Dental Services Market Size and Growth

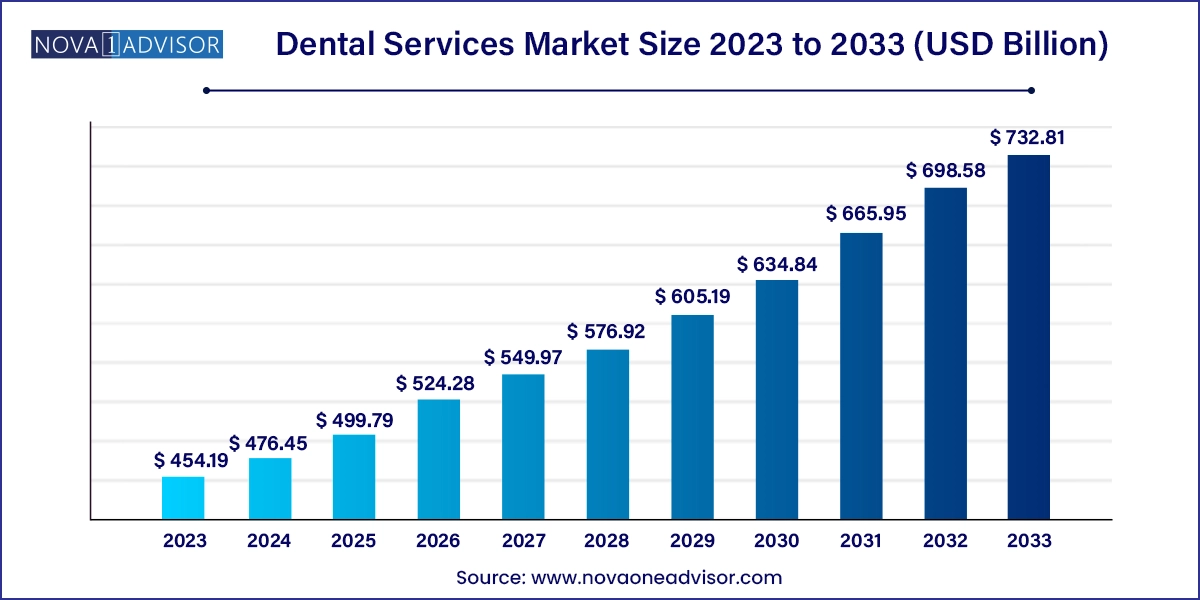

The global dental services market size was valued at USD 454.19 billion in 2023 and is anticipated to reach around USD 732.81 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

The diagnosis, prevention, and treatment of dental disorders are covered under dental services that are provided by dentists and dental professionals. Some of the key factors contributing to the growth are the growing awareness of dentistry among people, the rising prevalence of dental caries and other periodontal diseases, technological developments in dentistry, and the high demand for cosmetic and laser dentistry.

The ongoing COVID-19 pandemic has significantly impacted the dental care economy. As a result of the imposed strict social distancing guidelines, dental practices were closed in many countries. According to the data from the American Dental Association’s Health Policy Institute (HPI), the dental sector was at standstill due to COVID-19 as dental practices were allowed only in emergency cases in the early stage of the pandemic. In March 2020, the American Dental Association (ADA) issued public guidance to postpone elective dental procedures.

According to the ADA, the procedures that needed to be postponed included oral examinations, routine cleaning, radiographs, cosmetic procedures, and orthodontic treatments without pain management. The emergency dental services included oral bleeding, dental or facial trauma, painful caries, tooth fractures, and abnormal tissue biopsies.

Dental treatments encapsulate a wide array of services that help several patients in improving their oral health. The fillings and cement are being used in various treatments. The ongoing popular trend of smile makeover procedures is gaining attention nowadays. Moreover, the technological developments in endodontics have helped in the adoption of root canal procedures. The invisible braces that help in reshaping and alignment of teeth are in high demand. Hence, the market for dental services is anticipated to witness significant growth over the forecast period due to the introduction of new improved technologies, including dental caps, dentures, and drills.

