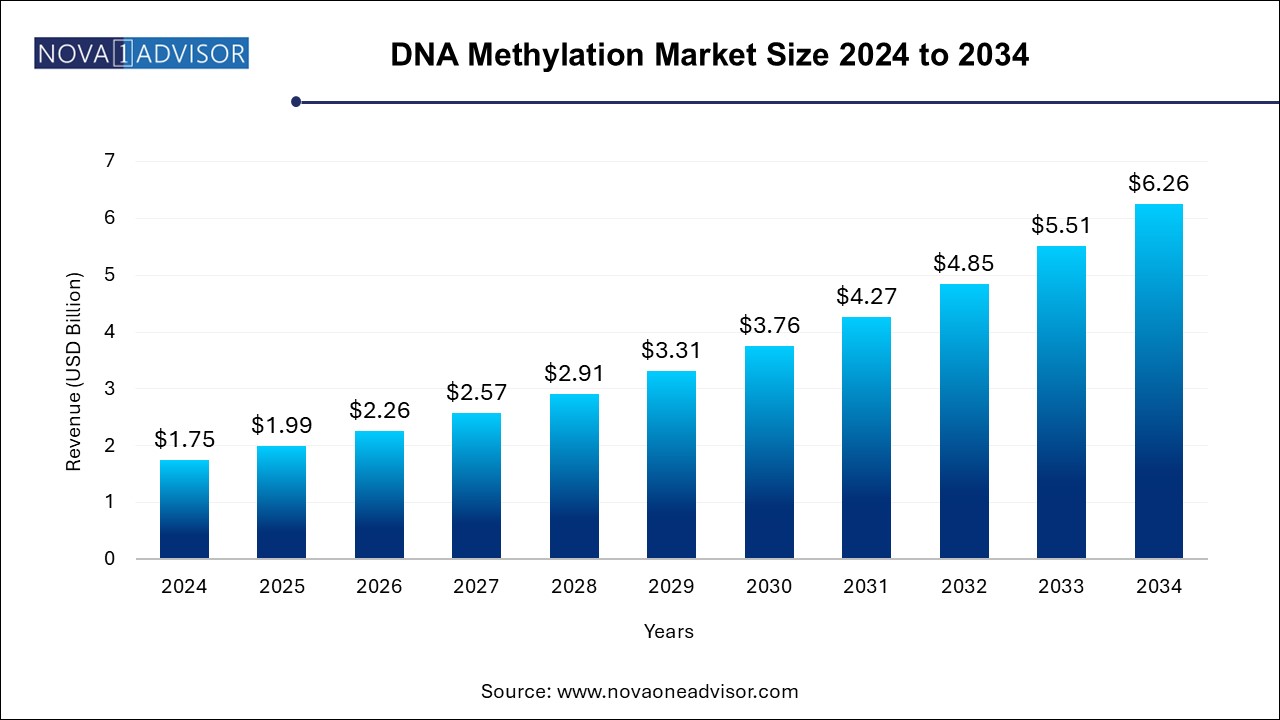

The DNA methylation market size was exhibited at USD 1.75 billion in 2024 and is projected to hit around USD 6.26 billion by 2034, growing at a CAGR of 13.6% during the forecast period 2024 to 2034.

The DNA methylation market represents a critical and rapidly expanding subset of the epigenetics industry, focused on the analysis and modulation of DNA methylation patterns that govern gene expression without altering the DNA sequence itself. DNA methylation is a vital biological process involving the addition of methyl groups to the cytosine base in DNA, typically at CpG dinucleotides. This epigenetic mechanism plays a pivotal role in various physiological processes, including embryonic development, X-chromosome inactivation, genomic imprinting, and the suppression of transposable elements. Moreover, aberrations in DNA methylation are strongly associated with numerous diseases, especially cancer, neurological disorders, autoimmune conditions, and metabolic syndromes.

The market has witnessed significant advancements due to the rising demand for precision medicine, increasing incidences of cancer globally, and growing applications of epigenetic studies in drug development. With researchers and clinicians emphasizing early disease detection and personalized treatment strategies, DNA methylation analysis has emerged as a valuable tool to identify disease-specific methylation patterns, biomarkers, and drug targets. Technologies such as high-throughput sequencing, microarrays, and PCR-based methylation assays have become integral to both research and clinical diagnostics.

In recent years, increased investments from public and private sectors into epigenomics research, the establishment of collaborations between academia and pharmaceutical companies, and the proliferation of startup enterprises focused on next-generation epigenetic diagnostics have propelled the DNA methylation market forward. Furthermore, the affordability of genome-wide methylation platforms has increased accessibility for small laboratories and research centers, fostering widespread adoption.

As of 2024, the global DNA methylation market is poised for robust growth, with multiple segments across technology, products, application areas, and end-users contributing to its dynamic landscape.

Rising Integration of AI and Machine Learning in Epigenetic Analysis: Bioinformatics tools powered by AI are being leveraged to decode complex methylation patterns and predict disease outcomes.

