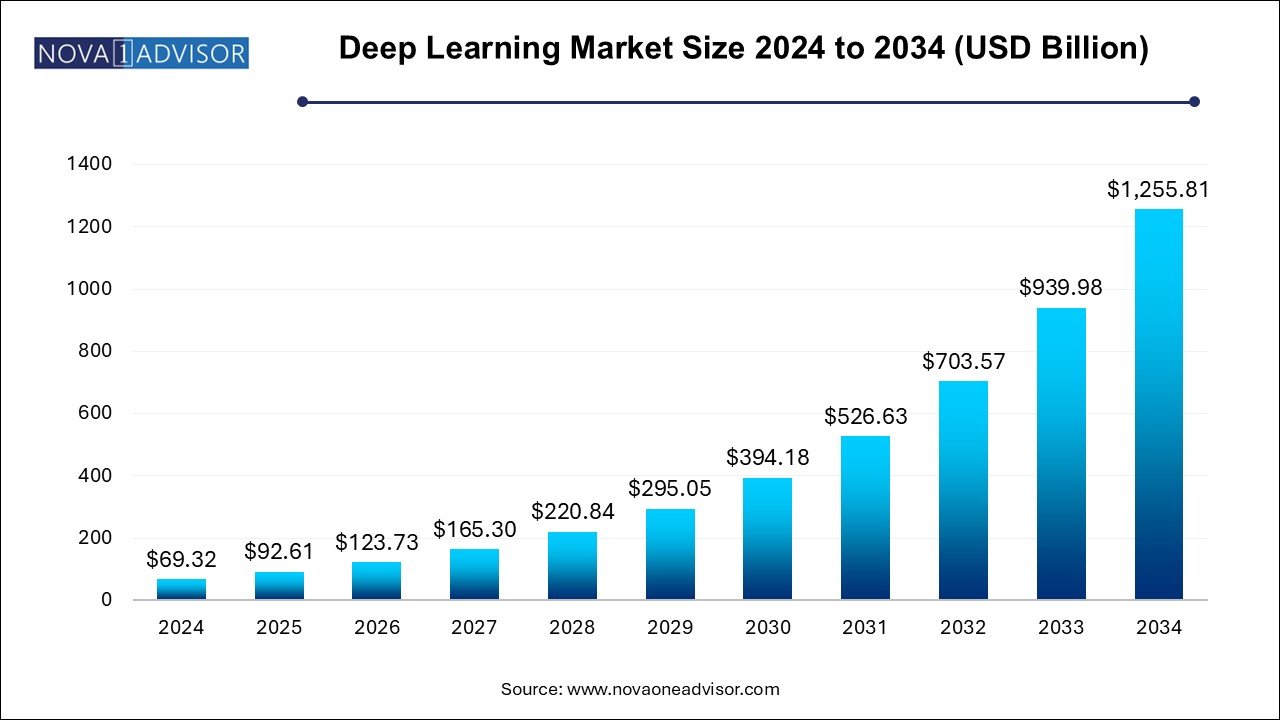

The deep learning market size was exhibited at USD 69.32 billion in 2024 and is projected to hit around USD 1255.81 billion by 2034, growing at a CAGR of 33.6% during the forecast period 2024 to 2034.

