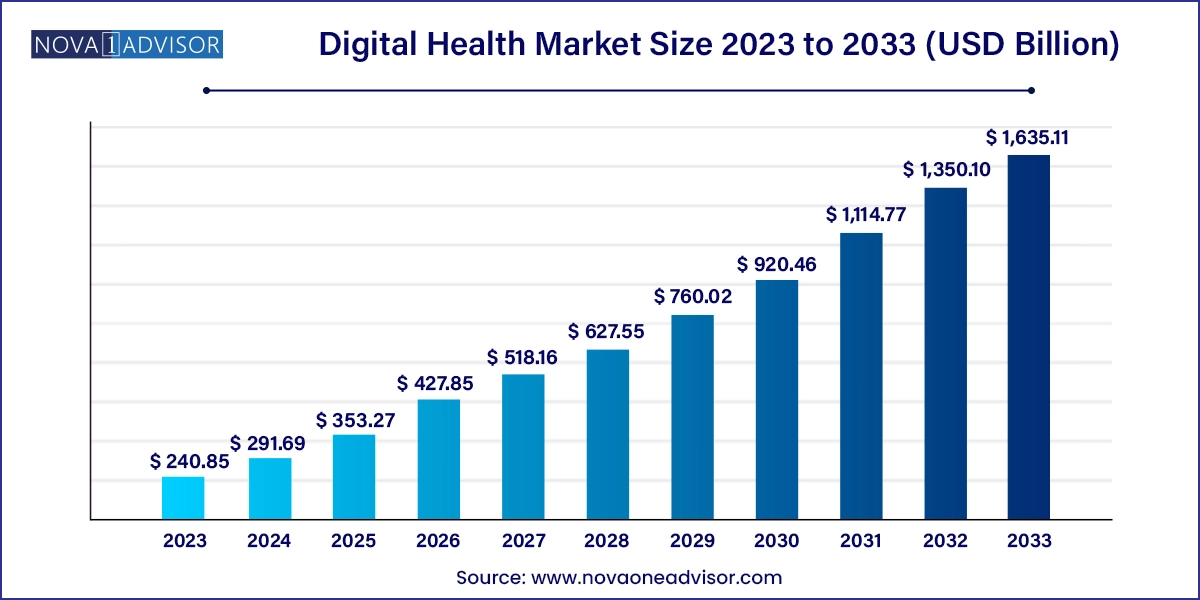

The global digital health market size was exhibited at USD 240.85 billion in 2023 and is projected to hit around USD 1,635.11 billion by 2033, growing at a CAGR of 21.11% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 291.69 Billion |

| Market Size by 2033 | USD 1,635.11 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 21.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Component, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Oracle Cerner; Veradigm; Apple Inc.; Telefonica S.A.; McKesson Corp.; Epic Systems Corp.; QSI Management, LLC; AT&T; Vodafone Group; Airstrip Technologies; Google, Inc; Samsung Electronics Co. Ltd.; Hims & Hers Health, Inc.; Orange; Qualcomm Technologies, Inc.; Softserve; Computer Programs and Systems, Inc.; Vocera Communications; IBM Corp.; CISCO Systems, Inc. |

The market is driven by several factors, such as a strong domestic market for telehealthcare platform developers, mHealth app providers, wearable device manufacturers, and e-prescription systems.

Moreover, the healthcare industry exhibits high growth potential for the IT industry due to supportive government initiatives across all regions. The growing trend of preventive healthcare & the rise in funding for mHealth startups are other factors boosting the market.

The rising incidence of chronic conditions such as diabetes, heart disease, and cancer is fueling the demand for remote monitoring and management solutions. Digital health tools can help patients track their health, adhere to treatment plans, and communicate with healthcare providers more effectively.

