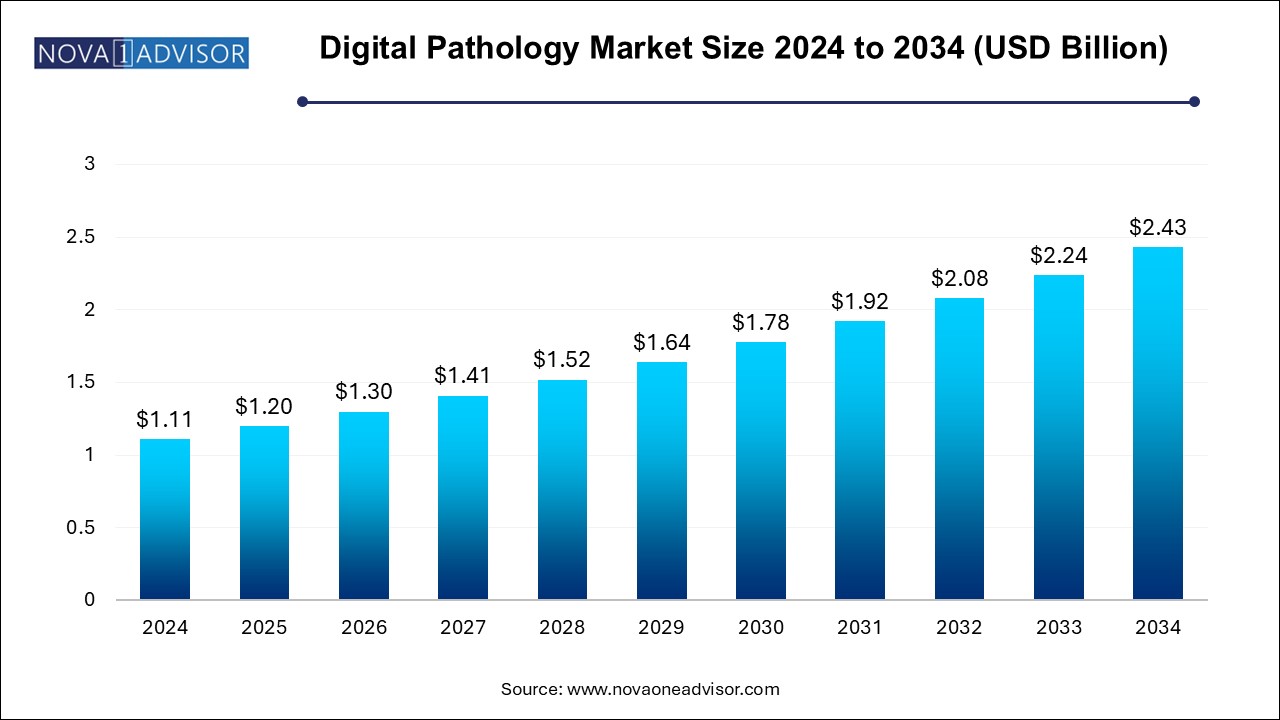

The digital pathology market size was exhibited at USD 1.11 billion in 2024 and is projected to hit around USD 2.43 billion by 2034, growing at a CAGR of 8.1% during the forecast period 2025 to 2034.