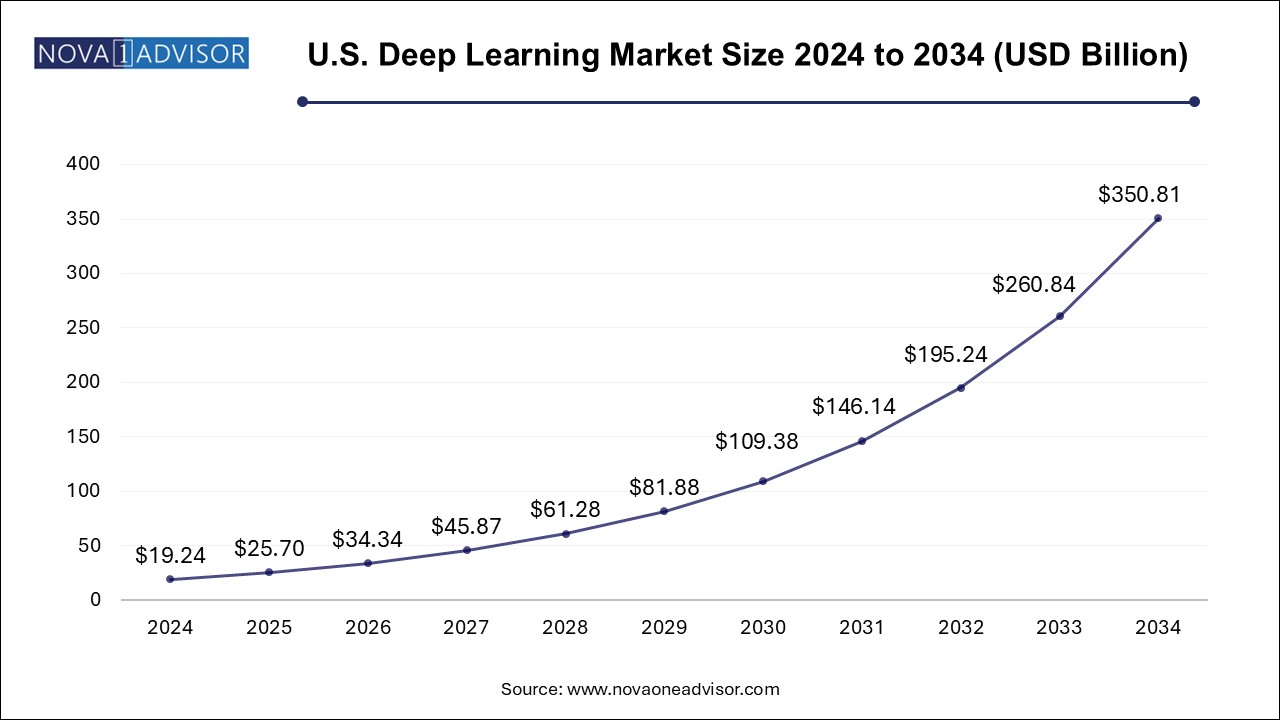

The U.S. deep learning market size is evaluated at USD 19.24 billion in 2024 and is projected to be worth around USD 350.81 billion by 2034, growing at a CAGR of 30.2% from 2024 to 2034.

North America dominates the global deep learning market, driven by strong investments in AI research, robust startup ecosystems, and technology giants like Google, Microsoft, Meta, and NVIDIA. The region has a well-developed infrastructure for cloud computing, high-performance computing (HPC), and academic-industry collaboration. Regulatory initiatives around AI ethics and data privacy are also fostering responsible innovation.

Asia Pacific is the fastest-growing region, led by countries such as China, Japan, and South Korea. China, in particular, has made AI and deep learning central to its national strategic plan, funding large-scale projects in surveillance, fintech, healthcare, and smart cities. Rapid digitization, high mobile penetration, and government-backed initiatives are accelerating adoption across sectors.

The deep learning market represents one of the most transformative segments in artificial intelligence (AI), revolutionizing how machines learn, interpret, and make decisions. At its core, deep learning leverages neural networks with multiple layers to model and analyze complex patterns and relationships in data, mimicking the human brain’s processing ability. This technology has found wide-ranging applications from voice assistants and facial recognition to autonomous vehicles and medical diagnostics driving its exponential growth.

Fueled by the convergence of big data, powerful hardware (such as GPUs), and sophisticated algorithms, deep learning has become an indispensable part of AI development across industries. Companies are increasingly deploying deep learning models for image classification, speech recognition, language translation, fraud detection, and predictive analytics. As deep learning transitions from research to real-world implementation, the market is witnessing robust demand across healthcare, finance, automotive, retail, aerospace, and defense sectors.

With cloud computing making deep learning more accessible, the emergence of edge AI and generative models (like GPT and diffusion models) is expanding the frontier of applications. Governments, academia, and private companies are investing heavily in deep learning infrastructure and workforce development. As a result, the global deep learning market is expected to continue its upward trajectory, becoming a foundational technology for digital transformation initiatives.

