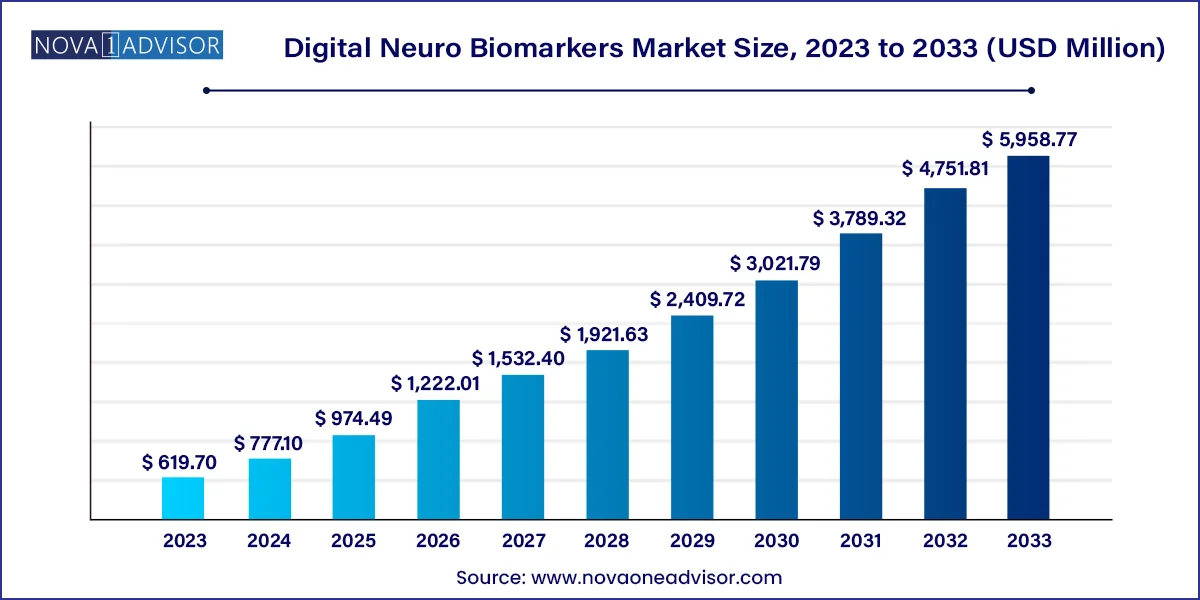

The global digital neuro biomarkers market size was USD 619.70 million in 2023, calculated at USD 777.10 million in 2024 and is expected to reach around USD 5,958.77 million by 2033, expanding at a CAGR of 25.4% from 2024 to 2033.

The digital neuro biomarkers market represents a revolutionary transformation in neurology and digital health. Digital neuro biomarkers are quantifiable, physiological, and behavioral data collected using digital devices—such as smartphones, wearables, sensors, and software platforms—to assess and monitor neurological functions. Unlike traditional biomarkers, these are non-invasive, continuous, and capable of capturing real-world data in naturalistic settings, offering unprecedented precision in the diagnosis, prognosis, and management of neurodegenerative and neuropsychiatric diseases.

Conditions such as Parkinson’s disease, Alzheimer’s disease, multiple sclerosis, epilepsy, and even psychiatric disorders like depression and schizophrenia are among the primary targets of digital neuro biomarkers. As neurology faces mounting challenges due to rising prevalence and a lack of effective treatments, real-time insights derived from digital biomarkers present new opportunities for early detection and disease progression monitoring. Their integration into clinical trials also accelerates drug development by improving patient stratification and outcome measures.

In the U.S., Europe, and increasingly in Asia-Pacific, digital health platforms have begun leveraging machine learning and AI to analyze massive streams of neurophysiological data. Pharmaceutical companies, medtech firms, and digital startups are actively collaborating with academic institutions and healthcare systems to validate and scale these tools. The growing demand for remote patient monitoring, coupled with regulatory interest in digital endpoints, is cementing digital neuro biomarkers as the next frontier in personalized neurology.

Integration of AI and Machine Learning: Advanced algorithms are being used to decode complex neurological patterns from continuous sensor data.

