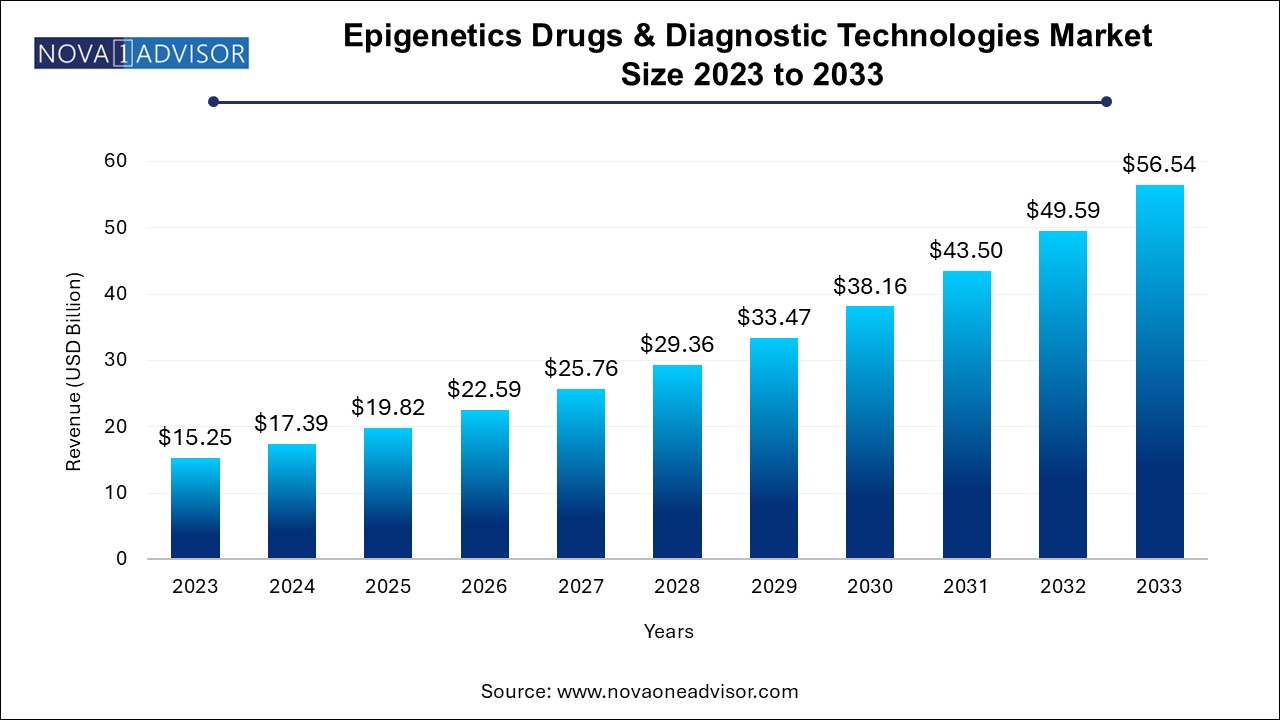

The epigenetics drugs & diagnostic technologies market size was exhibited at USD 15.25 billion in 2023 and is projected to hit around USD 56.54 billion by 2033, growing at a CAGR of 14.0% during the forecast period 2024 to 2033.

The Epigenetics Drugs & Diagnostic Technologies Market stands at the cutting edge of modern molecular medicine, offering groundbreaking advancements in the way diseases are diagnosed, treated, and monitored. Epigenetics, the study of heritable changes in gene expression that do not involve alterations in the DNA sequence, has emerged as a cornerstone in understanding complex diseases—particularly cancers, inflammatory disorders, metabolic conditions, and neurodegenerative ailments. As the scientific community gains deeper insight into the epigenomic landscape, the development of both therapeutic agents targeting epigenetic regulators and diagnostics capable of detecting epigenetic modifications has accelerated rapidly.

This market encapsulates a dual focus: epigenetic drugs such as DNA methyltransferase inhibitors (DNMTis) and histone deacetylase inhibitors (HDACis), which modulate gene expression for therapeutic benefit; and epigenetic diagnostic tools including kits, reagents, sequencing platforms, and service-based technologies designed to identify methylation patterns, histone modifications, and non-coding RNA profiles.

