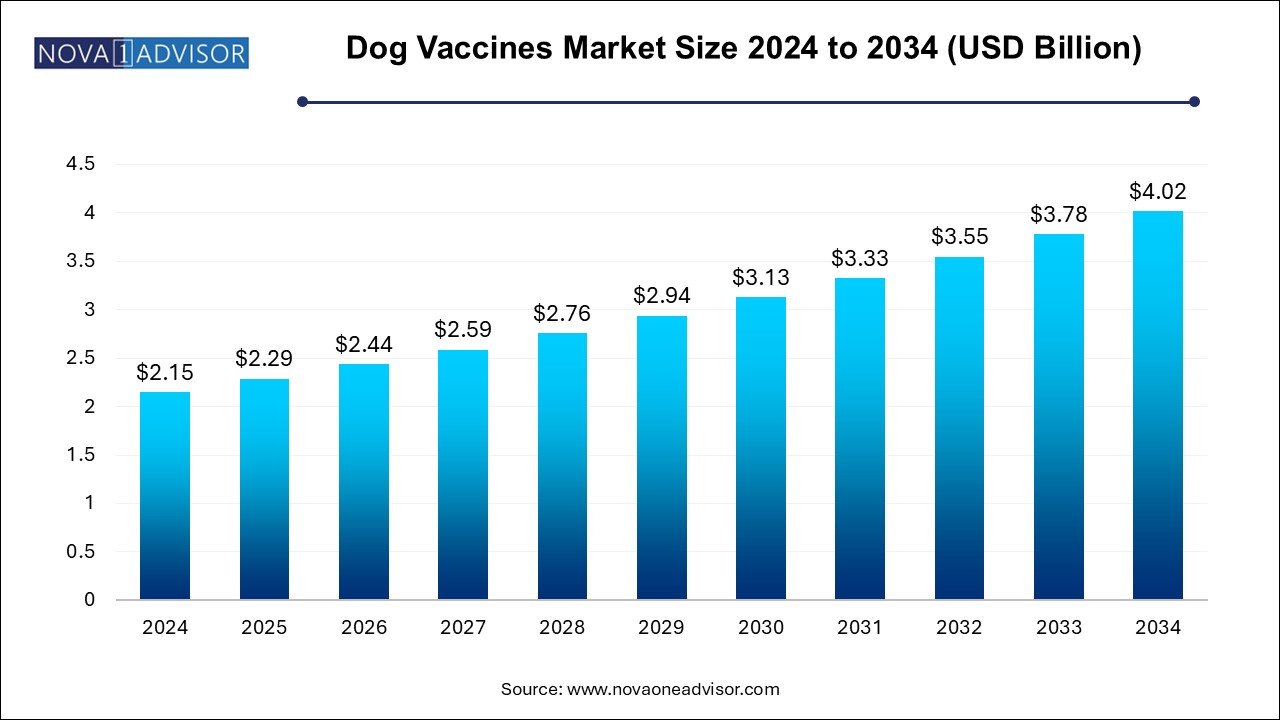

The dog vaccines market size was exhibited at USD 2.15 billion in 2024 and is projected to hit around USD 4.02 billion by 2034, growing at a CAGR of 6.46% during the forecast period 2025 to 2034.