The recommendations from dentists have helped drive the demand for various dental services. In addition, the shifting focus on marketing efforts to commercialize the practices involves free dental camps, online campaigns, and dental education programs. Moreover, several unmet needs and a wide service portfolio in the field of oral care have encouraged dental equipment manufacturers to invest in R&D activities to develop and capitalize on innovative technologies.

As more innovations emerge in the market, more patients are expected to avail of services in the coming years. In April 2020, Pacific Dental Services (PDS), a leading dental support organization, announced the launch of the TeleDentistry platform for patients in the U.S. The COVID-19 pandemic continues to put pressure on urgent care centers and hospital emergency rooms and the launch of the platform is expected to have a positive impact on the community.

With continuous economic growth and rapid urbanization around the globe, the disposable incomes of people have witnessed relatively steady growth. In addition, per capita consumption expenditure on healthcare services is likely to significantly increase in the years to come. The rising health and wellness consciousness among the millennial population, along with the growing purchasing power, is expected to contribute to the market growth over the forecast period.

Dental Services Market Report Scope

| Report Attribute | Details |

| Market Size in 2024 | USD 476.45 Billion |

| Market Size by 2033 |

USD 732.81 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Procedure Type, By Service Type, and By End User Type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Smile 360, Pacific Dental Services, Dental Services Group, Axiss Dental, Q & M Dental Group, Apollo White Dental, Coast Dental, Gentle Dental of New England, Abano Healthcare Group, Healthway Medical Corporation. |

Dental Services Market Dynamics

Drivers:

Growing Dental Awareness is driving the dental service market

Oral health tends to be neglected, even though approximately 3.5 billion individuals are currently dealing with oral diseases. Even though there are established methods for prevention, cavities persist as the most widespread chronic ailment among both adults and children, affecting an estimated 2.3 billion individuals. Periodontal disease is one of the most prevalent health issues worldwide, with severe gum diseases, potentially leading to tooth loss, impacting 10% of the global population. The level of public awareness and education about dental health and its importance has a significant impact on the demand for dental services. For instance, a nationwide campaign promoting the benefits of regular dental check-ups, proper oral hygiene practices, and the prevention of common dental issues like cavities and gum disease can lead to increased interest and utilization of dental services. Such campaigns include public service announcements, school programs, and community events focused on oral health. Campaigns such as National Smile Month by the Oral Health Foundation, Dental Care Awareness Month, World Health Day, and World Oral Health Day have resulted in an increased number of regular checkups and halitosis patients in 70% of the clinics belonging to the Dental Association A study published in the International Journal of Paediatric Dentistry found that the frequency of toothbrushing, use of dental services, and self-perceived need for dental treatment significantly decreased among adolescents during the COVID-19 pandemic but 70% of respondents visited the dentist more frequently compared to pre-Covid times due to the awareness campaigns.

Restraint:

The market for dental services is significantly restrained by uneven access to Care. Dental care is not sufficiently accessible in many areas, particularly in rural and underprivileged communities. This leads to differences in oral health outcomes, with certain populations receiving insufficient dental treatment due to a lack of dental facilities. Financial obstacles, geographic restrictions, and a lack of dental specialists in some places are all contributing factors to unequal access, which prevents people from getting timely and necessary dental care. For instance, nearly 80% of the Indian Population is dealing with Oral problems. There is an inadequate workforce. About 2.7 lakh dentists are responsible to cater 1.39 billion Indians. Which creates a huge gap in providing primary dental services. Moreover, the availability of dentists in rural areas in India is highly inconsistent. Owing to a lack of dental awareness and a shortage of government jobs, most dentists reside in urban India. This magnified the dental care problems of around 70% of the Indian Population. Lack of awareness, economic restrictions, and psychological and social barriers are the factors restraining the Indian Oral care facilities.

