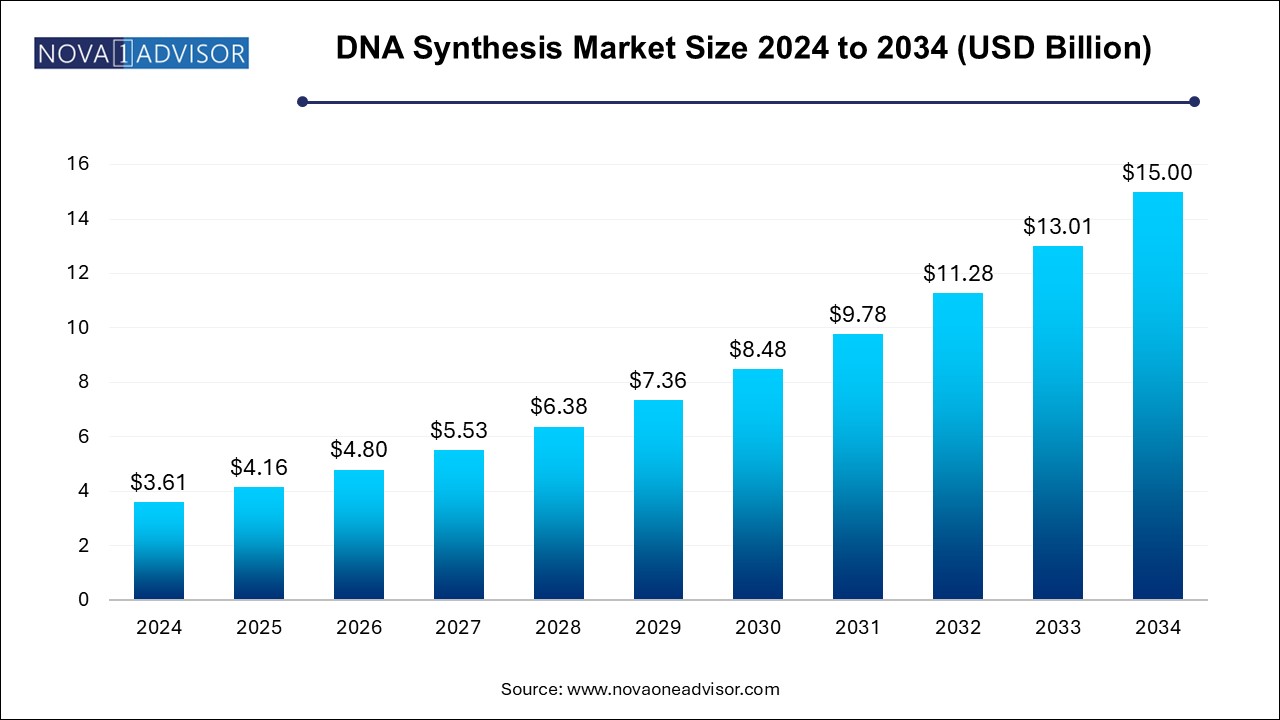

The DNA synthesis market size was exhibited at USD 3.61 billion in 2024 and is projected to hit around USD 15.0 billion by 2034, growing at a CAGR of 15.31% during the forecast period 2025 to 2034.