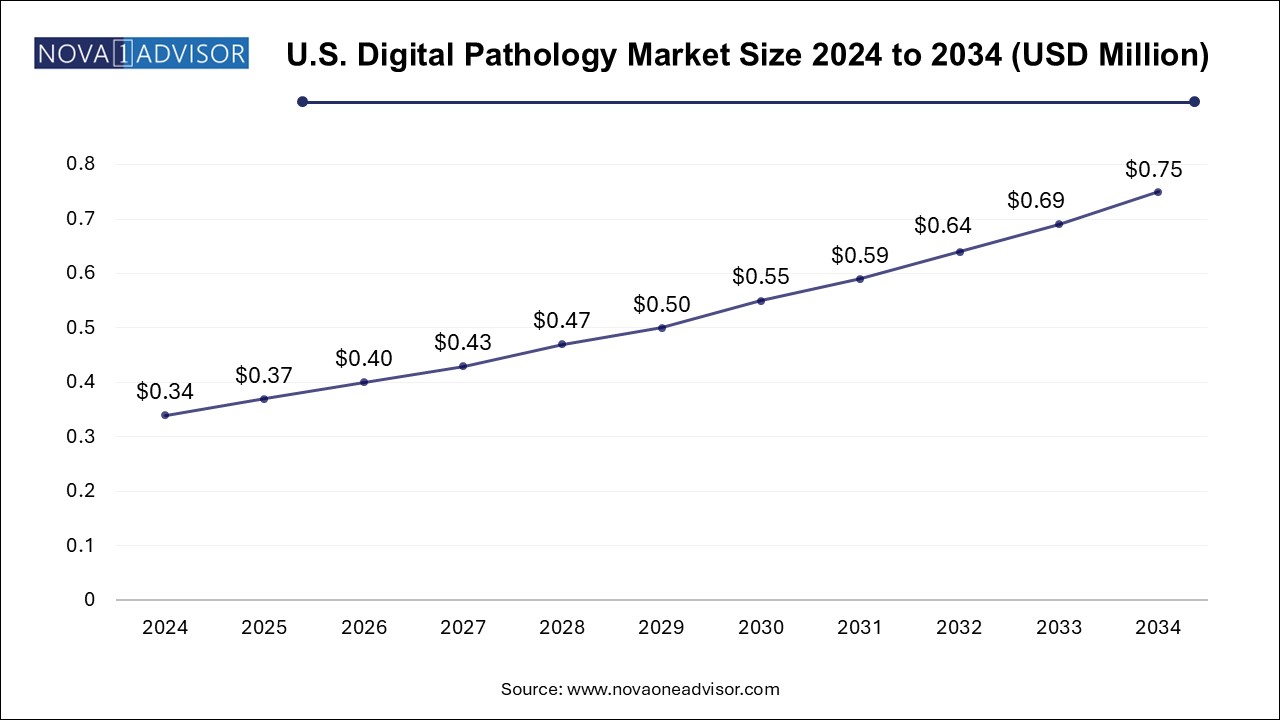

The U.S. digital pathology market size is evaluated at USD 0.340 million in 2024 and is projected to be worth around USD 0.750 million by 2034, growing at a CAGR of 7.45% from 2025 to 2034.

North America dominated overall market in 2024 with a share of 41.0% the global digital pathology market, supported by a well-established healthcare infrastructure, high adoption of AI in healthcare, and strong investment in precision diagnostics. The U.S. FDA’s approval of digital pathology systems for primary diagnosis (e.g., Philips IntelliSite) has provided regulatory clarity and encouraged wider adoption.

Asia Pacific is emerging as the fastest-growing region, propelled by increasing cancer prevalence, expanding healthcare infrastructure, and government investment in digital transformation. Countries such as Japan, China, India, and South Korea are witnessing rising adoption of digital pathology in both public and private sectors. Japan leads in advanced imaging and robotics integration, while China is rapidly building AI-powered medical research hubs.

Several Indian diagnostic chains and academic centers have started deploying slide scanners and telepathology platforms for outreach diagnostics and education. Furthermore, regional governments are offering grants and subsidies for digital health adoption, including pathology. The growing role of AI startups and the expansion of mobile internet connectivity make Asia Pacific a critical growth engine for the digital pathology market.

The digital pathology market represents a transformative shift in the field of pathology, redefining the traditional practice of microscopy through the integration of digital imaging, AI algorithms, data analytics, and cloud computing. Digital pathology enables the acquisition, management, sharing, and interpretation of pathology information in a digital environment, eliminating the limitations of physical slides and manual processing. This paradigm shift is not only enhancing diagnostic precision and laboratory efficiency but also playing a vital role in drug discovery, personalized medicine, and remote consultations.

Over the past decade, the confluence of digital technologies and healthcare innovation has brought significant momentum to this field. The ability to capture high-resolution digital images of tissue samples, annotate and archive them, and share them in real-time with specialists worldwide has led to unprecedented improvements in clinical collaboration and turnaround times. This is particularly beneficial in the context of cancer diagnostics, where time-sensitive and high-accuracy evaluations are essential.

