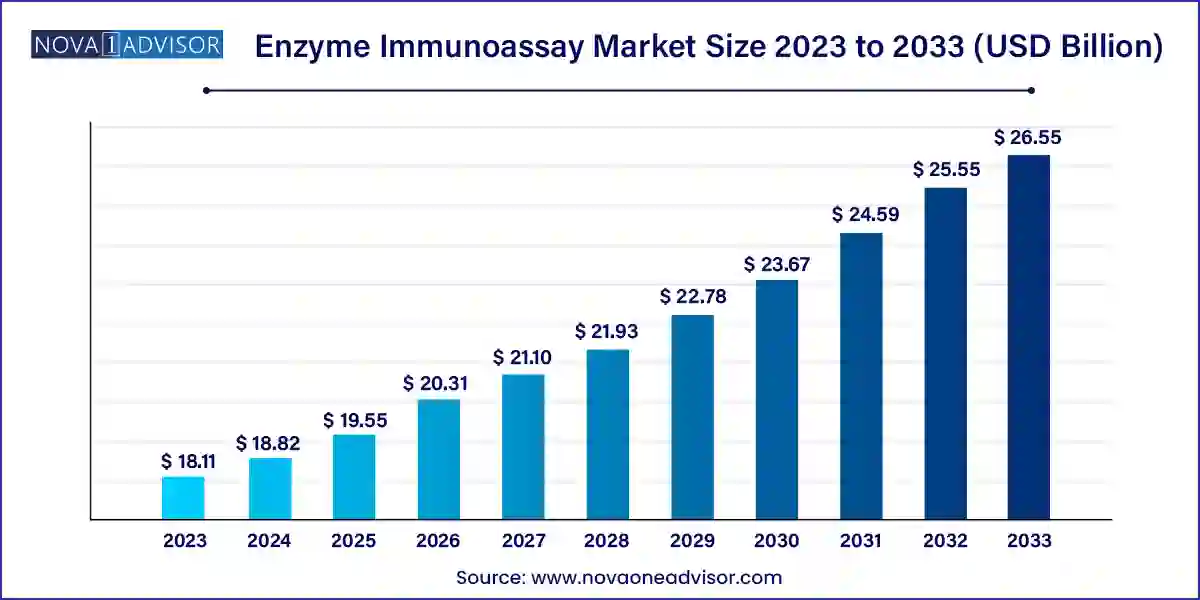

The global enzyme immunoassay market size was valued at USD 18.11 billion in 2023 and is anticipated to reach around USD 26.55 billion by 2033, growing at a CAGR of 3.9% from 2024 to 2033.