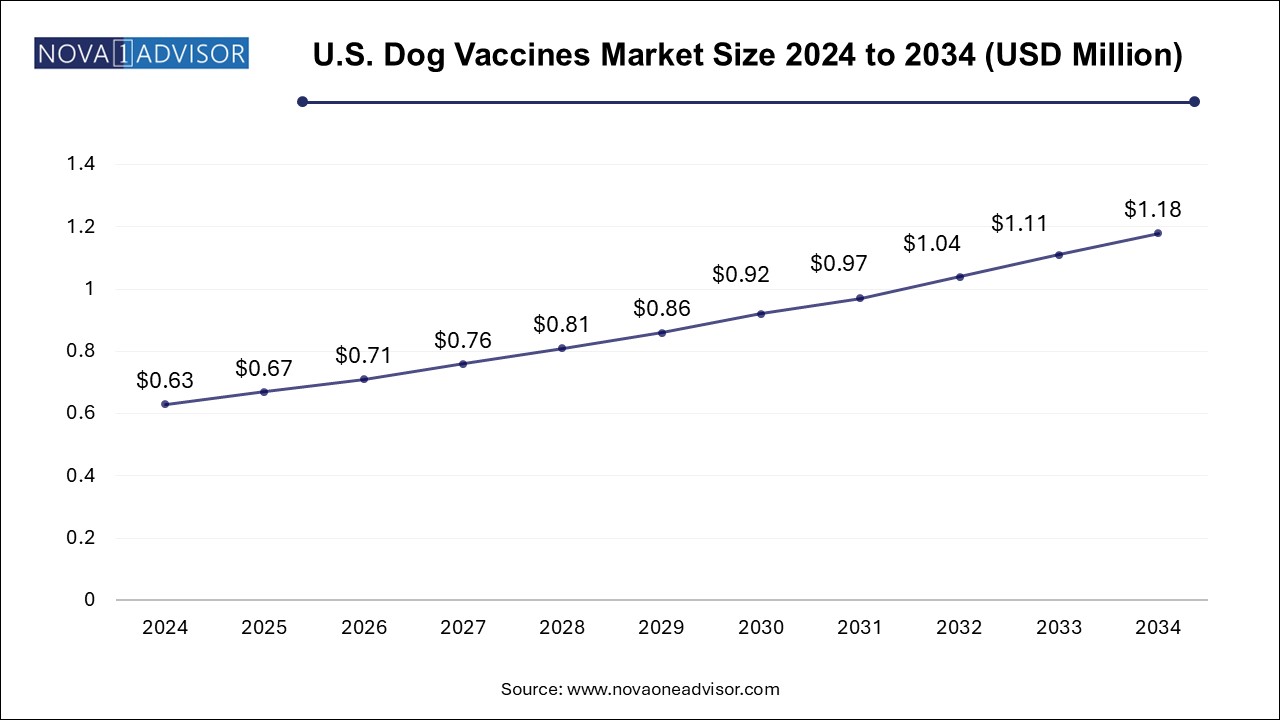

The U.S. dog vaccines market size is evaluated at USD 0.630 million in 2024 and is projected to be worth around USD 1.18 million by 2034, growing at a CAGR of 5.87% from 2025 to 2034.

The North America held the largest share of the global dog vaccines market in 2024, driven by high dog ownership rates, well-established veterinary infrastructure, and mandatory rabies vaccination policies. The U.S. and Canada both exhibit strong compliance with preventive veterinary care standards, supported by veterinary associations and educational outreach. The region is also home to major pharmaceutical players who actively conduct clinical trials and introduce innovative vaccines.

The integration of digital pet health records, tele-veterinary consultations, and pet insurance further supports vaccine uptake. Additionally, public health surveillance programs aimed at rabies eradication ensure a reliable demand for vaccines in both companion animals and shelter populations.

Asia Pacific is projected to be the fastest-growing region, with countries like China, India, Indonesia, and Thailand witnessing sharp increases in pet ownership and veterinary service expansion. Rising disposable incomes and a growing middle class are contributing to increased spending on pet care. Government campaigns for rabies control in countries like India, coupled with urbanization-driven lifestyle changes, are creating favorable conditions for vaccine market growth.

Local manufacturers in Asia are also investing in domestic production to meet rising demand, often with government support. Educational outreach and the establishment of mobile veterinary clinics are improving access to vaccines in rural areas, further boosting growth.

The dog vaccines market has evolved into a crucial pillar of the global veterinary healthcare industry, safeguarding the canine population from a broad spectrum of infectious and potentially fatal diseases. Vaccination not only protects dogs from severe ailments such as rabies, parvovirus, and distemper but also plays an integral role in public health by controlling zoonotic disease transmission. With the increase in dog ownership worldwide and growing awareness of preventive pet healthcare, the demand for effective, affordable, and longer-lasting vaccines continues to rise.

Vaccines are essential to the routine care of pet dogs, forming the first line of defense against infectious diseases in both domestic pets and dogs in commercial or community environments. Core vaccines, such as those for rabies, distemper, and parvovirus, are universally recommended, while non-core vaccines, like those targeting Lyme disease or leptospirosis, are often administered based on lifestyle, region, and exposure risk. The market encompasses various formulations including modified live vaccines, inactivated (killed) vaccines, and newer recombinant and subunit vaccines.

Market growth is being propelled by several factors including rising pet ownership, an increase in pet humanization, government mandates for rabies vaccination, and the emergence of multi-component combination vaccines that reduce the number of vet visits. Furthermore, increasing disposable incomes, especially in emerging economies, have empowered pet owners to seek comprehensive preventive care for their dogs. The market also benefits from strong support through veterinary clinics, e-commerce platforms, and retail outlets offering convenient access to vaccine-related services and products.

