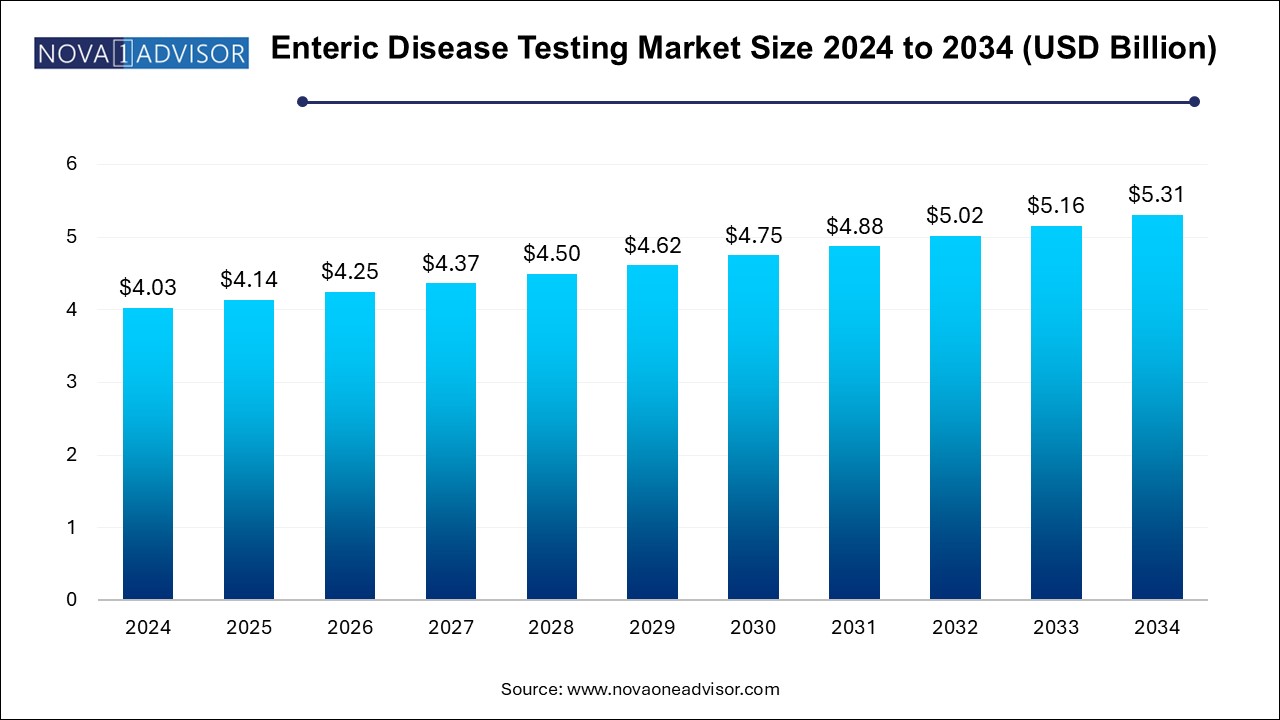

The enteric disease testing market size was exhibited at USD 4.03 billion in 2024 and is projected to hit around USD 5.31 billion by 2034, growing at a CAGR of 2.8% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.14 Billion |

| Market Size by 2034 | USD 5.31 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 2.8% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Disease Type, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Abbott; BD; Biomerica; BIOMÉRIEUX; Bio-Rad Laboratories, Inc.; Cepheid; Coris BioConcept; DiaSorin S.p.A.; Meridian Bioscience; Quest Diagnostics Incorporated |

Vital drivers of this market include technological advancements and supportive government funding in emerging economies. Furthermore, growing global demand for early diagnostics is expected to enhance the applicability of the market, fueling its growth.

