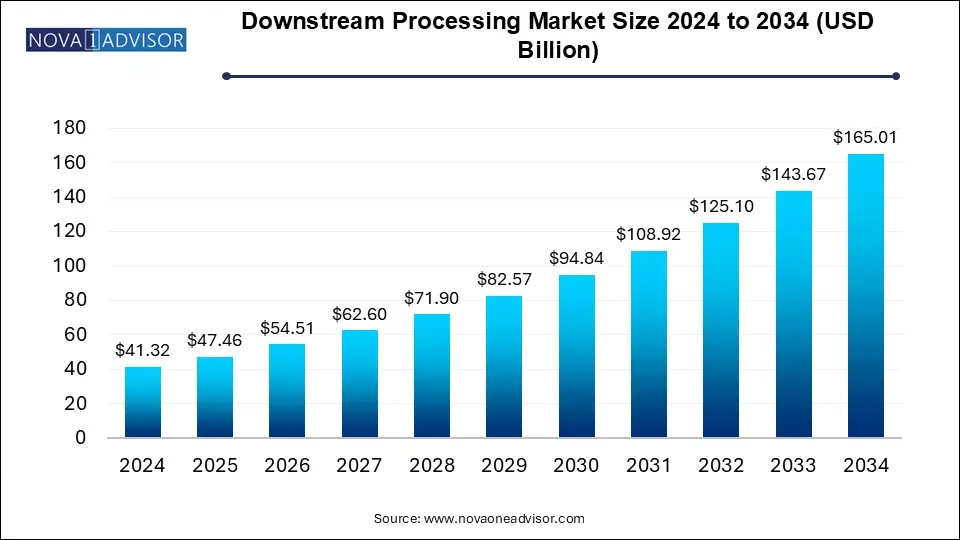

The downstream processing market size was exhibited at USD 41.32 billion in 2024 and is projected to hit around USD 165.01 billion by 2034, growing at a CAGR of 14.85% during the forecast period 2025 to 2034.

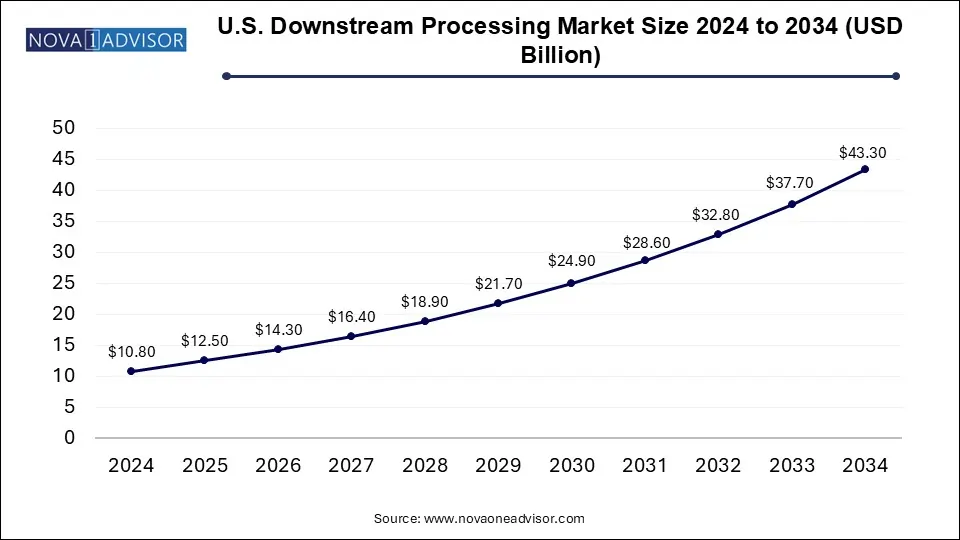

The U.S. downstream processing market size reached USD 10.8 billion in 2024 and is anticipated to be worth around USD 43.3 billion by 2034, poised to grow at a CAGR of 13.45% from 2025 to 2034.

North America dominated the market for downstream processing with the largest revenue share of 35.0% in 2024 owing to government support for promoting bioprocess technologies, rising medical expenditure, and developed healthcare infrastructure. In addition, the region has witnessed major collaborative activities with healthcare giants that are extensively investing in the R&D of biopharmaceuticals and vaccines. In addition, key players operating in the market for downstream processing are expanding their foothold in this region. For instance, Thermo Fisher Scientific Inc. recently announced a USD 97 million investment to extend its clinical research facilities in Richmond, Virginia. The facilities, which comprise laboratory operations obtained with the acquisition of PPD, Inc. in December 2021, will meet the growing need for consistent, greater laboratory services in biopharma to advance drug development.