As the focus on canine well-being intensifies, manufacturers are exploring longer-duration immunity vaccines, alternative delivery methods (like oral or intranasal routes), and region-specific disease-targeted formulations. The global push toward One Health strategies, emphasizing the interconnectedness of human and animal health, is also fostering a supportive regulatory and commercial environment for vaccine development and deployment.

Rising Demand for Combination Vaccines: Growing preference for vaccines that offer protection against multiple diseases in a single shot.

Innovation in Delivery Routes: Emergence of oral and intranasal vaccines for dogs to improve administration convenience and compliance.

Shifting Focus to Long-Term Immunity: Demand increasing for vaccines that offer three-year or longer protection to reduce frequency of administration.

Technological Advancement in Formulation: Advancements in recombinant and subunit vaccines improving safety and efficacy profiles.

Increased Pet Humanization: Pet owners are treating dogs as family members, boosting expenditure on preventive healthcare including vaccines.

Veterinary Telehealth and E-Commerce Channels Rising: Online platforms are offering consultations and doorstep delivery of vaccines in some regions.

Stronger Emphasis on Zoonotic Disease Prevention: Government mandates, particularly for rabies and leptospirosis, driving routine canine immunization.

Growth in Pet Insurance Coverage: Insurance plans increasingly cover preventive vaccines, encouraging higher uptake.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.29 Billion |

| Market Size by 2034 | USD 4.02 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.46% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Vaccine Type, Disease Type, Route of Administration, Duration of Immunity, Component, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Boehringer Ingelheim International GmbH; Zoetis Services LLC; Merck & Co., Inc.; Elanco; Hester Biosciences Limited; Virbac; Bioveta a.s; Brilliant Bio Pharma; Heska Corporation; Zendal Group |

One of the primary forces driving the dog vaccines market is the rising global dog population and the expanding trend of pet humanization. Over the past decade, pets have transitioned from being mere companions to valued family members, particularly in urban settings of developed and developing economies alike. This transformation has resulted in increased spending on premium healthcare services, including preventive treatments such as vaccinations.

In countries like the United States, over 65 million households own a dog, while rapid growth is also evident in regions like China, Brazil, and India. Pet owners are increasingly educated about disease prevention, often through social media, veterinary guidance, and pet wellness programs. The resulting behavioral change is a higher compliance rate with annual and triennial vaccination schedules, which directly translates into sustained demand across the dog vaccine value chain. This cultural shift towards comprehensive pet wellness is set to propel the market for the foreseeable future.

Despite the market’s strong growth potential, it faces the challenge of vaccine hesitancy among some pet owners and varying regulatory frameworks across regions. A segment of dog owners remains skeptical about the safety of frequent vaccination, citing concerns about side effects, over-vaccination, and long-term health risks. Misinformation on digital platforms and anti-vaccine sentiments mirrored from human health debates have, in some instances, influenced pet vaccination compliance.

From a regulatory standpoint, the market is also hindered by the lack of global harmonization. Approval pathways, product labeling, and vaccination schedules differ from country to country, leading to challenges in cross-border product marketing and supply chain standardization. Moreover, strict cold chain requirements and veterinary administration mandates can limit vaccine accessibility in rural and underserved areas, creating disparities in immunization coverage.

An important opportunity within the dog vaccines market lies in the development of vaccines offering extended immunity and those targeting region-specific diseases. Pet owners increasingly favor vaccines that reduce the number of required booster doses—making three-year or longer duration vaccines highly desirable. Manufacturers that successfully innovate in this space, especially with combined long-acting formulations, can build a loyal customer base and improve compliance.

Furthermore, region-specific vaccines represent a largely untapped potential. Diseases such as Lyme (endemic in parts of North America and Europe) or Leptospirosis (more common in tropical regions) offer unique market entry points. Tailoring vaccines to regional epidemiological patterns, combined with strategic distribution and education, can help manufacturers strengthen their competitive positioning and contribute meaningfully to disease burden reduction.

The Modified/attenuated live vaccines dominated the market in 2024, owing to their high efficacy, ability to provide rapid and long-lasting immune responses, and broad usage in routine vaccination programs. These vaccines, designed to mimic natural infection without causing disease, stimulate both cellular and humoral immunity and are widely used for conditions such as distemper, parvovirus, and adenovirus. Their widespread acceptance among veterinarians ensures steady demand across retail and clinical distribution channels.

