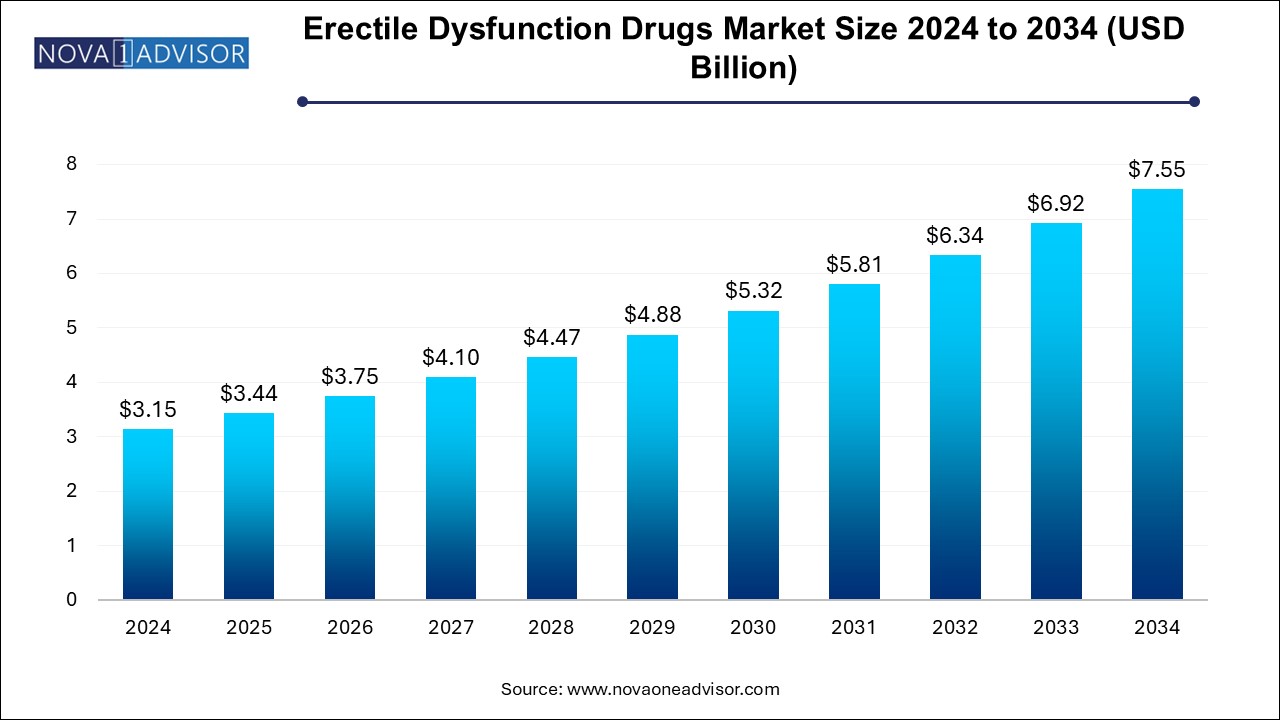

The erectile dysfunction drugs market size was exhibited at USD 3.15 billion in 2024 and is projected to hit around USD 7.55 billion by 2034, growing at a CAGR of 9.14% during the forecast period 2025 to 2034.

