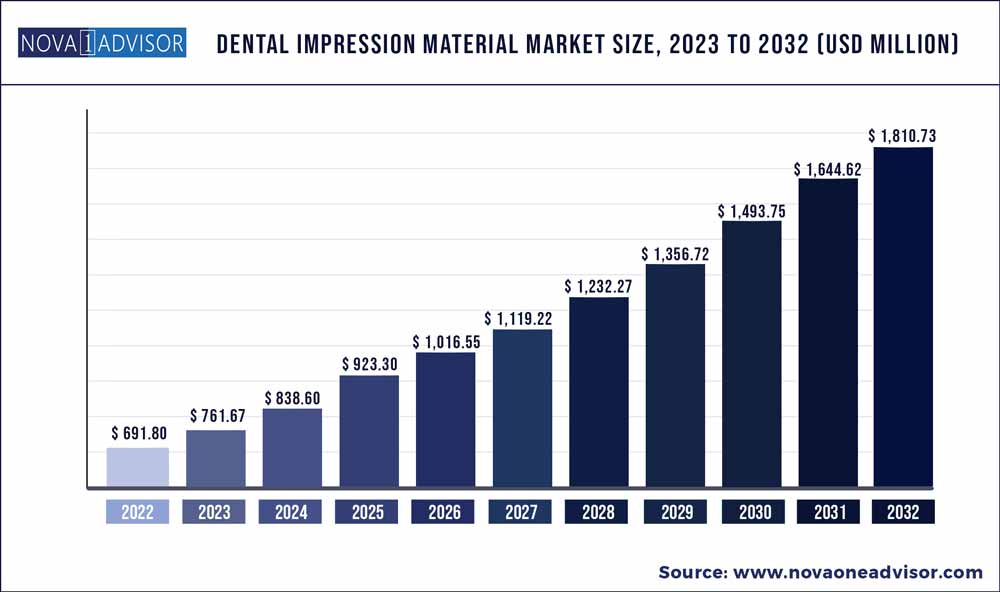

The global dental impression material market size was exhibited at USD 691.80 million in 2022 and is projected to hit around USD 1,810.73 million by 2032, growing at a CAGR of 10.1% during the forecast period 2023 to 2032.Dental impression materials are used to replicate the teeth and nearby oral structures by obtaining a dental impression filled with dental plaster to create a dental cast. The growing adoption of cosmetic dentistry, the growing prevalence of dental disorders, increase in oral health awareness coupled with the rise in disposable incomes, are expected to contribute to the growth of the market during the forecast period. The rising income levels in developing countries such as China, India, and Brazil, which have a relatively high DMFT index (decayed, missing, and filled teeth index) are expected to spur the growth of dental impression materials in these emerging countries in the coming years.

Key Takeaways:

Dental Impression Material Market Report Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 691.80 Million |

| Market Size by 2032 | USD 1,810.73 Million |

| Growth Rate From 2023 to 2032 | CAGR of 10.1% |

| Base Year | 2022 |

| Forecast Period | 2023-2032 |

| Segments Covered | Material Type, Application, End-Use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | 3M; Scott's Dental Supply; Zhermack SpA; GC America Inc.; Kerr Corporation; Hiossen; Keystone Dental Group; Dentsply Sirona; Thommen Medical AG; Pyrax Polymars |

The rising population of people with edentulism and growing periodontal disease are the driving factors for the growth of the market. According to a report by the Centre for Disease Control and Prevention, in 2019, the cases of untreated tooth decay were recorded to be around 26% of the total population. In addition, according to the American College of Prosthodontics, in 2019, more than 36 million of the U.S. population suffered from edentulism, and 120 million people in the U.S. were missing one tooth. The growing prevalence of dental caries and tooth decay globally is expected to fuel the demand for dental treatment.

The growing adoption of implants across cosmetic dentistry is also anticipated to boost the demand for the market. Furthermore, the growing adoption of digital impression technology and the increase in demand for cosmetic dentistry are the major factors driving the growth of the global market. COVID-19 has affected all the markets including the dental industry as there was a complete lockdown imposed by the government as a precautionary measure. Furthermore, the supply chain for dental impression materials was also affected. The pandemic caused a huge disruption in the supply chain of the overall medical device industry. The COVID-19 outbreak resulted in a decline in the number of procedures in 2020 and 2021 due to global restrictions. However, this is estimated to be a temporary effect and during the forecast period, the market demand is likely to increase. An increase in awareness of dental care and changing demographics will drive the growth of the market.