Driven by the rising burden of cancer and chronic diseases, increased investment in biomarker discovery, and the growing integration of multi-omics technologies in precision medicine, the market has become a priority for pharmaceutical giants, biotech startups, and academic research institutions alike. Furthermore, a global shift toward personalized medicine has underscored the importance of epigenetics as a dynamic and reversible regulator of health and disease.

As regulators approve new drugs, and diagnostic technologies gain clinical acceptance, the epigenetics market is transitioning from research-heavy innovation to commercial viability—poised to reshape therapeutic strategies and diagnostics over the next decade.

Growing adoption of epigenetic biomarkers in oncology for early detection, prognosis, and therapeutic response prediction, particularly in lung, breast, and hematological cancers.

Integration of AI and bioinformatics for epigenomic data interpretation, enabling faster identification of actionable targets and diagnostic signatures.

Development of combination therapies involving epigenetic drugs alongside immunotherapies or chemotherapeutics to enhance treatment efficacy.

Expansion of non-oncology applications, including autoimmune, metabolic, and infectious diseases, as evidence grows for epigenetic involvement in these disorders.

Advances in single-cell epigenomics, providing unprecedented resolution for understanding tumor heterogeneity and disease progression.

Increased collaboration between pharmaceutical companies and academic research centers to accelerate translational research and clinical trials.

Rise of liquid biopsy-based epigenetic diagnostics, especially using methylation-specific assays for cancer detection from blood samples.

Miniaturization and automation of sequencing kits and reagents, improving ease of use and reducing costs for labs and clinics.

Personalized epigenetic therapy pipelines, where patients are matched with targeted inhibitors based on their unique epigenomic profile.

Regulatory acceleration of orphan drug designations for epigenetic therapies targeting rare cancers or syndromes like Rett syndrome and Prader-Willi syndrome.

| Report Coverage | Details |

| Market Size in 2024 | USD 17.39 Billion |

| Market Size by 2033 | USD 56.54 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 14.0% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product & Service, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.; Eisai Co., Ltd.; Novartis AG; ELEMENT BIOSCIENCES; Cantata Bio; Illumina, Inc.; Promega Corporation.; Abcam Limited.; Merck KGaA |

The most prominent driver for the epigenetics drugs and diagnostics market is the growing global burden of cancer and the rising demand for targeted, less toxic treatments. Cancer is increasingly understood as not just a genetic, but also an epigenetic disease—characterized by disrupted DNA methylation patterns, histone modification errors, and non-coding RNA dysregulation. Unlike mutations, these changes are reversible, making them ideal drug targets.

For instance, FDA-approved epigenetic drugs like azacitidine (a DNMT inhibitor) and vorinostat (an HDAC inhibitor) have proven effective in treating myelodysplastic syndromes and cutaneous T-cell lymphoma, respectively. Their success has paved the way for a wave of next-generation compounds aimed at solid tumors and treatment-resistant cancers. Moreover, epigenetic diagnostic technologies are now helping clinicians stratify patients more accurately, monitor minimal residual disease, and adapt therapies based on dynamic tumor profiles.

This precision approach not only improves outcomes but also reduces the financial and physiological burden of conventional one-size-fits-all chemotherapy, firmly establishing epigenetics as a critical driver in cancer care innovation.

Despite its promise, the epigenetics field faces a fundamental challenge: the complexity and variability of epigenetic modifications across individuals, tissues, and time, which complicates both research and clinical translation. Unlike static genetic mutations, epigenetic changes are dynamic, reversible, and often influenced by environmental factors such as diet, stress, and infections.

This fluidity makes it difficult to define stable biomarkers or therapeutic targets. Furthermore, the lack of standardization across diagnostic technologies and protocols—from methylation assays to sequencing kits—creates inconsistencies in results and hinders clinical adoption. Many diagnostic assays remain in the research or lab-developed test category without widespread regulatory clearance.

To overcome this, the industry must invest in cross-platform validation, regulatory harmonization, and clinical trials that clearly demonstrate the utility of epigenetic tools. Without these advances, the market risks being siloed in academic settings rather than reaching its full clinical and commercial potential.

