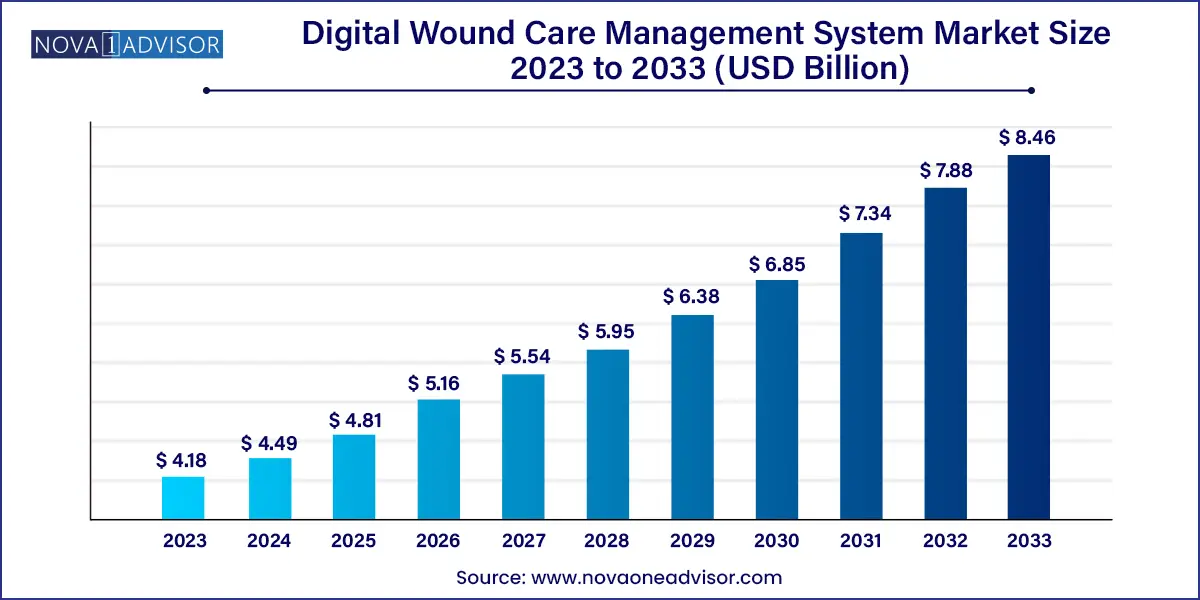

The global digital wound care management System market size was valued at USD 4.18 billion in 2023 and is anticipated to reach around USD 8.46 billion by 2033, growing at a CAGR of 7.3% from 2024 to 2033.

The Digital Wound Care Management System Market is undergoing a transformative evolution, integrating advanced technologies into the traditional wound care paradigm. Wound management—once reliant solely on physical dressings and visual assessments—has entered a new era where digital systems enable remote monitoring, image-based diagnostics, data-driven care planning, and artificial intelligence (AI)-enhanced predictions. These advancements are revolutionizing how chronic and acute wounds are assessed, treated, and followed up, offering enhanced precision, cost-effectiveness, and patient engagement.

The rising prevalence of chronic wounds—such as diabetic foot ulcers, venous leg ulcers, and pressure injuries—has created an urgent need for effective, standardized, and continuous wound care. The digitalization of wound care is addressing these needs through innovative software platforms and hardware devices. These systems offer capabilities like automated wound measurement, remote consultation, clinical data integration, predictive analytics, and telemedicine functionality.

As the healthcare sector shifts towards value-based care and outcome-driven reimbursement models, the demand for measurable healing outcomes and reduced hospital readmission rates is increasing. Digital wound care systems directly support these goals by enabling evidence-based, proactive intervention strategies. They provide wound care specialists, nurses, and clinicians with tools to track healing progression over time, identify complications early, and adjust treatments based on real-time analytics.

In addition, digital wound care systems offer significant benefits to patients in remote or underserved areas who lack access to specialized wound clinics. Telewound care solutions are expanding, allowing patients to receive ongoing evaluation and recommendations without frequent in-person visits. As the burden of chronic conditions continues to rise globally, the adoption of digital wound care solutions is poised for substantial growth over the next decade.

Adoption of AI and Machine Learning: AI-driven tools are being developed to automate wound assessment, predict healing times, and provide clinical decision support based on large datasets.