Shift Toward Non-Invasive Diagnostic Techniques: Liquid biopsy methods incorporating DNA methylation biomarkers are gaining traction in oncology diagnostics.

Development of Single-Cell Methylation Sequencing: High-resolution, single-cell analysis techniques are allowing researchers to detect cell-specific methylation differences that were previously untraceable.

Commercialization of Methylation-Specific Kits: Companies are introducing ready-to-use, highly specific kits that cater to both academic research and clinical diagnostic labs.

Expansion of Companion Diagnostics: DNA methylation profiling is being increasingly used in the development of targeted therapies, especially in cancer.

Rising Adoption of Next-Generation Sequencing (NGS): NGS-based methylation platforms are becoming more accessible and are replacing traditional methods in large-scale studies.

Collaborations Between Biotech Firms and Academia: These partnerships are accelerating research and facilitating clinical translation of epigenetic technologies.

| Report Coverage |

Details |

| Market Size in 2025 | USD 1.99 Billion |

| Market Size by 2034 | USD 6.26 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 13.6% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Technology, Product, Application, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | New England Biolabs; Sysmex Corporation; Abcam Limited; F. Hoffmann-La Roche Ltd; Diagenode Diagnostics S.A.; Thermo-Fisher Scientific Inc.; Agilent Technologies Inc.; Bio-Rad Laboratories, Inc.; Exact Sciences Corporation; QIAGEN ; Active Motif, Inc.; Illumina Inc. |

One of the strongest growth drivers in the DNA methylation market is the rising global burden of cancer and the simultaneous demand for early diagnostic tools. Cancer remains a leading cause of mortality worldwide, with over 19 million new cases reported in 2023. Many cancers exhibit distinct methylation profiles that can serve as early indicators, even before physical symptoms manifest. For example, hypermethylation of tumor suppressor genes such as BRCA1 or MLH1 has been associated with breast and colorectal cancers, respectively.

DNA methylation biomarkers are not only useful for diagnosis but also offer insights into disease progression, therapeutic response, and recurrence risk. Liquid biopsies analyzing cell-free DNA methylation patterns in blood or other body fluids have emerged as a non-invasive, efficient method to detect cancer in its nascent stages. Companies like Exact Sciences and Guardant Health have introduced tests that leverage such biomarkers, dramatically improving early cancer screening. These applications are expanding beyond oncology into neurodegenerative and cardiovascular diseases, underscoring the growing importance of DNA methylation in clinical diagnostics.

Despite the immense potential of DNA methylation technologies, the market faces a significant restraint due to the high costs and technical complexity associated with these advanced platforms. Techniques such as whole-genome bisulfite sequencing (WGBS), methylation-specific PCR (MSP), and microarray analysis require substantial investment in sophisticated instrumentation, reagents, and trained personnel.

Small- to mid-sized laboratories, particularly in developing countries, often lack the infrastructure or funding to implement such cutting-edge methods. Moreover, interpreting methylation data is computationally intensive, demanding robust bioinformatics pipelines and expertise. This limits the routine clinical adoption of methylation testing outside of large academic medical centers or specialized genomic research facilities. Furthermore, discrepancies in data quality, standardization challenges across platforms, and issues in reproducibility further hinder widespread commercialization.

A compelling opportunity within the DNA methylation market lies in its integration into personalized medicine and predictive diagnostics. As healthcare shifts from a reactive to a preventive and personalized model, methylation markers can serve as critical indicators of individual disease risk and therapeutic responsiveness. For instance, methylation of the MGMT gene is a known predictor of response to alkylating agents in glioblastoma patients, allowing clinicians to customize chemotherapy strategies.

In the cardiovascular domain, DNA methylation patterns are being studied to predict stroke risk and assess vascular aging. Moreover, companies are working toward developing comprehensive epigenetic panels that provide risk scores for chronic conditions based on an individual’s methylation status. The integration of such tools into electronic health records (EHRs), supported by machine learning algorithms, will empower clinicians to proactively manage patient health. Governments and regulatory agencies are increasingly supportive of such innovations, presenting favorable reimbursement landscapes and approval pathways for methylation-based diagnostic tools.

Microarray segment dominated the market and accounted for a share of 41.29% in 2024. Arrays such as the Illumina Infinium MethylationEPIC BeadChip provide a user-friendly, high-throughput alternative for assessing up to 850,000 CpG sites. Their growing use in epidemiological studies and population-based screenings supports their rapid adoption. Furthermore, microarrays are increasingly used in developing methylation panels for clinical diagnostics, further fueling market penetration.

Sequencing segment is expected to grow significantly with a CAGR of 14.5% during the forecast period Methods like Whole Genome Bisulfite Sequencing (WGBS) and Reduced Representation Bisulfite Sequencing (RRBS) are the gold standards for methylome profiling, widely adopted in research and pharmaceutical development. These methods allow a comprehensive understanding of methylation patterns in cancer, neurodegenerative diseases, and developmental disorders. The demand for these technologies is amplified by the increasing use of next-generation sequencing (NGS) platforms like Illumina NovaSeq and Thermo Fisher’s Ion Torrent.