Material Type Insights

In terms of material type, the alginate segment dominated the market in 2022 with the largest revenue share of 39.8%. Alginate material is one of the most preferred and extensively used materials of all dental impression materials, it is a hydrocolloid material made from seaweed. This hydrocolloid substance is gelatinous in nature and dispersed in water. The advantages of using alginate dental impression material include better tolerability from the patient’s perspective, economical, less time needed in execution and instrumentation, ease of manipulation, easy execution technique, and the possibility of identifying a detailed impression in a single step. Also, with several other advantages such as composability, biocompatibility, and nontoxicity, it is expected to boost the growth of the segment over the forecast period.

The silicone segment is expected to grow at the fastest CAGR of 11.0% over the forecast period from 2023 to 2032. Silicone dental impression material is mostly used as a “final dental impression material” for the filling and fabrication of crowns and bridges. Dental professionals may use this type of dental impression depending on their state practice act.

Application Insights

In terms of application, the application segment is categorized into restorative dentistry & prosthodontics, and orthodontics. The restorative dentistry and prosthodontics segment dominated the market in 2022 with the highest revenue share of 59.9%. Growth in the number of people with edentulism and the increasing number of geriatric population suffering from dental problems are driving the growth of this segment. With the growing aging population more dental care to maintain dental health and function will be required. Increasing outsourcing of customization and fabrication of restorative and prosthetic products to restorative dentistry and increasing demand for restorative dentistry are driving the growth of global restorative dentistry.

Restorative dentistry are effective teeth and mouth care solution that helps benefit overall oral health, specifically facial appearance. Advanced dental implant technology allows dental professionals to insert dental implants through minimally invasive surgeries and incorporate advanced monitoring and navigation technologies. Furthermore, the rising product launches in the field of restorative dentistry are expected to boost the demand for the segment. For instance, Straumann AG in October 2018, launched a new standard line of mini Restorative Dentistry for Osseointegration in Vienna at the 27th Annual Scientific Meeting of the European Association.

The orthodontics segment is expected to grow at the fastest CAGR of 11.1% over the forecast period from 2023 to 2032 owing to the surge in interest in enhanced tooth movement in adults. Due to the pandemic, the world shifted to video conferencing platforms, which made people more conscious of their appearance on screen indicating an increase in demand for orthodontic treatments.

End-use Insights

Based on end-use, the market is segmented into hospitals, dental clinics, and others. The dental clinics segment dominated the market with the largest revenue share of 55.8% in 2022 and is expected to grow at the fastest CAGR of 10.8% over the forecast period from 2023 to 2032. The growing number of dental clinics across the globe and the wide adoption of cosmetic dentistry by small and large dental clinics are the major factors driving the growth of the dental clinic segment. The rising number of dental clinics, especially in well-developed countries is also expected to boost the market.

Furthermore, the rising adoption of the dental franchise model is likely to create opportunities for dental clinics to grow. The dental franchise model provides the benefit of increased negotiating power and cost savings through economies of scale. For instance, the Indian dental practice chain company, Clove Dental, in September 2018, invested INR 171 crore ($25 million) to widen its franchise network to 600 clinics in India, over the next five years. This franchise model reduces the overall prices of the treatment and services, thereby driving the dental clinics market growth.

Regional Insights

In terms of region, Europe dominated the market in 2022 with the largest revenue share of 40.1% owing to the increasing number of dental problems among children and adult population and increasing reimbursement for dental service. North America registered the second highest market value share in the global market with the increasing number of specialist dental service providers. For instance, Huntsman Gay Global Capital (HGGC), a leading middle-market private equity firm announced in January 2023 about its strategic investment in Dentive, a dental support organization that primarily serves general and specialty dental practices managed by independent, doctor-owned businesses in the western U.S.

Asia Pacific is expected to grow at the fastest CAGR of 11.9% over the forecast period from 2023 to 2032 owing to a favorable government initiative, a large population, and the availability of developed healthcare facilities. Populated regions like India and China are suffering from problems related to oral diseases and are prescribed widely by dental professionals to replace lost natural teeth and treat decayed teeth. China and India are currently the major tobacco-producing and consuming regions having the lowest smoking awareness. The most dominant form of tobacco consumption in India is smokeless tobacco and frequently used products are gutkha and khaini, with tobacco. These factors are expected to drive the market of dental and oral diseases in the region anticipating the demand for dental impression material.

Some of the prominent players in the Dental impression material Market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2032. For this study, Nova one advisor, Inc. has segmented the global Dental impression material market.

Material Type

Application

End-use type

By Region