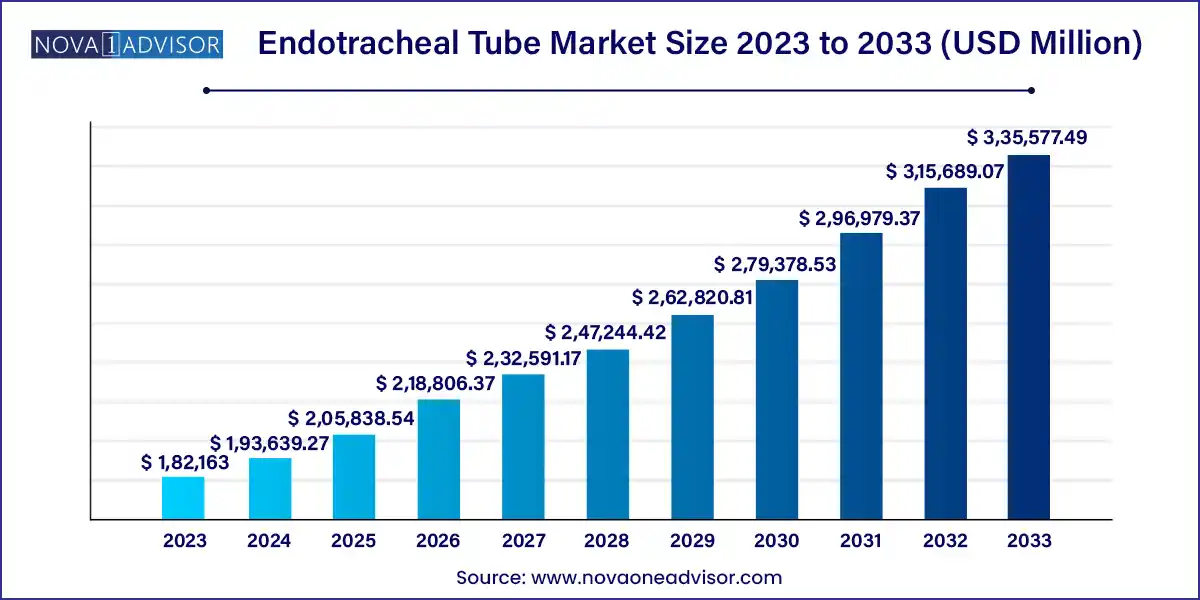

The global endotracheal tube market size was exhibited at USD 182,163.00 million in 2023 and is projected to hit around USD 335,577.49 million by 2033, growing at a CAGR of 6.3% during the forecast period of 2024 to 2033.

The Endotracheal Tube Market is a critical segment within the global medical device and respiratory care industry. Endotracheal tubes (ETTs) are life-saving devices primarily used for airway management, enabling ventilation and protecting the airway in patients who are unconscious, critically ill, or undergoing surgery. They are essential tools in emergency departments, operating rooms, intensive care units (ICUs), and during pre-hospital emergency response.

The market’s growth is propelled by a range of clinical needs: from anesthesia delivery and emergency trauma care to prolonged mechanical ventilation for critically ill patients. The COVID-19 pandemic underscored the indispensable role of endotracheal tubes, with millions of patients requiring intubation worldwide. Beyond pandemics, the increasing burden of respiratory diseases, trauma incidents, and surgical procedures continues to drive global demand.

Additionally, technological advancements have led to innovations such as reinforced tubes for head and neck surgeries, anti-microbial coatings to reduce ventilator-associated pneumonia (VAP), and integrated sensors for real-time monitoring. Coupled with the rising prevalence of chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea, the global market is expected to maintain strong growth over the next decade.

Surge in ICU and Surgical Admissions Post-COVID-19: The long-term implications of pandemic-induced respiratory care have elevated ICU preparedness and endotracheal tube stockpiling.

Antimicrobial and Coated Tubes Gaining Popularity: Designed to reduce VAP and other complications during prolonged intubation.

Preference for Cuffed Tubes: Enhanced airway protection and reduced aspiration risk are driving adoption, especially in adult populations.

Growth in Pediatric and Preformed Tube Demand: Customized solutions for neonatal and pediatric care are becoming increasingly important.