In the Asia Pacific, the market for downstream processing is expected to register the highest growth rate of 15.67% during 2023-2034 due to the rising investments by developers and consumers in the field of biotechnology. The presence of a large population base is driving the need for advanced medical facilities for which players are keen on implementing rapid analytical methods to support in-process designing and bioprocessing. China dominated the market share in the Asia Pacific owing to the growing biopharmaceutical industry and increasing demand for medicines and vaccines. The biopharmaceutical industry is amongst the most active economic sectors in China and is marked by continuous revolution with modern biopharmaceutical equipment and process. For instance, in April 2021, Asahi Kasei Corporation, a solution supplier to the biologics manufacturing sector, extended its operations in China with the establishment of Asahi Kasei Bioprocess Co., Ltd. By localizing inventory management and order processing for faster delivery periods, the introduction of AKBC facilitates company development in China.

| Report Coverage | Details |

| Market Size in 2025 | USD 47.46 Billion |

| Market Size by 2034 | USD 165.01 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 14.85% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Technique, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Merck KGaA; Sartorius Stedim Biotech S.A; GE Healthcare; Thermo Fisher Scientific Inc.; Danaher Corporation; Repligen; 3M Company; Boehringer Ingelheim International GmbH; Corning Corporation; Lonza Group Ltd; Dover Corporation; Ashai Kasei; Ferner PLC; Eppendorf AG |

The chromatography systems segment dominated the market for downstream processing and accounted for the largest revenue share of 41.29% in 2024. Continuous R&D to improve the efficiency and speed of chromatography systems is anticipated to propel the segment growth. In April 2021, Thermo Fisher Scientific launched the HyPeak chromatography system, its company's only single-use chromatography system for bioprocessing, with significant functions in therapeutic protein as well as vaccine development. A rise in the deals and developments pertaining to chromatography systems also facilitates segment growth. For instance, in January 2021, Sartorius Stedim Biotech announced acquiring the chromatography equipment business from Novasep. This will assist Sartorius to develop novel chromatography systems which in turn will overcome efficiency issues and bottlenecks in downstream processing.

The filters segment is expected to register the fastest CAGR of 16.10% from 2025 to 2034. The rise in the utility of filters for viral inactivation is the key factor driving this market for downstream processing. In September 2020, a team of researchers from Pennsylvania State University analyzed the efficiency of BioEX hollow fiber and Planova 20N virus filters for the removal of viral-size particles. Such studies are anticipated to increase the adoption rate of filters for downstream processing of biologics.

The purification by chromatography segment dominated the downstream processing market and accounted for the largest revenue share of 40.98% in 2024. Single-use chromatography and filtration systems are considered the gold standards in downstream bioprocessing, hence companies are engaging in business development strategies such as acquisition, merger, and agreement for expanding their chromatography portfolio. For instance, in December 2021, Repligen bought Newton, New Jersey-based BioFlex Solutions. The purchase adds to and enhances Repligen's single-use fluid management product line, as well as simplifies its supply chain. The integration of BioFlex Solutions strengthens its system offering by further integrating components and assemblies. Similarly, In August 2021, Danaher Corporation has completed the acquisition of Aldevron. Aldevron will function as a separate operational business and brand inside Danaher's Life Sciences sector.

Solid-liquid separation is expected to witness the highest CAGR of 16.03% from 2025 to 2034. There are several advantages of solid-liquid separation such as it is simple, cost-effective, and well suited for continuous mode manufacturing. However, high shear forces generated is a common hurdle with this technique. Therefore, to cope up with such problems, recent developments such as depth filters include multistage depth filtration, alternating tangential flow microfiltration, and tangential flow filtration methods are increasingly adopted for high cell density processes.

The antibiotic production segment dominated the market for downstream processing and generated the largest revenue share of 33.0% in 2024 owing to the wide applications of antibiotics for the treatment of several disorders. More than 700,000 people die of antibiotic-resistant bacteria annually. This leads to high demand for the development of antibiotics which, in turn, propels the market growth.

Antibodies production is expected to grow at the fastest CAGR of 15.62% by 2034 owing to the rise in demand for monoclonal antibodies. The launch of novel products for efficient purification of antibodies also propels segment growth. For instance, in January 2021, Cytiva launched HiScreen Fibro PrismA for process development and purification of monoclonal antibody (mAb). The product features a fiber-based Protein A platform which enables a 20-fold increase in productivity.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Downstream Processing Market

By Product

By Technique

By Application

By Regional