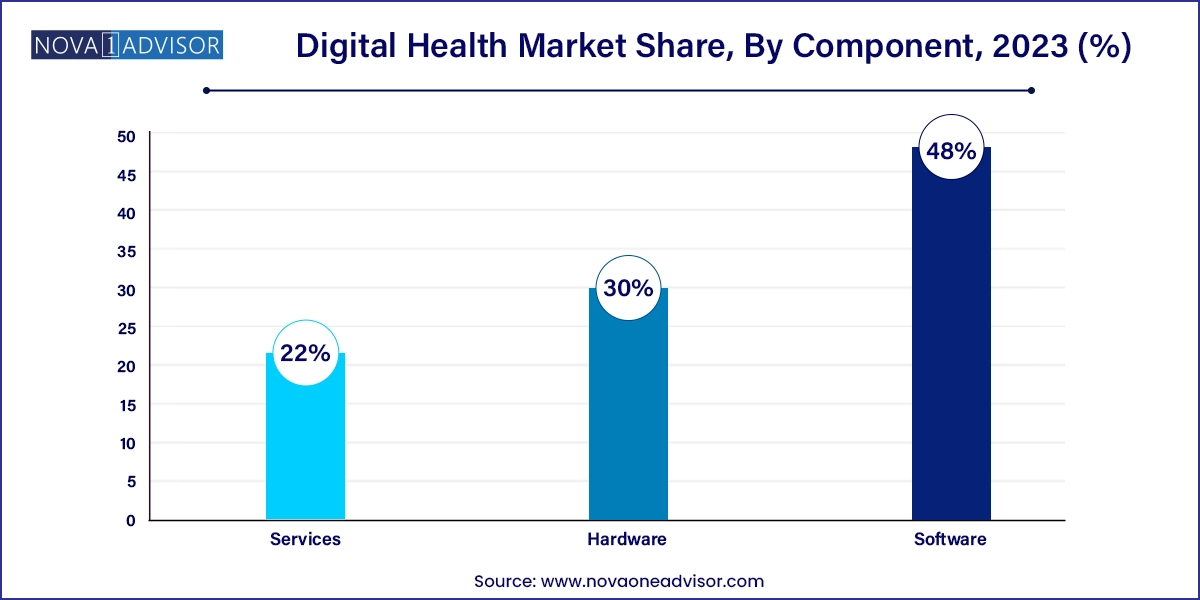

Based on component, the services segment led the market with the largest revenue share 48.0% in 2023, owing to the growing demand for services, such as installation, staffing, training, maintenance, and other services. Market players are either providing these services as standalone or in packages. The growing demand for advanced software solutions and platforms, such as Electronic Medical Records (EMRs), EHR, and the increasing need for upgradation & training required to run these software solutions, are contributing to segment growth. As per 2021 HealthIT.gov report, nearly 88% of U.S. office-based doctors use EHRs, within that 78% using certified EHRs. Key players provide a wide array of pre- & post-installation services, covering project planning, staffing, implementation, training, and resource allocation & optimization.

The software segment is anticipated to register the fastest CAGR of 23.2% from 2024 to 2033, due to rapid adoption of software systems among patients, healthcare facilities, providers, and insurance payers. Growing healthcare expenses and the trend of healthcare digitalization are contributing to the growth of the software segment. Growing consumer demand for personalized medicine and the transition to value-based care is driving segment growth. In emerging economies, healthcare facilities readily adopt these advanced software solutions and platforms to streamline their organizational workflows and enhance their clinical, operational, & financial outcomes.

Based on technology, the tele healthcare segment led the market with a largest revenue share of 43.12% in 2023 and is also expected to register the fastest CAGR over the forecast period. This growth rate can be attributed to advancing internet connectivity, growing smartphone penetration, advanced technology readiness, a growing shortage of healthcare providers, increasing medical expenses, easy availability of telehealth applications, and rising adoption of these technologies by patients & physicians. The constant evolution of telehealth applications and rapid technological innovations further boost segment growth. Government support, policies promoting healthcare digitization, and growing healthcare IT spending are major factors driving segment growth.

