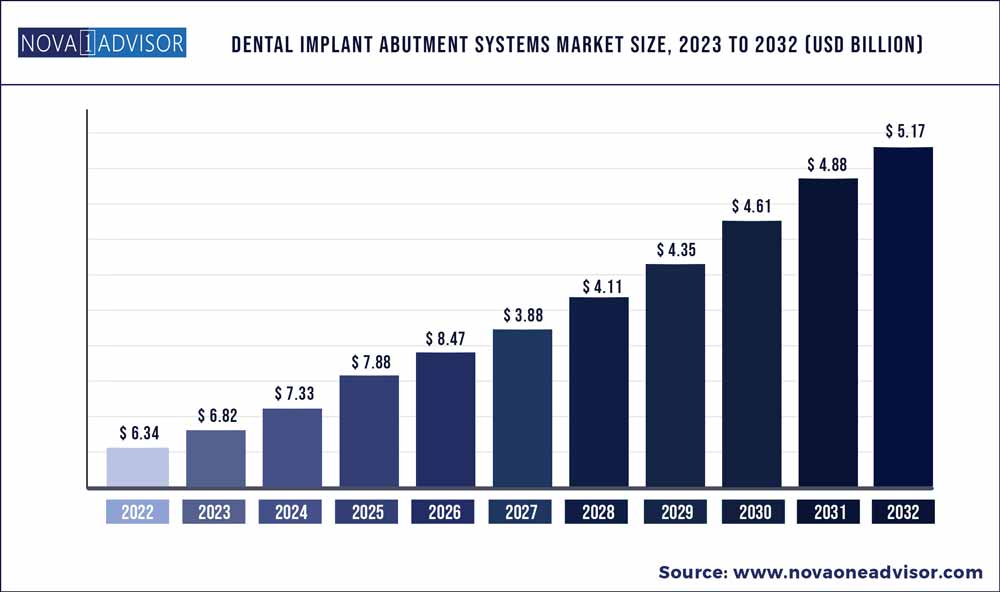

The global dental implants and abutment systems market size was exhibited at USD 6.34 billion in 2022 and is projected to hit around USD 13.07 billion by 2032, growing at a CAGR of 7.5% during the forecast period 2023 to 2032.

Key Pointers:

Dental implants and abutment systems Market Report Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 6.82 Billion |

| Market Size by 2032 | USD 13.07 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.5% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product, Material, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing demand for cosmetic dentistry will accelerate the overall industry growth. Dental implants help patients in overcoming tooth problems and enhance their aesthetic appearance. The global incidence of dental disorders is growing at a worrying rate. As of 2022, more than 160 million Americans were estimated to have dental coverage plans. This statistic indicates a large potential for the demand of dental products, to secure long-term solution for oral care problems.

The geriatric population base, which is highly susceptible to dental disorders, is expanding at a notable pace across the world. For instance, as per estimates by the UN Department of Economic and Social Affairs, the global share of individuals aged 65 years or over is predicted to reach 13.7% by 2032. This will positively influence the dental implants and abutment systems industry trends.

Medical product such as dental implants have a high production cost, which variably leads to increased treatment expenses for patients. These considerable costs involved in implant dentistry could impact the industry growth to some extent. Also, some regions across the world are experiencing a shortage of medical professionals, which could further restrict the access to suitable oral treatment solutions.

Based on product, the dental implant segment is bifurcated into tapered and parallel-walled implants. The need for implants is increasing among the elderly population, which is at a higher risk of suffering from tooth decays and other oral problems. According to the UN, by 2030, the share of people aged 65 years and above in Europe & North America will be around 23%. Other factors, such as technological advancements and growing incidence of periodontal diseases will drive the product adoption. Dental implants and abutment systems market share from the tapered implants segment was around USD 4.1 billion in 2022.

In terms of the material, global dental implants and abutment systems market share from the titanium segment was USD 2.9 billion in 2022. The material provides numerous options to customers for surface modification, which renders it more suitable for implant procedures. Titanium implants also have a high success rate. They provide beneficial mechanical features, such as low density and high biocompatibility that help them last longer.

New technologies are also being introduced to improve the safety of titanium dental products, which will favor their demand. For instance, medical researchers have implemented nanotechnology to increase titanium’s biocompatibility, by creating surfaces that have an accurate topography and chemical composition.

Hospital end-users held more than 28.5% share of global dental implants & abutment systems market during 2022. Increasing number of road accidents, sports injuries and other trauma will influence the global demand for dental treatment products. Consistent rise in new hospital investments will further boost the industry forecast. For example, the US, India, and China were among the leading countries in terms of new hospital projects expected to complete in 2022. Substantial geriatric population, rising disposable incomes and a surge in road accidents will drive dental implants and abutments demand from hospital end-users across these regions.

North America held around 38.7% share of dental implants and abutment systems market in 2022. The region is witnessing an alarming rise in the prevalence of dental ailments. Dental caries is one of the most common oral problems in the region. About 9 out of 10 people aged 20-64 years are affected by the disorder in the U.S. Regional governments are also focused on increasing the awareness about oral care issues and treatment options. These factors will strengthen the demand for dental implants and abutment systems to provide long-term protection.

Some of the prominent players in the Dental implants and abutment systems Market include:

Dentsply Sirona, AB Dental Devices Ltd, Adin Dental Implant Systems Ltd., Bicon, LLC, AVINENT Science and Technology, Cortex, Envista Holdings Corporation (Implant Direct), Glidewell, Henry Schein Inc., among others

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global dental implants and abutment systems market.

By Product

By Material

By End-use

By Region