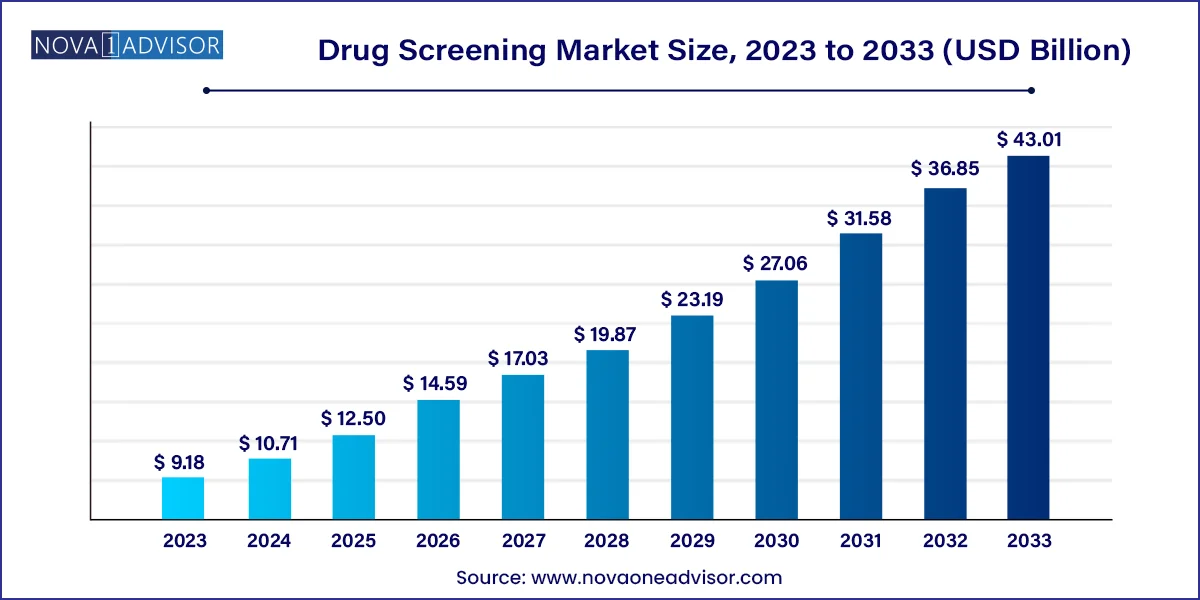

The global drug screening market size was valued at USD 9.18 billion in 2023 and is anticipated to reach around USD 43.01 billion by 2033, growing at a CAGR of 16.7% from 2024 to 2033.

The market growth is attributed to the rising substance abuse, stringent regulations, government funding, technological advancements, and increasing demand for substance testing across sectors like healthcare and sports, driven by the need for effective substance abuse detection and management.

The increasing consumption of drugs and alcohol globally is a significant driver for the growth of the industry. For instance, around 83.4 million adults (29%) in the EU have reportedly used illicit drugs at least once, according to the 2023 European Drug Report. In addition, drug use continues to be high worldwide, with an estimated 296 million users in 2021, representing 5.8% of the global population aged 15-64. This substantial increase in illicit substance and alcohol consumption, often associated with public safety concerns, is expected to escalate the demand for illicit substance screening solutions and propel industry growth.

The growing number of individuals engaging in drug use globally is directly contributing to the increased demand for screening products and services, driving innovation and advancements in the industry to cater to the rising need for effective screening solutions. Furthermore, developing improved screening technology and growing awareness of the benefits of alcohol or illicit substance screening are creating business opportunities. Moreover, the increased alcohol consumption among adolescents and the elderly is likely to fuel the demand for testing kits. The advent of workspace-based regulatory steps is expected to create opportunities for the market players, further contributing to the market's expansion.

According to the Quest Diagnostics Drug Testing Index Analysis, post-accident workforce drug positivity for cannabis reached a 25-year high in 2022. Based on more than 10.6 million hair, de-identified urine, and oral-fluid substance test results, this analysis provides crucial insights into substance use patterns among the American workforce, highlighting the significance of substance testing in workplace settings. In addition, the growth of substance testing on arrests by police forces within England and Wales has resulted in nearly 100,000 drug tests conducted on suspects since March 2022. The data from these sources highlight the significant impact of testing initiatives on addressing illicit substance-related issues in law enforcement and workplace environments.

The regulatory body's approval of the new drug test also contributes to the industry expansion. For instance, in October 2023, the FDA's approval of the Alltest Fentanyl Urine Test Cassette, a rapid test for detecting fentanyl in urine, contributed to the expansion of the industry. This development provides a new tool for the preliminary detection of fentanyl, a significant driver in market's growth. The test's ability to detect fentanyl in urine samples helps in addressing the opioid crisis by enabling early detection and intervention. This innovation is expected to drive the demand for products and services, particularly in the context of opioid abuse and misuse.

