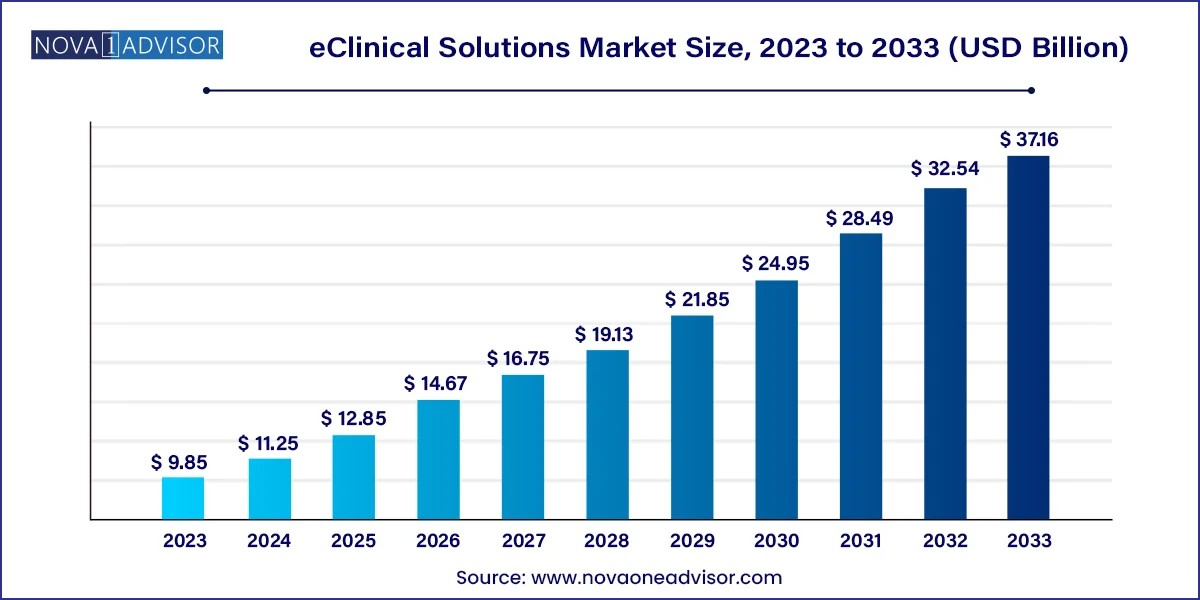

The global eclinical solutions market size was valued at USD 9.85 billion in 2023 and is projected to surpass around USD 37.16 billion by 2033, registering a CAGR of 14.2% over the forecast period of 2024 to 2033.