Opportunity:

Teledensitry has gained considerable momentum leading to the growth of the dental services market. Teledensitry uses digital technology to deliver follow-up treatment and dental consultations remotely. The ability of teledentistry to increase accessibility, improve convenience, and allow for remote monitoring of oral health concerns is expected to drive growth. This possibility is expected to develop further due to the COVID-19 pandemic's acceleration of telemedicine adoption. Dental clinics take advantage of Teledentistry by investing in technology, advertising their services, making sure privacy laws are followed, providing flexible hours, and working with insurance companies to reach a larger patient base. Implementing Teledentistry promotes treatments that are advanced and patient-focused, addressing changing demands in the medical field.

Procedure Type Insights

By procedure type, the non-cosmetic dentistry segment led the global dental services market with a remarkable revenue share in 2023 and is anticipated to retain its dominance throughout the forecast period. This is due to the rising prevalence of dental caries among the population. According to the FDI World Dental Federation, around 2.3 billion people were suffering from tooth decay of permanent teeth in 2015. Hence, it is the most common dental issue and non-cosmetic dentistry segment deals with the fixation of this issue.

On the other hand, the cosmetic dentistry is estimated to be the most opportunistic segment during the forecast period. This is attributed to the growing aesthetic concerns among the young population. Cosmetic dentistry deals with various dental issues such as teeth whitening, bonding, contouring, and veneers.

Service Insights

By service type, the oral surgery segment hit remarkable revenue share in 2023 and is anticipated to retain its dominance throughout the forecast period. This is because most of the oral and dental problems such as dental exams, crowns, fillings, and root canals are taken care of by the general dentists.

On the other hand, the orthodontics & prosthodontics is expected to be the most opportunistic segment owing to the technological advancements and development of affordable and latest technology such as digital photography, digital intra oral scanners, and computer-aided-design and computer-aided-manufacturing of dental products. These technological advancements are driving the growth of this segment.

End User Insights

In 2023, the dental clinics segment held the largest revenue share of more than 68.5% and is likely to grow at a CAGR of over 4.0% from 2024 to 2033. The majority of dental patients visit private practice dental clinics due to the availability of specialists. Over 80% of dental practices are run by the owners. The number of independent practices is rising across the globe. This trend is likely to continue in the coming years owing to the cost efficiency, the availability of specialists, and technologically advanced equipment.

During the initial phase of the COVID-19 pandemic, the dental care market faced many issues as the dentists’ offices were at high risk of spreading the infection. The dental clinics were not operating during the initial phase. However, the practices are getting back to their normal operations. In these unprecedented times, dental professionals should be well-informed about the recent guidelines to follow by the regulatory protocols to avoid the spread of the virus.

Regional Insights

In 2023, North America dominated the market with a revenue share of over 48.3% owing to factors including a preventive approach towards oral care and hygiene, the presence of independent clinics, growing R&D activities in dentistry, and rising disposable income. The increasing government funding for dental programs is likely to contribute to market growth. The U.S. federal funding for Medicare & Medicaid is expected to increase the demand for oral care services as patients are likely to pay less out-of-pocket expenses.

Asia Pacific is anticipated to witness the fastest growth of 5.7% from 2024 to 2033 due to the growing number of clinics, rising dental tourism, increasing R&D in manufacturing, and growing awareness about oral care. The majority of dental practices in the Asia Pacific are private. The healthcare infrastructure in the Asia Pacific is expanding with advanced technology and equipment. Various companies and governments in countries, such as China and India, are introducing initiatives to spread awareness regarding dental care. For instance, in June 2021, My Dental Plan announced that it would add 4,000 more clinics, thereby expanding its reach to 250 cities by the end of 2021.

Dental Services Market Top Key Companies:

Dental Services Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Dental Services market.

