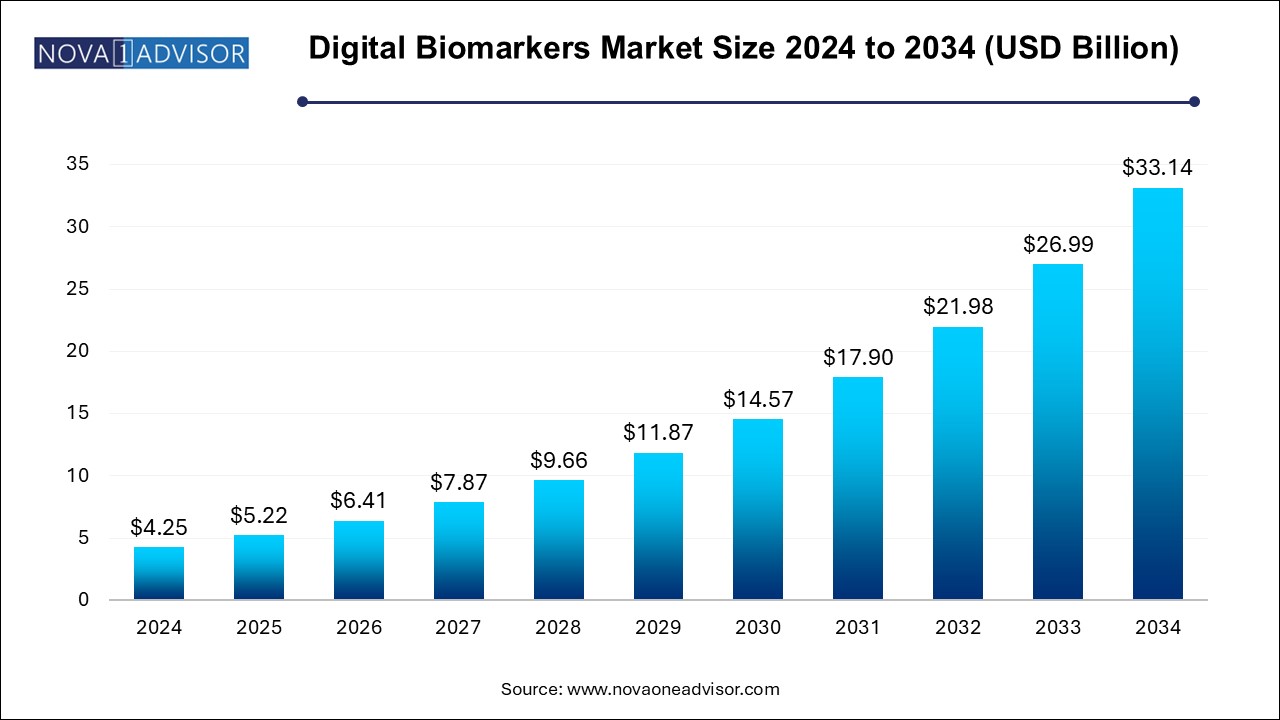

The digital biomarkers market size was exhibited at USD 4.25 billion in 2024 and is projected to hit around USD 33.14 billion by 2034, growing at a CAGR of 22.8% during the forecast period 2024 to 2034.

The digital biomarkers market represents one of the most transformative developments in the intersection of healthcare, life sciences, and digital technologies. Unlike traditional biomarkers that rely on biological samples such as blood or tissue, digital biomarkers are defined as objective, quantifiable physiological and behavioral data collected through digital devices such as wearables, smartphones, implantables, and ambient sensors. These technologies enable continuous, real-time monitoring of health metrics and provide actionable insights for diagnosis, monitoring, and therapeutic interventions.

The growing availability of Internet of Things (IoT) infrastructure in healthcare, the proliferation of smart wearables, and increasing consumer health awareness are collectively accelerating the adoption of digital biomarkers. Pharmaceutical companies, payers, and healthcare providers are recognizing the potential of these tools in remote patient monitoring, clinical trial optimization, drug development, and personalized medicine.

Digital biomarkers are particularly gaining momentum in therapeutic areas like neurology, cardiology, psychiatry, and respiratory disorders, where traditional methods often fall short in providing dynamic and longitudinal health data. With regulatory agencies like the FDA and EMA beginning to approve digital biomarker-integrated trials and therapies, the market is entering a phase of rapid maturity and standardization.

Integration of Artificial Intelligence (AI) with Digital Biomarkers: AI enables predictive analytics and pattern recognition, enhancing diagnostic and prognostic accuracy.

Use in Decentralized Clinical Trials (DCTs): Digital biomarkers facilitate remote patient enrollment, engagement, and real-time health monitoring.

Rise of Multi-modal Biomarkers: Combining data from wearables, voice analysis, imaging, and apps to develop composite digital endpoints.

Shift Toward Preventive and Personalized Care: Digital biomarkers are enabling risk profiling and early disease intervention strategies.

Validation and Regulatory Acceptance: Increased collaboration between tech developers and regulatory bodies is promoting standardization.