Integration with Electronic Health Records (EHRs): Digital wound care platforms are increasingly being integrated into hospital-wide EHR systems for seamless data sharing and interoperability.

Telewound and Remote Monitoring Expansion: Especially after COVID-19, demand for remote monitoring tools for home-based or rural patients has surged.

Image-Based Documentation: High-resolution imaging via smartphones, tablets, or dedicated devices allows for standardized, objective wound measurement and tracking.

Mobile Apps for Patient Engagement: Apps that allow patients or caregivers to document wound changes and communicate with clinicians are enhancing adherence and self-care.

Cloud-Based Data Management: Cloud infrastructure is enabling real-time access to patient data and collaborative care models across geographically dispersed teams.

Personalized Wound Treatment Algorithms: Advanced systems are now offering personalized care plans based on wound type, comorbidities, and patient history.

| Report Attribute | Details |

| Market Size in 2024 | USD 4.49 Billion |

| Market Size by 2033 | USD 8.46 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.3% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, wound type, end use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Healogics; LLC.; WoundZoom; Smith+Nephew; WoundMatrix, Inc.; Healthy.io Ltd; Swift Medical Inc.; eKare, Inc.; Joerns Healthcare (digitalMedLab Ltd.); Net Health Systems, Inc.; Essity Aktiebolag (publ); 3M; Entec Health Ltd.; The Wound Pros, Inc.; MolecuLight Inc.; NATROX Wound Care (Inotec AMD Limited.) |

The growing prevalence of chronic wounds is the most significant driver of the digital wound care management system market. Chronic wounds—especially diabetic foot ulcers, venous leg ulcers, and pressure ulcers—affect millions globally and are associated with high morbidity, long healing times, and substantial healthcare costs. For example, the CDC estimates over 34 million Americans have diabetes, and diabetic foot ulcers are a leading complication, often resulting in amputation if not managed effectively.

These wounds require ongoing assessment, dressing changes, and patient monitoring—tasks that become resource-intensive without digital support. Digital wound care systems allow clinicians to monitor healing trends, access historical wound data, and provide timely interventions through alerts and analytics. This streamlining of care not only reduces complications but also significantly improves healing outcomes and lowers long-term costs. The rising geriatric population, a high-risk group for chronic wounds, further amplifies the need for advanced wound care tools that enable continuous, accurate monitoring.

Despite the benefits, the widespread adoption of digital wound care systems is restrained by the high initial cost of implementation and integration complexities. Acquiring specialized imaging devices, software licenses, cloud storage, and user training can be cost-prohibitive for small clinics or underfunded healthcare systems. Many healthcare providers still rely on traditional, manual methods of wound assessment due to budget constraints.

Moreover, interoperability remains a challenge. Many digital wound platforms lack standardization or compatibility with existing EHR systems, leading to siloed data and disrupted workflows. Integrating imaging data, clinician notes, and wound progression analytics into hospital records without redundancy or information loss requires custom API development or third-party integration services, adding to complexity and cost. These barriers can slow market penetration, especially in developing regions or rural hospitals.

The growing popularity and acceptance of telemedicine present a strong opportunity for the digital wound care market. As healthcare shifts towards decentralization, home-based care models are gaining prominence, particularly for managing chronic conditions. Patients with limited mobility or those living in remote areas face significant challenges in accessing wound care specialists. Digital wound platforms that support remote monitoring, virtual consultations, and patient-driven documentation can bridge this gap effectively.

Companies are increasingly offering solutions that integrate with tablets or smartphones, enabling nurses or caregivers to capture wound images, input data, and share reports with specialists in real-time. These systems help reduce unnecessary hospital visits, facilitate early intervention, and provide continuous care. The development of AI tools that can analyze images remotely and flag issues like infection or stalled healing further enhances the potential of telewound care. As payers begin reimbursing remote services, this segment is expected to experience exponential growth.

The Software segment currently dominates the digital wound care market, owing to its central role in wound tracking, data analytics, clinical decision support, and telecommunication. These platforms offer wound documentation, 3D imaging support, trend analysis, automated alerts, and patient management dashboards. Major providers have developed user-friendly, cloud-based platforms that integrate with existing hospital information systems. Companies like Tissue Analytics and WoundMatrix have pioneered software that allows clinicians to capture and analyze wound metrics accurately, minimizing subjective interpretation.

