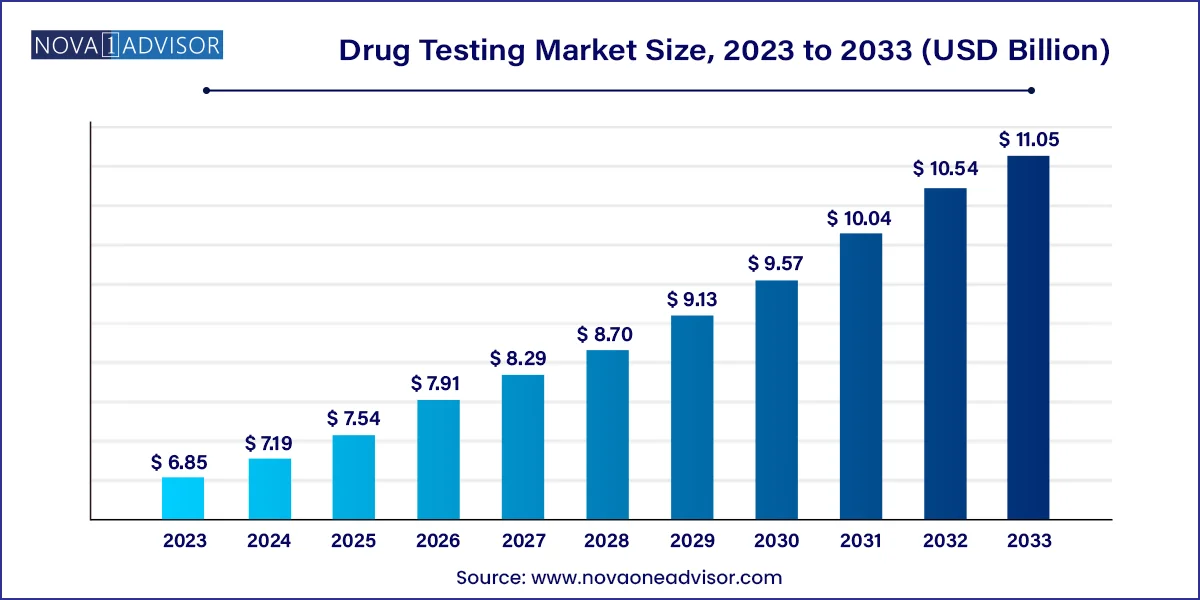

The global drug testing market size was valued at USD 6.85 billion in 2023 and is anticipated to reach around USD 11.05 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

The global drug testing market is witnessing robust growth, driven by the rising prevalence of substance abuse, increasing workplace safety regulations, growing governmental support for drug screening programs, and a shift toward preventive healthcare. Drug testing is widely implemented across diverse sectors including law enforcement, transportation, healthcare, educational institutions, and corporate organizations to monitor, deter, and detect the use of illicit substances.

In recent years, the market has been significantly influenced by evolving legal frameworks, particularly around cannabis legalization in several countries. While this has introduced regulatory complexity, it has also expanded testing applications for compliance monitoring. The integration of rapid diagnostics, point-of-care testing devices, and artificial intelligence-based analysis is reshaping operational capabilities in both centralized laboratories and decentralized testing facilities.

As of 2024, the global drug testing market was valued at over USD 8.5 billion and is projected to surpass USD 17 billion by 2034, growing at a steady CAGR. The market spans a diverse range of products and services, from high-precision laboratory analyzers to handheld devices for on-the-spot testing. Growth is especially prominent in regions with stringent workplace safety mandates and proactive anti-drug policies.

Adoption of Rapid Testing Devices: Demand for point-of-care drug tests has surged in occupational health and emergency care, enabling faster decision-making.

Expansion of Drug Panels: Testing protocols have expanded to cover newer synthetic drugs, designer opioids, and recreational substances like LSD and psilocybin.

Rise in Cannabis Testing Post-Legalization: Legalization has increased cannabis use, prompting heightened screening in safety-sensitive industries such as aviation and logistics.