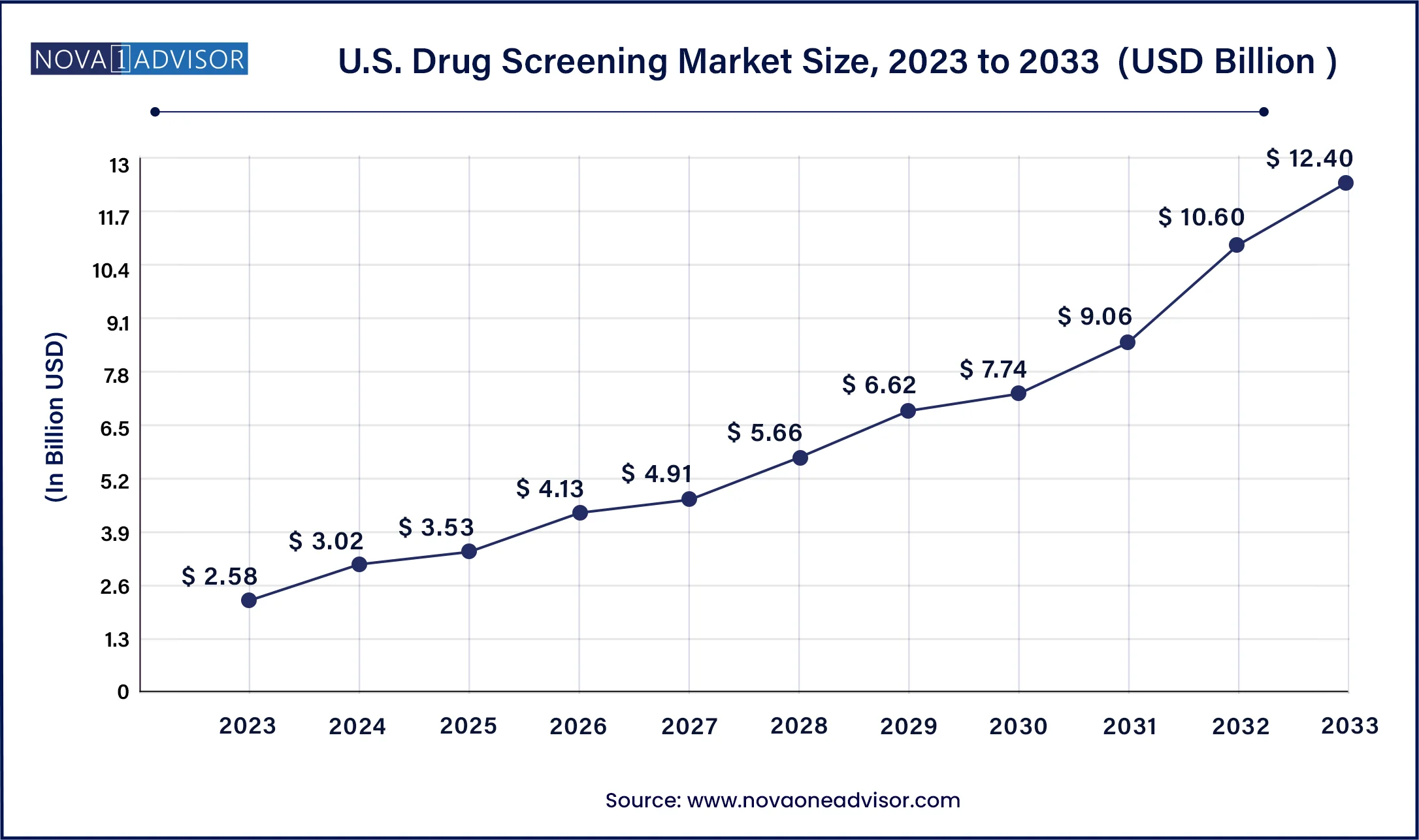

The U.S. drug screening market size is projected to be worth around USD 12.40 billion by 2033 from USD 2.58 billion in 2023, at a CAGR of 17.0% from 2024 to 2033.