A major untapped opportunity in the market lies in the application of epigenetic drugs and diagnostics to non-oncological diseases—particularly in inflammatory, metabolic, cardiovascular, and infectious conditions. Increasing evidence suggests that epigenetic dysregulation plays a critical role in the pathogenesis of diseases like type 2 diabetes, atherosclerosis, rheumatoid arthritis, and even long COVID.

For example, HDAC inhibitors are being studied for their anti-inflammatory properties in diseases like ulcerative colitis, while DNMT inhibitors are being evaluated for fibrosis. Epigenetic diagnostics could also identify risk profiles or disease predispositions well before symptoms arise, allowing for early intervention. As the field matures, novel drug targets beyond the “classic” HDAC and DNMT classes are emerging—such as bromodomain inhibitors and methyl-binding domain inhibitors.

Companies that invest early in this cross-disciplinary research, and collaborate with regulatory bodies and payers to establish value-based pricing models, could capitalize on this vast and relatively unpenetrated therapeutic frontier.

Diagnostics products and services dominated the market and accounted for the largest revenue share of 94.9% in 2023. Particularly bisulfite conversion and RNA sequencing kits used in research and clinical labs for epigenetic biomarker discovery. Reagent manufacturers are continuously optimizing products for high-sensitivity, low-input applications to support liquid biopsy and early cancer detection. Additionally, the rise of multi-omics analysis—which includes methylation sequencing, histone mapping, and RNA expression profiling—is driving demand for integrative diagnostic kits. Instruments and services that support automation, high-throughput analysis, and cloud-based bioinformatics platforms are also gaining popularity, especially among academic and translational research centers.

Drugs are expected to grow at a CAGR of 10.9% over the forecast period. Particularly the subcategories of HDAC and DNMT inhibitors, due to their regulatory approvals and established efficacy in oncology. HDAC inhibitors like romidepsin and panobinostat are approved for various hematological malignancies, while DNMT inhibitors are used extensively in treating myelodysplastic syndromes and certain leukemias. These drugs have a growing footprint in clinical oncology practices across North America and Europe, with pipeline compounds advancing in solid tumors such as breast, prostate, and lung cancers. The success of these compounds has also drawn the attention of big pharma, with many acquiring or partnering with biotech startups developing novel epigenetic modulators.