Technological Advancements: Integration of AI, cloud-based data management, and portable mass spectrometry has improved test accuracy and workflow automation.

Telehealth Integration for Remote Testing: Drug screening kits are increasingly integrated into telemedicine services for remote or home-based monitoring.

Workplace Drug Testing Programs: Corporates are prioritizing employee well-being and productivity through regular testing programs and pre-employment screenings.

Government and Insurance Incentives: In countries like the U.S. and Canada, federal support for opioid crisis management and insurance reimbursements are fueling adoption.

| Report Attribute | Details |

| Market Size in 2024 | USD 7.19 Billion |

| Market Size by 2033 | USD 11.05 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, sample, drug, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Quest Diagnostics Incorporated; Abbott; F. Hoffmann-La Roche Ltd.; Quidel Corporation; Thermo Fisher Scientific, Inc.; Siemens Healthcare GmbH; Bio-Rad Laboratories, Inc.; Agilent Technologies, Inc.; Laboratory Corporation of America Holdings; Clinical Reference Laboratory Inc.; Cordant Health Solutions |

A primary driver for the global drug testing market is the increasing prevalence of substance abuse combined with strict enforcement of workplace safety regulations. According to the World Drug Report by the United Nations, over 296 million people used drugs in 2022, with a steady increase each year. The societal and economic implications of drug abuse—ranging from accidents to loss in productivity—have pressured governments and employers to adopt regular screening protocols.

Workplace drug testing, in particular, is mandated in industries where operational safety is paramount. For instance, transportation, aviation, construction, and healthcare facilities are required to comply with regulations from bodies such as the U.S. Department of Transportation (DOT) and the Occupational Safety and Health Administration (OSHA). These measures have intensified demand for accurate, reliable, and scalable drug testing solutions, fueling market growth.

One of the most significant restraints in the market is the ethical and legal complexities surrounding drug testing practices. While intended to promote safety and health, drug screening—especially in workplaces—has often raised questions about privacy rights, consent, and discrimination. In some jurisdictions, employees have successfully challenged employer-led testing protocols on grounds of invasive surveillance or disproportionate penalties for trace amounts of legal or prescription drugs.

Further complications arise with the decriminalization or legalization of cannabis in countries like Canada and certain U.S. states. Employers are often caught in a legal grey zone when trying to balance zero-tolerance policies with changing societal norms. Additionally, there is rising concern about false positives and the risk of stigmatization, particularly in populations undergoing treatment for past substance abuse. These issues can deter organizations from implementing rigorous testing frameworks and may result in selective application, thus limiting market penetration.

An emerging opportunity in the market is the expansion of at-home and remote drug testing, particularly through eHealth platforms. Driven by the shift toward telehealth and digital health models, at-home test kits are now available for purchase online, offering users the ability to screen for drugs discreetly and at their convenience. These solutions have gained traction among healthcare providers offering addiction recovery programs and remote patient monitoring services.

At-home testing is particularly valuable in rural or underserved areas where access to clinical labs is limited. Innovations in sample collection methods—such as saliva and hair tests—have enabled easy administration with minimal supervision. Additionally, results can now be verified using smartphone apps, AI algorithms, and cloud-based dashboards, creating seamless and secure data sharing between patients, providers, and caregivers. This trend not only broadens market reach but also aligns with the growing demand for personalized and accessible healthcare.

The consumables segment dominated the market with a share of 36.12% in 2023 Many companies, law enforcement agencies, and educational institutions outsource their testing needs to accredited labs due to the accuracy, scalability, and legal defensibility of laboratory results. These service providers offer a wide range of testing panels, sample types, and compliance documentation, making them the preferred choice for high-volume screening.

Rapid testing devices are anticipated to witness the fastest growth over the forecast period, This segment includes urine dip cards, oral fluid swabs, and handheld analyzers that are widely used in field testing, emergency rooms, and occupational health settings. Their cost-effectiveness, portability, and simplicity are driving adoption in small businesses, educational campuses, and remote locations. Moreover, the COVID-19 pandemic has accelerated the development of self-administered drug testing kits, further boosting the rapid device segment.