The mHealth segment held the second largest position in terms of revenue share in 2023 in the global market. Growing penetration of smartphones & internet connectivity and rising adoption of mHealth technologies by physicians & patients are factors driving segment growth. As per Uswitch Limited's calculations, the UK had approximately 71.8 million mobile connections at the beginning of 2022, surpassing the country's population by 4.2 million. This represents a 3.8% increase from 2021, which is equivalent to around 2.6 million new mobile connections. Increasing trend of preventive healthcare & rising funding for mHealth startups are other factors boosting the market.

Based on applications, the diabetes segment led the market with the largest revenue share of 24.13% in 2023 and is expected to register the fastest CAGR of 23.7% from 2024 to 2033. The prevalence of diabetes and its associated complications has positioned it as the largest segment in the digital health space. Digital health technologies offer innovative solutions to address the needs of individuals with diabetes. Digital health tools, ranging from smartphone applications for glucose monitoring to wearable devices that track physical activity and offer real-time health data, enable patients to actively engage in managing their diabetes. Moreover, these technologies facilitate remote patient monitoring, enabling healthcare providers to receive timely data, make informed decisions, and offer timely interventions, ultimately contributing to more effective diabetes management.

The obesity segment is the second largest in application due to high global prevalence and the rising need for effective weight management solutions. Digital health technologies offer personalized interventions, ranging from mobile applications for dietary tracking to wearable devices monitoring physical activity, driving the segment's growth. Moreover, a shift beyond conventional applications in weight management is evident, with a growing number of companies adopting personalized approaches. This includes the use of metabolic testing, glucose monitoring, and innovative technologies such as Prism Lab’s body mapping and Spren’s smart mirror to customize treatment plans. Remote monitoring companies such as Qardio, and Rimidi utilize smart scales to track weight and aggregate data for risk factor assessment. Integration with medications enhances their role in stratifying appropriate care and monitoring adherence. All these factors collectively drive the growth of the obesity segment in the digital health landscape.

Based on end-use, the patient segment held the market with the largest revenue share of 34.11% in 2023 and is expected to witness the fastest CAGR from 2024 to 2033, owing to the shift toward patient-centered care and high awareness of managing health among individuals. Digital health technologies have revolutionized the healthcare landscape by providing patients with tools for remote monitoring, self-management, and access to health information. From mobile health apps that track vital signs to telehealth platforms facilitating virtual consultations, the focus on the patient segment reflects the industry's commitment to enhancing patient engagement, promoting proactive health management, and fostering a more collaborative and informed healthcare experience.

The providers segment holds a significant share of the global market and is expected to maintain their market share over the forecast period. The growth is propelled by the widespread adoption of innovative technologies, such as telemedicine and digital therapeutics. Healthcare providers are increasingly leveraging digital solutions to offer remote consultations, personalized treatment plans, and evidence-based therapies outside traditional care settings. The integration of digital tools allows providers to deliver more accessible and tailored care, contributing to improved patient outcomes.