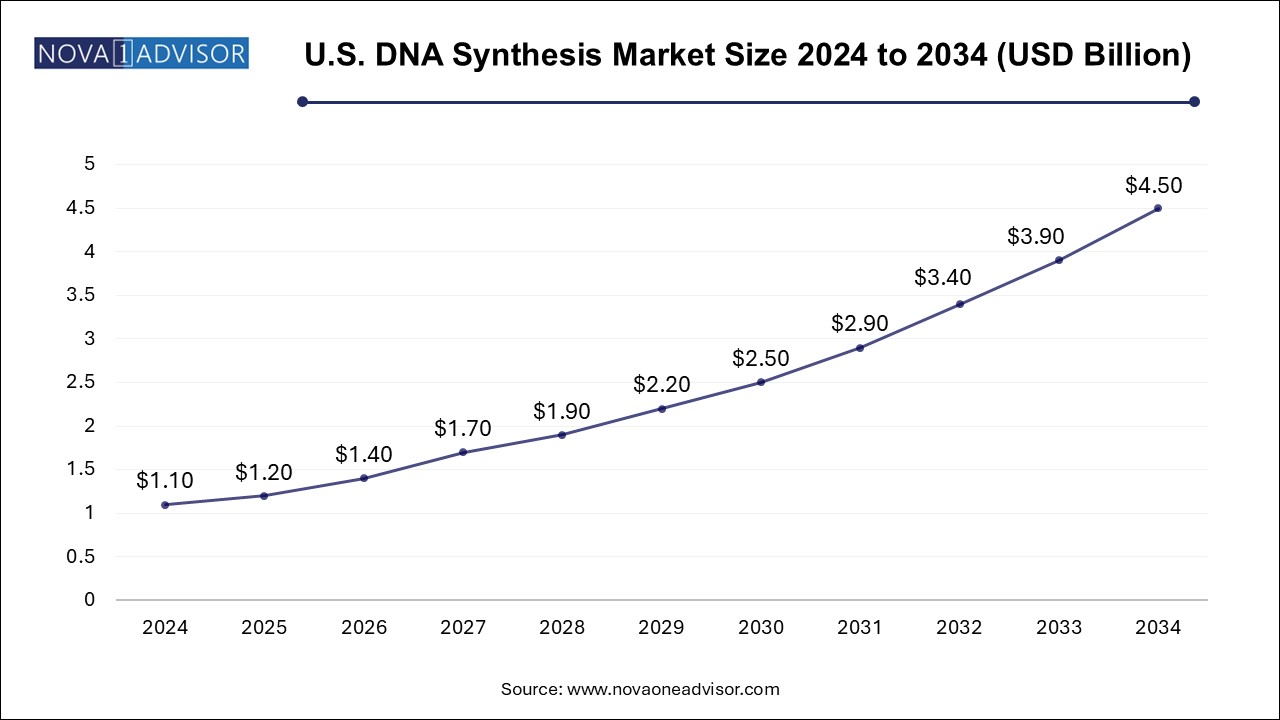

The U.S. DNA synthesis market size is evaluated at USD 1.1 billion in 2024 and is projected to be worth around USD 4.5 billion by 2034, growing at a CAGR of 13.66% from 2025 to 2034.

North America dominated the market and accounted for a 40.0% revenue share in 2024. The region experiences market growth due to heightened public awareness, robust medical facilities, and substantial R&D investments. In addition, the prevalence of chronic illnesses and substantial investments by market players in gene synthesis and gene therapy research amplify regional expansion, fostering a promising environment for further growth. Furthermore, the presence of key players in the market is expected to support regional expansion.

U.S. DNA Synthesis Market Trends

The U.S. DNA synthesis market has witnessed significant growth in recent years. Growth in the region can be attributed to the increasing demand for synthetic DNA & RNA sequences in various applications, such as research, diagnostics, and therapeutics. The competitive landscape of this market is characterized by a mix of established players and emerging companies striving to capture a share of the expanding market.

Europe DNA Synthesis Market Trends

DNA synthesis market in Europe was identified as a lucrative region in this industry. This is attributed to strong government support, advancements in research infrastructure, and the increased prevalence of chronic diseases & rising adoption of gene therapy.

UK DNA synthesis market is expected to grow over the forecast period due to robust research and innovation in genetic & molecular studies, coupled with supportive government initiatives and a strong healthcare infrastructure that fosters advancements in biomedical research. According to an article published in November 2024 by the Imperial College Healthcare NHS Trust, the UK's approval of gene editing therapy, specifically the CRISPR-based Casgevy, marks a milestone with potential implications for the UK DNA Synthesis market.