Integration of Smart Features: Emerging ETTs include integrated sensors for cuff pressure monitoring and placement confirmation.

Increased Use in Ambulatory Surgical Centers (ASCs): ASCs now perform a broader range of procedures requiring general anesthesia and intubation.

Focus on Single-Use and Eco-friendly Tubes: In response to infection control protocols and sustainability pressures.

| Report Coverage | Details |

| Market Size in 2024 | USD 193,639.27 Million |

| Market Size by 2033 | USD 335,577.49 Million |

| Growth Rate From 2024 to 2033 | CAGR of 6.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product Type, Route Type, Application, End- user, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Angiplast Pvt Ltd; Advin Health Care; Sterimed Group; ICU Medical, Inc.; Medtronic (Covidien); Van Oostveen Medical B.V.; Teleflex Incorporated; Convatec Inc.; Fuji Systems Corp; SEWOON MEDICAL Co., Ltd.; Mercury Medical; Hollister Incorporated; Well Lead Medical Co.,Ltd; Viggo Medical Devices; ARMSTRONG MEDICAL; Medline; BD; BRIO DEVICE, LLC.; pfm medical ag |

A significant driver for the endotracheal tube market is the rising global incidence of respiratory disorders and the growing volume of surgical procedures requiring general anesthesia. According to the World Health Organization (WHO), COPD is the third leading cause of death worldwide, and its management often involves acute interventions, including endotracheal intubation.

Similarly, surgeries involving the brain, thorax, and upper abdomen almost always necessitate airway control through intubation. With an aging population globally and increasing lifestyle-related health issues, the number of surgeries performed annually is growing. As a result, hospitals, trauma centers, and surgical clinics are expanding their usage and inventory of endotracheal tubes, fueling consistent demand.

The integration of ETTs into advanced life support protocols and their role in emergency response especially during events like cardiac arrest and trauma—further cements their indispensability in modern healthcare.

Despite its life-saving importance, the use of endotracheal tubes is not without risks. A primary restraint in the market is the high risk of complications associated with prolonged intubation, including ventilator-associated pneumonia (VAP), tracheal stenosis, and accidental extubation. VAP, in particular, is one of the most common hospital-acquired infections and significantly increases morbidity, length of hospital stay, and costs.

These risks necessitate careful monitoring, often requiring additional devices or procedures, and pose challenges especially in under-resourced healthcare settings. In addition, improper tube placement or sizing can result in damage to the trachea, impaired ventilation, and adverse outcomes, which may deter use in non-specialist environments and increase training and procedural costs.

Thus, there is a critical need for innovations that minimize risk while maintaining cost-efficiency and ease of use.

An exciting opportunity for the endotracheal tube market lies in the emergence of technologically advanced and "smart" endotracheal tubes. Companies are developing ETTs embedded with micro-sensors that monitor cuff pressure, CO₂ levels, and tube positioning in real time. These advancements significantly reduce the risk of complications such as VAP, aspiration, and unrecognized extubation.

The integration of these technologies with electronic health records (EHRs) and ICU monitoring systems supports a more proactive and predictive approach to respiratory management. Furthermore, AI algorithms can assist in detecting tube displacement or potential airway obstructions.

This innovation wave not only enhances clinical outcomes but also aligns with global trends toward personalized, digital, and preventive care models making smart ETTs a promising avenue for market expansion and product differentiation.

Regular endotracheal tubes dominate the market, representing the standard choice for most short-term surgical and emergency applications. Their affordability, ease of use, and availability in various sizes and materials make them a universal tool in both high-income and resource-limited settings. Hospitals and EMS systems typically rely on regular ETTs for a broad range of use cases including trauma, anesthesia, and respiratory failure.

However, reinforced and specialty tubes are the fastest-growing sub-segments, especially reinforced endotracheal tubes, which are crucial in head, neck, and dental surgeries where patient positioning might compromise tube patency. Double-lumen tubes are gaining traction in thoracic surgeries where lung isolation is necessary, and preformed tubes are increasingly used in ENT and pediatric surgeries due to their anatomical compliance and patient comfort.