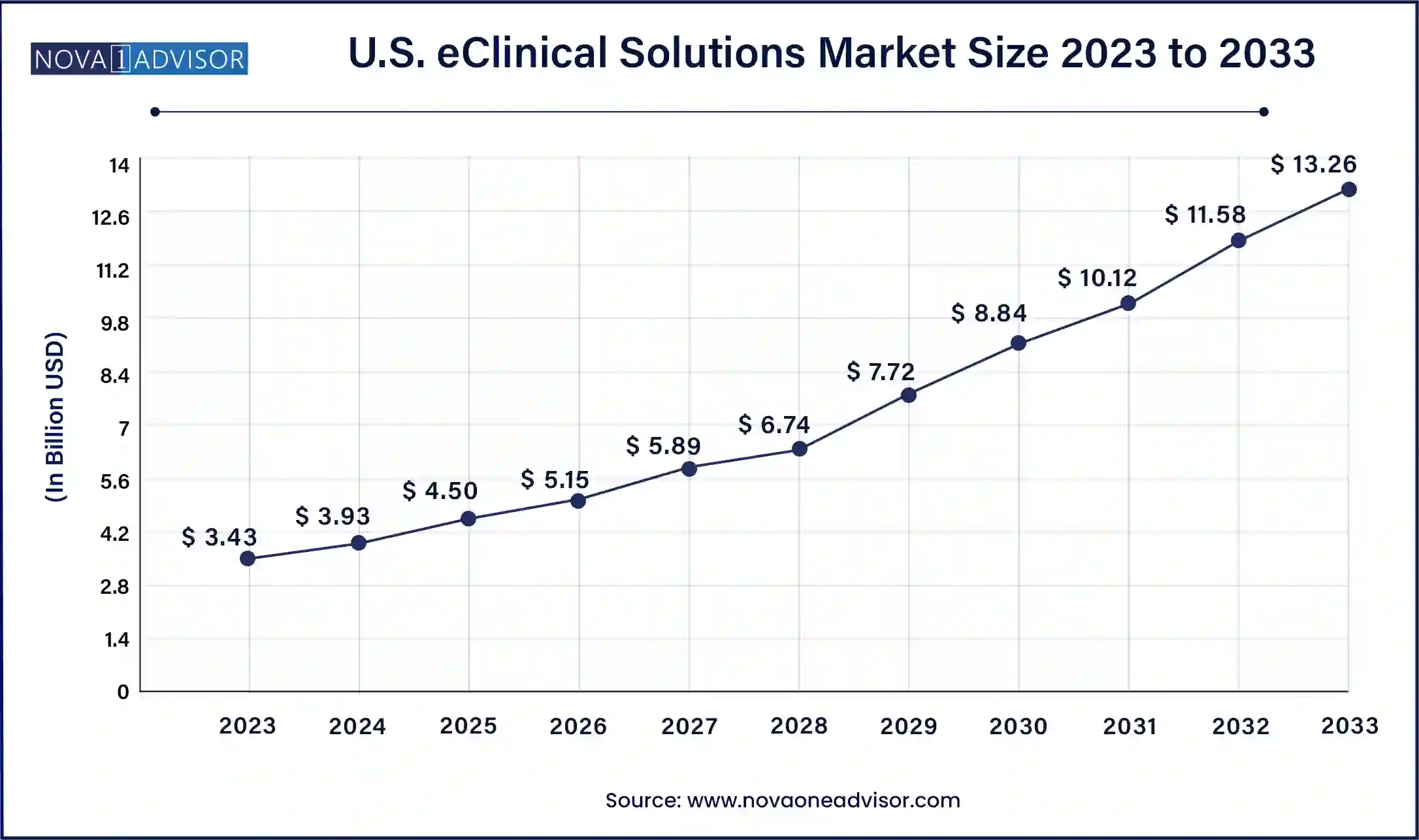

The U.S. eclinical solutions market size was valued at USD 3.43 billion in 2023 and is anticipated to reach around USD 13.26 billion by 2033, growing at a CAGR of 14.5% from 2024 to 2033.