Throughout the COVID-19 pandemic, there was an increasing focus on viral and bacterial infections, leading individuals to prioritize the consumption of home-cooked and hygienic food to minimize the risk of infection. Therefore, there was a decrease in the incidence of enteric diseases and a subsequent decline in the demand for enteric disease testing in 2020 and 2021. Additionally, COVID-19 testing had top priority during the pandemic, surpassing testing for other infectious diseases, due to which the demand for enteric disease testing products experienced a negative impact, thereby impeding market growth.

In regions such as Asia, Africa, and Latin America, the prevalence of enteric infections, including salmonella, campylobacter, escherichia coli, and norovirus, remains significantly high. According to the National Library of Medicine, as of 2018, a case fatality rate of 1% is observed in enteric fever cases in the Asia and Africa regions. Consequently, there is an increasing demand for enteric disease testing to enable accurate and timely diagnoses. Moreover, there is increasing awareness among individuals, healthcare providers, and government entities regarding the importance of early detection and effective management of enteric diseases. As a result, various organizations and government bodies are undertaking initiatives to enhance awareness, implement screening programs, and advocate for the utilization of diagnostic tests, thereby stimulating market growth.

The traditional diagnostic process of enteric diseases was based on the culture method which demanded skilled staff and was a time-consuming procedure. The development of molecular diagnostics and other diagnostic technologies revolutionized the enteric disease testing market over the last decade. The increasing mortality rate due to these conditions and the cost efficiency of technologically advanced diagnostic systems are expected to drive the demand for early diagnosis of these conditions.

Initial symptoms associated with enteric diseases include abdominal cramps, vomiting, nausea, and anorexia, which can progress to severe conditions characterized by substantial fluid and nutrient loss from the body. The vulnerability of pediatric and geriatric age groups to these diseases is sensitive due to their weakened immune systems. According to the Bill and Melinda Gates Foundation, annually, approximately 500,000 young children under the age of 5 succumb to enteric and diarrheal diseases, predominantly in developing nations. Furthermore, an estimated 25,000 children annually lose their lives to enteric fever, primarily affecting regions lacking access to safe water and adequate sanitation facilities.

The mild initial symptoms of enteric diseases are sometimes overlooked, which poses a significant constraint to the market. These diseases have emerged as a leading cause of morbidity and mortality globally, particularly in developing countries with inadequate drainage and sanitation infrastructure. In terms of incidence and epidemiology, it is estimated that developing nations contribute to more than 85% of the total enteric infection cases.

Rising incidence of enteric diseases and the cost-efficiency of technologically advanced diagnostic systems are expected to drive demand for the early diagnosis of enteric disease. For instance, according to the Centers for Disease Control and Prevention, salmonella bacteria cause approximately 1.35 million infections, around 26,500 hospitalizations, and about 420 deaths every year in the U.S. Increasing incidence of enteric conditions in developing economies along with a lack of adequate laboratory settings and limited awareness is expected to provide a largely untapped market. According to the Foundation Merieux, enteric diseases are the second leading cause of death among children under 5 years in Asian and African countries. In addition, 90% of deaths caused by diarrhea are due to a lack of access to safe drinking water and basic sanitation facilities. Furthermore, 90% of deaths due to typhoid occur in Asia. As of 2021, there are an estimated 11 to 21 million typhoid fever cases and 128,000 to 161,000 deaths in south Asian countries every year. Thus, the increasing prevalence of enteric disease and poor sanitation facilities in developing countries provides a largely untapped market.

Molecular diagnostics are used in various areas of microbiology, which include strain identification and isolation of enteric pathogens. Disease-causing microorganisms are also studied using different molecular diagnostics techniques. The application of molecular diagnostics in microbiology is expected to increase due to the introduction of technologically advanced instruments with improved accuracy levels. Clinical laboratories are adopting molecular diagnostics as a part of laboratory automation. Currently, polymerase chain reaction (PCR), implicit association test (IAT), and gene chip are the most widely used molecular diagnostic tests for infectious diseases. Thus, the rising adoption of molecular diagnostics in the detection of enteric diseases is expected to drive the enteric diseases market over the forecast period.