DNA synthesis market in France has a high burden of cancer which is also the leading cause of death. Oligonucleotides and genetic profiles are increasingly important in cancer diagnostics, including personalized medicine approaches, such as gene expression profiling and liquid biopsies. Moreover, cardiovascular diseases are another major health concern in France, and oligonucleotides & genetic profiles of individuals are being investigated for their potential in diagnosing & treating conditions, such as atherosclerosis & heart failure, propelling the demand for DNA synthesis.

Germany DNA synthesis market is expected to grow over the forecast period owing to Germany’s strong R&D landscape in diagnostics & therapeutics that harness the adoption of innovative therapies. Furthermore, the government in Germany is actively promoting the development of biotechnology and healthcare infrastructure. Initiatives such as “Industrie 4.0” and grants for R&D empower domestic players and attract foreign investments, impacting the DNA synthesis market positively.

Asia Pacific DNA Synthesis Market Trends

DNA synthesis market in Asia Pacific is anticipated to witness the fastest growth at a CAGR of 17.50% from 2024 to 2030 in the DNA synthesis market. The regional market is expected to be driven by the growing demand for synthetic DNA in research & diagnostics, the increasing prevalence of genetic diseases, and the rising need for personalized medicine.

China DNA synthesis market is expected to grow at the highest CAGR of 21.41% over the forecast period. The rise of CROs and the outsourcing of drug discovery & development activities by pharmaceutical & biotech companies are contributing to the market growth in China. Moreover, expansion plays a key role in this market. It involves investing in larger and more advanced synthesis facilities. For instance, in May 2024, GenScript expanded its oligonucleotide manufacturing facility in Jiangsu, China.

The DNA synthesis market in Japan is expected to witness significant growth over the forecast period. Japan has a significant aging population and a high focus on personalized medicine. Japan is a major player in scientific research, particularly in biotechnology and biopharmaceuticals. This research relies on oligonucleotides and gene expressions for various experiments and analyses, propelling the market growth.

India DNA synthesis market is anticipated to grow at a rapid rate over the forecast period. Due to the high birth rate, India has a high prevalence of genetic disorders due to various factors, such as consanguineous marriages and founder mutations. The Indian government is actively promoting the development of biotechnology and healthcare infrastructure. Moreover, the initiatives like “Make in India” and R&D grants empower domestic players and attract foreign investments, impacting the DNA synthesis market. For instance, in September 2019, the Department of Biotechnology (DBT) launched the Unique Methods of Management & Treatment of Inherited Disorders (UMMID) initiative in India to tackle inherited genetic diseases in newborn babies. These factors are expected to boost the market in India.

Middle East And Africa DNA Synthesis Market Trends

The DNA synthesis market in Middle East and Africa is projected to grow in near future due to the rising prevalence of chronic & infectious diseases, the growing incidence of genetic diseases, and the increased investments in the field of biotechnology & life sciences.

Saudi Arabia DNA synthesis market is expected to grow over the forecast period. The country has been investing in biotechnology and life sciences initiatives, including R&D. The growth of these initiatives is expected to drive the demand for DNA synthesis in various applications, such as genomics, diagnostics, and therapeutics. In addition, the growing incidence of genetic diseases and various government initiatives to combat them are projected to boost the market

DNA synthesis market in UAE is anticipated to witness growth over the forecast period due to the rapidly growing healthcare sector fueled by government investments, an increasing population, and rising disposable incomes. Moreover, there is a growing awareness of the benefits of genetic testing in the UAE, particularly for prenatal screening, cancer diagnosis, and personalized medicine. The UAE government is actively promoting the adoption of precision medicine, which tailors medical treatments to an individual’s genetic makeup. For instance, in June 2024, the Department of Health - Abu Dhabi (DoH), M42, and AbbVie signed a Memorandum of Understanding (MoU). It aimed to combine the expertise and resources of DoH, M42, & AbbVie to tailor personalized medicine & genomics solutions for individuals in Abu Dhabi.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.16 Billion |

| Market Size by 2034 | USD 15.0 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 15.31% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Service Type, Length, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Thermo Fisher Scientific, Inc; Twist Bioscience; BIONEER CORPORATION; Eton Bioscience, Inc.; LGC Biosearch Technologies; IBA Lifesciences GmbH; Eurofins Scientific; Integrated DNA Technologies, Inc.; Quintara Biosciences; GenScript |