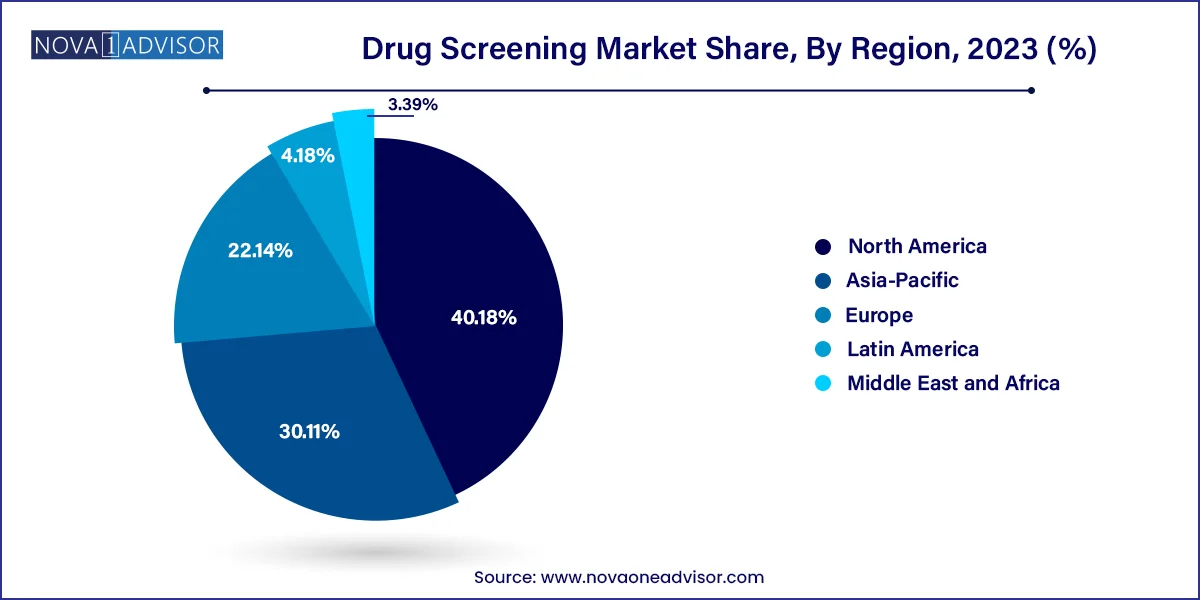

North America drug screening market accounted for a 40.18% share in 2023. The region's high consumption of illegal substances and the necessity for workplace drug tests significantly contributed to its market share. In the U.S. in 2021, there were over 80,000 opioid overdose deaths, with a significant portion attributed to synthetic opioids like fentanyl. Similarly, Canada witnessed a rise in illicit substance overdose deaths linked to the proliferation of synthetic opioids, particularly fentanyl. The prevalence of opioid-related deaths in both countries underscores the urgent need for effective screening measures. In addition, with an estimated 13.2 million people injecting illicit substances in 2021, North America has the highest number of individuals engaging in injection substance use globally. This growing trend emphasizes the importance of robust public health interventions and strategies to address the risks associated with substance abuse, further solidifying North America's position as a dominant force in the market.

U.S. Drug Screening Market Trends

The drug screening market in the U.S. is expected to grow over the forecast period due to frequent approvals and product launches, aided by increasing investment in the advancement of substance screening solutions.

Europe Drug Screening Market Trends

The drug screening market in Europe was identified as a lucrative region in this industry. The growth of the market in the region can be attributed to the increasing substance abuse in the region and the local presence of key market players in this region.

The drug screening market in the UK is expected to grow over the forecast period due to the presence of well-established healthcare infrastructure, high disposable income, and rising awareness of the benefits of substance screening.

France drug screening market is expected to grow over the forecast period attributed to the advancements in screening technology, including smart, efficient, and fast solutions.

The drug screening market in Germany is expected to grow over the forecast period due to the rising number of initiatives taken by the government to help spread awareness. Increasing government funding for pharmaceutical research supports the development and adoption of substance-screening products and services.

Asia Pacific Drug Screening Market Trends

The drug screening market in Asia Pacific is anticipated to witness fastest growth over the forecast period. The presence of large target population, high unmet clinical needs, and developing healthcare is anticipated to provide high growth potential for the industry in the region. The region's increasing investment in healthcare infrastructure and research and development activities, leading to advancements in technologies and methodologies. In addition, the rising prevalence of chronic diseases, the need for effective disease monitoring, and the growing trend of outsourcing drug discovery services have fueled the demand in the Asia Pacific region. For instance, the region's growing population, particularly in countries like China and India, is driving the demand for healthcare services, including substance screening. Furthermore, the increasing awareness about the importance of illicit substance screening in the diagnosis and treatment of diseases is also contributing to the growth of the Asia Pacific region.

China drug screening market is expected to grow over the forecast period due to the growing focus on improving healthcare R&D aided with development of novel technologies.

The drug screening market in Japan is expected to grow over the forecast period due to the presence of well-established healthcare system and high adoption of advanced diagnosis tests & therapies for effective diagnosis.

Latin America Drug Screening Market Trends

The drug screening market in Latin America was identified as a lucrative region in this industry. Technological advancements and the growing awareness of the benefits of alcohol or illicit substance-testing in the region are anticipated to fuel market growth.

Brazil drug screening market is expected to grow over the forecast period due to the concerns related to public safety, such as substance abuse promoting violence and impaired driving, driving the demand for drug testing solutions.