Growing adoption of generative AI models for text, image, and video synthesis

Shift toward edge deployment of deep learning for faster inference and data privacy

Rise of AI-as-a-service platforms offering deep learning tools via cloud APIs

Increasing use of transfer learning and pretrained models to reduce development time

Expansion of deep learning in robotics for perception, navigation, and manipulation

Integration of deep reinforcement learning in industrial automation and simulation

Deployment of deep learning in cybersecurity for anomaly and threat detection

Emphasis on explainable AI (XAI) to make deep learning models more transparent and auditable

| Report Coverage | Details |

| Market Size in 2025 | USD 92.61 Billion |

| Market Size by 2034 | USD 1255.81 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 33.6% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Solution, Hardware, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Advanced Micro Devices, Inc.; ARM Ltd.; Clarifai Inc.; Entilic; Google, Inc.; HyperVerge; IBM Corporation; Intel Corporation; Microsoft Corporation; NVIDIA Corporation |

Software solutions dominate the deep learning market, encompassing frameworks, libraries, model development tools, and training/inference engines. Popular platforms such as TensorFlow, PyTorch, and Keras are widely adopted by developers for building and deploying deep neural networks. These solutions support everything from model training and hyperparameter tuning to visualization and real-time deployment.

Services are the fastest-growing segment, driven by the demand for specialized consulting, integration, and maintenance support. Companies increasingly seek external expertise to integrate deep learning capabilities into existing IT ecosystems. Services include model customization, data annotation, deployment optimization, and ongoing performance monitoring. Cloud-based deployment and AI consultancy offerings are especially in demand among non-tech enterprises.

Graphics Processing Units (GPUs) dominate the hardware segment, as they offer high parallel processing capabilities essential for training deep neural networks. Companies like NVIDIA have developed specialized AI GPUs such as the A100, optimized for deep learning workloads. These units are integral to data centers, cloud platforms, and even edge AI devices.

Application-Specific Integrated Circuits (ASICs) are the fastest-growing hardware type, particularly in scenarios where energy efficiency and inference speed are critical. Google's TPU (Tensor Processing Unit) is a prime example of ASICs designed for AI tasks. ASICs are increasingly used in mobile devices, autonomous vehicles, and industrial robots, where real-time processing with minimal power draw is essential.

Image recognition is the largest application area, fueled by its adoption in facial recognition, medical imaging, autonomous driving, and security systems. Deep convolutional networks have shown unparalleled performance in object detection and classification tasks, making image recognition foundational to various industries.

Voice recognition is experiencing rapid growth, driven by the popularity of smart assistants, voice search, and call center automation. Deep learning has significantly improved speech-to-text accuracy, enabling real-time transcription, sentiment analysis, and natural language understanding in voice-based applications. The combination of audio signal processing and transformer models is enhancing usability in both consumer and enterprise domains.

Healthcare leads the end-use segment, as deep learning is revolutionizing diagnostics, patient monitoring, and personalized medicine. Algorithms are now capable of detecting diseases, predicting patient risk scores, and automating routine clinical tasks. With growing electronic health record (EHR) adoption and imaging data availability, healthcare presents immense potential for deep learning integration.

Automotive is the fastest-growing vertical, largely due to the adoption of deep learning in autonomous vehicles and advanced driver-assistance systems (ADAS). Real-time object detection, lane keeping, traffic sign recognition, and driver monitoring are enabled by deep learning models that process camera, lidar, and radar data in milliseconds. As the industry moves toward Level 4 and Level 5 autonomy, deep learning will be at its core.

March 2025: NVIDIA launched its Blackwell GPU architecture designed specifically for multi-trillion parameter deep learning models, promising 4x performance improvements.

January 2025: Google DeepMind unveiled AlphaFold 3, a next-generation protein prediction model incorporating multimodal deep learning inputs.

December 2024: OpenAI and Microsoft announced the integration of GPT-5 into Azure AI services, enabling advanced NLP and vision applications.

October 2024: Intel released a new deep learning inference chip under its Gaudi line aimed at edge and mobile applications.

September 2024: IBM Research launched an open-source toolkit for explainable deep learning, enabling better transparency in critical applications.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the deep learning market

By Solution

By Hardware

By Application

By End-use

By Regional