The COVID-19 pandemic acted as a catalyst for digital pathology adoption, as remote workflows, telepathology, and decentralized research became a necessity. Post-pandemic, the growth curve has been sustained due to expanding applications across academic research, pharmaceutical R&D, and diagnostic labs. As healthcare systems globally prioritize precision medicine and interoperability, digital pathology is evolving into a foundational layer for integrated diagnostics, with immense commercial potential through 2034.

Growing Adoption of Whole Slide Imaging (WSI) and High-Throughput Scanning Systems

Integration of Artificial Intelligence (AI) for Automated Image Analysis and Quantification

Expansion of Cloud-Based Pathology Platforms for Global Collaboration

Increasing Use of Digital Pathology in Oncology and Companion Diagnostics

Rising Implementation in Drug Discovery and Preclinical Toxicology Studies

Mergers Between Imaging Tech Companies and Pathology Solution Providers

Regulatory Clearances for Clinical Use in the U.S. and Europe Boosting Confidence

Surge in Academic Collaborations for AI-Powered Histopathology Research

Development of Interoperable Platforms with Laboratory Information Systems (LIS)

Increased Adoption of Digital Pathology in Veterinary Practices and Biobanking

| Report Coverage | Details |

| Market Size in 2025 | USD 1.20 Billion |

| Market Size by 2034 | USD 2.43 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.1% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Type, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Leica Biosystems Nussloch GmbH (Danaher); Hamamatsu Photonics, Inc.; Koninklijke Philips N.V.; Olympus Corp.; F. Hoffmann-La Roche Ltd.; Mikroscan Technologies, Inc.; Inspirata, Inc.; Epredia (3DHISTECH Ltd.); Visiopharm A/S; Huron Technologies International Inc.; ContextVision AB; HANGZHOU ZHIWEI INFORMATION TECHNOLOGY CO. LTD. (MORPHOGO); West Medica Produktions- und Handels- GmbH (West Medica); aetherAI; IBEX (IBEX MEDICAL ANALYTICS); SigTuple Technologies Private Limited; Morphle Labs, Inc; Bionovation Biotech, Inc. |

A central driver of the digital pathology market is the growing need for workflow optimization and operational efficiency in pathology laboratories. Traditional pathology relies heavily on manual slide preparation, glass slide storage, and optical microscopy—a process that is labor-intensive, time-consuming, and prone to human error. With rising biopsy volumes and global shortages of trained pathologists, laboratories are under pressure to deliver faster and more reliable diagnostics.

Digital pathology addresses these challenges by enabling high-speed slide scanning, automated quantification, digital archiving, and remote case review. Labs can operate in centralized or decentralized models, allowing flexible access to expert consultations without delays. AI-powered analytics further reduce review times and assist in diagnostic consistency. Collectively, these capabilities lead to higher throughput, enhanced accuracy, and substantial cost savings over time—strong incentives for hospitals and labs to invest in digital pathology infrastructure.

Despite its benefits, a significant restraint for the market is the high initial cost of implementation. Acquiring high-resolution scanners, storage systems, slide management platforms, and integration with hospital IT systems can represent a substantial financial burden, especially for small- and medium-sized pathology labs or institutions in developing countries. Additionally, costs associated with training personnel, transitioning workflows, and ensuring compliance with data security standards contribute to overall expenditure.

Another barrier is the requirement for high-speed internet, secure cloud architecture, and standardized file formats to support remote viewing and data interoperability. In regions with limited digital infrastructure, these challenges can slow adoption. Furthermore, while AI holds promise, its integration into clinical workflows faces regulatory hurdles and requires extensive validation before becoming a standard practice.

One of the most promising opportunities in the digital pathology market is the application of artificial intelligence and machine learning in image analysis. AI can automate the identification and quantification of key histological features, such as cell morphology, mitotic figures, or biomarker expression, thereby supporting more accurate and reproducible diagnoses. This is especially valuable in high-volume pathology settings and complex cancer subtyping where manual evaluation can be subjective.