The oligonucleotide synthesis segment dominated the industry in 2024. The larger share of this segment can be attributed to the focus on genomics research, personalized medicine, and understanding the genetic basis of diseases. Oligonucleotides are essential for molecular biology, genetics, and genomics, supporting applications such as PCR, DNA sequencing, & gene expression studies.

The growing awareness and understanding of genetic disorders contribute to the demand for oligonucleotides in diagnostics & potential therapeutic interventions. For instance, in August 2024, UC San Diego launched a Gene Therapy Initiative to develop innovative treatments for rare diseases, made possible by a USD 5 million donation from the Nancy and Geoffrey Stack Foundation. The initiative seeks to discover novel therapies for children and adults affected by genetic diseases.

The gene synthesis segment is expected to witness the highest CAGR of 16.71% over the forecast period. The gene synthesis is further segmented into custom gene synthesis and gene library synthesis. In gene therapy, new genes are introduced into existing cells to cure or prevent diseases.

Other methods involve regulating mutated genes, using selective reverse mutation by repairing mutated genes, and swapping mutated genes for functional genes. Gene synthesis can be used for cloning synthetic therapeutic genes into custom-made viral vectors for optimizing the expression and enhancing the specificity of gene delivery.

The biopharmaceutical and diagnostics companies segment dominated the market in 2024 with a market share of 50.0%. Biopharmaceutical companies involved in the market regularly use gene synthesis as an engineering tool to design and produce new DNA sequences & protein functions of interest. Companies involved in this domain include Integrated Biotechnologies, Twist Bioscience, and Codex.

For instance, in May 2021, Twist Bioscience collaborated with GP-write launch a Computer-Aided Design (CAD) platform, which can enable genome building through software. Furthermore, companies involved in developing diagnostics technologies, such as QIAGEN and F. Hoffmann-La Roche Ltd, are witnessing promising growth prospects due to the high demand for effective DNA-based diagnostic tests.

The contract research organizations (CROs) segment is projected to witness the highest CAGR of 17.17% over the forecast period. The growing number of small biotechnology companies and increasing outsourcing trends are expected to influence segment growth. Moreover, contributions by emerging biotechnology companies in the biomedical field are on the rise, owing to increasing funding in the startup ecosystem. This has led to an expansion of the scope of services offered by CROs.

The oligonucleotide synthesis segment dominated the market with the larger revenue share in 2024. The growing awareness and understanding of genetic disorders contribute to the demand for oligonucleotides in diagnostics & potential therapeutic interventions. Short oligonucleotides are used as primers in PCR and qPCR techniques. Researchers often require short, customized oligonucleotides for specific experiments & applications in molecular & cellular biology and other research areas.

Moreover, long oligonucleotides are essential for gene synthesis, allowing the assembly of entire genes or custom DNA constructs. This is crucial in synthetic biology, genetic engineering, and the creation of modified DNA sequences for specific applications. Furthermore, it also plays a key role in synthetic biology, facilitating the design and construction of synthetic genomes or genetic circuits.

The gene synthesis segment is projected to witness the fastest growth at a CAGR of 16.71% from 2024 to 2030. Gene synthesis involves assembling DNA sequences to create custom-designed genes. Advancements in gene synthesis technologies and the growth in complexity of genetic engineering projects further contribute to market growth.

For instance, Eurofins Genomics provides custom gene synthesis services for diagnostic applications, enabling the design of genes for accurate and sensitive diagnostic assays. Moreover, GeneArt Gene Synthesis by Thermo Fisher Scientific offers custom gene synthesis services for metabolic engineering projects, supporting pathway construction.