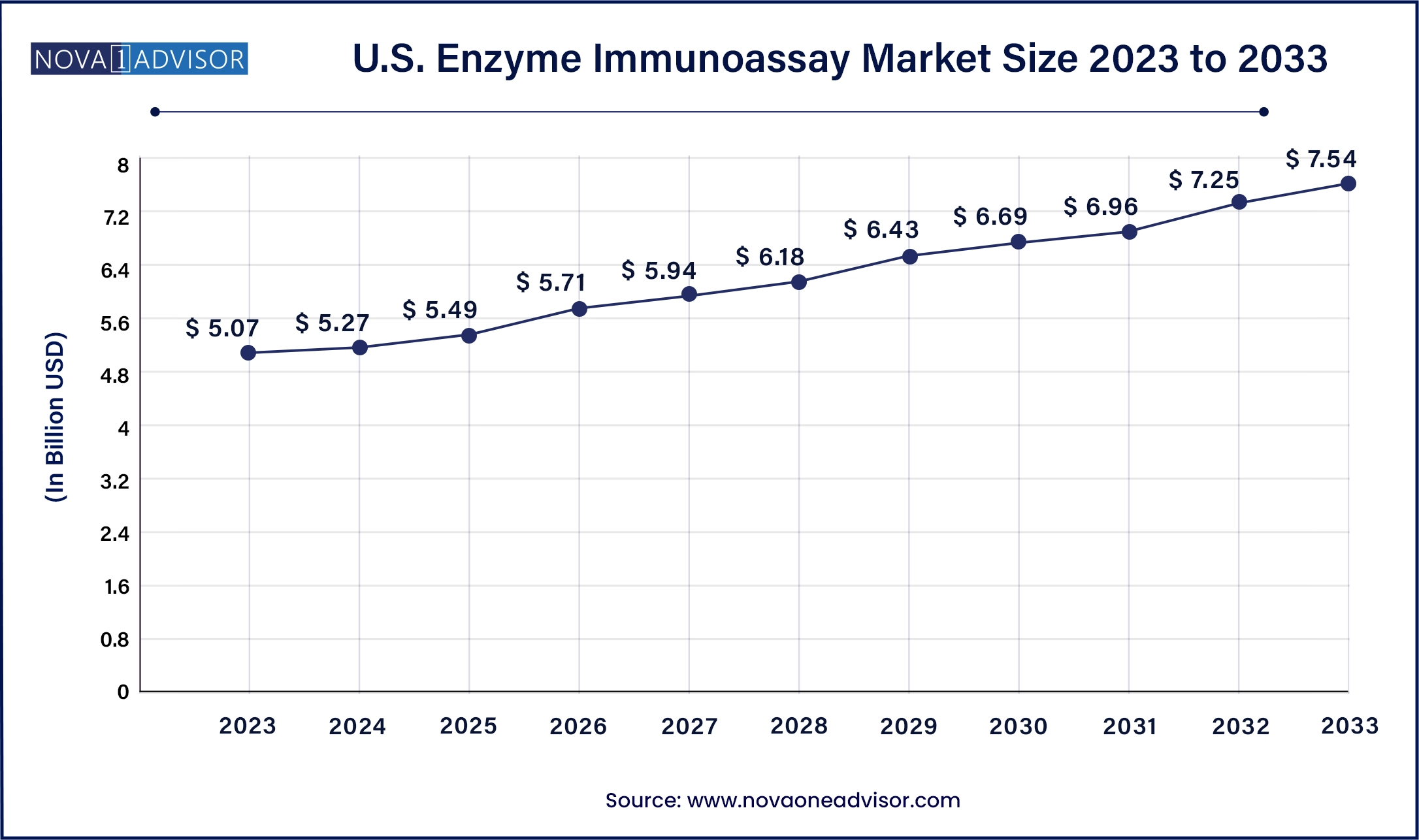

The U.S. Enzyme Immunoassay market is valued at USD 5.07 billion in 2023, and it is expected to reach USD 7.54 billion by 2033, with a CAGR of 4.06% during the forecast period of 2024-2033.

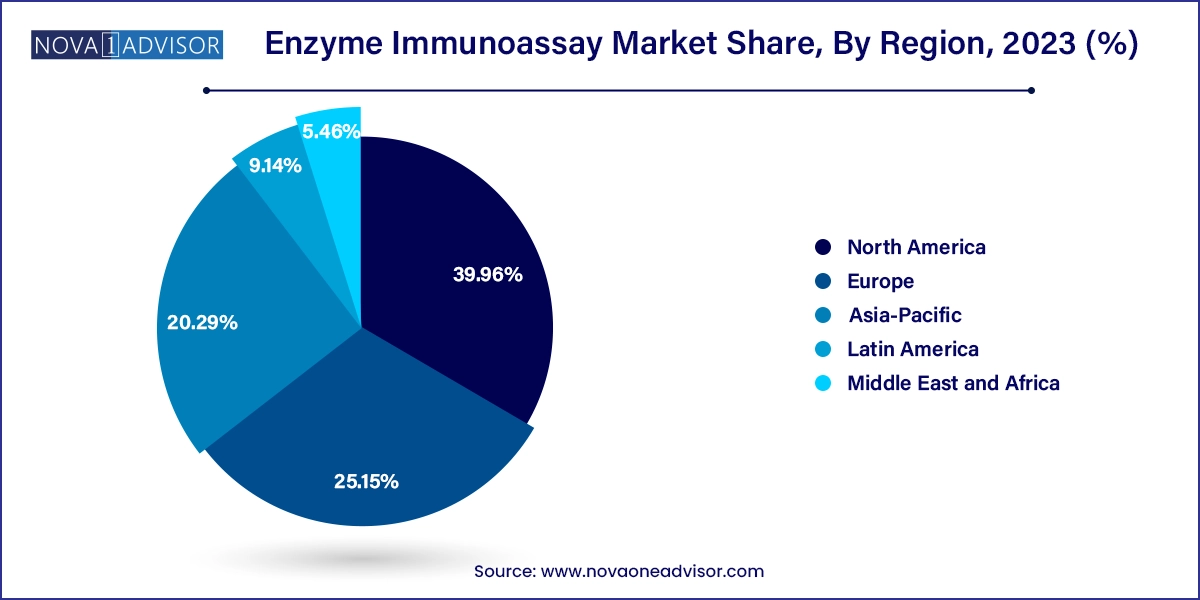

North America dominated the enzyme immunoassay market in 2023, driven by strong healthcare infrastructure, high adoption of advanced diagnostic technologies, and robust funding for biomedical research. The presence of key industry players like Thermo Fisher Scientific, Bio-Rad Laboratories, and Abbott Laboratories ensures continuous innovation and product availability. Governmental support through agencies such as the National Institutes of Health (NIH) and Centers for Disease Control and Prevention (CDC) also supports the development and deployment of immunoassay technologies across diverse medical specialties.