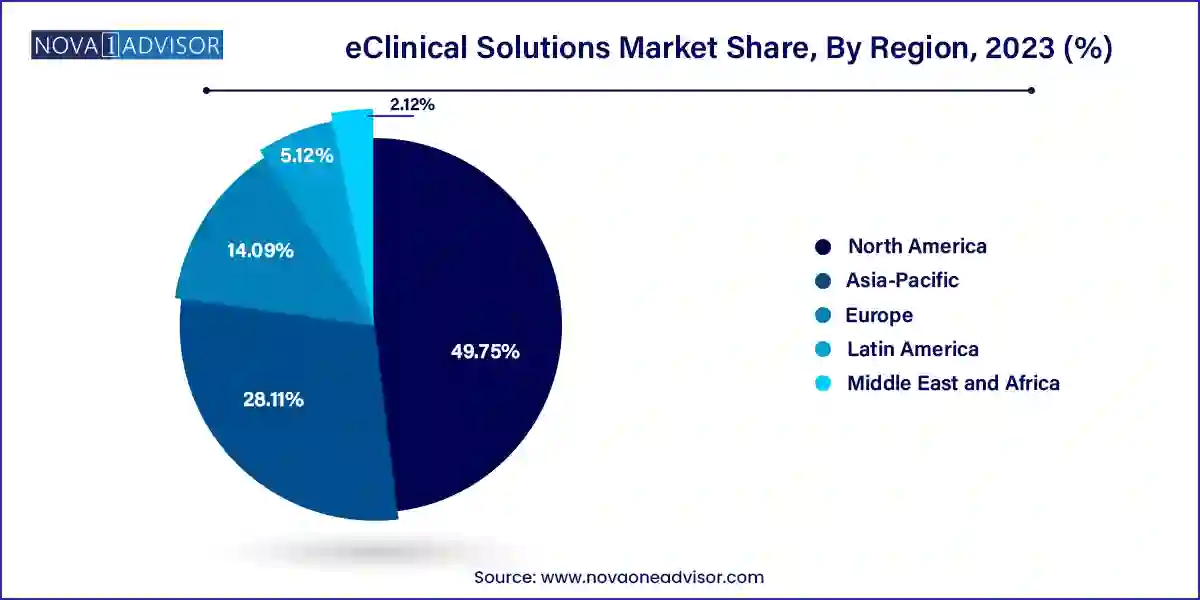

North America is the leading region in the eClinical solutions market, driven by a high concentration of biopharmaceutical companies, regulatory clarity, and advanced healthcare IT infrastructure. The U.S. is home to leading solution providers such as Medidata Solutions, Oracle Health Sciences, and Veeva Systems. The region’s commitment to innovation in digital health and its rapid response to remote trial technologies during the COVID-19 pandemic have further strengthened its position. Regulatory agencies like the FDA actively support the use of electronic systems, further facilitating widespread adoption.

Asia-Pacific is the fastest-growing region due to the increasing number of clinical trials being conducted across China, India, Japan, and South Korea. Cost advantages, diverse patient populations, and improved regulatory frameworks have attracted global sponsors to the region. Local CROs and hospitals are increasingly investing in eClinical infrastructure to meet international standards. Additionally, the rise of regional software vendors and partnerships with global technology firms is boosting adoption. Government initiatives to digitize healthcare and promote pharmaceutical innovation are also playing a key role in accelerating growth.

The eClinical solutions market represents a pivotal transformation in the way clinical trials are designed, executed, and monitored. These digital technologies optimize the clinical development process by integrating disparate trial data sources, automating routine processes, and enhancing overall data quality, thereby accelerating the path from molecule to market. eClinical solutions encompass a broad range of software and platforms used throughout all phases of clinical trials, including electronic data capture (EDC), clinical data management systems (CDMS), electronic trial master files (eTMF), clinical trial management systems (CTMS), randomization tools, and safety platforms.

With pharmaceutical and biotechnology companies increasingly under pressure to reduce R&D timelines and costs, eClinical platforms offer a strategic advantage. The digitization of clinical trials not only expedites decision-making but also supports regulatory compliance and real-time monitoring. As of the post-pandemic era, decentralized clinical trials (DCTs), virtual patient engagement, and remote monitoring have emerged as core themes in clinical operations, further accelerating the demand for cloud-based and integrated eClinical technologies.

Additionally, the market has benefited from a surge in clinical trials, driven by novel therapeutic development in areas such as oncology, rare diseases, and infectious diseases. Contract Research Organizations (CROs) have also emerged as vital users and promoters of eClinical tools, offering end-to-end services to sponsors while leveraging sophisticated digital infrastructure. As the industry shifts toward data-driven decision-making and patient-centric models, the eClinical solutions market is positioned for rapid and sustained growth over the next decade.

Rise of Decentralized Clinical Trials (DCTs): The adoption of virtual trial models is driving the use of eConsent, remote monitoring, and electronic data capture tools.

Increased Use of AI and Predictive Analytics: Clinical analytics platforms are integrating machine learning algorithms to forecast trial outcomes and identify anomalies in real time.

Cloud-First Deployment Strategies: Life sciences companies are transitioning from on-premise to cloud-based platforms for scalability, collaboration, and faster implementation.

Integrated Data Management Ecosystems: Demand for unified platforms that consolidate data from EDC, eCOA, eTMF, and other systems into a single clinical data warehouse.