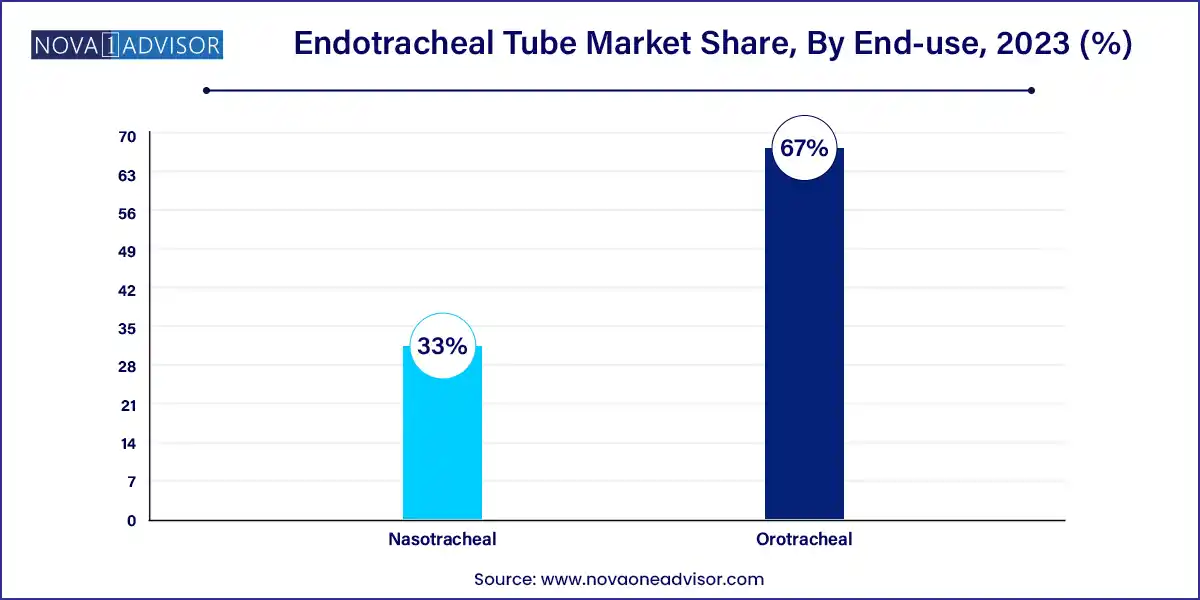

Orotracheal tubes are the most commonly used, accounting for the largest market share due to their ease of placement, wide application across emergency and surgical settings, and lower complication rates compared to nasotracheal tubes. Orotracheal intubation is the standard procedure for both elective and emergency surgeries, especially when rapid airway control is needed.

Nasotracheal tubes are growing in demand, particularly in ENT procedures, maxillofacial surgeries, and long-term intubation scenarios. Their ability to provide a secure airway without occupying the mouth offers advantages in dental surgeries and certain ICU patients. Although technically more challenging to place, they are preferred in specific surgical cases and for patients requiring speech or oral function.

Emergency treatment is the dominant application segment, driven by the frequent use of ETTs in trauma care, resuscitation, and critical care units. Emergency Medical Services (EMS), including ambulances and air transport, heavily rely on intubation to maintain the airway in life-threatening conditions such as cardiac arrest, drug overdose, or severe injury.

Therapeutic use of ETTs, especially in prolonged ventilation cases in ICUs, is a rapidly expanding application, particularly in the wake of the COVID-19 pandemic. Patients with severe respiratory failure often require mechanical ventilation over days or weeks, necessitating safe, secure, and comfortable endotracheal intubation. This growth is especially strong in high-acuity hospital settings with advanced critical care infrastructure.

Hospitals remain the largest end-user segment, as they host emergency departments, ICUs, and surgical suites—all primary users of endotracheal tubes. Tertiary hospitals maintain large stocks of multiple types and sizes of ETTs to meet varying patient and procedural needs. Moreover, hospitals are early adopters of advanced technologies such as antimicrobial-coated and sensor-enabled ETTs.

Ambulatory Surgical Centers (ASCs) are the fastest-growing segment, aligned with the healthcare industry’s shift toward outpatient procedures. Many general and specialty surgeries at ASCs now use short-term anesthesia with airway management, driving demand for reliable, compact, and easy-to-use ETTs. Specialty clinics focusing on ENT, oral-maxillofacial, and pediatric care also increasingly utilize ETTs tailored to their procedural focus.