The research and development segment dominated the market with a share of 63.30% in 2024. This is due to the growing use of DNA synthesis to support ongoing research studies across the globe. Oligonucleotides are essential tools in molecular biology research, genetic testing, and drug development. The process of DNA synthesis holds importance in a variety of research and development fields such as biopharmaceuticals, synthetic biology, gene synthesis, and genome editing.

Moreover, the market is witnessing heightened demand due to the widespread adoption of CRISPR technology. As researchers increasingly employ CRISPR for diverse applications, including gene knockout studies and therapeutic interventions, the industry is experiencing significant growth.

The therapeutics segment is projected to witness the highest CAGR of 16.41% over the forecast period. Nucleotide synthesis is used to consistently support ongoing therapeutic research studies across the globe. Moreover, availability of rapid, accurate DNA synthesis enables faster and effective profiling of a wider range of targets, from the capacity to develop synthetic gene circuits to developing & screening enzymes for therapeutic use. The quest for personalized treatments for numerous genetic illnesses and cancers has pushed therapeutics to the forefront of DNA synthesis applications.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the DNA synthesis market

By Service Type

By Length

By Application

By End-use

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Service Type

1.2.2. Length

1.2.3. Application

1.2.4. End-use

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

1.10.1. Objective 1

1.10.2. Objective 2

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Snapshot

2.3. Competitive Insights Landscape

Chapter 3. DNA Synthesis Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook.

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increasing application of DNA synthesis in clinical diagnostics

3.2.1.2. Changing regulatory environments for genetic research and its applications in healthcare

3.2.1.3. Increasing public-private spending on genomics

3.2.1.4. Technological advancements in gene editing technologies

3.2.2. Market restraint analysis

3.2.2.1. High cost associated with genomics research

3.2.2.2. Lack of skilled professionals and research support in undeveloped countries

3.3. DNA synthesis Market Analysis Tools

3.3.1. Industry Analysis - Porter’s Five Forces

3.3.2. PESTEL Analysis

3.3.3. COVID-19 Impact Analysis

Chapter 4. DNA Synthesis Market: Service Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Global DNA Synthesis Market Service Type Movement Analysis

4.3. Global DNA Synthesis Market Size & Trend Analysis, by Service Type, 2021 to 2034 (USD Million)

4.4. Oligonucleotide synthesis

4.4.1. Oligonucleotides synthesis market estimates and forecasts 2021 to 2034 (USD Million)

4.4.2. Standard oligonucleotides synthesis

4.4.2.1. Standard oligonucleotides synthesis market estimates and forecasts 2021 to 2034 (USD Million)

4.4.3. Custom oligonucleotide synthesis

4.4.3.1. Custom oligonucleotides synthesis market estimates and forecasts 2021 to 2034 (USD Million)

4.5. Gene synthesis

4.5.1. Gene synthesis market estimates and forecasts 2021 to 2034 (USD Million)

4.5.2. Custom gene synthesis

4.5.2.1. Custom gene synthesis market estimates and forecasts 2021 to 2034 (USD Million)

4.5.3. Gene library synthesis

4.5.3.1. Gene library synthesis market estimates and forecasts 2021 to 2034 (USD Million)

Chapter 5. DNA Synthesis Market: Length Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Global DNA Synthesis Market Length Movement Analysis

5.3. Global DNA Synthesis Market Size & Trend Analysis, by Length, 2021 to 2034 (USD Million)

5.4. Oligonucleotide synthesis

5.4.1. Oligonucleotides synthesis market estimates and forecasts 2021 to 2034 (USD Million)

5.4.2. Less than 50nt

5.4.2.1. Less than 50nt market estimates and forecasts 2021 to 2034 (USD Million)

5.4.3. 51-100nt

5.4.3.1. 51-100nt market estimates and forecasts 2021 to 2034 (USD Million)

5.4.4. 101-150nt

5.4.4.1. 101-150nt synthesis market estimates and forecasts 2021 to 2034 (USD Million)