By Procedure

By Service

By Gender

By End User

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Dental Services Market, By Procedure

7.1. Dental Services Market, by Procedure Type, (2024-2033)

7.1.1. Cosmetic Dentistry

7.1.1.1. Market Revenue and Forecast (2021-2033)

7.1.2. Non-Cosmetic Dentistry

7.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 8. Global Dental Services Market, By Service

8.1. Dental Services Market, by Service, (2024-2033)

8.1.1. General Dentistry

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Oral Surgery

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Orthodontics & Prosthodontics

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Dental Services Market, By End User

9.1. Dental Services Market, by End User, (2024-2033)

9.1.1. Dental Clinics

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Hospitals

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Dental Services Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.1.2. Market Revenue and Forecast, by Service (2021-2033)

10.1.3. Market Revenue and Forecast, by End User (2021-2033)

10.1.4. U.S.

10.1.4.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Service (2021-2033)

10.1.4.3. Market Revenue and Forecast, by End User (2021-2033)

10.1.5. Rest of North America

10.1.5.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.1.5.2. Market Revenue and Forecast, by Service (2021-2033)

10.1.5.3. Market Revenue and Forecast, by End User (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.2.2. Market Revenue and Forecast, by Service (2021-2033)

10.2.3. Market Revenue and Forecast, by End User (2021-2033)

10.2.4. UK

10.2.4.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Service (2021-2033)

10.2.4.3. Market Revenue and Forecast, by End User (2021-2033)

10.2.5. Germany

10.2.5.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Service (2021-2033)

10.2.5.3. Market Revenue and Forecast, by End User (2021-2033)

10.2.6. France

10.2.6.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Service (2021-2033)

10.2.6.3. Market Revenue and Forecast, by End User (2021-2033)

10.2.7. Rest of Europe

10.2.7.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.2.7.2. Market Revenue and Forecast, by Service (2021-2033)

10.2.7.3. Market Revenue and Forecast, by End User (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.3.2. Market Revenue and Forecast, by Service (2021-2033)

10.3.3. Market Revenue and Forecast, by End User (2021-2033)

10.3.4. India

10.3.4.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Service (2021-2033)

10.3.4.3. Market Revenue and Forecast, by End User (2021-2033)

10.3.5. China

10.3.5.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Service (2021-2033)

10.3.5.3. Market Revenue and Forecast, by End User (2021-2033)

10.3.6. Japan

10.3.6.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Service (2021-2033)

10.3.6.3. Market Revenue and Forecast, by End User (2021-2033)

10.3.7. Rest of APAC

10.3.7.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.3.7.2. Market Revenue and Forecast, by Service (2021-2033)

10.3.7.3. Market Revenue and Forecast, by End User (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.4.2. Market Revenue and Forecast, by Service (2021-2033)

10.4.3. Market Revenue and Forecast, by End User (2021-2033)

10.4.4. GCC

10.4.4.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Service (2021-2033)

10.4.4.3. Market Revenue and Forecast, by End User (2021-2033)

10.4.5. North Africa

10.4.5.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Service (2021-2033)

10.4.5.3. Market Revenue and Forecast, by End User (2021-2033)

10.4.6. South Africa

10.4.6.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Service (2021-2033)

10.4.6.3. Market Revenue and Forecast, by End User (2021-2033)

10.4.7. Rest of MEA

10.4.7.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.4.7.2. Market Revenue and Forecast, by Service (2021-2033)

10.4.7.3. Market Revenue and Forecast, by End User (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.5.2. Market Revenue and Forecast, by Service (2021-2033)

10.5.3. Market Revenue and Forecast, by End User (2021-2033)

10.5.4. Brazil

10.5.4.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Service (2021-2033)

10.5.4.3. Market Revenue and Forecast, by End User (2021-2033)

10.5.5. Rest of LATAM

10.5.5.1. Market Revenue and Forecast, by Procedure (2021-2033)

10.5.5.2. Market Revenue and Forecast, by Service (2021-2033)

10.5.5.3. Market Revenue and Forecast, by End User (2021-2033)

Chapter 11. Company Profiles

11.1. Pacific Dental Services

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Dental Services Group

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Q & M Dental Group

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Apollo White Dental

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Coast Dental

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Axiss Dental

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Gentle Dental of New England

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Abano Healthcare Group

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Smile 360

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Healthway Medical Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms