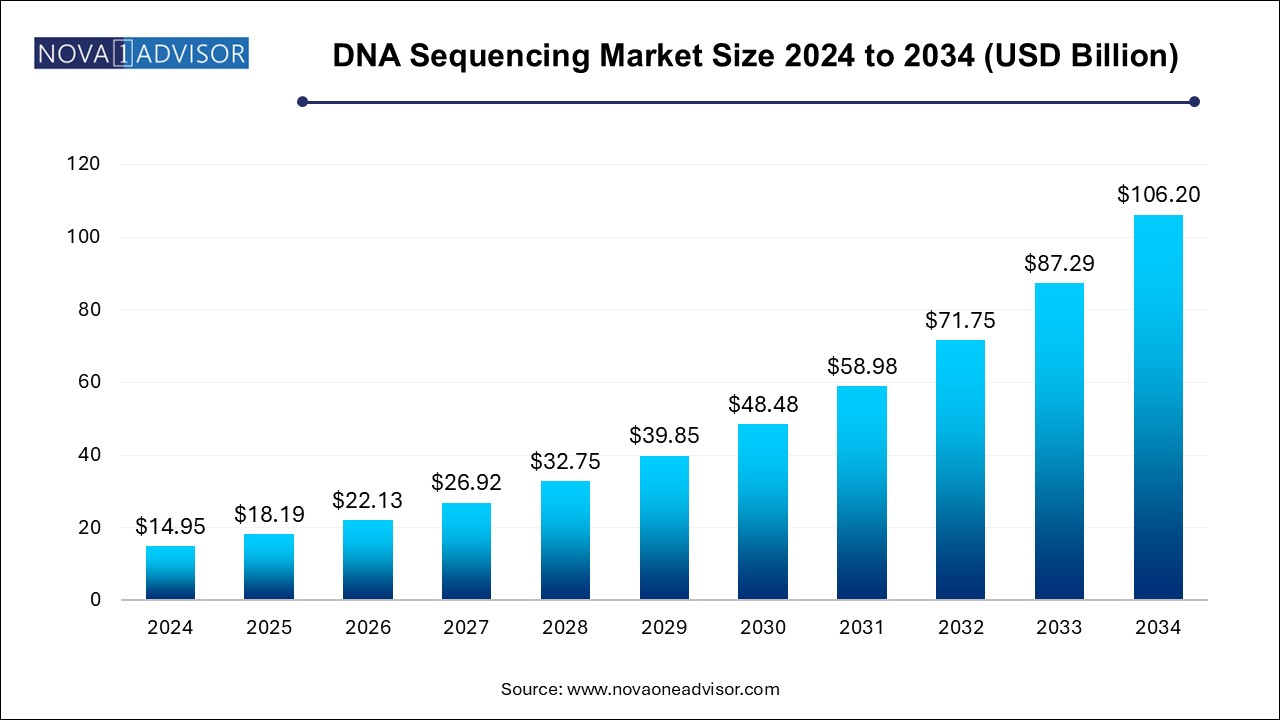

The DNA sequencing market size was exhibited at USD 14.95 billion in 2024 and is projected to hit around USD 106.20 billion by 2034, growing at a CAGR of 21.66% during the forecast period 2024 to 2034.The rapid progress in technology and bioinformatics has facilitated the detection of DNA variations, allowing for the identification of variants linked to an increased risk of disease.

| Report Coverage | Details |

| Market Size in 2025 | USD 18.19 Billion |

| Market Size by 2034 | USD 106.20 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 21.66% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product & Service, Technology, Workflow, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Thermo Fisher Scientific, Inc; Agilent Technology; Illumina, Inc.; QIAGEN; F. Hoffmann-La Roche Ltd.; Macrogen, Inc.; PerkinElmer Genomics; PacBio; BGI; Bio-Rad Laboratories, Inc.; Myriad Genetics; PierianDx; Partek Incorporated; Eurofins Scientific |

The utilization of Next-Generation and Whole-Genome Sequencing technologies in clinical diagnosis applications is also broadening the scope of DNA sequencing. These developments are anticipated to contribute to market growth over the forecast period.

The continuous evolution of sequencing technologies has revolutionized the field of genomics and has a widespread impact across the healthcare industry. One key aspect of technological advancement is the substantial improvement in sequencing speed. NGS platforms, such as those developed by Illumina, have dramatically increased the pace at which genetic information can be decoded. These platforms employ parallel processing, enabling the simultaneous analysis of multiple DNA fragments. This acceleration in speed has far-reaching implications, allowing researchers & clinicians to process large volumes of genomic data more efficiently than ever. For instance, in March 2024, Illumina Inc. unveiled its Connected Insights cloud-based software designed to facilitate tertiary analysis for clinical NGS data. Such initiatives are expected to boost market growth in the coming years.