Regulatory Push for Digital Documentation: Regulatory bodies like the FDA and EMA are endorsing eSource and digital trial master files, encouraging electronic documentation.

Patient-Centric Technologies: eCOA platforms and mobile-based trial interfaces are being developed to enhance patient compliance and real-world data collection.

Blockchain in Clinical Trials: Emerging applications of blockchain technology are being explored for ensuring data traceability, consent validation, and protocol compliance.

| Report Attribute | Details |

| Market Size in 2024 | USD 11.25 Billion |

| Market Size by 2033 | USD 37.16 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 14.2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, delivery mode, development phase, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Fountayn, formerly known as Datatrak International, Inc.; Oracle; Calyx, formerly part of Parexel International Corporation; Medidata (Dassault Systemes); CRF Health (Signant Health); Clario (ERT and Bioclinica); eClinicalWorks; Merative (IBM Watson Health); Anju Software; eClinical Solutions; MaxisIT; IQVIA; Castor; Veeva Systems |

A key driver behind the growth of the eClinical solutions market is the rising complexity of clinical trials. As clinical research increasingly involves multiple trial sites, global patient populations, combination therapies, and adaptive trial designs, the traditional paper-based or fragmented electronic systems have proven inadequate. Trials in oncology, rare diseases, and immunotherapies now demand real-time access to data, cross-platform integration, and dynamic protocol management.

To meet regulatory demands for data transparency, quality assurance, and subject protection, sponsors are turning to eClinical tools that standardize workflows, ensure audit readiness, and facilitate electronic submissions. Agencies like the FDA’s CDER (Center for Drug Evaluation and Research) have advocated for digital transformation through guidelines on electronic source data, eConsent, and eCOA usage. As a result, eClinical solutions have become indispensable for clinical operations, regulatory teams, and pharmacovigilance groups, driving strong and sustained demand across development phases.

Despite its advantages, one of the core restraints in the eClinical solutions market is the high upfront cost and complexity associated with implementation. Integrating eClinical systems with existing IT infrastructure, Electronic Health Records (EHRs), and laboratory information systems can be technically demanding and resource-intensive. Small and mid-sized sponsors often struggle with capital investment requirements, particularly for platforms offering comprehensive data integration and analytics.

Additionally, the multiplicity of vendors and lack of interoperability standards complicate data consolidation and system harmonization. This not only increases IT dependency but also raises concerns about data migration errors, compliance risks, and staff training needs. Even cloud-based platforms, while more accessible, require significant change management to overcome resistance within traditionally conservative clinical operations departments.

An emerging opportunity in the eClinical market lies in the integration of artificial intelligence (AI) and machine learning (ML) into clinical trial processes. AI algorithms can identify patterns in trial data that humans might miss, optimizing site selection, improving patient recruitment, and enhancing risk-based monitoring. By analyzing historical trial data, AI can forecast dropout risks, predict protocol deviations, and recommend protocol amendments to improve efficiency and success rates.

AI-powered clinical analytics platforms are also enabling dynamic trial designs and adaptive responses to interim results. Companies are investing in real-time dashboards that integrate predictive models with trial data streams, giving sponsors a proactive edge. Moreover, NLP-based AI tools are assisting in unstructured data extraction from clinical narratives, lab reports, and investigator notes. The infusion of AI into eClinical ecosystems not only improves trial outcomes but also accelerates timelines, offering a compelling value proposition to stakeholders.

Electronic Data Capture (EDC) and Clinical Data Management Systems (CDMS) dominate the eClinical solutions market due to their foundational role in data collection and processing across clinical trials. These systems are essential for capturing, cleaning, validating, and locking data from trial sites and electronic sources. Their wide adoption in Phase II and III studies reflects their utility in managing high-volume, multicenter datasets. Platforms like Medidata Rave, Oracle InForm, and Veeva Vault CDMS have become industry standards due to their scalability, regulatory compliance features, and support for diverse trial designs.

