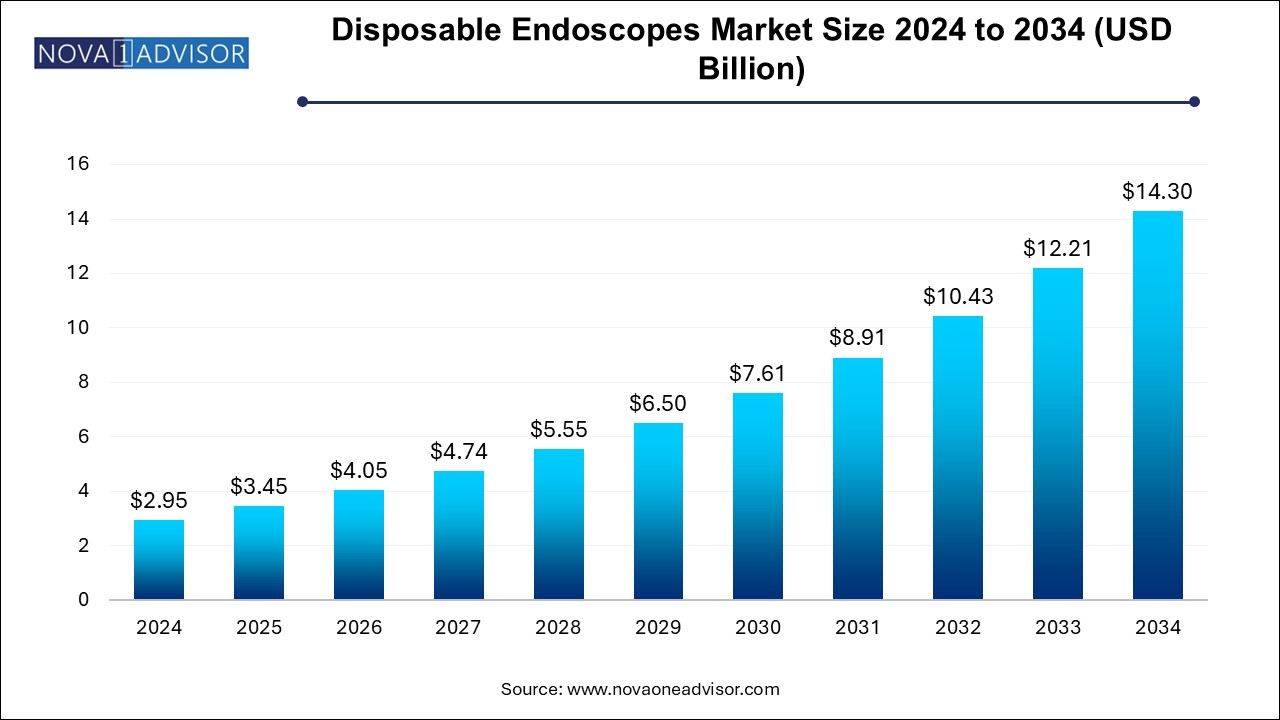

The disposable endoscopes market size was exhibited at USD 2.95 billion in 2024 and is projected to hit around USD 14.30 billion by 2034, growing at a CAGR of 17.1% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.45 Billion |

| Market Size by 2034 | USD 14.30 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 17.1% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Ambu A/S; Boston Scientific Corporation; obp Surgical Corporation; COOPERSURGICAL, INC.; Flexicare medical Limited; Welch Allyn (Hill Rom); HOYA Corporation; KARL STORZ; Olympus Corporation; OTU Medical |

Rising demand for single use endoscopes for eliminating the risk of device-related infection is a key factor driving the global market growth. Moreover, higher patient preference for minimally invasive procedures, supportive regulatory framework, and favorable reimbursement policies in developed countries are further fueling the market growth. Moreover, the increasing investments, funds, grants by governments and other organizations to improve healthcare infrastructure and research areas of endoscopy has created lucrative growth opportunities for the market.

COVID-19 pandemic partially impacted the market as the number of surgical procedures declined due to reduced hospital and outpatient department visits. In addition, patients emphasized more on safety and elimination of every possible chance of infection. However, in the second phase of pandemic, the adoption of disposable medical devices raised significantly as it reduced the chances of cross contamination. Hence, the raised adoption of single use endoscopy devices and higher burden of target diseases are anticipated to cater market demand during the forecast period.

The increasing adoption of minimally invasive procedures owing to several benefits such as high patient acceptance rate, less pain, cost effective nature and less chances of complications is fueling growth of the global market. For instance, according to NIH as of January 2024, there is an increasing trend of ambulatory minimally invasive procedures in the U.S. In addition, evolving demand of disposable endoscopes across hospitals, diagnostic centers, and escalating adoption of single use endoscopy devices for ENT, bronchoscopy, dentistry procedures are likely to provide growth momentum over the forecast period.

The bronchoscopes segment held the largest share of 27.9% in 2024 and is anticipated to grow at a steady rate during the projected period. The largest revenue share of the segment is due to increasing prevalence of respiratory and lung disorders coupled with high adoption of minimally invasive bronchoscopy procedures. According to WHO, COPD is third leading cause of death globally and over 90% of COPD deaths occur in low and middle-income countries. Moreover, rising adoption of single use flexible bronchoscopes and high preference of healthcare professionals to disposable bronchoscopes is further escalating segment expansion. Moreover, rising product approvals is another factor supporting market growth. For instance, in August 2021, the U.S. FDA granted 510 (k) clearance to Boston Scientific’s single use bronchoscope for use in ICU and operating rooms. The device is highly suitable for multiple bronchoscopy procedures.