Asia-Pacific is projected to be the fastest-growing region during the forecast period. Rapid improvements in healthcare access, increasing awareness about early disease detection, and a growing elderly population are driving demand for diagnostic tests in countries like China, India, and Japan. Furthermore, the surge in medical tourism and the rise of regional biotech firms are leading to localized production and affordable pricing models for EIA reagents and kits. Favorable government initiatives, such as India's National Health Mission and China's Healthy China 2030, are expected to further propel market growth in this region.

The global Enzyme Immunoassay (EIA) market, also commonly referred to as the Enzyme-Linked Immunosorbent Assay (ELISA) market, is a cornerstone of clinical diagnostics and biomedical research. EIA is a biochemical technique used to detect the presence of an antibody or antigen in a sample, employing enzyme-labeled antigens or antibodies and substrate reagents. Its precision, sensitivity, and versatility make it invaluable in fields such as disease diagnostics, drug monitoring, and therapeutic intervention.

Over the last two decades, the growing burden of infectious diseases, autoimmune disorders, and chronic ailments has intensified the demand for quick and accurate diagnostic tools. Enzyme immunoassays offer a rapid, reliable, and scalable solution, making them increasingly indispensable in clinical settings. Their utility in high-throughput screening, disease surveillance, vaccine development, and biomedical research continues to drive their adoption across hospitals, diagnostic laboratories, pharmaceutical firms, and academic research centers.

Additionally, the COVID-19 pandemic provided a significant boost to the market by highlighting the need for robust immunoassay platforms in managing viral outbreaks. EIAs were used extensively to monitor antibodies and antigens in infected populations. This experience has led to long-term investments in immunoassay R&D and infrastructure, further fueling market expansion.

Miniaturization and Automation: Integration of microfluidics and robotics into EIA workflows for rapid and hands-free testing.

Rise of Multiplex Assays: Increasing adoption of platforms that can detect multiple biomarkers simultaneously.

Point-of-Care (PoC) Testing: Expansion of compact, rapid EIAs for decentralized testing in rural or resource-limited settings.

AI Integration in Diagnostics: Use of artificial intelligence and machine learning to analyze assay results, optimize protocols, and predict disease patterns.

Customized Assay Development: Growing demand for tailor-made kits in niche research and clinical domains such as rare disease monitoring.

Sustainability Focus: Development of eco-friendly reagents and reusable microplates to reduce environmental impact.

| Report Attribute | Details |

| Market Size in 2024 | USD 18.82 Billion |

| Market Size by 2033 | USD 26.55 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, application,specimen, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Siemens Healthineers; Danaher Corporation (Beckman Coulter); bioMérieux SA; QuidelOrtho Corporation.; Sysmex Corporation; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche AG; Becton, Dickinson, and Company; Thermo Fisher Scientific, Inc. |

One of the primary drivers of the enzyme immunoassay market is the mounting global burden of infectious diseases and chronic conditions. According to the World Health Organization (WHO), infectious diseases remain a leading cause of death globally, with increasing incidence of emerging pathogens such as Zika, Ebola, and coronaviruses. In addition, non-communicable diseases such as diabetes, cardiovascular disorders, and autoimmune diseases have become endemic in both developed and developing nations.

Enzyme immunoassays are a frontline tool in the early detection, diagnosis, and monitoring of these diseases. For example, hepatitis B and C, HIV, tuberculosis, and COVID-19 are all diseases routinely monitored using ELISA technology. As the healthcare industry moves toward proactive and preventive care models, the demand for sensitive and cost-effective diagnostic platforms like EIAs continues to grow.

Despite their widespread applications, the high capital investment required for modern enzyme immunoassay analyzers, along with associated infrastructure and maintenance costs, acts as a significant barrier. Advanced EIA systems often come with complex calibration requirements, proprietary reagents, and ongoing service contracts that increase the total cost of ownership.