The urine sample dominated the market and accounted for the largest share of 40.18% in 2023. This preference is due to the ease of collection, cost-effectiveness, and the wide availability of test panels and interpretation protocols. Urine testing is suitable for detecting a broad range of substances and is mandated by federal regulations for transportation and safety-critical industries. The standardized nature of urine testing makes it a staple in pre-employment, random, and post-accident screening processes.

The oral fluid samples are gaining traction as the fastest-growing segment due to their non-invasive collection process, reduced risk of sample adulteration, and suitability for detecting recent drug use. They are particularly effective for on-site and roadside testing, making them ideal for law enforcement and transport safety authorities. Advances in saliva assay technology and increased regulatory approvals for oral fluid devices are further propelling this segment's growth. Furthermore, oral testing aligns well with remote and telehealth applications due to its simplicity and rapid turnaround time.

The cannabis/marijuana dominated the market and accounted for the largest share of 24.16% in 2023. Despite its legalization in parts of North America and Europe, cannabis remains a banned substance in many professional environments. This creates sustained demand for THC-specific tests, particularly in sectors such as aviation, transportation, and law enforcement where safety standards are non-negotiable.

The cannabis/marijuana segment is also expected to register the fastest growth during the forecast period. The increasing incidence of fentanyl and methamphetamine abuse has prompted the expansion of drug panels to include these substances. Testing for LSD and hallucinogens, although less prevalent, is also growing in response to recreational use and psychotherapeutic experimentation. This evolving drug landscape necessitates continuous innovation in assay development and test customization.

The drug testing laboratories segment dominated the end use segments with the largest market share of 36.11% in 2023. These labs are equipped with advanced testing technologies such as gas chromatography-mass spectrometry (GC-MS) and high-performance liquid chromatography (HPLC) that ensure reliable results. Laboratories also offer expanded testing menus, chain-of-custody documentation, and court-admissible reporting, making them indispensable for government, healthcare, and legal clients.

The workplace segment is anticipated to grow at the fastest growth rate over the forecast period. Many employers have integrated drug screening into their hiring processes, routine employee evaluations, and wellness programs. The rise of flexible employment models and gig economy participants has also necessitated broader and more frequent testing protocols. With increasing investment in workplace safety and productivity, this segment is poised to drive substantial market expansion.

North America Dominates the Global Drug Testing Market

North America holds the dominant share in the global drug testing market, led by the U.S., which accounts for the highest adoption rates across workplace, forensic, and healthcare settings. The region's leadership is attributed to stringent federal regulations, widespread corporate screening practices, and significant government spending on substance abuse prevention. Agencies like the Substance Abuse and Mental Health Services Administration (SAMHSA) and National Institute on Drug Abuse (NIDA) continuously support policy implementation and research, further strengthening the market ecosystem.

Moreover, North America is home to some of the largest drug testing companies and diagnostic labs, including Quest Diagnostics and LabCorp. The ongoing opioid crisis and legalization of cannabis have further intensified the demand for nuanced testing methods and comprehensive screening panels. The region’s advanced healthcare infrastructure, insurance coverage, and technological integration enable rapid adoption of innovative solutions such as tele-drug testing and AI-based reporting.

Asia-Pacific is the Fastest Growing Region

The Asia-Pacific region is emerging as the fastest-growing market, driven by rising substance abuse rates, expanding healthcare access, and heightened awareness of drug-related health and safety issues. Countries like China, India, Australia, and Japan are investing in preventive health programs and workplace regulations that incorporate routine drug testing. Urbanization, population growth, and increasing cross-border drug trafficking are prompting governments to adopt aggressive screening strategies, especially in schools, transportation, and border control.

In addition, cost-effective manufacturing capabilities and growing investment in diagnostics are fostering local innovation. Private laboratories and healthcare chains are expanding drug screening offerings to meet growing demand in tier-2 and tier-3 cities. With supportive policies and emerging diagnostic technologies, Asia-Pacific is poised to be a key revenue contributor in the coming years.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Drug Testing market.

By Product

By Sample

By Drug

By End-use

By Region