Technological advancement is another key factor accelerating market growth. Technological advancements such as gastrointestinal panel tests are used for the identification and qualitative detection of multiple parasitic, bacterial, and viral nucleic acids in individuals with signs and symptoms of gastroenteritis or infectious colitis. The tests are performed on saliva and stool samples to generate rapid results for 15 pathogens in 6 hours. It is also used for testing the inherited food sensitivities/allergies to organisms such as Toxoplasma gondii and Entamoeba histolytica. This test has been approved by the U.S. FDA. Market players undergoing clinical studies to develop a new diagnostic test with high accuracy and high-performance delivery is anticipated to drive the market. For instance,in November 2019, the XTAG Gastrointestinal (GPP) test was approved by the Food and Drug Administration (FDA). XTAG is a multiplexed nucleic acid test designed to detect multiple viral, parasitic, and bacterial nuclei in stool samples simultaneously.

Based on disease type the market of enteric disease testing is segmented into bacterial, viral, and parasitic enteric diseases. The bacterial enteric diseases segment dominated the market with the largest revenue share and is also expected to grow at the fastest CAGR during the forecast period from 2025 to 2034. Various bacteria that cause these diseases include C. difficile, E. coli, shigella, salmonella, and campylobacter. According to the National Institute of Health, C. Difficile infections affect about half a million people in the U.S. every year. About 29,000 of these people die within a month of being diagnosed with the disease and E. Coli causes approximately 63,000 cases of hemorrhagic colitis in the U.S. every year. The parasitic disease testing segment is expected to witness significant growth owing to rising incidences of such infections and the emergence of new parasitic strains. According to the World Health Organization (WHO), as of February 2023, at least 18 countries are still reporting cholera outbreaks. The mortality from these outbreaks is alarming since many countries have reported higher cholera mortality rates than in the past years. The global cholera mortality rate in 2021 was around 1.9%, and similar trends are expected for 2024 and 2023.

According to the Child Health Epidemiology Research Group (CHERG), enteric pathogens such as salmonella spp., rotavirus, and V. cholera caused more mortality as compared to other enteric pathogens and thus the WHO committee has given the highest priority to the development of new and improved vaccines against these pathogens. Even if some viruses are geographically ubiquitous, such as rotavirus, which infects about 90 percent of the population of the world younger than five years of age, most of the time infections are environmentally determined along with restricted seasonal and geographical patterns that are related to hygiene and degree of sanitation and access to clean drinking water.

