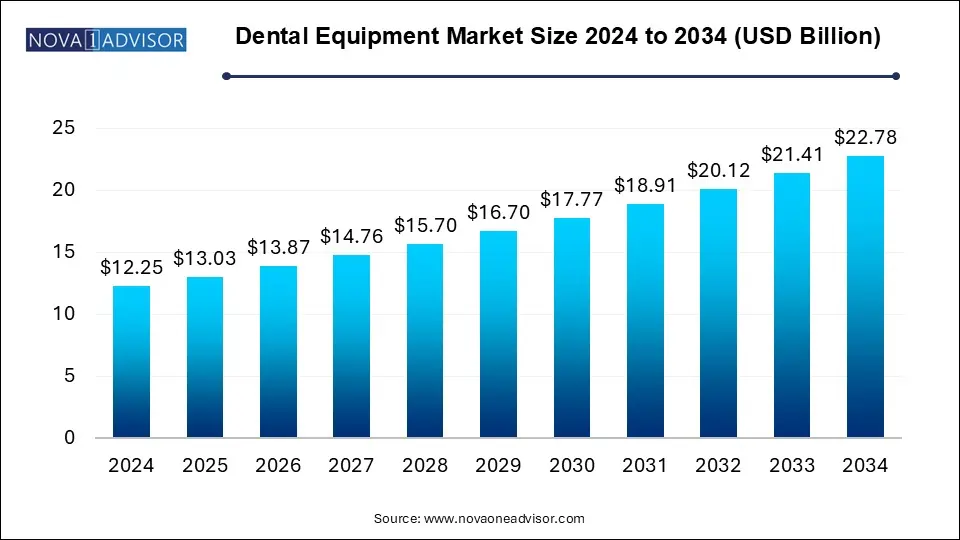

The global dental equipment market size was calculated at USD 12.25 billion in 2024 and is predicted to increase from USD 13.03 billion in 2025 to approximately USD 22.78 billion by 2034, expanding at a CAGR of 6.4% from 2025 to 2034. The demand for dental care services has increased, driving the global dental equipment market. The large and aging population fuels high demand for dental care, driving the adoption of dental equipment. Additionally, the rising shift toward digital dentistry and cosmetic dentistry is contributing to further expansion.

The dental equipment market has witnessed transformative growth with technological advancements, increased awareness of oral health & hygiene, and a large and growing population. The increased adoption of digital density technologies like 3D imaging and CAD/CAM systems is contributing to the market growth. Factors like the increasing prevalence of dental disease, especially in the aging population and pediatric population, and the shift of dental tourism are contributing vital shares to market growth. The manufacturing companies are demonstrating technological advancements in digital impressions, AI integration, and minimally invasive laser systems, to enhance precision, comfort, functionality, and efficiency for dentists and patients.

The demand for dental equipment has witnessed extreme growth in the cosmetic industry. Dental lasers have gained significant popularity in cosmetic areas. Growing awareness of aesthetics and the trend of smile makeovers are driving demand for advanced dental equipment. Additionally, the availability of disposable income has increased, allowing people to spend on cosmetic dentistry. The adoption of advanced technologies like 3D imaging, advanced dental lasers, and CAD/CAM systems is covering the cosmetic areas.

Key Factors Contributing to Dental Equipment Market Growth

| Report Coverage | Details |

| Market Size in 2025 | USD 13.03 Billion |

| Market Size by 2034 | USD 22.78 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.40% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | A-Dec Inc.; Planmeca Oy; Dentsply Sirona; Patterson Companies Inc.;Straumann; GC Corp.; Carestream Health Inc.; Biolase Inc.; Danaher Corp.; 3M EPSE |

Government Initiatives Contributing to Increased Demand for Dental Equipment

The government promoting various oral health programs, policies for promoting the utilization of digital dental equipment, and funding initiatives are rapidly boosting the dental equipment market. Government initiatives play a crucial role in increasing awareness of oral care, access to services, and encouragement to adopt cutting-edge technologies in the healthcare infrastructure. The government offers training and education programs to advance dental professionals to develop skilled environments. Government emphasis on promoting the adoption of digital health technologies, fulfilling innovative approaches in dental equipment. Additionally, the regulatory support for novel technology innovation & developments, as well as the maintenance of safety and effectiveness, concerns the increasing use of digital dental equipment.

High-Cost Hampering Access to Dental Equipment

The dental equipment market faces major hindrances to adoption due to high expenses related to advanced technologies such as digital radiography and CAD/CAM systems. The high cost of certain dental treatments is restraining the adoption of dental equipment. Hospitals are seeking cost-effective alternatives to reduce cost burdens. Lack of funding and insurance availability for dental services limits the affordability of advanced dental equipment for the middle-class population. Furthermore, the high costs associated with technologies, materials, and marketing are the major barriers to small clinics and enterprises' entry into the market.

Based on the product, the dental systems and parts segment dominated the market in 2024. Dental procedures majorly require dental systems and parts that drive the segment. Additionally, the emphasis on advancing dental system speed, accuracy, and integration of edge technologies like cloud computing and AI with existing systems and parts are playing a favorable role in this growth.

The dental lasers segment is the second largest segment leading the market. Technological advancements like providing more precise, comfortable, functional, and efficient treatments are driving the adoption of dental lasers. The increased demand for minimally invasive procedures is driving a shift toward dental lasers.

Favorable Reimbursement Policies: To Boost the North American Market

North America is leading the global dental equipment market due to factors like a rising aging population, favorable regulatory environment, presence of key vendors, well-established healthcare infrastructure, and high adoption of advanced technologies. The demand for dental services is increasing in North America, driven by an aging population and a focus on oral hygiene and health.

The United States leads the regional market with a high prevalence of dental disease and an aging population. The government and regulatory support for new product launches contributed to this growth. For instance, the ADA Standards Program organization of the U.S. determined to improve alignment between national and international standards, offer better use of dental equipment, and better address novel and emerging technologies.

In March 2024, the AAO nominated prospective volunteers to serve on new American Dental Association Consensus Bodies (CBs) to replace the current ADA Standards Committees on Dental Products and Dental Informatics (SCDP and SCDI) and the U.S. Technical Advisory Group for ISO Technical Committee 106 on Dentistry (U.S. TAG).

High Adoption of Dental Equipment in Asia’s Cosmetic Industry

Asia Pacific is seen to grow at the fastest rate in the upcoming years. The regional growth is driven by a growing population, expanding healthcare expenditure, and demand for the cosmetic industry. Asia Pacific has witnessed high demand for advanced dental equipment, including dental lasers and CAD/CAM systems.

China is the largest market for dental equipment market in the Asia Pacific, driven by a large and aging population, high manufacturing capabilities, growing concerns over oral health & hygiene, and rising availability of disposable income. Chinese government initiatives are contributing to enhancing countries' aim to increase global adoption of Chinese-made equipment, including dental equipment.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Dental Equipment Market

By Product

By Regional