Furthermore, the rising interest in genomics research and personalized medicine is a powerful catalyst for the expansion of the market. As technological advancements continue to unravel the complexities of the human genome, researchers & healthcare professionals are increasingly turning to DNA sequencing to obtain valuable insights that have transformative implications for medical diagnosis, treatment, and disease prevention.

In addition, the COVID-19 pandemic has had a multifaceted impact on the market, influencing both short-term operational challenges and long-term trends. In the short term, the market experienced disruptions in the supply chain due to lockdowns, travel restrictions, and manufacturing slowdowns. Delays in the delivery of instruments, consumables, and reagents were prevalent, affecting research timelines & ongoing projects. However, the pandemic has also accelerated the adoption of DNA sequencing technologies. The urgency to understand the genomic makeup of the SARS-CoV-2 virus and its variants spurred the demand for industry services. The global scientific community leveraged DNA sequencing technologies to analyze the virus’s genetic code, monitor its evolution, and track the spread of different variants.

Based on product & service, the consumables segment led the market for the largest revenue share of 49.12% in 2024. The growing accessibility of reagents and kits designed for various library construction stages, including DNA fragmentation, adapter ligation, and quality control, is a key factor in expanding market share. Many of these tools are characterized by simplified and streamlined workflows, pre-prepared components, and compatibility with low-input and formalin-fixed specimens.

The services segment is anticipated to witness the fastest CAGR over the forecast period. Comprehensive data analysis, library preparation, identification & quantification of the binding sites of proteins of DNA, DNA methylation profiles on a genome-wide scale, shotgun sequencing, primer walking sequencing, bacterial artificial chromosome end sequencing, and expressed sequence tags are among the few sequencing services available in the market. The demand for the services segment is expected to be driven by the availability of several players offering these services. GENEWIZ, Illumina, QIAGEN, Eurofins Genomics LLC, GenScript, Applied Biological Materials Inc., and Agilent Technologies are a few major service providers operating in the market.

Based on technology, the next generation sequencing segment led the market with a largest revenue share of 87.29% in 2024. The radical advances in these technologies and the reducing time and declining cost of sequencing have made genome sequencing affordable and more accurate. In addition, NGS technology is gaining popularity as a routine clinical diagnostic test, particularly with the COVID-19 pandemic, which positively impacts the segment’s revenue share.

The third-generation sequencing segment is projected to witness the fastest CAGR over the forecast period. This technology overcomes the problems of second-generation sequencing as it includes easy sample preparation without the need for PCR amplification which reduces the time and cost required for sequencing. Moreover, this technology can generate long reads exceeding numerous kilobases for the resolution of assembly issues, as well as repetitive sites of complex genomes. The abovementioned benefits associated with the third-generation sequencing segment are expected to boost the segment growth over the forecast period.

Based on workflow, the sequencing segment held the market with a largest revenue share of 56.96% in 2024. This step enables the sequence profiling of the genome and DNA-protein interactions. It is an integral part of the entire DNA sequencing workflow in research and discovery studies, which accounts for its larger share. The ability of sequencers to generate a large amount of data in a relatively short period accelerates understanding of human health and disease treatments. Moreover, major players like Illumina, Inc and Thermo Fisher Scientific, Inc. provide novel platforms for sequencing workflow.

The data analysis segment is projected to witness the fastest CAGR over the forecast period. Several industry participants offer data analysis platforms and software. The data analysis software includes sequence assembly and data examination. As terabytes of data are produced during a single run of DNA sequencing, data storage, and interpretation equipment are essential to any DNA sequencing workflow. With the expected increase in implementation of whole genome sequencing, the subsequent data generated from DNA sequencing projects is expected to increase. Industry players are launching software and platforms to analyze large volumes of data generated from these projects. For instance, in October 2024, PacBio, a major industry player, introduced a new software pipeline for human whole genome sequencing data analysis. Thus, the increasing launches of analysis and computational software are expected to support the segment growth in the forecast period.

In terms of application, the oncology segment led the market with a largest revenue share of 25.53% in 2024. Technology holds great potential in clinical research and development of cancer diagnostics and therapeutics. The value of these technologies in companion diagnostics and precision medicine is widely recognized by clinicians and companies, which is anticipated to propel the segment over the forecast period. NGS is widely used in oncology, where gene mutations are sequenced and cataloged to develop new cancer diagnoses & treatment methods.