In contrast, the Hardware segment is the fastest-growing. This includes high-resolution imaging devices, portable scanners, tablets, and integrated diagnostic tools specifically designed for wound documentation. Newer innovations in AI-powered cameras, mobile wound imaging devices, and Bluetooth-enabled dressings that send real-time healing data are transforming hardware into an indispensable part of digital wound care. Hospitals and clinics are investing in these devices to enhance diagnostic accuracy and reduce clinician workload.

Hospitals remain the leading end users in this market, driven by their large patient base, budget flexibility, and focus on adopting innovative technologies for better patient outcomes. Large hospitals and wound centers are increasingly adopting digital wound care platforms to reduce variability in wound assessments and improve inter-professional communication. Integration with hospital-wide EHR systems also allows for better documentation, billing, and performance tracking. Moreover, the high cost of chronic wound management has encouraged hospitals to adopt technologies that promise faster healing and reduced readmission.

Meanwhile, Wound Care Clinics represent the fastest-growing end-use segment. As outpatient care becomes more prevalent and patient expectations for efficient service increase, specialty wound clinics are adopting digital platforms to differentiate their services and improve care quality. These clinics benefit from software tools that help track multiple patients across extended treatment periods while supporting clinical research and documentation. The focus on community-based care and the expansion of private wound care chains are further fueling demand in this segment.

Chronic wounds dominated the market due to their long healing periods, high recurrence rates, and need for ongoing monitoring. Diabetic foot ulcers and venous leg ulcers, in particular, demand comprehensive wound management strategies that span months or even years. Digital systems provide standardized measurements, healing trend visualization, and alerts for when a wound is not progressing, allowing clinicians to take early action. These tools have proven especially valuable in multi-disciplinary care teams and in geriatric patient management.

However, the Acute Wounds segment is gaining momentum as hospitals and trauma centers adopt digital systems to improve post-operative wound care and reduce surgical site infections (SSIs). Acute wounds, including those from surgery, trauma, and burns, require timely interventions and accurate documentation during the healing phase. Digital wound care platforms facilitate quick assessments, streamline handoffs between departments, and support better compliance with hospital accreditation standards.

North America holds the largest share of the digital wound care management system market, owing to advanced healthcare infrastructure, early adoption of digital health technologies, and high prevalence of chronic wounds. The U.S. healthcare system, in particular, has led the transition from manual to digital wound assessment methods in hospitals and specialty clinics. Government initiatives promoting value-based care and the integration of AI in clinical settings have further supported market growth. Reimbursement for telemedicine wound care visits and the presence of key players such as Swift Medical, Tissue Analytics, and Net Health underscore the region’s leadership.

The Asia-Pacific region is witnessing the fastest growth, fueled by a growing elderly population, increasing diabetes prevalence, and expanding healthcare digitalization. Countries like China, India, and Japan are experiencing a surge in chronic diseases and surgeries, creating a large patient pool for wound management. Governments and private providers are investing in healthcare modernization, including digital health platforms. Mobile health adoption is particularly rapid in Asia, making smartphone-enabled wound care platforms an attractive solution for rural outreach. As awareness grows and infrastructure improves, this region presents strong growth opportunities for digital wound care technology providers.

The following are the leading companies in the digital wound care management system market. These companies collectively hold the largest market share and dictate industry trends.

In March 2025, Swift Medical, a leader in AI-powered wound imaging and analytics, announced a new partnership with the Mayo Clinic to pilot its advanced remote wound monitoring solution across multiple facilities.

Tissue Analytics launched a cloud-native platform update in January 2025, offering enhanced integration with Cerner and Epic EHR systems to improve workflow efficiency.

In February 2025, WoundMatrix introduced a smartphone-based wound measurement app with real-time telehealth capabilities, targeting home health and rural care segments.

Net Health unveiled its next-gen wound care software suite in April 2025, which integrates AI-driven predictive healing models and secure patient portals.

KCI, an Acelity company, partnered with a European med-tech startup in December 2024 to integrate smart sensors into wound dressings, allowing real-time tracking of healing parameters.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Digital Wound Care Management System market.

By Product Mode

By Wound Type

By End Use

By Region