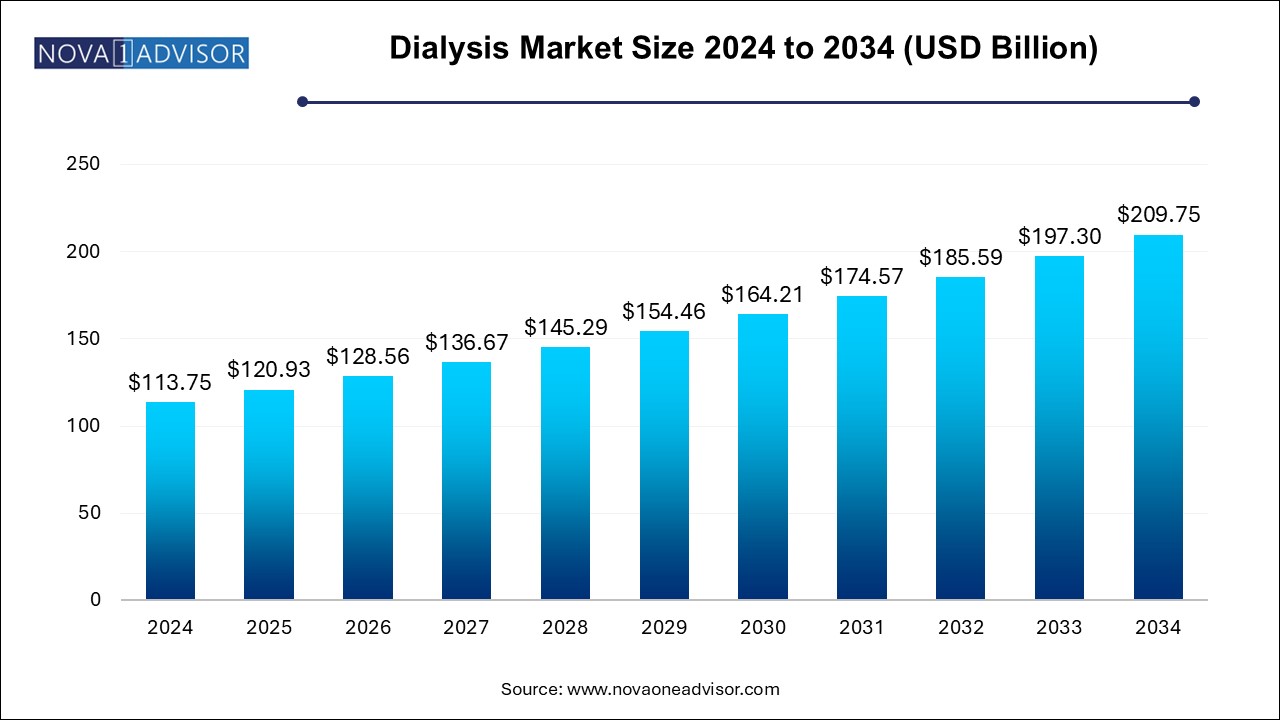

The dialysis market size was exhibited at USD 113.75 billion in 2024 and is projected to hit around USD 209.75 billion by 2034, growing at a CAGR of 6.31% during the forecast period 2025 to 2034.