The consumer genomics segment is projected to exhibit the fastest CAGR over the forecast period. Growing personal health awareness and rising use of paternity testing & genealogy are anticipated to drive the consumer genomics segment as a DNA sequencing application. Several key market players like PerkinElmer, Inc., Royal Philips, and Quest Diagnostics are constantly working toward expanding their product portfolios by launching new products in the market, which would further drive the segment growth.

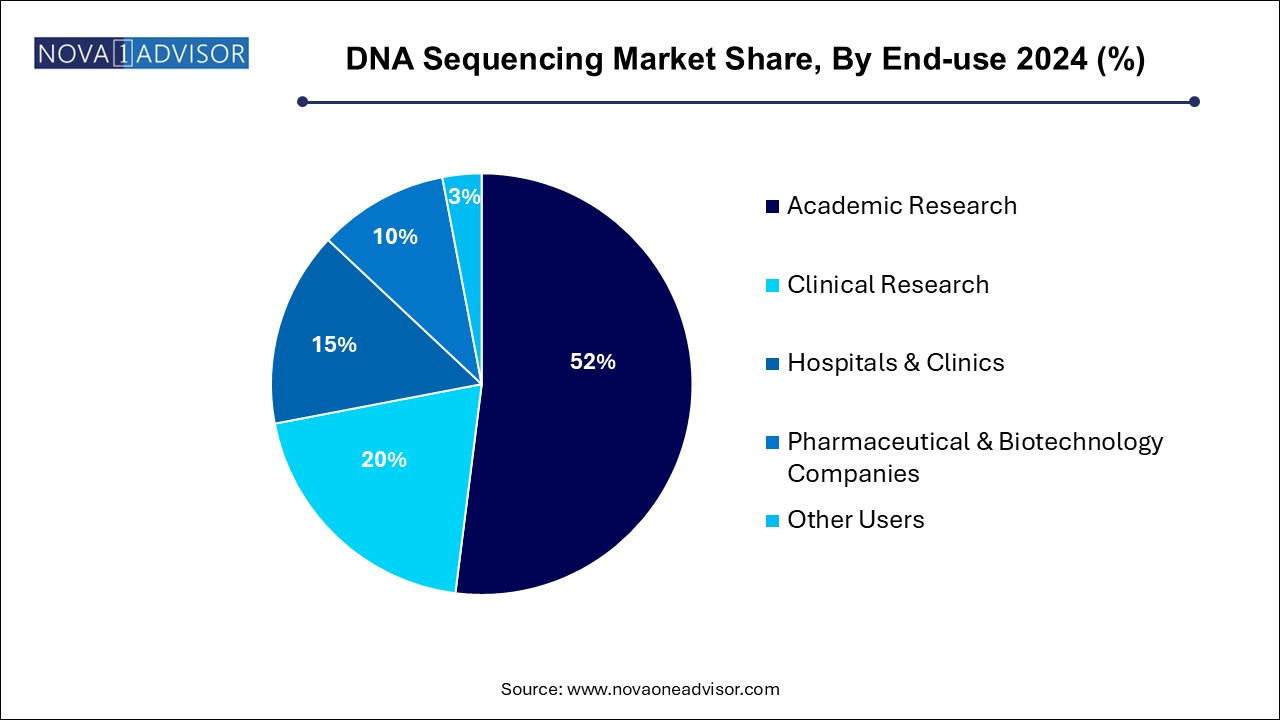

Based on end-use, the academic research segment held the market in 2024 with the largest revenue share of 52.0%. This can be attributed to the wide acceptability of Sanger technology and NGS in academic & institutional research projects. In addition, a rise in funding and investment programs augments the demand of these entities for DNA sequencing products and services, resulting in a larger revenue share. Moreover, several workshops, exhibitions, and symposiums are also driving the adoption of NGS technologies among scientists & researchers. For instance, in August 2024, PacBio, along with GeneDx, announced a research collaboration with the University of Washington to analyze and understand long-read whole genome sequencing for better diagnostic yield in neonatal care. Such initiatives are expected to drive the segment’s growth.

The clinical research segment is projected to witness the fastest CAGR over the forecast period. NGS technologies have gained immense popularity because of their massive parallel sequence analysis capability that allows simultaneous screening of multiple genes. This potential of NGS technologies makes it a preferred choice for clinical testing procedures, even in the testing of multiple gene markers with a smaller number of nucleic acids. Moreover, the implementation of DNA analysis for studying tumor heterogeneity, the discovery of new cancer-related genes, and the identification of alterations related to tumorigenesis are expected to result in significant growth of this segment.

