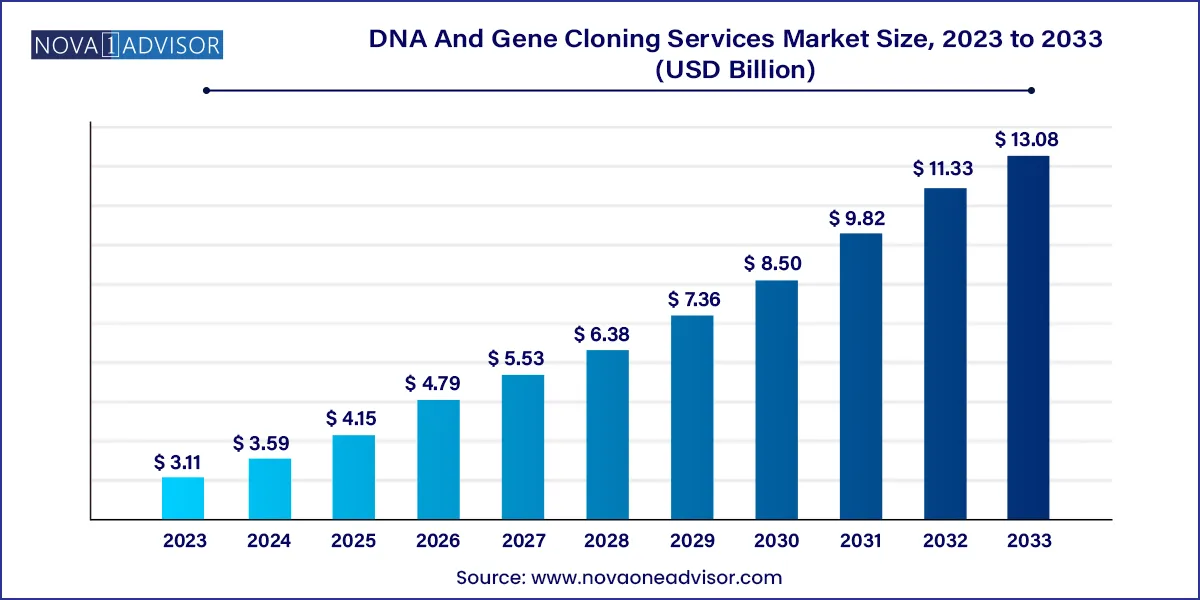

The global DNA and Gene Cloning Services market size was exhibited at USD 3.11 billion in 2023 and is projected to hit around USD 13.08 billion by 2033, growing at a CAGR of 15.45% during the forecast period of 2024 to 2033.

The DNA and Gene Cloning Services Market has become a critical pillar in the broader biotechnology and life sciences ecosystem, empowering research, drug development, and synthetic biology. At its core, gene cloning involves the isolation and replication of DNA sequences to create identical copies, often integrated into vectors for expression in host organisms. DNA and gene cloning services facilitate this process at both academic and industrial scales, offering turnkey solutions for everything from vector design to sequence optimization and large-scale plasmid preparation.

These services are foundational to numerous applications, including recombinant protein production, gene function analysis, genome editing (CRISPR/Cas9), vaccine development, and personalized medicine. Cloning is also instrumental in agricultural biotechnology for trait development and in synthetic biology for constructing novel genetic circuits.

As the biotech industry becomes increasingly fragmented—with many startups and small labs lacking in-house capabilities—outsourcing gene cloning to specialist service providers is becoming the norm. The demand for accuracy, speed, and compliance with regulatory standards has further increased reliance on professional DNA and gene cloning services. The global push for COVID-19 vaccines, mRNA therapies, and monoclonal antibody production has only emphasized the value of these services, positioning the market for sustained growth.

Rise of Synthetic Biology: Expansion in synthetic genomics and minimal genome projects is fueling complex cloning demands.

Integration with CRISPR Technologies: Gene cloning is foundational for developing guide RNA libraries and engineered cell lines for genome editing.

Custom Cloning & High-Throughput Services: Service providers are offering scalable platforms for large-scale and multiplexed cloning.

Increased Adoption of AI and Automation: AI-driven sequence design and automated platforms are streamlining cloning processes.

Cloud-Based Order Portals and Bioinformatics: Digital ordering, sequence tracking, and data analytics are transforming customer experience.

Growth in Agricultural Biotechnology: Cloning services are being used to develop genetically modified crops and microbial biofertilizers.

Regulatory-Compliant GMP Cloning for Therapeutics: Service expansion to offer preclinical and clinical-grade cloning for gene therapy and vaccine development.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.59 Billion |

| Market Size by 2033 | USD 13.08 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 15.45% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, application, end use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Bio-Techne; Charles River Laboratories; Eurofins Scientific; GenScript; Danaher Corporation; Syngene International Limited; Twist Bioscience; Thermo Fisher Scientific Inc.; Merck KGaA; Curia Global, Inc. |

A primary driver of the DNA and gene cloning services market is the explosive growth in biologics and gene-based therapeutics, including monoclonal antibodies, mRNA vaccines, and gene therapies. These products often begin with cloning and expression of target sequences in microbial or mammalian systems. With the growing prevalence of diseases like cancer, rare genetic disorders, and infectious diseases, the demand for gene-targeted interventions has soared.