5.4.5. More than 150nt

5.4.5.1. More than 150nt synthesis market estimates and forecasts 2021 to 2034 (USD Million)

5.5. Gene synthesis

5.5.1. Gene synthesis market estimates and forecasts 2021 to 2034 (USD Million)

5.5.2. Less than 500nt

5.5.2.1. Less than 500nt market estimates and forecasts 2021 to 2034 (USD Million)

5.5.3. 501-1000nt

5.5.3.1. 501-1000nt market estimates and forecasts 2021 to 2034 (USD Million)

5.5.4. 1001-1500nt

5.5.4.1. 1001-1500nt synthesis market estimates and forecasts 2021 to 2034 (USD Million)

5.5.5. 1501-2000nt

5.5.5.1. 1501-2000nt synthesis market estimates and forecasts 2021 to 2034 (USD Million)

5.5.6. 2001-2500nt

5.5.6.1. 2001-2500nt synthesis market estimates and forecasts 2021 to 2034 (USD Million)

5.5.7. More than 2500nt

5.5.7.1. More than 2500nt synthesis market estimates and forecasts 2021 to 2034 (USD Million)

Chapter 6. DNA Synthesis Market: Application Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Global DNA Synthesis Market Application Movement Analysis

6.3. Global DNA Synthesis Market Size & Trend Analysis, by Application, 2021 to 2034 (USD Million)

6.4. Research & Development

6.4.1. Research & development market estimates and forecasts 2021 to 2034 (USD Million)

6.4.2. Oligonucleotide synthesis

6.4.2.1. Oligonucleotide synthesis tumors market estimates and forecasts 2021 to 2034 (USD Million)

6.4.2.2. PCR

6.4.2.2.1. PCR synthesis tumors market estimates and forecasts 2021 to 2034 (USD Million)

6.4.2.3. NGS

6.4.2.3.1. NGS synthesis tumors market estimates and forecasts 2021 to 2034 (USD Million)

6.4.2.4. CRISPR

6.4.2.4.1. CRISPR synthesis tumors market estimates and forecasts 2021 to 2034 (USD Million)

6.4.2.5. Cloning and mutagenesis

6.4.2.5.1. Cloning and mutagenesis synthesis tumors market estimates and forecasts 2021 to 2034 (USD Million)

6.4.2.6. Others

6.4.2.6.1. Others synthesis tumors market estimates and forecasts 2021 to 2034 (USD Million)

6.4.3. Gene synthesis

6.4.3.1. Gene synthesis market estimates and forecasts 2021 to 2034 (USD Million)

6.4.3.2. Synthetic biology

6.4.3.2.1. Synthetic biology tumors market estimates and forecasts 2021 to 2034 (USD Million)

6.4.3.3. Vaccine development

6.4.3.3.1. Vaccine development synthesis tumors market estimates and forecasts 2021 to 2034 (USD Million)

6.4.3.4. Genetic engineering

6.4.3.4.1. Genetic engineering synthesis tumors market estimates and forecasts 2021 to 2034 (USD Million)

6.4.3.5. Others

6.4.3.5.1. Others synthesis tumors market estimates and forecasts 2021 to 2034 (USD Million)

6.5. Diagnostics

6.5.1. Diagnostics market estimates and forecasts 2021 to 2034 (USD Million)

6.6. Therapeutics

6.6.1. Therapeutics market estimates and forecasts 2021 to 2034 (USD Million)

6.6.2. RNAi therapies

6.6.2.1. RNAi therapies market estimates and forecasts 2021 to 2034 (USD Million)

6.6.3. Antisense and oligonucleotide-based therapies

6.6.3.1. Antisense and oligonucleotide-based therapies market estimates and forecasts 2021 to 2034 (USD Million)

6.6.4. Others

6.6.4.1. Others market estimates and forecasts 2021 to 2034 (USD Million)

Chapter 7. DNA Synthesis Market: End-Use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Global DNA Synthesis Market End-use Movement Analysis