MEA Drug Screening Market Trends

The drug screening market in MEA was identified as a lucrative region in this industry. The market in this region is driven by the increasing consumption of illicit substances and alcohol, aided with improvements in healthcare infrastructure.

Saudi Arabia drug screening market is expected to grow over the forecast period owing to the need for better diagnostics and improvements in treatment options due to increasing consumption of illicit substance and alcohol.

| Report Attribute | Details |

| Market Size in 2024 | USD 10.71 Billion |

| Market Size by 2033 | USD 43.01 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 16.7% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product type, sample type, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Abbott; Quest Diagnostics Incorporated; F. Hoffmann-La Roche Ltd; Thermo Fisher Scientific Inc.; Siemens Healthcare AG; Laboratory Corporation of America Holdings; Alfa Scientific Designs, Inc.; OraSure Technologies, Inc.; Omega Laboratories, Inc.; Drägerwerk AG & Co. KGaA; Bio-Rad Laboratories, Inc. |

Consumables led the market and accounted for 35.18% of the global revenue in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. This dominance is attributed to the fact that consumables, such as assay kits, sample collection devices, and calibrators & controls, are crucial for on-site illicit substance testing, readily available, and must be repeatedly purchased due to their one-time use nature. In addition, immunoassay analyzers, often used with consumables, provide quick and cost-effective screening of samples in various matrices, further contributing to the segment's significance in the market. This reliance on consumables for accurate and efficient drug testing processes highlights their pivotal role in the drug screening industry. Moreover, product launch by the industry player further contributes to the segment growth. For instance, in June 2023, Sysmex launched assay kits to measure amyloid beta (Aβ) levels in blood, which can help identify Aβ accumulation in brain, a characteristic of Alzheimer's disease.

Services and others held the second-largest market share in 2023 due to their significant role in providing essential services and support for substance screening processes. This segment encompasses screening services, laboratory services, and other related services that are crucial for accurate and efficient testing. For instance, drug testing laboratories, drug treatment centers, and pain management centers fall under this category, offering specialized services for drug testing. In addition, this segment includes analytical instruments, rapid testing devices, and drug screening services that play a vital role in conducting drug tests effectively. The growth of this segment is driven by the increasing demand for reliable screening measures, the rise in substance abuse issues, and the need for innovative testing technologies to address evolving challenges in drug testing. The emphasis on providing comprehensive services and advanced solutions to cater to diverse industries and end-users contributes to the dominance of the services and others segment in the marketplace.

Drug treatment centers led the market with a market share of 27.22% in 2023. The segment dominance can be attributed to the increasing focus on substance abuse treatment and rehabilitation, leading to a higher demand for drug testing services in these centers. Drug treatment centers play a crucial role in providing comprehensive care and support to individuals struggling with substance abuse, making drug screening an essential component of their services. In addition, the rising prevalence of drug addiction contributes to the segment's share. For instance, according to the Addiction Center, about 25% of people who use illicit substances develop an addiction, emphasizing the need for effective monitoring and management of patients undergoing treatment, further strengthening the segment's share.

Pain management centers is projected to witness fastest growth rate over the forecast period. The increasing demand for specialized pain management services and the rising prevalence of chronic pain conditions globally. Pain management centers play a crucial role in providing comprehensive care and treatment for individuals suffering from various forms of chronic pain, driving the need for efficient drug screening within these facilities. In addition, the presence of key companies such as Boston Scientific Corp., Medtronic, and Abbott in the market supports the growth of this segment through strategic initiatives and technological innovations.

Urine Samples led the market with a market share of 42.16% in 2023. Urine is most often the preferred test substance because of ease of collection. Urine testing is non-invasive, detecting a wide range of drugs, including illegal and prescription drugs, and provides a longer detection window for drug use identification. The rising application of urine drug testing for monitoring patients with long-term opioid therapy further propelled the segment’s growth. In addition, urine drug testing is generally more cost-effective compared to other testing methods, such as hair testing. These advantages and the growing demand for comprehensive and reliable drug screening contributed to the urine samples segment's dominance.

Oral fluid samples held the second-largest market share in the market in 2023. Oral fluid samples are easier to collect compared to other sample types, making the testing process more convenient and less invasive for individuals. In addition, oral fluid samples can rapidly detect drug substances, allowing for quicker results and decision-making. Moreover, the enforcement of stringent laws and regulations for substance examining methods and alcohol testing by authorities has also contributed to the growth of the oral fluid samples segment. This segment is expected to continue its dominance due to the growing demand for efficient and less invasive testing methods.

The following are the leading companies in the drug screening market. These companies collectively hold the largest market share and dictate industry trends.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Drug Screening market.

By Product Type

By Technology

By End-use

By Region