For instance, the development of the mRNA-based COVID-19 vaccines involved rapid cloning of the SARS-CoV-2 spike protein gene for expression studies. Similarly, gene therapies for spinal muscular atrophy or CAR-T cell treatments for leukemia rely on engineered viral vectors, which in turn depend on precision gene cloning. Outsourcing cloning accelerates research timelines, ensures reproducibility, and allows innovators to focus on downstream development and regulatory strategies.

A key restraint in this market is variability in service quality and concerns over intellectual property (IP) protection. While numerous providers offer cost-effective cloning services, discrepancies in sequence fidelity, vector selection, or host compatibility can lead to failed experiments or batch rejections, increasing project timelines and costs.

Furthermore, the outsourcing of proprietary gene constructs or sequences raises significant IP concerns. Institutions and startups working on novel therapeutic targets may be hesitant to send sensitive sequences to external vendors without strict confidentiality and data handling protocols. This limits outsourcing to only highly trusted or certified providers, narrowing the market scope for smaller or new entrants.

An emerging opportunity lies in the application of cloning services in personalized medicine and high-throughput diagnostics. As precision medicine evolves, there is growing interest in developing custom therapeutic constructs based on individual patient genotypes. Personalized vaccines, neoantigen-targeted cancer immunotherapies, and rare disease gene corrections are becoming mainstream and all begin with the cloning of patient-specific sequences.

Service providers that offer rapid turnaround, high-accuracy custom gene synthesis, and downstream expression analysis for personalized constructs will see rising demand. The ability to integrate cloning with vector engineering, gene delivery, and analytics creates opportunities for full-stack solution providers in next-generation medicine.

Gene synthesis dominates the services segment, accounting for the largest market share. Gene synthesis offers the advantage of designing and assembling complete gene constructs de novo without requiring a physical DNA template. This allows for the rapid generation of optimized sequences with codon optimization, site-directed mutagenesis, or restriction site modification tailored to specific host systems. With applications in vaccine development, protein engineering, and synthetic biology, demand for gene synthesis continues to surge.

Custom cloning is the fastest-growing service, driven by growing requirements for high-fidelity vector design, insertion of gene fragments into specific backbones, and custom mutagenesis. Laboratories and biotech startups often outsource cloning of unique constructs for novel targets or pathway modeling. Providers offering design-to-delivery pipelines including sequence verification, plasmid prep, and transfection-ready DNA are increasingly preferred.

DNA sequencing remains the dominant application, as cloned genes are typically sequenced to confirm accuracy, identify mutations, or analyze structural variants. DNA and gene cloning is foundational to many downstream applications, and sequencing ensures the fidelity and integrity of inserted genetic material. With the integration of NGS and Sanger sequencing in post-cloning verification, this segment continues to maintain strong relevance.

Mutagenesis is the fastest-growing application, particularly site-directed and random mutagenesis used in protein engineering, antibody optimization, and functional genomics. Researchers increasingly require variants of genes with single or multiple mutations to study disease mechanisms, resistance patterns, or enzyme kinetics. High-throughput mutagenesis services paired with cloning enable screening of hundreds of variants in parallel, boosting growth in this segment.

Academic & research institutes dominate the end-use segment, reflecting their foundational role in molecular biology research. Universities and publicly funded labs continue to generate high volumes of cloning projects in basic biology, plant genomics, microbial engineering, and gene function studies. These institutions often partner with cloning service providers for cost-effective and scalable DNA assembly solutions.

Pharmaceutical & biotechnology companies represent the fastest-growing segment, driven by their increasing need to accelerate drug discovery pipelines. Biotech startups and pharma R&D departments use cloning services for target validation, vector development, and CRISPR screening. The need for compliance-ready cloning for clinical-grade applications, including plasmids for cell and gene therapies, is expected to drive premium service growth in this segment.

North America dominates the DNA and gene cloning services market, owing to the presence of a large number of biotech companies, advanced academic research centers, and well-funded genomics programs. The U.S. leads in outsourcing molecular biology services, with many universities and startups relying on third-party providers. Additionally, the regulatory and IP infrastructure in North America supports outsourced research and promotes contract service partnerships.

Asia-Pacific is the fastest-growing region, led by rapid growth in life science research in China, India, and South Korea. Local cloning service providers are emerging in APAC with highly competitive pricing, short turnaround times, and growing capabilities in synthetic biology. Government initiatives, like China’s National Genomics Plan and India’s Biotech Research Fund, are expanding cloning demand in academic and commercial domains.

GenScript Biotech (April 2025): Launched a cloud-based AI-powered plasmid design platform integrated with its cloning and synthesis services to accelerate gene construct ordering.

Twist Bioscience (March 2025): Partnered with a leading pharmaceutical company to provide high-throughput cloning and synthetic biology services for drug discovery.

Thermo Fisher Scientific (February 2025): Expanded its gene synthesis and cloning service portfolio to support GMP-grade plasmid production for cell and gene therapy developers.

Genewiz (January 2025): Introduced a high-efficiency site-directed mutagenesis service targeting oncology and virology researchers, enabling rapid variant library creation.

Boster Biological Technology (December 2024): Announced a new division focused on agricultural cloning services, targeting CRISPR-based crop improvement and microbial biofertilizer development.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global DNA and Gene Cloning Services market.

By Service

By Application

By End use

By Region