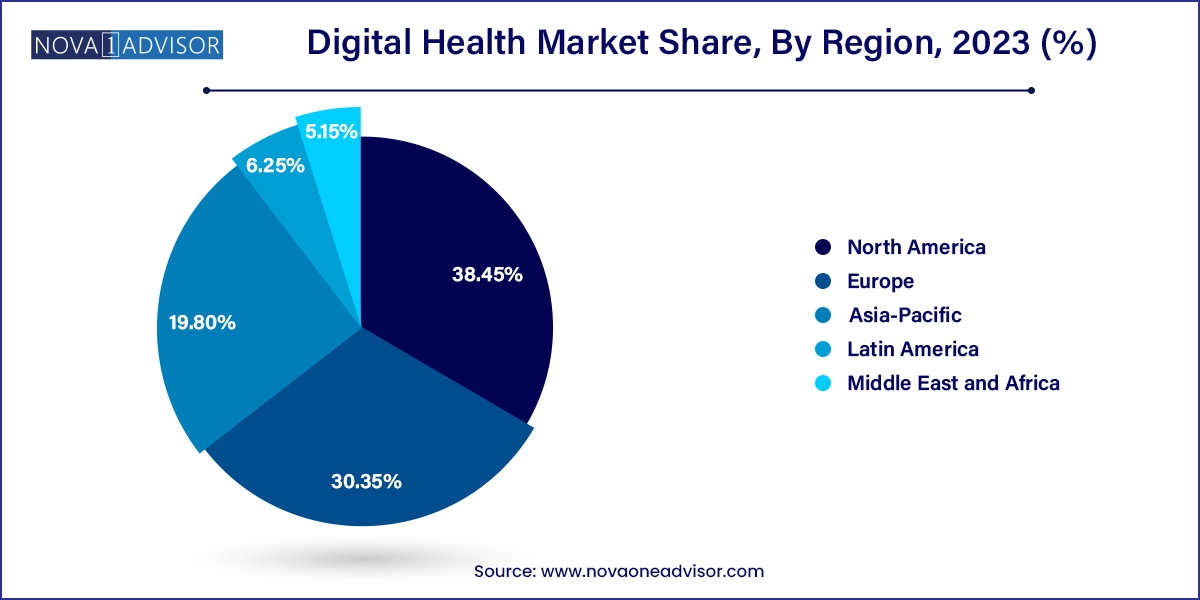

North America dominated the market with the largest revenue share of 38.45% in 2023, owing to technological advancements, growing healthcare IT expenditure to advance infrastructure, favorable government initiatives, emergence of startups, readiness to adopt advanced technological solutions, options for growing smartphone penetration, advancements in internet connectivity, and lucrative funding. In addition, factors, such as advancements in coverage networks, rapid growth in the adoption of smartphones, a rise in geriatric population & prevalence of chronic diseases, and shortage of primary caregivers are responsible for industry growth.

U.S. Digital Health Market Trends

The U.S. leads in the digitalization of healthcare in North America with a revenue share of 88.2% in 2023, due to advanced healthcare management & innovative software developments and the presence of numerous key players operating across segments, such as mobile & network operations. According to a survey conducted by Insider Intelligence in December 2022, around 63.4% of U.S. adults used a health-related app in the past 12 months. In addition, health-related mobile apps are extremely popular across the U.S. due to rising health consciousness. Hence, fitness and nutrition tracking has been a leading factor in adopting digital healthcare systems, indicating a strong consumer preference for these apps.

Asia Pacific Digital Health Market Trends

Asia Pacific is estimated to witness the fastest CAGR from 2024 to 2033 in the digital health market. This surge is attributed to the increasing adoption of eHealth platforms and a rise in healthcare expenditure across the region. The growing demand for remote patient monitoring and telehealth services, supported by increasing government investments in healthcare, is expected to drive industry expansion. Notably, data from The World Bank in 2019 indicates that China allocated 5.4%, India 3.1%, and Japan 10.7% of their respective GDPs to healthcare spending. The active participation of key players in Asia Pacific has further accelerated the adoption of digital apps and platforms in the region.

The digital health market in India holds significant amount of share in the Asia Pacific region. It is one of the key countries readily embracing digital technology. The increased smartphone penetration, improved network coverage, and favorable government initiatives (such as Digital India and Disha) are boosting the adoption of digital healthcare services in the country. DISHA aims to regulate digital health data into a federal structure. It regulates a National level Healthcare Authority (NeHA) and a State level Healthcare Authority (SeHA). Under this act, national- and state-level executive committees will aid & assist NeHA and SeHA in performing their functions under DISHA.

MEA Digital Health Market Trends

The digital health market in the Middle East and Africa is expected to see significant growth in the coming years. This growth is driven by factors such as increasing adoption of digital technologies, a growing awareness of healthcare solutions, and efforts to improve healthcare infrastructure. Digital health is revolutionizing healthcare in MEA, facilitated by improving internet connectivity and government initiatives. Telemedicine, wearable devices, mHealth apps, and Artificial Intelligence (AI) are key trends transforming healthcare access, costs, & outcomes. Despite challenges including infrastructure, affordability, and data privacy, digital health’s potential to improve MEA healthcare is substantial.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the digital health market

Technology

Component

Application

End-use

Regional