Regulatory Recognition of Digital Endpoints: Regulatory bodies like the FDA and EMA are increasingly recognizing digital biomarkers in clinical trials.

Rise of Wearable Neurotechnology: Devices like smartwatches, headbands, and smart glasses are becoming central to real-time neurological data acquisition.

Expansion of At-home Neurological Assessments: Remote digital assessments are enabling clinicians to monitor patients outside of clinical settings.

Partnerships Between Pharma and Tech Firms: Collaborations are rising to co-develop and validate digital biomarkers for neurodegenerative diseases.

Growing Use in Clinical Trials: Digital biomarkers are improving patient recruitment, compliance tracking, and endpoint validation.

Voice and Speech Analysis for Cognitive Disorders: Speech pattern analysis is emerging as a powerful tool for early Alzheimer’s and Parkinson’s detection.

Focus on Pediatric and Geriatric Populations: Custom digital biomarker platforms are being tailored for both early childhood development and aging-related decline.

| Report Attribute | Details |

| Market Size in 2025 | USD 974.49 million |

| Market Size by 2033 | USD 5,958.77 million |

| Growth Rate From 2024 to 2033 | CAGR of 25.4% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, clinical practice, end use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Altoida Inc.; Koneksa; Biogen Inc.; Roche (Navify); NeuraMetrix; Merck KGaA; Linus Health; Neurotrack Technologies, Inc.; Huma; NeuraLight |

One of the most powerful drivers of the digital neuro biomarkers market is the rising prevalence of neurodegenerative diseases such as Alzheimer’s disease, Parkinson’s disease, and multiple sclerosis. In the U.S. alone, over 6 million people are living with Alzheimer’s, and this number is projected to double by 2050. Traditional clinical tools often detect these conditions too late for effective intervention. Digital biomarkers offer a unique advantage by enabling the detection of subtle, early-stage changes in cognitive or motor functions through passive data collection and continuous monitoring.

For instance, subtle changes in gait, balance, or reaction time—captured via smartphone accelerometers or wearable sensors—can serve as early indicators of Parkinson’s disease. Similarly, digital speech and typing pattern analysis have demonstrated utility in identifying cognitive decline years before clinical diagnosis. This predictive potential aligns with the global push for early intervention and preventive healthcare, creating immense demand for validated digital biomarker tools.

Despite significant advancements, one of the most persistent restraints is the challenge of managing data privacy and regulatory compliance. Digital neuro biomarkers inherently involve the collection and analysis of sensitive neurological and behavioral data, often in real-time and across multiple platforms. Ensuring data security, interoperability, and compliance with HIPAA, GDPR, and other regulatory frameworks remains a complex and evolving issue.

Moreover, regulatory pathways for digital biomarkers are still in development, with ambiguity surrounding validation criteria, clinical trial acceptance, and reimbursement strategies. The lack of standardized frameworks for assessing digital endpoints creates a hurdle for both developers and adopters, especially smaller firms with limited regulatory expertise. These concerns can slow down product approval, integration into clinical workflows, and patient trust.

A transformative opportunity lies in the integration of AI with remote monitoring platforms that leverage digital neuro biomarkers. With increasing demand for telehealth, particularly post-COVID-19, digital biomarkers provide a scalable and efficient means of extending neurology care into patients’ homes. AI-driven tools can analyze continuous behavioral data—such as typing dynamics, facial expressions, eye movement, or sleep patterns—to provide insights into cognitive or motor deterioration.

Companies like Altoida and Rune Labs are pioneering platforms that combine wearable and mobile data streams with AI analytics to generate clinically meaningful insights. This integration enables physicians to receive alerts about neurological decline or treatment inefficacy, enabling timely intervention. Moreover, such platforms enhance clinical trial designs by reducing patient dropout and enabling decentralized participation. As AI matures and regulatory frameworks solidify, this domain is set to redefine how neuro care is delivered.

Wearable devices dominated the digital neuro biomarkers market, owing to their ability to capture continuous physiological and motor data. Wearables like smartwatches, EEG headbands, and motion sensors are widely used to monitor gait, tremor, heart rate variability, and sleep patterns. These devices are particularly valuable in Parkinson’s disease management and post-stroke rehabilitation. For example, Apple Watch has been explored for fall detection and movement tracking in neurological patients, while headband EEGs are gaining traction for epilepsy monitoring and sleep analysis.