Enzymes segment accounted for the largest market revenue share of 35.9% in 2024. These include bisulfite conversion kits, methylation-specific PCR kits, and reagents for library preparation and sequencing. Companies like Zymo Research and Qiagen have a robust catalog of standardized kits tailored for different sample types. The convenience of ready-to-use reagents reduces processing time and variability, making them the preferred choice for laboratories worldwide.

Instruments & software segment is expected to grow significantly with a CAGR of 13.9% during the forecast period. Innovations in sequencing systems, real-time PCR machines, and digital droplet PCR are enhancing throughput and accuracy. Additionally, the emergence of dedicated software tools for methylation data analysis (e.g., Bismark, MethPipe, and Partek) has addressed the computational challenges in interpreting methylation data. Demand for integrated solutions offering real-time, cloud-based analysis is increasing, particularly in high-throughput genomic research settings.

Clinical research segment accounted for the largest market revenue share of 40.3% in 2024 due to the growing number of clinical trials for various diseases worldwide. Epigenetic drug discovery—especially involving DNA methyltransferase (DNMT) inhibitors—is a burgeoning field. Several Phase I and II trials are investigating methylation-based therapies, including agents targeting TET enzymes. The integration of methylation profiling into clinical trials for patient stratification and therapy response prediction further underpins the research segment’s momentum.

The diagnostic segment is expected to register the fastest CAGR during the forecast period. Methylation-based assays are being validated and commercialized for various cancers, including colorectal, lung, bladder, and cervical cancers. Products such as Epi proColon and Guardant360 have showcased the clinical utility of methylation markers. Hospitals and labs are increasingly adopting these tests owing to their non-invasive nature and predictive accuracy.

Pharmaceutical & biotechnology companies segment accounted for the largest market revenue share of 47.0% in 2024. Companies are developing epigenetic therapies aimed at reversing abnormal methylation. Additionally, pharma companies partner with diagnostic firms to co-develop companion diagnostics based on methylation markers. This integration of therapeutics and diagnostics is central to personalized medicine strategies, driving commercial adoption.

Research and academia represent the fastest-growing end-use segment, underpinned by global initiatives like the International Human Epigenome Consortium and NIH's Roadmap Epigenomics Project. Academic institutions leverage methylation data to uncover novel disease pathways and identify biomarkers. The increasing availability of government and institutional grants, coupled with growing demand for publishing high-impact research, has led to expanded use of methylation assays in academic settings.

North America currently dominates the DNA methylation market, accounting for the largest revenue share. This leadership stems from a mature healthcare infrastructure, robust research ecosystem, and early adoption of advanced diagnostic technologies. The U.S., in particular, is a hub for epigenetic research, supported by initiatives like the NIH Epigenomics Program. Furthermore, the presence of major market players such as Illumina, Thermo Fisher Scientific, and Exact Sciences bolsters product availability and innovation.

The region also benefits from a favorable regulatory environment for genomic diagnostics and high healthcare spending. Reimbursement policies for epigenetic testing are gradually improving, making these tests more accessible to patients. With extensive clinical trial activity and widespread implementation of precision medicine initiatives, North America will likely retain its leading position throughout the forecast period.

Asia Pacific: The Fastest-Growing Region

Asia Pacific is projected to witness the fastest growth during the forecast timeline. Countries like China, India, Japan, and South Korea are investing heavily in biotechnology, genomics, and healthcare infrastructure. Government-funded research bodies such as the Chinese Academy of Sciences and Japan's RIKEN are actively exploring epigenetic modifications in chronic diseases. Moreover, the region’s large patient pool and increasing cancer burden make it a strategic market for diagnostic expansion.

Collaborations between Western biotech firms and Asian healthcare institutions are becoming more common, bringing state-of-the-art technologies to regional markets. As awareness of precision medicine grows and laboratory infrastructure advances, the demand for methylation-based assays and platforms is expected to surge rapidly.

February 2025: Guardant Health announced the expansion of its methylation-based liquid biopsy pipeline to include early detection for pancreatic and ovarian cancers, reinforcing its leadership in blood-based cancer diagnostics.

December 2024: Illumina introduced a new methylation analysis module integrated into its DRAGEN Bio-IT platform, improving data processing speed and accuracy for clinical and research users.

October 2024: Zymo Research launched its next-generation EZ DNA Methylation-Lightning™ Kit, enhancing conversion efficiency and reducing processing time for bisulfite-treated DNA.

August 2024: Qiagen partnered with Sysmex Corporation to co-develop methylation-based diagnostic tests for the Asian market, targeting gastric and colorectal cancer.

June 2024: Thermo Fisher Scientific acquired EpiGentek, a key player in the DNA methylation kits space, aiming to expand its epigenetics portfolio and global reach.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the DNA methylation market

Technology

Product

Application

End Use

Regional