7.3. Global DNA Synthesis Market Size & Trend Analysis, by End-use, 2021 to 2034 (USD Million)

7.4. Biopharmaceutical & Diagnostic Companies

7.4.1. Biopharmaceutical & diagnostic companies market estimates and forecasts 2021 to 2034 (USD Million)

7.5. Academic & Research Institutes

7.5.1. Academic & research institutes market estimates and forecasts 2021 to 2034 (USD Million)

7.6. Contract Research Organizations

7.6.1. Contract Research Organizations market estimates and forecasts 2021 to 2034 (USD Million)

Chapter 8. DNA Synthesis Market: Regional Estimates & Trend Analysis

8.1. Regional Market Share Analysis, 2024 & 2034

8.2. Regional Market Dashboard

8.3. Market Size, & Forecasts Trend Analysis, 2021 to 2034:

8.4. North America

8.4.1. North America market estimates and forecasts 2021 to 2034 (USD Million)

8.4.2. U.S.

8.4.2.1. Key country dynamics

8.4.2.2. Competitive scenario

8.4.2.3. U.S. market estimates and forecasts 2021 to 2034 (USD Million)

8.4.3. Canada

8.4.3.1. Key country dynamics

8.4.3.2. Competitive scenario

8.4.3.3. Canada market estimates and forecasts 2021 to 2034 (USD Million)

8.5. Europe

8.5.1. Europe market estimates and forecasts 2021 to 2034 (USD Million)

8.5.2. UK

8.5.2.1. Key country dynamics

8.5.2.2. Competitive scenario

8.5.2.3. UK market estimates and forecasts 2021 to 2034 (USD Million)

8.5.3. Germany

8.5.3.1. Key country dynamics

8.5.3.2. Competitive scenario

8.5.3.3. Germany market estimates and forecasts 2021 to 2034 (USD Million)

8.5.4. France

8.5.4.1. Key country dynamics

8.5.4.2. Competitive scenario

8.5.4.3. France market estimates and forecasts 2021 to 2034 (USD Million)

8.5.5. Italy

8.5.5.1. Key country dynamics

8.5.5.2. Competitive scenario

8.5.5.3. Italy market estimates and forecasts 2021 to 2034 (USD Million)

8.5.6. Spain

8.5.6.1. Key country dynamics

8.5.6.2. Competitive scenario

8.5.6.3. Spain market estimates and forecasts 2021 to 2034 (USD Million)

8.5.7. Norway

8.5.7.1. Key country dynamics

8.5.7.2. Competitive scenario

8.5.7.3. Norway market estimates and forecasts 2021 to 2034 (USD Million)

8.5.8. Sweden

8.5.8.1. Key country dynamics

8.5.8.2. Competitive scenario

8.5.8.3. Sweden market estimates and forecasts 2021 to 2034 (USD Million)

8.5.9. Denmark

8.5.9.1. Key country dynamics

8.5.9.2. Competitive scenario

8.5.9.3. Denmark market estimates and forecasts 2021 to 2034 (USD Million)

8.6. Asia Pacific

8.6.1. Asia Pacific market estimates and forecasts 2021 to 2034 (USD Million)

8.6.2. Japan

8.6.2.1. Key country dynamics

8.6.2.2. Competitive scenario

8.6.2.3. Japan market estimates and forecasts 2021 to 2034 (USD Million)

8.6.3. China

8.6.3.1. Key country dynamics

8.6.3.2. Competitive scenario

8.6.3.3. China market estimates and forecasts 2021 to 2034 (USD Million)

8.6.4. India

8.6.4.1. Key country dynamics

8.6.4.2. Competitive scenario

8.6.4.3. India market estimates and forecasts 2021 to 2034 (USD Million)

8.6.5. Australia

8.6.5.1. Key country dynamics

8.6.5.2. Competitive scenario

8.6.5.3. Australia market estimates and forecasts 2021 to 2034 (USD Million)

8.6.6. South Korea

8.6.6.1. Key country dynamics

8.6.6.2. Competitive scenario