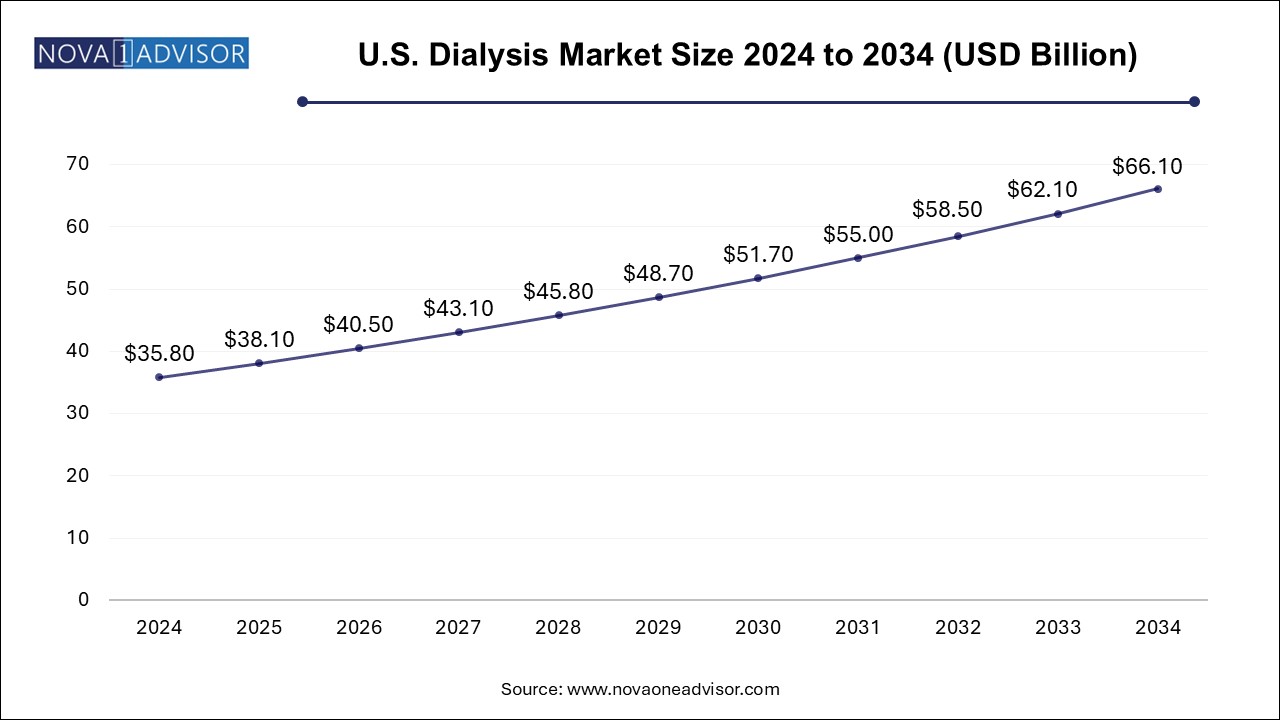

The U.S. dialysis market size is evaluated at USD 35.8 billion in 2024 and is projected to be worth around USD 66.1 billion by 2034, growing at a CAGR of 5.73% from 2025 to 2034.

In 2024, the North American market was worth USD 380 billion. During the projection period, North America is expected to dominate the market share. The high incidence of CKD and ESRD in the United States and Canada, together with greater treatment rates in these countries, are expected to drive market growth over the projected period. The United States is also expected to see an increase in demand for services and products as a result of the rising prevalence of coronavirus infections and associated renal failures. Europe is predicted to be the second biggest region in this market in terms of size, with moderate long-term growth. The region's rapid expansion is mostly owing to a rising senior population suffering from renal problems.

Furthermore, Asia-Pacific is predicted to see comparatively large value development in this market. Funding from public players to enhance access to renal care is expected to boost market growth throughout the projected period. The National Health and Family Planning Commission of China established regulations for the fundamental standard and administration of haemodialysis facilities in December 2016, with the goal of standardising the growth of autonomous such centres across the nation. Such a well-established regulatory framework for renal treatment facilities is expected to drive market growth in Asia Pacific throughout the forecast period.