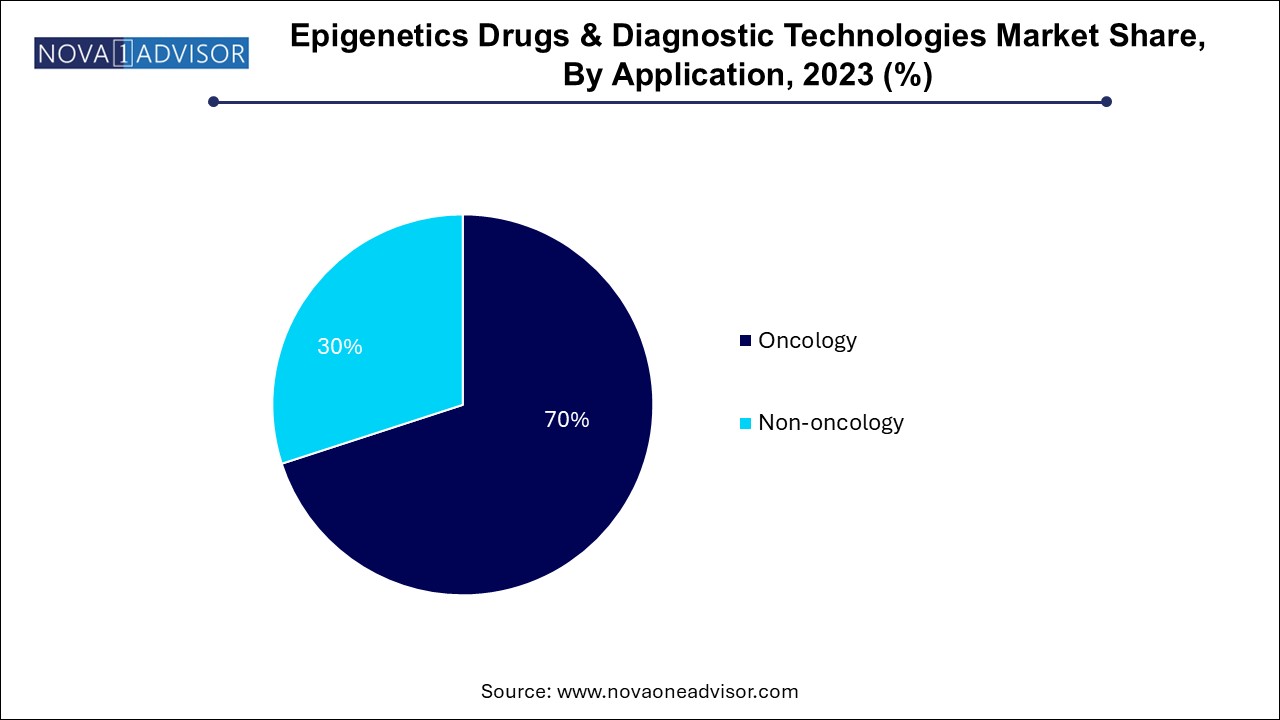

Oncology led the market and accounted for the largest revenue share of 70.0% in 2023, driven by the central role of epigenetic dysregulation in tumorigenesis and cancer progression. Solid tumors, including breast, colorectal, and lung cancers, account for a significant share due to the increasing use of epigenetic profiling in guiding targeted therapy. For example, methylation signatures are being incorporated into breast cancer risk prediction models, while HDAC inhibitors are undergoing trials in combination with checkpoint inhibitors for lung cancer. Liquid tumors like lymphoma and leukemia also benefit from epigenetic therapies, with DNMT inhibitors forming the backbone of first-line treatment in certain subtypes

Non-oncology application is expected to grow at a CAGR of 15.5% over the projected years. albeit from a smaller base. Researchers are actively exploring the role of epigenetics in autoimmune diseases (e.g., lupus), metabolic disorders (e.g., NAFLD), and infectious diseases (e.g., tuberculosis and HIV). For instance, histone methylation changes have been implicated in viral latency and immune evasion, offering novel therapeutic angles. Companies developing diagnostics for cardiovascular and metabolic epigenetic markers are also expanding into preventive health and risk stratification markets, laying the groundwork for future adoption in clinical settings beyond cancer.

North America epigenetics drugs & diagnostic technologies market dominated the global market and accounted for the largest revenue share of 41.5% in 2023. owing to robust R&D investments, strong presence of pharmaceutical leaders, and supportive regulatory and reimbursement frameworks. The U.S. alone accounts for a major share, bolstered by institutions such as the NIH, which fund epigenetics research through initiatives like the Roadmap Epigenomics Program. Additionally, the region is home to key companies like Epizyme, Syndax Pharmaceuticals, and Constellation Pharmaceuticals (acquired by MorphoSys), which are actively developing and commercializing epigenetic therapies.

Asia Pacific is the fastest-growing region, driven by rising cancer incidence, improving healthcare infrastructure, and increasing investment in precision medicine. Countries such as China, Japan, and South Korea are at the forefront, with national genomics programs that integrate epigenomics. For instance, Chinese biotech firms are developing HDAC inhibitors tailored to regional patient populations, while Japanese institutions are advancing methylation-based diagnostics. Furthermore, collaborations between local academic centers and international companies are enabling technology transfer and regulatory alignment, which will likely propel market growth in the coming years.

March 2025: Syndax Pharmaceuticals reported Phase 3 trial results of its HDAC inhibitor “entinostat” in combination with immunotherapy for advanced breast cancer, showing significant improvement in progression-free survival.

January 2025: Epigenomics AG announced FDA pre-submission for its blood-based colorectal cancer test using DNA methylation biomarkers, positioning itself for potential U.S. market entry.

November 2024: Chroma Medicine, a CRISPR-based epigenetic editing startup, raised $135 million in Series B funding to advance its preclinical pipeline targeting genetic diseases through epigenomic modulation.

September 2024: Hologic Inc. expanded its diagnostics portfolio with the acquisition of a methylation-based liquid biopsy platform for cervical and ovarian cancer risk detection.

July 2024: Bayer AG entered a collaboration with Omega Therapeutics to develop programmable epigenetic medicines using Omega’s OMEGA platform for liver and inflammatory diseases.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the epigenetics drugs & diagnostic technologies market

Product & Service

Application

Regional