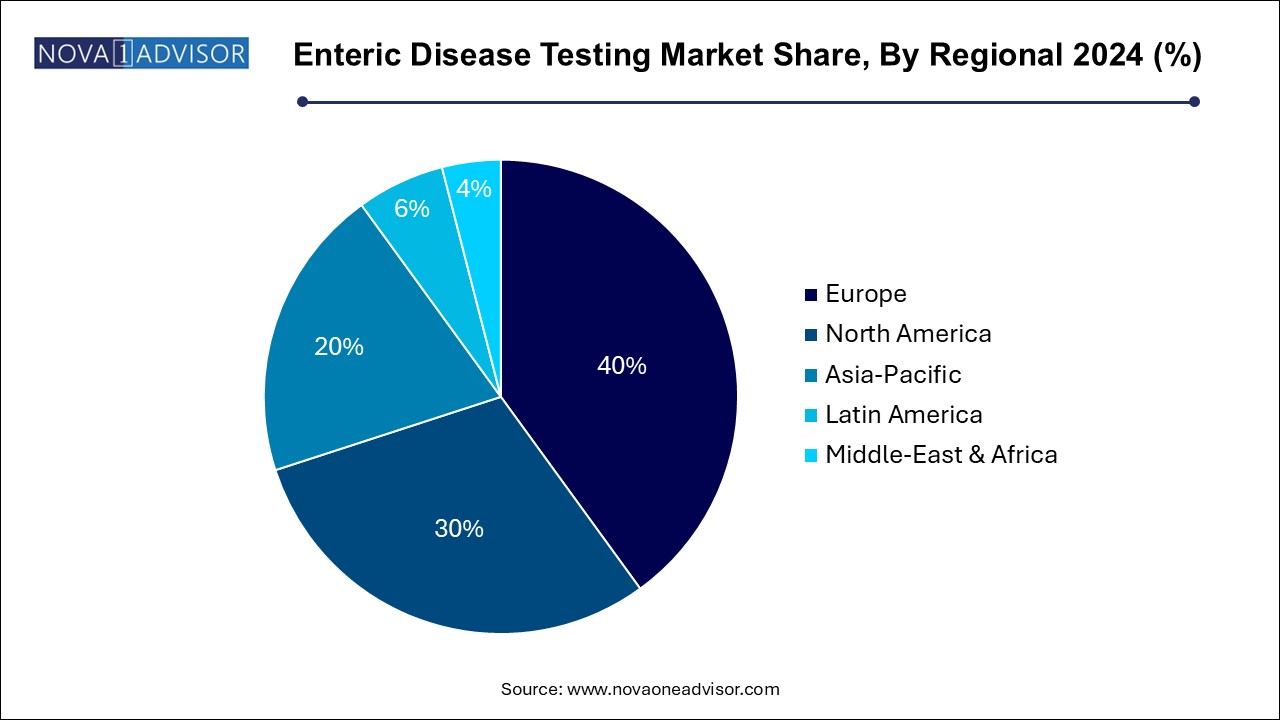

Europe dominated the market with the largest revenue share of 40.0% in 2024. Germany holds a considerable share in Europe’s market, primarily owing to its large geriatric population. According to the United Nation’s population data, one in every 20 people in Germany is aged above 80, which is expected to increase to one in every 6 individuals by 2050. People above the age of 65 accounted for 22.4% of the total population. In 2019, there were 90.4 million people above 65 years of age living in Europe. Problems with the increasing geriatric population include a higher risk of enteric diseases due to the onset of senescence & decreased immunity levels. Rapid diagnostic techniques such as point-of-care diagnostic devices are useful for this demographic. Key manufacturers such as Roche and Bio-Rad are strengthening their operations in Germany, which is expected to boost the enteric disease testing market.

Asia Pacific is expected to grow at the fastest CAGR of 4.0% over the forecast period from 2025 to 2034 owing to rising awareness levels among people for testing and increasing infections. Attractive regions for the market are placed in developing nations such as China and India thereby promoting the fastest growth for Asia Pacific. The spread of enteric diseases is higher in Asian countries. For instance, Bangladesh reports the highest number of typhoid cases 252 cases per 100,000.

Brazil is expected to hold strong opportunities for market growth. Growth in economic & political stability has led to positive economic growth in Brazil. Healthcare reforms, such as the Unified Health System (SUS), provide free healthcare services to individuals at all levels without charging an additional amount. The SUS is a combination of public, private, and supplemental healthcare services. Supportive government initiatives, such as collaboration between the U.S. and Brazil on biomedical research to accelerate R&D in the diagnosis & treatment of infectious diseases, are also boosting the market. However, access to advanced diagnostics in Brazil is currently limited to urban areas due to the lack of infrastructure in rural settings which could slow down the market growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the enteric disease testing market

By Disease Type

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Disease type

1.1.2. Regional scope

1.1.3. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Disease type outlook

2.2.2. Regional outlook

2.3. Competitive Insights

Chapter 3. Enteric Disease Testing Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Market Dynamics

3.3.1. Market driver analysis

3.3.2. Market restraint analysis

3.4. Enteric Disease Testing Market Analysis Tools

3.4.1. Industry Analysis - Porter’s

3.4.1.1. Supplier power

3.4.1.2. Buyer power

3.4.1.3. Substitution threat

3.4.1.4. Threat of new entrant

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Technological landscape

3.4.2.3. Economic landscape

Chapter 4. Enteric Disease Testing Market: Disease Type Estimates & Trend Analysis