Companies are increasingly investing in the development of AI algorithms trained on large, annotated digital pathology datasets to aid in early cancer detection, risk stratification, and prognosis prediction. In drug development, AI tools are being used to evaluate treatment response markers and optimize clinical trial stratification. As regulatory frameworks begin to recognize AI-based decision support tools, the integration of these technologies will significantly enhance the utility of digital pathology platforms and expand market access.

The device segment, including scanners and slide management systems, is witnessing rapid growth. Scanners are essential for converting physical slides into high-resolution digital formats. Innovations in speed, image clarity, and compatibility are driving demand, particularly in centralized labs and research organizations. Slide management systems ensure proper indexing, retrieval, and data tagging of scanned slides. Together, these devices form the hardware backbone of digital pathology workflows.

The software segment dominates the digital pathology market due to its central role in enabling image analysis, data management, visualization, annotation, and reporting. Pathology software platforms serve as the operational hub, connecting scanning devices, laboratory information systems, AI tools, and cloud archives. These solutions are vital for facilitating case reviews, second opinions, teleconsultations, and education.

The hospitals segment dominated the market in 2024 with a share of 37.0%. Hospitals are the most preferred healthcare setting for disease diagnosis and care. benefiting from increasing digital investments in education and collaborative research. Digital pathology enables remote slide access for medical students, interdisciplinary training, and comparative research. Leading universities and research centers are also investing in digital pathology repositories for AI model development and open-access knowledge sharing.

The Diagnostic laboratories hold the largest share in terms of end use, driven by their critical role in delivering clinical pathology services at scale. Centralized reference labs and hospital diagnostic centers have embraced digital pathology to reduce turnaround times, minimize logistical challenges, and support remote consultations. High-throughput scanning, AI triage tools, and cloud-based sharing platforms are especially popular among pathology labs managing high specimen volumes.

Human pathology is the dominant type segment, primarily due to the widespread use of digital pathology in cancer diagnostics, histopathological research, and hospital-based laboratory services. Human pathology applications encompass a broad spectrum, from dermatology and gastrointestinal studies to oncology and hematology. With the rise of personalized medicine and genomic correlation studies, digital pathology is increasingly being integrated into clinical care pathways.

Veterinary pathology, though smaller in scale, is growing rapidly. Veterinary diagnostics benefit significantly from digital tools, especially in large animal practices and wildlife studies where physical transport of specimens can be logistically difficult. Telepathology and digital archiving are enabling remote review and collaboration between general veterinarians and pathologists. This segment is gaining momentum in academic veterinary schools, contract research organizations (CROs), and biopharmaceutical animal health programs.

The academic research segment dominated the market in 2024 with a share of 45.7%, Digital pathology has revolutionized cancer diagnostics by offering precise, high-resolution visualization of tumor structures, cellular abnormalities, and biomarker staining patterns. Sub-applications like cancer cell detection are critical for determining tumor grade, stage, and treatment strategy. Pathologists use digital slides for immunohistochemistry (IHC), in situ hybridization (ISH), and molecular pathology interpretations.

Meanwhile, drug discovery and development is the fastest-growing application area. Pharmaceutical companies are deploying digital pathology tools in preclinical toxicology studies, tissue biomarker validation, and histological endpoint evaluation in animal models. These tools enhance reproducibility and regulatory compliance in the research process. Moreover, academic research institutions are increasingly adopting digital workflows to facilitate collaborative research, image sharing, and teaching.

March 2025: Philips Healthcare launched its new IntelliSite Pathology 2.0 platform with integrated AI tools for breast cancer and lung pathology interpretation, targeting labs across North America and Europe.

February 2025: Roche Diagnostics announced a partnership with a UK-based AI firm to co-develop deep learning models for automated slide triage in hematopathology.

January 2025: Leica Biosystems released an upgrade to its Aperio GT450 platform, enhancing slide scanning speed by 30% and expanding cloud integration features.

December 2024: 3DHISTECH signed a multi-country deal with Southeast Asian academic institutes to install whole-slide scanners and cloud repositories for pathology education.

November 2024: Visiopharm launched a CE-marked AI image analysis suite for prostate cancer histology, designed for pathologists using any WSI-compatible scanner.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the digital pathology market

By Product

By Type

By Application

By End-use

By Regional