The ureteroscopes segment held the second largest revenue among type segment and its high revenue is attributed to increasing number of ureteroscopy procedures owing to high disease burden. Moreover, its lower service and cleaning costs coupled with less chances of cross contamination are fueling adoption of advanced ureteroscopes in kidney stones detection. Furthermore, availability of robust product portfolio of technologically advanced ureteroscopes has created a lucrative growth potential for the market. For instance, Olympus Corporation has a wide range of products for improved stone management.

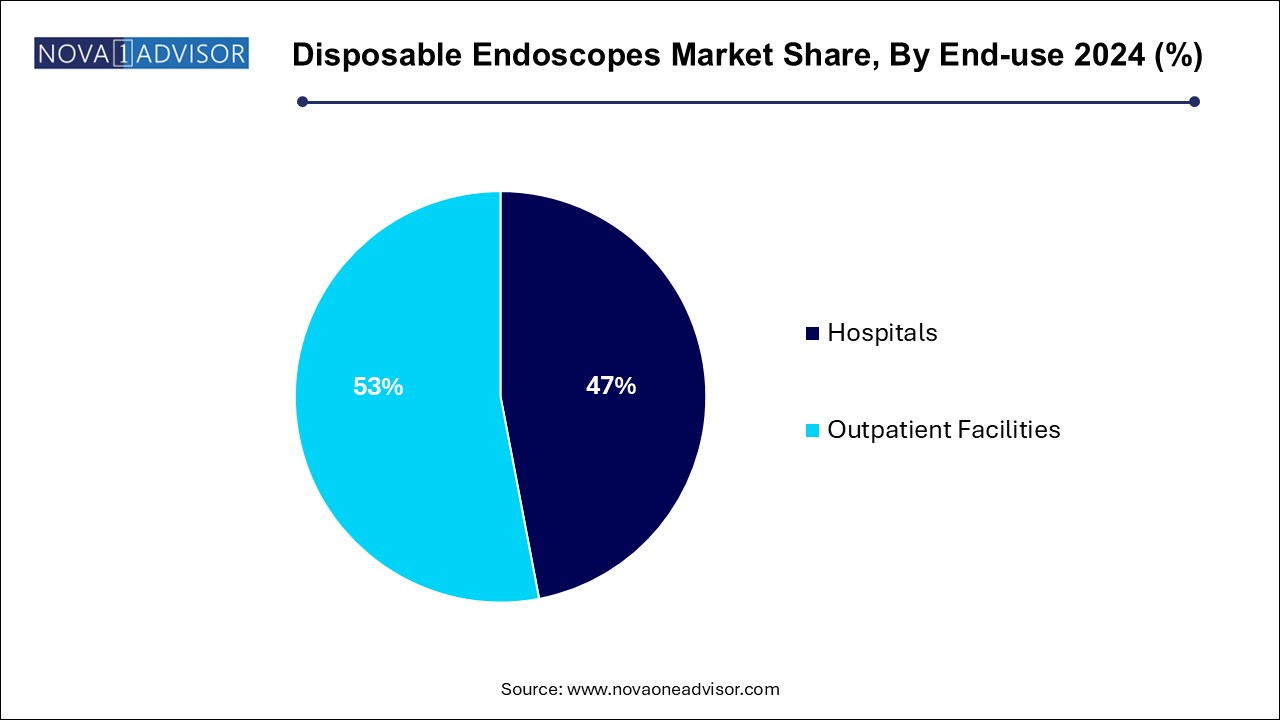

The outpatient facilities dominated the global market share of 47.0% in 2024. and it is projected to exhibit lucrative growth rate throughout the forecast period. Increasing number of outpatient facilities performing endoscopic procedures is the crucial factor driving the segment demand. Moreover, certain benefits like easy accessibility of outpatient facilities, and cost-effective services are supporting market expansion. Furthermore, government initiatives to strengthen healthcare infrastructure is projected to fuel segment uptake in coming years.

Favorable reimbursement scenario, high number of hospitals performing endoscopic procedures, and high preference of hospitals for minimally invasive procedures are the factors responsible for high revenue growth of the hospital segment. In addition, higher adoption of single use endoscopes in hospitals to reduce the chances of infection and leakage is also catering segment demand. Also, technological advancements coupled with high sensitivity of disposable endoscopes is providing momentum to the segment expansion.

North America led the overall market and held the largest revenue share of 41.71% in 2024, owing to presence of large number of market players and various strategic initiatives undertaken by them. Within North America, U.S. is the largest market as majority of players initially sought the U.S. FDA approval to launch their product in the country. Moreover, increasing awareness about cost-effective single use endoscopes and high per capita health expenditure is another factor fueling region’s growth. Furthermore, advanced healthcare infrastructure, supportive government initiatives and optimum treatment coverage are also responsible for the robust growth of North America region.

Asia Pacific is anticipated to witness lucrative CAGR throughout the forecast period and this robust growth is accounted to the high burden of target diseases, and larger population pool is likely to provide traction to region’s expansion. The improving healthcare infrastructure and rising investments from market players owing to flourishing demand of medical devices in APAC region has propelled region’s growth to a certain extent. Furthermore, the greater transition from reusable to disposable endoscopes in region and an increase in epidemiological factors hold high promise for region’s growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the disposable endoscopes market

By Type

By End-use

By Regional