North America dominated the market with a revenue share of 50.70% in 2024. The significant adoption of DNA sequencing technology and the presence of several major players like Thermo Fisher Scientific, Inc., Oxford Nanopore Technologies plc, Illumina, Inc., and Agilent Technologies Inc. are driving the market growth in this region. Furthermore, the players operating in the U.S. are undertaking several strategic initiatives to strengthen their market presence in the country, supporting regional expansion. For instance, in August 2024, Complete Genomics, Inc., the U.S.-based company, received the "Oscars of Innovation" award from the R&D World Magazine in recognition of the ultra-high throughput gene sequencer DNBSEQ-T20×2*("T20"). Such recognitions and awards for innovative products are expected to drive novel developments in the regional market.

The U.S. dominated North America’s market due to its extensive genomics, oncology, and whole-genome-based research. Other factors that can be attributed to the significant adoption of DNA sequencing technology in this country are sophisticated research & medical infrastructure, funding, skilled personnel, and companies pushing for better research methods to identify newer technologies for diagnosis & therapies.

The Europe market is expected to grow at a significant CAGR during the forecast period, due to the increasing R&D investments and continuous research by scientists which has boosted the demand for innovative NGS solutions. For instance, in March 2020, using Thermo Fisher Scientific’s NGS research assay, a team of Italian researchers analyzed the SARS-CoV-2 genome from specimens collected locally and suggested that the rapidly spreading virus's genome is stable.

The UK market is expected to grow at the fastest CAGR over the forecast period, due to increase in development of companion diagnostics and subsequent establishment of molecular diagnostic development facilities by key market players. Furthermore, ongoing strategic alliances between players in European and eastern markets are expected to fuel the market growth during the forecast period in the region.

The France market is witnessing a rapid growth due to extensive government initiatives that are boosting the adoption of NGS solutions in the country. Since 2013, the French National Cancer Institute (INCa) has supported the implementation of targeted NGS as part of routine clinical practice. In addition, France implemented a national plan, the 2025 France Genomic Medicine Initiative, to ensure adequate access to genomic medicine for all patients.

Several initiatives taken in Germany are anticipated to expand the scope of genomic studies drive the uptake of sequencing solutions. For instance, in January 2020, Germany joined the initiative— “Towards access to at least 1 million sequenced genomes in the EU by 2022.” This initiative aims to enhance disease prevention and scale up clinical research for personalized treatments.

The Asia Pacific is anticipated to witness the fastest CAGR of 24.28% during the forecast period. The regional market is expected to be driven by the ongoing developments in HLA and prenatal NGS testing coupled with international collaborations with U.S. & European companies. Moreover, the increasing developments in genomics in several countries like Japan and India are expected to support the regional market. For instance, in July 2022, All India Institute of Medical Sciences (AIIMS) Nagpur, along with JHPIEGO-USAID-RISE, announced that it is establishing a WGS facility.

The China has one of the fastest growing and most advanced market. In 2020, the country’s genetic testing companies raised approximately USD 3 billion in financing. NGS can improve human health by enabling early diagnosis of rare diseases, more pathogen monitoring, and improved outcomes for cancer patients. Each year, 4 million people in the country are diagnosed with cancer, accounting for nearly 30% of cancer-related deaths globally. Thus, NGS testing is the only way to meet the unmet needs of patients by offering personalized therapies.

The Healthcare and clinical research service providers in Japan have been integrating Next-Generation Sequencing (NGS) technologies for the past couple of years and are expected to account for a considerable share of Asia Pacific DNA sequencing revenue share. Ongoing developments in HLA and prenatal NGS testing coupled with international collaborations with U.S. & European companies are expected to fuel the market growth of Japan during the forecast period.

The market growth of Saudi Arabia can majorly be attributed to the increasing involvement of the government and rising awareness about the benefits of NGS. The government initiated Saudi Human Genome Program in 2018 to develop the field of diagnostics and prevent genetic diseases. Extensive research studies involving sequencing can help expand the usage rate of advanced DNA sequencing techniques in this country. A research study published in July 2020 represented the draft genome sequence of AY1MRC from the Mycobacterium tuberculosis strain with the help of whole-genome sequencing technology. The implementation of such programs is projected to have a positive impact on the demand for DNA sequencing tools in the forecast period.

In Kuwait, several new genome projects are being launched to sequence underrepresented populations and to understand the genetic variation of humans. For instance, the Kuwait Genome Project was an attempt to sequence the individual genomes of the population in the country.

Key DNA Sequencing Company Insights Key players operating in the global market are undertaking strategic initiatives such as collaborations, new product launch, and acquisitions to strengthen their market position and enhance their market presence. For instance, companies are undertaking the launch of novel software and informatics platforms to expand their market offerings.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the DNA sequencing market

By Product & Services

By Technology

By Workflow

By Application

By End-use

By Regional