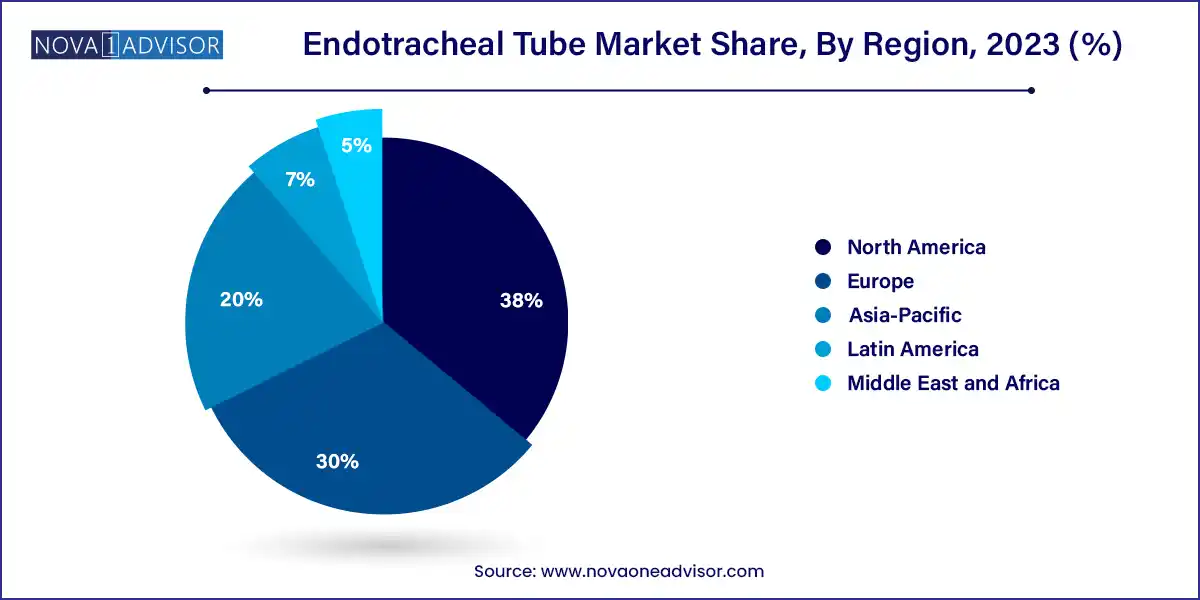

North America dominates the endotracheal tube market, owing to its advanced healthcare infrastructure, high surgical volumes, and rapid adoption of new medical technologies. The United States leads in terms of ICU capacity and surgical case load, further fueled by aging populations and chronic respiratory conditions. Leading medical device companies are headquartered here, and regulatory bodies like the FDA provide a structured pathway for innovation in airway management.

Asia-Pacific is the fastest-growing region, driven by the rapid expansion of healthcare systems in countries like China, India, and Southeast Asia. These regions are investing heavily in ICU modernization, EMS development, and hospital infrastructure, boosting the procurement of critical airway devices. In addition, the increasing burden of respiratory illnesses and the rise in elective surgeries are contributing to strong demand for both basic and specialized endotracheal tubes.

Medtronic (April 2025): Launched a new line of intelligent ETTs integrated with cuff pressure sensors and wireless alerts for ICU environments, enhancing safety in ventilated patients.

Smiths Medical (March 2025): Expanded its line of single-use reinforced ETTs tailored for ambulatory surgical centers and short-stay hospitals in North America.

Teleflex Incorporated (February 2025): Announced strategic collaboration with hospitals in the EU for pilot deployment of its antimicrobial-coated endotracheal tubes, aiming to reduce VAP incidence.

Vyaire Medical (January 2025): Rolled out its pediatric preformed ETT series across major Southeast Asian markets in response to regional demand in pediatric care facilities.

Ambu A/S (December 2024): Acquired a mid-size airway device manufacturer in India to expand its market footprint in emerging economies.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global endotracheal tube market.

Product Type

Route Type

Application

End-User

By Region