4.1. Enteric Disease Testing Market, Key Takeaways

4.2. Enteric Disease Testing Market: Movement & Market Share Analysis, 2022 & 2030

4.3. Bacterial Enteric Disease

4.3.1. Bacterial enteric disease market estimates and forecasts, 2018 to 2030 (USD Million)

4.4. Viral Enteric Disease

4.4.1. Viral enteric disease market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.2. Rotavirus

4.4.2.1. Rotavirus market estimates and forecasts, 2018 to 2030 (USD Million)

4.4.3. Norovirus

4.4.3.1. Norovirus market estimates and forecasts, 2018 to 2030 (USD Million)

4.5. Parasitic Enteric Disease

4.5.1. Parasitic enteric disease market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 5. Enteric Disease Testing Market: Regional Estimates & Trend Analysis

5.1. Regional Outlook

5.2. Enteric Disease Testing Market by Region: Key Takeaway

5.3. North America

5.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.3.2. U.S.

5.3.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.3.3. Canada

5.3.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.4. Europe

5.4.1. UK

5.4.1.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.4.2. Germany

5.4.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.4.3. France

5.4.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.4.4. Italy

5.4.4.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.4.5. Spain

5.4.5.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.4.6. Sweden

5.4.6.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.4.7. Norway

5.4.7.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.4.8. Denmark

5.4.8.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.5. Asia Pacific

5.5.1. Japan

5.5.1.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.5.2. China

5.5.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.5.3. India

5.5.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.5.4. Australia

5.5.4.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.5.5. Thailand

5.5.5.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.5.6. South Korea

5.5.6.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.6. Latin America

5.6.1. Brazil

5.6.1.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.6.2. Mexico

5.6.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.6.3. Argentina

5.6.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.7. MEA

5.7.1. Saudi Arabia

5.7.1.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.7.2. South Africa

5.7.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.7.3. UAE

5.7.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

5.7.4. Kuwait

5.7.4.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

Chapter 6. Competitive Landscape

6.1. Recent Developments & Impact Analysis, By Key Market Participants

6.2. Company/Competition Categorization

6.2.1. Abbott

6.2.1.1. Company overview

6.2.1.2. Financial performance

6.2.1.3. Product benchmarking

6.2.1.4. Strategic initiatives

6.2.2. BD

6.2.2.1. Company overview

6.2.2.2. Financial performance

6.2.2.3. Product benchmarking

6.2.2.4. Strategic initiatives

6.2.3. Biomerica

6.2.3.1. Company overview

6.2.3.2. Financial performance

6.2.3.3. Product benchmarking

6.2.3.4. Strategic initiatives

6.2.4. BIOMÉRIEUX

6.2.4.1. Company overview

6.2.4.2. Financial performance

6.2.4.3. Product benchmarking

6.2.4.4. Strategic initiatives

6.2.5. Bio-Rad Laboratories, Inc.

6.2.5.1. Company overview

6.2.5.2. Financial performance

6.2.5.3. Product benchmarking

6.2.5.4. Strategic initiatives

6.2.6. Cepheid

6.2.6.1. Company overview

6.2.6.2. Financial performance

6.2.6.3. Product benchmarking

6.2.6.4. Strategic initiatives

6.2.7. Coris BioConcept

6.2.7.1. Company overview

6.2.7.2. Financial performance

6.2.7.3. Product benchmarking

6.2.7.4. Strategic initiatives

6.2.8. DiaSorin S.p.A.

6.2.8.1. Company overview

6.2.8.2. Financial performance

6.2.8.3. Product benchmarking

6.2.8.4. Strategic initiatives

6.2.9. Meridian Bioscience

6.2.9.1. Company overview

6.2.9.2. Financial performance

6.2.9.3. Product benchmarking

6.2.9.4. Strategic initiatives

6.2.10. Quest Diagnostics Incorporated

6.2.10.1. Company overview

6.2.10.2. Financial performance

6.2.10.3. Product benchmarking

6.2.10.4. Strategic initiatives