8.6.6.3. South Korea market estimates and forecasts 2021 to 2034 (USD Million)

8.6.7. Thailand

8.6.7.1. Key country dynamics

8.6.7.2. Competitive scenario

8.6.7.3. Thailand market estimates and forecasts 2021 to 2034 (USD Million)

8.7. Latin America

8.7.1. Latin America market estimates and forecasts 2021 to 2034 (USD Million)

8.7.2. Brazil

8.7.2.1. Key country dynamics

8.7.2.2. Competitive scenario

8.7.2.3. Brazil market estimates and forecasts 2021 to 2034 (USD Million)

8.7.3. Mexico

8.7.3.1. Key country dynamics

8.7.3.2. Competitive scenario

8.7.3.3. Mexico market estimates and forecasts 2021 to 2034 (USD Million)

8.7.4. Argentina

8.7.4.1. Key country dynamics

8.7.4.2. Competitive scenario

8.7.4.3. Argentina market estimates and forecasts 2021 to 2034 (USD Million)

8.8. MEA

8.8.1. MEA market estimates and forecasts 2021 to 2034 (USD Million)

8.8.2. South Africa

8.8.2.1. Key country dynamics

8.8.2.2. Competitive scenario

8.8.2.3. South Africa market estimates and forecasts 2021 to 2034 (USD Million)

8.8.3. Saudi Arabia

8.8.3.1. Key country dynamics

8.8.3.2. Competitive scenario

8.8.3.3. Saudi Arabia market estimates and forecasts 2021 to 2034 (USD Million)

8.8.4. UAE

8.8.4.1. Key country dynamics

8.8.4.2. Competitive scenario

8.8.4.3. UAE market estimates and forecasts 2021 to 2034 (USD Million)

8.8.5. Kuwait

8.8.5.1. Key country dynamics

8.8.5.2. Competitive scenario

8.8.5.3. Kuwait market estimates and forecasts 2021 to 2034 (USD Million)

Chapter 9. Competitive Landscape

9.1. Company/Competition Categorization

9.2. Strategy Mapping

9.3. Company Market Position Analysis, 2023

9.4. Company Profiles/Listing

9.4.1. Thermo Fisher Scientific Inc.

9.4.1.1. Company overview

9.4.1.2. Financial performance

9.4.1.3. Product benchmarking

9.4.1.4. Strategic initiatives

9.4.2. Twist Bioscience

9.4.2.1. Company overview

9.4.2.2. Financial performance

9.4.2.3. Product benchmarking

9.4.2.4. Strategic initiatives

9.4.3. BIONEER CORPORATION

9.4.3.1. Company overview

9.4.3.2. Financial performance

9.4.3.3. Product benchmarking

9.4.3.4. Strategic initiatives

9.4.4. Eton Bioscience, Inc

9.4.4.1. Company overview

9.4.4.2. Financial performance

9.4.4.3. Product benchmarking

9.4.4.4. Strategic initiatives

9.4.5. LGC Biosearch Technologies

9.4.5.1. Company overview

9.4.5.2. Financial performance

9.4.5.3. Product benchmarking

9.4.5.4. Strategic initiatives

9.4.6. IBA Lifesciences GmbH

9.4.6.1. Company overview

9.4.6.2. Financial performance

9.4.6.3. Product benchmarking

9.4.6.4. Strategic initiatives

9.4.7. Eurofins Scientific

9.4.7.1. Company overview

9.4.7.2. Financial performance

9.4.7.3. Product benchmarking

9.4.7.4. Strategic initiatives

9.4.8. Integrated DNA Technologies, Inc.

9.4.8.1. Company overview

9.4.8.2. Financial performance

9.4.8.3. Product benchmarking

9.4.8.4. Strategic initiatives

9.4.9. Quintara Biosciences

9.4.9.1. Company overview

9.4.9.2. Financial performance

9.4.9.3. Product benchmarking

9.4.9.4. Strategic initiatives

9.4.10. GenScript

9.4.10.1. Company overview

9.4.10.2. Financial performance

9.4.10.3. Product benchmarking

9.4.10.4. Strategic initiatives