Inactivated (killed) vaccines are projected to grow at the fastest pace, particularly in response to safety concerns associated with live vaccines in immunocompromised animals. These vaccines do not replicate within the host, making them suitable for puppies, older dogs, or those with underlying health conditions. With advancements in adjuvant technologies improving the efficacy of inactivated vaccines, their use is expanding, especially for diseases such as rabies and Leptospirosis where inactivation ensures safety without compromising immune protection.

The Canine rabies vaccines accounted for the largest disease segment share, reflecting global legal mandates and public health imperatives. Rabies vaccination is compulsory in many jurisdictions and often required for licensing, travel, or adoption. These vaccines are administered annually or triennially, depending on the formulation and regional laws. The severity and zoonotic nature of rabies ensure consistent and large-scale demand for canine vaccination.

Canine Leptospirosis vaccines are expected to see the highest growth, especially as awareness of this bacterial disease spreads across temperate and tropical regions. Increased reporting of zoonotic transmission, especially during monsoon and flood seasons, is pushing more veterinarians to recommend Leptospirosis as a core vaccine in vulnerable regions. Combined vaccines that incorporate Leptospirosis antigens are becoming more common in veterinary protocols.

The Combined vaccines held the majority share, due to their convenience, reduced handling stress on animals, and the ability to protect against multiple diseases simultaneously. The "5-in-1" and "7-in-1" vaccine formulations, for instance, are commonly administered during puppyhood to build broad-spectrum immunity. This segment benefits from strong support from veterinary associations and pharmaceutical companies who promote their cost-effectiveness and reduced injection burden.

Mono vaccines are gaining popularity, particularly in booster protocols or disease-specific outbreaks. They are also preferred when customizing vaccine schedules for individual dogs based on age, breed, health status, and regional disease prevalence. Single-antigen vaccines for rabies or Leptospirosis are commonly administered as boosters or when legal requirements demand mono-format certifications.

Injectables continue to dominate the administration route segment, primarily due to their established use, strong efficacy, and easy integration into clinical practices. Most core and non-core vaccines are delivered intramuscularly or subcutaneously by trained veterinarians during annual wellness visits. Injectable formats also allow for better control of dosage, batch consistency, and cold chain integrity.

Oral and intranasal vaccines are projected to be the fastest-growing segments, especially for respiratory disease vaccines like Bordetella bronchiseptica. Intranasal administration avoids the stress of needles and is preferred in puppies or sensitive dogs. These formats are gaining popularity among both veterinarians and pet owners seeking less invasive options, particularly in community settings such as shelters, dog daycares, and training centers.

The 1-year vaccines currently dominate, as many core and non-core vaccines are approved with annual boosters. This format aligns with traditional veterinary practice, allowing for annual wellness checks that also include diagnostics, parasite control, and nutrition counseling. Frequent interaction helps reinforce pet-owner relationships and compliance with other aspects of preventive care.

3-year duration vaccines are growing faster, as newer formulations offering longer immunity become more widely adopted. Rabies and distemper vaccines with triennial protection are increasingly preferred by both owners and clinics aiming to reduce the frequency of vet visits while maintaining protection. These products also appeal to cost-conscious customers and those concerned about vaccine overload.

The Hospital/clinic pharmacies led the market, being the primary distribution point for vaccine administration. Pet owners overwhelmingly trust veterinarians to determine vaccination needs and administer shots during scheduled check-ups. Veterinary clinics offer the added advantage of patient record management and follow-up reminder systems.

E-commerce is the fastest-growing channel, driven by the expansion of pet telehealth, direct-to-consumer vaccine education, and the growing number of home-based veterinary service providers. Online platforms are increasingly being used to schedule mobile vaccine clinics or ship vaccines to licensed veterinarians in remote locations. This trend is particularly visible in North America and Europe where digital infrastructure and veterinary licensing are more developed.

In March 2025, Zoetis launched a new recombinant combination vaccine with triennial protection against parvovirus, distemper, and adenovirus in North America.

In January 2025, Elanco Animal Health introduced an upgraded oral Bordetella vaccine formulation for easier administration in community veterinary settings.

In November 2024, Boehringer Ingelheim partnered with veterinary networks in Southeast Asia to expand cold-chain vaccine logistics and support rural immunization drives.

In September 2024, Virbac announced the successful regulatory approval of its canine leptospirosis mono-vaccine in Brazil, customized for regional serovar strains.

In July 2024, Merck Animal Health launched a mobile app-based vaccine reminder platform for pet owners integrated with veterinary clinics in the U.S. and Canada.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the dog vaccines market

By Vaccine Type

By Disease type

By Route of Administration

By Duration of Immunity

By Component

By Distribution Channel

By Regional