This can be particularly prohibitive for smaller diagnostic labs, healthcare centers in low-income regions, and academic institutions with constrained budgets. In addition, operational complexity and the need for skilled technicians can restrict the broader adoption of advanced immunoassay systems.

The ongoing shift toward personalized medicine represents a significant opportunity for the enzyme immunoassay market. Personalized therapies rely heavily on biomarker profiling to identify patient-specific disease mechanisms and tailor treatments accordingly. EIAs are highly effective in quantifying biomarkers in bodily fluids, making them ideal tools for companion diagnostics and pharmacogenomics.

For example, in oncology, EIA-based assays are used to measure tumor markers like PSA (prostate-specific antigen) or CA-125 for ovarian cancer. As the pharmaceutical industry expands its focus on biomarker-driven drug development, the demand for reliable, customizable, and scalable immunoassay platforms is expected to surge.

Reagents & Kits dominated the enzyme immunoassay market in 2024. This dominance is attributed to their recurring use in diagnostic procedures, ensuring a constant demand. Unlike analyzers, which are typically one-time purchases, reagents and kits are consumables used in every assay cycle. These include antibodies, substrates, buffers, and detection reagents. The increasing availability of disease-specific kits and the demand for home-testing options (e.g., COVID-19 antibody kits) have further driven their sales.

On the other hand, Analyzers/Instruments are expected to witness the fastest growth rate due to rapid technological advancements. Integration of automation, cloud connectivity, and miniaturization are making these systems more efficient and user-friendly. Newer models allow for high-throughput testing, minimal human intervention, and compatibility with lab information systems (LIS), which are essential for large hospital labs and commercial diagnostic centers.

Infectious Disease Testing held the largest market share in terms of application. The widespread use of immunoassays for screening and monitoring diseases like HIV, hepatitis, dengue, COVID-19, and syphilis underlines this trend. In addition, governmental and NGO-sponsored testing programs for endemic and emerging infectious diseases have spurred market growth in this segment.

Therapeutic Drug Monitoring (TDM) is anticipated to grow at the fastest rate. The increasing need for personalized dosing regimens, especially in fields like oncology, psychiatry, and transplant medicine, is propelling demand for TDM solutions. EIAs are used to monitor drug levels, ensuring efficacy while avoiding toxicity. As more targeted therapies reach the market, the need for precise drug level monitoring will only intensify.

Blood samples dominated the enzyme immunoassay market by specimen type. Blood-based tests provide highly accurate and reliable results due to the rich presence of antigens, antibodies, hormones, and drug metabolites in serum or plasma. Their use spans across all major diagnostic applications, including endocrinology, infectious disease testing, and autoimmune disorders.

However, Saliva specimens are emerging as the fastest-growing category. Saliva-based EIAs are non-invasive, user-friendly, and suitable for mass screening, including pediatric and geriatric populations. Technological improvements in sample processing and detection sensitivity have enhanced the reliability of saliva-based tests, making them ideal for rapid diagnostics and at-home test kits.

Hospitals remain the leading end-users of enzyme immunoassays, thanks to their capacity for large-scale diagnostic services and continuous patient monitoring. The integration of EIA analyzers into centralized labs in hospitals facilitates the quick turnaround of results, essential for emergency care, infectious disease management, and critical care settings.

In contrast, Pharmaceutical and Biotech Companies are expected to be the fastest-growing segment. These entities rely heavily on EIAs during drug discovery, preclinical studies, and clinical trials. Whether used for pharmacokinetics, immunogenicity assessments, or biomarker validation, EIAs offer reliable, reproducible, and scalable results. The increasing number of new drug applications and research on biologics underlines their expanding role in this domain.

February 2025: Thermo Fisher Scientific announced the launch of a new high-sensitivity EIA kit designed for low-abundance biomarker detection in neurodegenerative diseases.

December 2024: Bio-Techne Corporation unveiled its automated ELISA workstation integrated with AI-powered assay optimization software.

October 2024: Abbott Laboratories introduced a next-gen immunoassay platform tailored for point-of-care testing in remote areas.

August 2024: Siemens Healthineers collaborated with a German university hospital to develop multiplex EIAs for oncology applications.

May 2024: Merck KGaA expanded its reagent production facility in Massachusetts to meet rising global demand for diagnostic test kits.

Key players operating in the enzyme immunoassay industry are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

The following are the leading companies in the enzyme immunoassay market. These companies collectively hold the largest market share and dictate industry trends.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Enzyme Immunoassay market.

By Product

By Application

By Specimen

By End-use

By Region