In Brazil, the increased prevalence of CKD among the senior population is fueling the expansion of the market for services and goods. Due to the delayed diagnosis of chronic CKD and ESRD, the Middle East and Africa region is anticipated to develop slowly to moderately over the forecast period. Though, increased urbanisation in the area and rising awareness regarding the seriousness of renal illnesses are expected to drive revenue in this region throughout the projection period.

| Report Coverage | Details |

| Market Size in 2025 | USD 120.93 Billion |

| Market Size by 2034 | USD 209.75 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.31% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Dialysis Type, End User, Geography |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Fresenius Se and Co. Kgaa, Asahi Kasei Corporation, B. Braun Melsungen Ag, Baxter International Inc., Becton, Dickinson And Company (C. R. Bard, Inc.), Davita, Angiodynamics Inc., Diaverum Deutschland Gmbh., Nikkiso Co. Ltd., Nipro Corporation, Medtronic, Asahi Kasei Corporation |

Dialysis Market is divided into two categories i.e Hemodialysis and Peritoneal Dialysis’s. Hemodialysis is further classified into two types: conventional and everyday (short daily and nocturnal hemodialysis). Hemodialysis produced the most revenue of the two in 2024 and is predicted to continue to dominate revenue throughout the projection period. Waste materials like as urea are removed extracorporeally from the inmate's blood during haemodialysis. The peritoneum in the stomach is used in dialysis in peritoneal dialysis. During the foreseeable years, haemodialysis is likely to stay dominant. Inadequate peritoneal treatment training in both developed and developing nations has reduced peritoneal treatment preference. Aside from the therapeutic benefits linked with this treatment, such as the reduced time required to operate and adopt arteriovenous fistula (AV Fistula), the demand for haemodialysis is increasing.

Peritoneal Dialysis (PD) is one of the most rapidly developing treatment choices for kidney failure and is a superior alternative, particularly for patients with residual kidney function and sensitivity to the rapid fluid balance changes associated with hemodialys. PD allows for more treatment options and minimises the number of visits to dialysis clinics. Choosing PD home dialysis has advantages such as improved outcomes, less drugs, and fewer food restrictions. Patients may use PD at home without assistance and simply monitor themselves 24 hours a day, seven days a week. These benefits have made peritoneal dialysis more popular among renal patients today, and will continue to fuel the home care segment development of the peritoneal dialysis market over the projection period. The majority of end-stage renal disease patients receiving PD therapy are older, and their degree of accessibility, experience, and technical knowledge varies greatly. Many senior cycler patients' technophobia and unwillingness to utilise cyclers are seen as market limitations.

Currently, the coronavirus pandemic is posing a number of difficulties for patients and clinical healthcare professionals all around the world. A possible upsurge in the incidence of kidney injury is predicted to result from the surge in COVID patients and its severity rate. The epidemic has greatly boosted the need for renal replacement fluids on a global scale. Comparing COVID-19 patients to historical US populations, the need for RRT has risen fivefold (4.9 percent as of 2020 VS. 0.9 percent earlier). Prior to the pandemic, there had been a progressive trend toward home hemodialysis treatment, and concerns about the spread of the COVID-19 virus have significantly increased patient interest in HD therapy. This issue is probably going to increase the use of home hemodialysis equipment during the pandemic.

Although the majority of patients choose hemodialysis, peritoneal dialysis is predicted to be the fastest expanding category throughout the projection period due to effective elimination of harmful chemicals and increased desire for homecare among dialysis patients.

The market is divided into two types: Services and Products. In 2024, services made up the greatest portion, mostly due to the expansion of renal care centres with modern equipment for both chronic and urgent treatment throughout the world, as well as a growing emphasis on quality-care delivery to patients by service providers. Additionally, increasingly patient-focused and profit-driven business models among care providers are raising service demand. The product sector is predicted to develop steadily in the coming years as the number of local and regional companies in this market increases to meet the increased demand for innovative goods and consumables.

End consumers in the worldwide market are classified as centres and hospitals, as well as home care. In terms of value, dialysis treatment centres accounted for the largest market share in 2024, owing to favourable reimbursement offered by renal facilities and hospitals for renal treatments, an expanding patient population with CKD and ESRD, and increasing population healthcare spending. Homecare, on the other hand, is expected to be the fastest-growing category over the projected period, with a significantly higher CAGR. The hospital segment is expected to develop in the near future because to an increase in the number of COVID-19.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the dialysis market

By Type

By Dialysis Type

By End User

By Regional