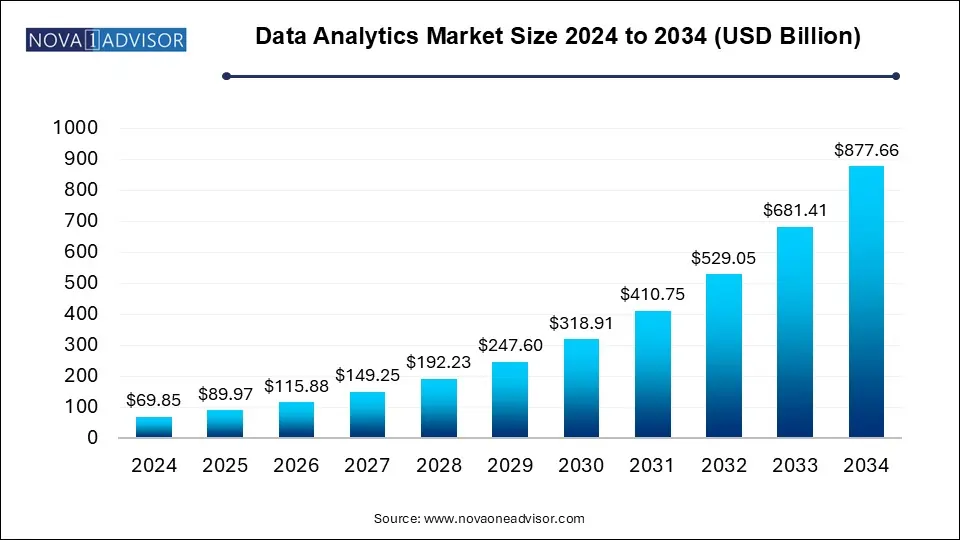

The data analytics market size was exhibited at USD 69.85 billion in 2024 and is projected to hit around USD 877.66 billion by 2034, growing at a CAGR of 28.8% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 89.97 Billion |

| Market Size by 2034 | USD 877.66 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 28.8% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Solution, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Amazon Web Predictive Analytics Inc., International Business Machines Corporation, Looker Data Sciences, Inc., Mu Sigma, Oracle Corporation, SAP SE, Sisense Inc., Tableau Software LLC., Zoho Corporation Pvt. Ltd. |

The main factors propelling the data analytics industry expansion are the growing adoption of machine learning and artificial intelligence to offer the increased acceptance of social networking platforms, individualized consumer experiences, and the rise of online shopping. The increasing adoption of smart applications, emerging social media platforms, and the industrial revolution is expected to produce massive databases.

The rise of big data analytics, increasing security Intelligence technology expenditures, and large amounts of data generated by virtual offices are all driving the expansion of the data analytics industry. Enterprises can improve crucial business processes, goals, and activities by utilizing big data analytics. Multiple healthcare providers and organizations come together to use big data for predictive analytics in patient care. For instance, projects such as the predictive model at Mount Sinai Medical Center, a prominent healthcare system in New York City, help hospitals forecast patient admissions by analyzing historical data.

Equipment used in agriculture, including smart machines, GPS-equipped tractors, and soil sensors, generate massive data sets. Moreover, data analytics is applied in agriculture to analyze huge data sets, including advanced risk assessment, natural trends, supply tracks, ideal crops, and more, which leads to market growth. Moreover, an enormous volume of data is generated from social media platforms, including Facebook, YouTube videos, Instagram, Snapchat, and others. Thus, rising databases across industries will fuel the data analytics industry growth.

Cloud-based data platforms are increasingly integrating with other tools and services to create seamless workflows. This integration enables more scalable and efficient analytics solutions for businesses. For instance, in December 2024, ClickHouse, Inc., a U.S.-based data analytics company, partnered with AWS for a five-year collaboration to enhance real-time data analytics, integrating ClickHouse Cloud with AWS tools. This collaboration aims to optimize performance, improve query capabilities, and support advanced applications for customers.

The need for connected devices is growing, accelerating the implementation of edge computing. Unlike Security Intelligence, edge computing solutions place processors closer to the data source or destination. Organizations achieve greater responsiveness and efficiency with data analytics operations at the edge. Edge computing is particularly applicable to the IoT due to its ability to process data in real time and with faster response time. For instance, in March 2023, Minima Global Ltd, a Europe-based blockchain platform developer, collaborated with Inferrix Limited, a software company in the UK, by combining Minima's blockchain technology with Inferrix's IoT edge and AI offerings. This partnership aims to develop IoT solutions by ensuring efficient and secure sensor communication.

The predictive analytics segment dominates the market, with a revenue share of 32.56% in 2024. Predictive Analytics provides accurate and reliable insights, helping organizations to solve problems and identify opportunities, including fraud detection, marketing campaign optimization, improvement in decision-making and efficiency in operations. The growth is majorly driven by factors such as increased adoption across various industries, advancements in machine learning, and the exponential growth of big data. The integration of artificial intelligence and IoT technologies is enhancing the capabilities of predictive analytics tools, making them more effective for forecasting trends and behaviors. Moreover, government investments in data initiatives are further fueling this growth, particularly in regions like Asia-Pacific. Companies are integrating predictive models to help health plans and providers anticipate patient needs and deliver proactive care. For instance, in October 2024, Clarify, a U.S.-based healthcare data and analytics company, and Prealize Health partnered to enhance predictive analytics for health plans and providers. This collaboration integrates Prealize's MetisAI with Clarify's Atlas Platform, enhancing predictive analytics and enabling proactive, data-driven decisions.

With the increasing demand for client experience management, customer retention, and better lead management, the customer analytics segment is expected to register prominent CAGR over the forecast period. Customer analytics is used in retail to create personalized communications and marketing campaigns. Customers' increasing demand for an omnichannel experience in the retail industry has fueled the segment's growth. Well-known companies such as Walmart and Amazon have successfully leveraged the benefits of various social media sites such as Facebook. The segment is expected to grow as more retail businesses focus on providing omnichannel Predictive Analytics to their customers.

The security intelligence segment dominates the market, with prominent revenue share in 2024. The growing adoption of advanced analytics to identify fraudulent activity, optimize processes, and address data risks drives the segment's growth. Increased solution of business intelligence software to provide controlled access to customer databases, transaction security, and improved customer experience is also expected to drive segment growth over the forecast period. Security intelligence is becoming more popular because it employs a risk-reduction strategy that integrates internal and external threat, security, and business intelligence across an organization.

Data mining is used in diverse applications such as marketing, banking, healthcare, telecom industries, and other areas, leading to the segment's growth. Data mining benefits manufacturing and service companies because any significant amount of data is analyzed to help the business make strategic decisions to gain a competitive advantage. Many e-commerce sites use data mining to cross-sell and upsell their products. For instance, Amazon.com Inc. uses text mining to find the product's lowest price. Moreover, Netflix, Inc. uses data mining insights to determine how to make a movie or series popular among customers.Consortiums such as the Knowledge Discovery and Data Mining (KDD) community bring together businesses, universities, and research institutions to share data mining methods, tools, and findings. They promote collaboration in developing new algorithms and applications across fields such as finance, healthcare, and marketing.

The supply chain management segment dominated the market, with a significant revenue share of 28.0% in 2024. Data analytics in supply chain management help organizations increase profits through efficient production planning. The use of data analytics in supply chain management encourages the use of advanced technologies such as artificial intelligence and machine learning to uncover hidden patterns and gain valuable insights from available supply chain data. Manufacturing companies can use data analytics in sales and operations planning, capacity planning, business intelligence, and demand forecasting to optimize their supply chain processes, which propels the segment's growth.

The enterprise resource planning segment is expected to grow at the fastest CAGR during the forecast period. Data analytics applications can bridge data warehouses, traditional databases, and data lakes to incorporate Big Data with business application data to improve forecasting, analysis, and planning. Moreover, as organizations increasingly rely on data-driven decision-making, there is a greater need to access and analyze databases. The rapid advancements in hybrid Security Intelligence, artificial intelligence, IoT, and edge computing led to the exponential growth of big data, generating even more complexity for businesses to manage, resulting in the segment's growth.

North America data analytics market accounted for a dominant global share of 31.75% in 2024. The region is home to prominent businesses from all industries, and the software are being widely implemented. For instance, Facebook, Twitter, and Instagram collect user information using data analytics about their preferences and send targeted advertisements. The availability of infrastructure that supports data analytics and the increased use of advanced technologies such as AI and machine learning are responsible for the market growth in North America.

U.S. Data Analytics Market Trends

The U.S. data analytics market is experiencing significant growth. This growth is driven by the increasing adoption of big data solutions across various sectors, particularly in IT, healthcare, and retail. The rise of technologies like artificial intelligence and machine learning is further enhancing data analytics capabilities, allowing businesses to derive actionable insights more efficiently. In addition, the market for Data-as-a-Service (DaaS) is expected to grow rapidly, indicating a shift towards cloud-based analytics solutions. Overall, the data analytics landscape in the U.S. is evolving rapidly, fueled by technological advancements and a growing demand for data-driven decision-making.

Europe Data Analytics Market Trends

The Europe data analytics market is witnessing steady growth. This growth is primarily driven by the rapid digitalization of processes and a pressing demand for skilled data professionals, particularly in Northwestern European countries like the UK, Germany, and France. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) into analytics is transforming operations, allowing businesses to derive insights more effectively and efficiently. Therefore, the European data analytics landscape is evolving rapidly, fueled by technological advancements and an increasing need for resilience in business operations.

Asia Pacific Data Analytics Market Trends

The Asia Pacific data analytics market is emerging as a major player driven by the rising adoption of social media platforms, the internet, and smartphones; advancements in communication technologies, and digitalization are all expected to increase the market share of data analytics. Many Asian countries, including India, China, and Japan, are using the features of information-intensive AI and ML technologies in various industries, which leads to the growing use of data analytics. The growing adoption of big data analytics tools and solutions is also increasing market growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the data analytics market

By Type

By Solution

By Application

By Regional