Consumerization of Health Monitoring: Patient-driven health data collection through apps and smart devices is creating a more informed population.

Expanding Role in Mental Health Monitoring: Voice, keystroke, and facial expression analytics are being explored to monitor depression, anxiety, and cognitive decline.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.22 Billion |

| Market Size by 2034 | USD 33.14 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 22.8% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Type, Clinical Practice, Therapeutic Area, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | ActiGraph LLC; AliveCor Inc.; Koneksa; Altoida Inc.; Amgen Inc.; Biogen Inc.; Empatica Inc.; Vivo Sense; IXICO plc; Adherium Limited ;Neurotrack Technologies, Inc.; Aural Analytic; Huma; Sonde Health; Inc.; Clario; Imagene AI; Brainomix |

One of the strongest drivers in the digital biomarkers market is the rising global demand for real-time and remote health monitoring. This demand is particularly fueled by aging populations, increasing prevalence of chronic diseases, and healthcare systems striving to reduce costs and hospital readmissions.

Digital biomarkers allow clinicians to track a patient’s physiological parameters continuously such as heart rate variability, gait, speech patterns, or sleep cycles without needing the patient to be physically present. This shift is critical in managing long-term diseases like heart failure, Parkinson’s disease, diabetes, and mental health disorders, where fluctuations in health status can be sudden and critical.

Furthermore, the COVID-19 pandemic emphasized the need for non-invasive, remote solutions to maintain care continuity while minimizing infection risks. As telehealth infrastructure expands globally, digital biomarkers are emerging as essential data sources for virtual care models.

Despite the rapid adoption of digital biomarkers, data privacy and cybersecurity remain major concerns restraining market growth. Digital biomarkers often involve continuous monitoring, producing large volumes of sensitive health data that are transmitted across various devices and cloud platforms. Any breach of this data can compromise patient trust, lead to legal consequences, and affect clinical decisions.

Different regions have distinct regulatory standards like HIPAA in the U.S., GDPR in the EU, and evolving frameworks in Asia and the Middle East. These varying guidelines make cross-border data sharing and global deployments complex. Moreover, device manufacturers and app developers must ensure interoperability, encryption, anonymization, and compliance with ethical standards, which adds to development time and cost.

The lack of harmonized international standards and increasing incidences of healthcare cyberattacks could slow adoption unless robust data governance models are put in place.

A significant growth opportunity lies in the integration of digital biomarkers into drug development pipelines and clinical trials. Traditional clinical trials often suffer from high dropout rates, infrequent data collection, and recruitment barriers. Digital biomarkers offer a way to collect continuous, real-world data that improves participant engagement, compliance, and trial accuracy.

Pharmaceutical companies are partnering with digital health firms to deploy digital endpoints that can quantify treatment responses, side effects, and patient-reported outcomes. These markers can also help in early detection of safety issues, improving trial safety and reducing time to market. For example, gait and tremor analysis via smartphones can be used in trials evaluating Parkinson’s disease drugs.

Moreover, regulatory bodies are beginning to accept digital endpoints as co-primary or exploratory endpoints, signaling a paradigm shift in how trials are designed and validated. This creates a fertile ground for market players to offer scalable solutions tailored to clinical research needs.

Wearables dominate the type segment, owing to their widespread availability, user acceptance, and ability to collect a wide array of physiological signals such as heart rate, temperature, oxygen saturation, motion, and sleep cycles. Smartwatches, fitness bands, and chest straps are widely used in both consumer health and professional monitoring, making this segment a key revenue contributor.

Mobile-based applications are the fastest-growing segment, propelled by smartphone penetration and app-based wellness ecosystems. Apps designed for mental health, cardiac monitoring, and medication adherence are increasingly incorporating digital biomarker capabilities, such as voice tracking for depression or keyboard typing patterns for neurodegenerative disease detection.

Monitoring digital biomarkers hold the largest market share, particularly in managing chronic conditions like cardiovascular disease, COPD, and diabetes, where continuous or episodic measurement of biometrics helps clinicians optimize care pathways. Wearables and connected sensors are widely used to track vital signs and activity metrics, improving patient outcomes and compliance.

Predictive and prognostic digital biomarkers are the fastest-growing segment, as AI and data analytics make it possible to forecast disease onset or progression. These tools are especially critical in oncology, neurology, and psychiatry, where early intervention significantly influences prognosis.

Cardiovascular and metabolic disorders dominate the therapeutic area segment, driven by the global burden of heart disease, hypertension, and diabetes. Devices that measure ECG, blood pressure, and blood glucose are routinely integrated into digital biomarker platforms, aiding both real-time monitoring and early risk detection.

Neurological disorders are the fastest-growing therapeutic area, as digital biomarkers increasingly support the detection and tracking of Alzheimer’s disease, Parkinson’s disease, multiple sclerosis, and epilepsy. Parameters like speech changes, eye movement, motor function, and memory can be monitored remotely, transforming how clinicians manage and study these conditions.