Mobile-based applications are the fastest-growing segment, driven by the ubiquity of smartphones and the growing number of health-focused apps. Cognitive assessment tools, mood tracking applications, and voice analysis platforms are leveraging phone sensors and microphones to assess mental health and neurological function. Applications like Altoida’s digital cognitive assessment app use AR and machine learning to predict Alzheimer’s risk years before onset. The convenience, affordability, and real-time data analytics offered by mobile-based tools are accelerating their integration into clinical and at-home care.

Monitoring digital neuro biomarkers led the segment, as continuous tracking is essential in chronic neurological conditions. These biomarkers are used to evaluate treatment response, symptom progression, and side effect emergence. For instance, Rune Labs’ StrivePD platform uses wearable data to monitor Parkinson’s symptoms, providing neurologists with actionable insights between clinic visits. Continuous monitoring ensures better personalization of therapy and early detection of adverse events.

Predictive and prognostic digital neuro biomarkers are emerging as the fastest-growing category, especially in Alzheimer’s and multiple sclerosis research. Tools that predict disease onset, relapse, or deterioration are being integrated into early screening programs and clinical trials. Predictive biomarkers can identify high-risk individuals, improving clinical outcomes through early intervention. Prognostic tools also aid payers and providers in estimating disease trajectories and optimizing care resources.

Healthcare companies, including pharma and biotech firms, dominate the end-use landscape, as digital neuro biomarkers become critical for drug development and clinical trial management. Pharmaceutical giants are increasingly integrating digital endpoints into CNS trials to improve patient stratification and endpoint sensitivity. For example, Biogen and Eisai are using digital biomarker data to evaluate therapeutic efficacy in Alzheimer’s drug trials, aiming to complement traditional imaging and cognitive scoring methods.

Healthcare providers are the fastest-growing end users, as clinicians adopt digital biomarker tools for remote monitoring and diagnostics. Hospitals and neurologists are incorporating digital tools into electronic health records (EHRs) to track patients over time and adjust treatments accordingly. This growth is supported by increasing reimbursement for remote monitoring and a broader shift toward digital-first care models.

North America dominates the digital neuro biomarkers market, driven by robust healthcare infrastructure, high digital adoption, and strong regulatory support for digital health innovations. The United States, in particular, leads in the development and validation of digital biomarkers, with heavy investment from both private and public sectors. The FDA’s Digital Health Center of Excellence has paved the way for regulatory acceptance of digital endpoints in CNS trials. Companies like Rune Labs, Biogen, Mindstrong, and Altoida are headquartered in the U.S., collaborating closely with academic institutions like Harvard, MIT, and Stanford on neuro biomarker research.

Asia-Pacific is the fastest-growing region, bolstered by rising neurological disease burden, smartphone penetration, and government-backed digital health initiatives. Countries like Japan, China, and South Korea are rapidly deploying mobile health solutions to address aging populations and rural healthcare challenges. Local companies and multinationals are partnering to localize AI models and voice analysis tools for non-English-speaking populations. Additionally, supportive policies and digital infrastructure improvements are encouraging the adoption of remote neuro monitoring platforms.

April 2025 – Rune Labs received FDA clearance to use its StrivePD platform with Apple Watch to track movement data in Parkinson’s patients, making it one of the first wearable-based digital biomarkers cleared for clinical use in neurology.

February 2025 – Altoida secured $25 million in funding to scale its AI-based neurodiagnostic platform, which uses augmented reality and smartphone sensors to detect Alzheimer’s disease 5–10 years before clinical symptoms.

January 2025 – Eisai and Biogen launched a real-world study using digital speech biomarkers to monitor cognitive decline in Alzheimer’s patients, in collaboration with Aural Analytics.

November 2024 – Koneksa expanded its digital biomarker platform to include neurodegenerative conditions, focusing on gait analysis and voice biomarkers through smartphone integrations.

September 2024 – Cogstate partnered with a major U.S. academic hospital to validate tablet-based cognitive testing for remote Alzheimer's screening.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Digital Neuro Biomarkers market.

By Type

By Clinical Practice

By End Use

By Region