Clinical Analytics Platforms are emerging as the fastest-growing product category, driven by the need for real-time insights and predictive decision-making. These platforms allow researchers to monitor site performance, protocol adherence, patient safety, and trial efficiency using dashboards and data visualizations. By integrating AI and machine learning, they enable risk-based monitoring and early warning systems for potential trial failures. As stakeholders seek operational agility and data transparency, investment in advanced analytics tools is expected to soar, making this the most dynamic segment in the coming years.

Cloud and web-based platforms dominate the eClinical solutions landscape, reflecting a major shift in deployment strategies. Cloud-based solutions offer flexibility, faster implementation, and scalability, making them especially appealing to CROs and small-to-midsize biotechs. These platforms support remote trial monitoring, site communication, and centralized data access, all of which are vital in decentralized and hybrid trial models. Vendors like Veeva Systems, Medidata, and Bio-Optronics have spearheaded this shift with robust cloud-native offerings.

On-premise solutions, while still in use among large pharmaceutical companies with dedicated IT infrastructure, are declining in popularity. The cost of maintaining on-site servers, updating software, and managing compliance manually is increasingly viewed as inefficient. Moreover, cloud platforms now offer strong cybersecurity, backup, and GxP compliance capabilities, addressing earlier concerns and accelerating the market transition.

Phase III trials account for the largest share of the eClinical market due to their complexity, duration, and volume of data. These pivotal trials often span multiple geographies and involve thousands of patients, requiring robust data management, regulatory documentation, and safety monitoring systems. EDC, eCOA, CTMS, and RTSM platforms are extensively used in Phase III studies to ensure data integrity, patient tracking, and endpoint analysis. Sponsors invest heavily in eClinical infrastructure during this phase to ensure successful regulatory approval and market access.

Phase I trials, though smaller in scale, are growing rapidly in terms of eClinical adoption. Increasingly, early-phase trials are being conducted in parallel cohorts or adaptive designs that demand dynamic data collection and near real-time decision-making. Integration of safety monitoring systems, eConsent, and cloud-based CTMS is becoming more common even at this early stage. The growth of first-in-human biologics and precision therapies is further contributing to this trend, making Phase I trials a hotbed for eClinical innovation.

Pharma and biotech organizations lead the market due to their direct involvement in drug development pipelines. These stakeholders rely on eClinical tools for protocol design, patient enrollment, safety reporting, and trial management. Large pharmaceutical companies have adopted end-to-end platforms that integrate CTMS, EDC, analytics, and document management for streamlined operations. With increasing investment in specialty therapeutics and biologics, these organizations are doubling down on digital infrastructure to maintain competitive advantage.

Contract Research Organizations (CROs) are the fastest-growing end users, acting as the operational backbone for many sponsors. CROs handle clinical development on behalf of pharmaceutical companies, and eClinical tools enhance their ability to manage multiple trials simultaneously. With outsourcing on the rise, CROs are expanding their capabilities in eTMF, CTMS, and RTSM to attract sponsors and differentiate themselves. CROs are also investing in proprietary eClinical platforms, further fueling demand and innovation in the market.

Veeva Systems (March 2024): Launched Veeva Vault Study Portal, a unified site for trial stakeholders to collaborate across CTMS, eTMF, and eConsent platforms, enhancing protocol adherence and data consistency.

Medidata Solutions (February 2024): Partnered with a leading CRO to deploy its AI-driven clinical trial analytics platform in a global Phase III oncology study across 12 countries.

Oracle Health Sciences (January 2024): Introduced enhanced integration between Oracle InForm EDC and its cloud-based safety solutions, aimed at streamlining pharmacovigilance in real-time.

Clario (December 2023): Announced the expansion of its decentralized trial suite with new eCOA tools supporting wearable device integration and mobile-based patient-reported outcomes.

Medrio (November 2023): Released a no-code eClinical platform targeting mid-sized biotech firms, enabling flexible trial design and rapid deployment of EDC and RTSM modules.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the eClinical Solutions market.

By Product

By Delivery Mode

By Development Phase

By End-use

By Region