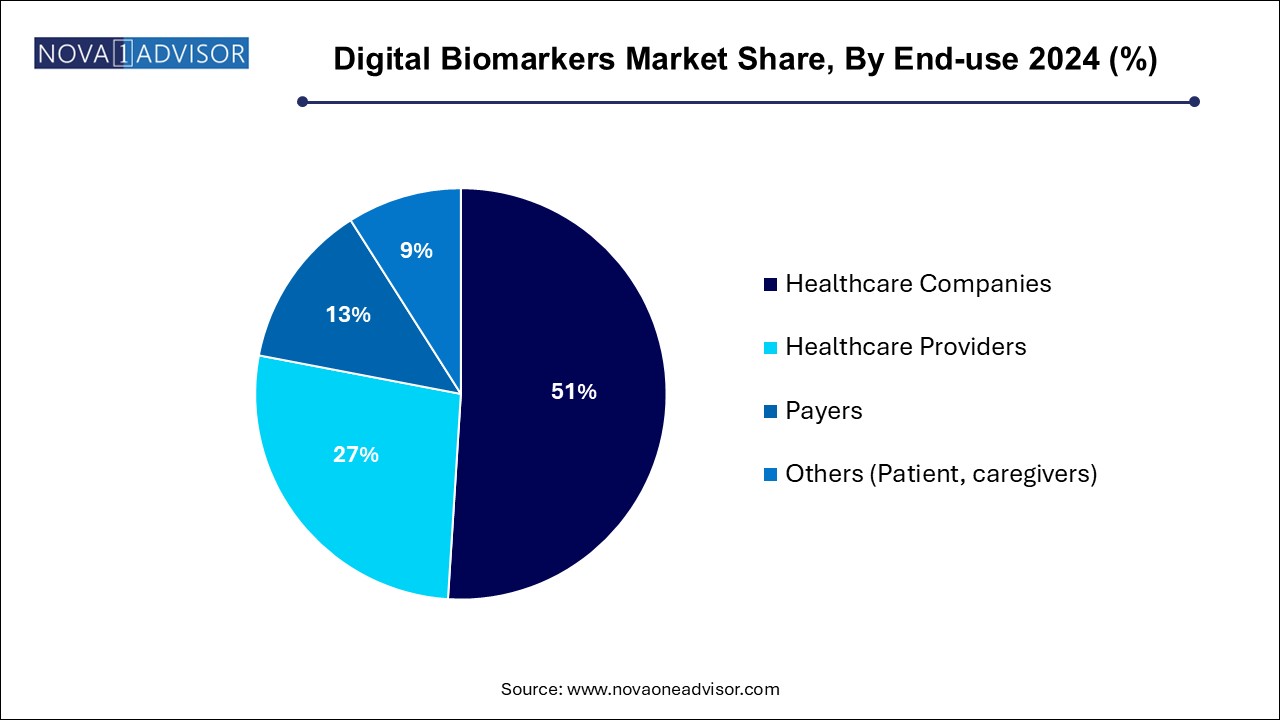

Healthcare providers dominate the end-use segment, using digital biomarkers to enhance patient monitoring, personalize treatment plans, and integrate with electronic health records (EHRs). Hospitals, specialty clinics, and virtual care platforms are increasingly deploying remote biomarker-based solutions for long-term patient engagement.

Healthcare companies (pharma and medtech) are the fastest-growing segment, as drug manufacturers increasingly adopt digital biomarkers to streamline clinical trials, track therapeutic responses, and improve patient stratification. Partnerships between pharmaceutical giants and tech firms are multiplying in this space.

North America leads the global digital biomarkers market, primarily due to advanced healthcare infrastructure, widespread technology adoption, and a strong ecosystem of startups, academic institutions, and regulatory clarity. The U.S., in particular, benefits from a favorable reimbursement landscape, early adopters in digital health, and substantial investment from both private and government sources.

Asia-Pacific is the fastest-growing region, fueled by the rapid expansion of digital health platforms in countries like China, India, Japan, and South Korea. Rising healthcare digitalization, smartphone penetration, and government-backed chronic disease management programs are driving demand for scalable, cost-effective biomarker solutions. The region also presents a large pool of tech-savvy populations and diverse disease burdens, making it a prime growth market.

March 2025 – Biogen partnered with Apple to launch a study using wearable-based cognitive biomarkers to monitor early signs of Alzheimer’s disease.

February 2025 – Evidation Health received funding to develop a behavioral digital biomarker platform focused on depression and sleep disorders using passive smartphone data.

January 2025 – Verily (Alphabet Inc.) unveiled Verily Baseline, a digital health platform that integrates multiple biomarkers for clinical research and chronic disease management.

December 2024 – Philips launched an AI-enabled wearable for heart failure monitoring, integrating digital biomarkers with clinical decision support.

November 2024 – Mindstrong Health expanded its mental health platform with new smartphone-based biomarkers to predict relapse in bipolar disorder.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the digital biomarkers market

By Type

By Clinical Practice

By Therapeutic Area

By End-use

By Regional