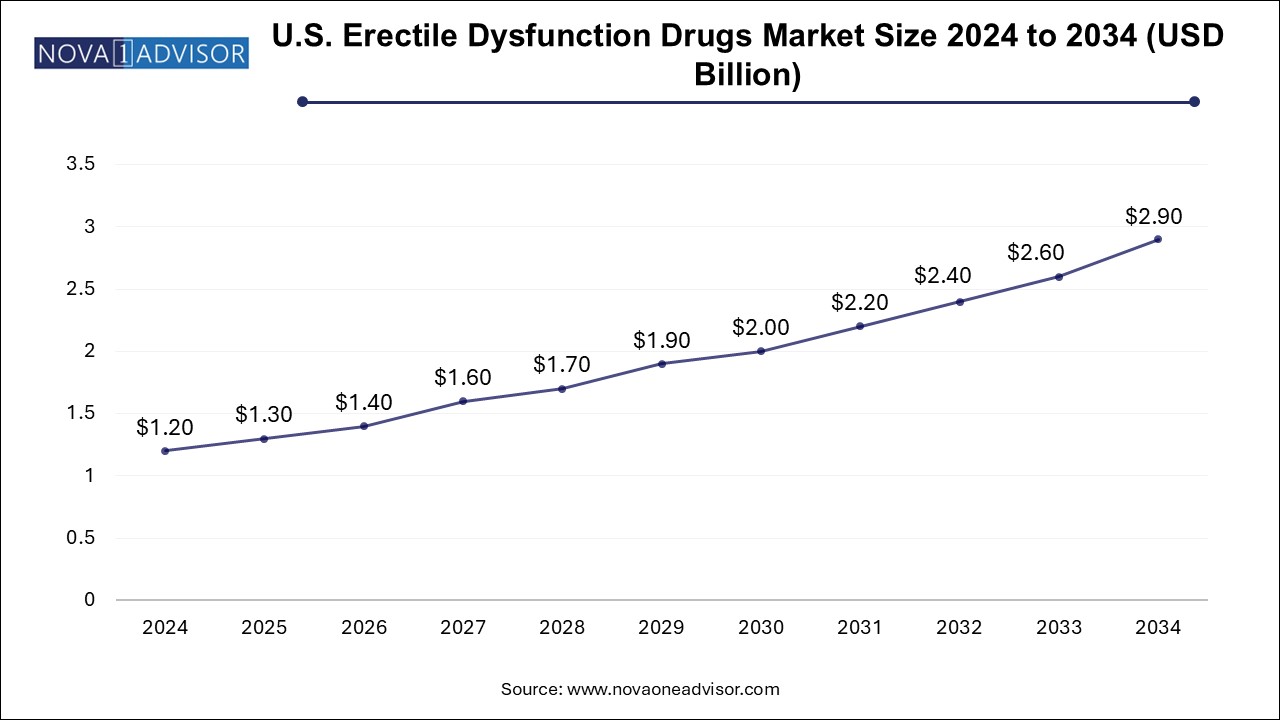

The U.S. erectile dysfunction drugs market size is evaluated at USD 1.20 billion in 2024 and is projected to be worth around USD 2.90 billion by 2034, growing at a CAGR of 8.35% from 2025 to 2034.

The erectile dysfunction drugs market in North America dominated globally and accounted for 51.0% of revenue share in 2024. The market is driven by the high burden of disease, robust healthcare infrastructure, and rapid approval of new products for treatment in the region. Furthermore, advances in medical technology have led to the development of more effective and convenient treatment options for ED. This has encouraged more individuals to seek treatment and has expanded the market for ED drugs.

U.S. Erectile Dysfunction Drugs Market Trends

The erectile dysfunction drugs market in the U.S. held a significant share in the North America region in 2024, fueled by the high burden of disease, robust healthcare infrastructure, and rapid approval of new products for treatment in the region. Sedentary lifestyles, stress, unhealthy dietary habits, and other lifestyle factors contribute to the prevalence of ED. Furthermore, advances in medical technology have led to the development of more effective and convenient treatment options for ED. This has encouraged more individuals to seek treatment and has expanded the market for ED drugs. Moreover, the increasing prevalence of ED and the growing demand for personalized nutrition contribute to market growth.

Europe Erectile Dysfunction Drugs Market Trends

The erectile dysfunction drugs market in Europe is anticipated to experience significant growth over the forecast period. The increasing incidence of ED in Europe due to factors like aging populations, lifestyle changes, and chronic diseases is a significant driver for market growth. Moreover, factors such as established healthcare infrastructure, increasing preference for personalized medication, and increased investments in pharmaceutical R&D are driving market growth.

The erectile dysfunction drugs market in the UK is likely to show significant growth over the forecast period owing to various factors, such as the high prevalence of Erectile Dysfunction (ED), increasing awareness about available treatment options, technological advancements in drug development, and the presence of key pharmaceutical companies specializing in these medications. One of the primary drivers of the market in the U.S. is the rising prevalence of ED among men. Factors such as sedentary lifestyles, stress, the aging population, and chronic conditions like diabetes & heart disease contribute to the increasing incidence of ED.

The erectile dysfunction drugs market in Germany is anticipated to experience significant growth over the forecast period. The market in Germany is a significant part of the global market. Germany, being one of the largest economies in Europe, has a well-established healthcare system and a high level of awareness regarding health issues, including ED. The market for ED drugs in Germany is driven by factors such as an aging population, the increasing prevalence of lifestyle diseases, and the growing adoption of sedentary lifestyles.

Asia Pacific Erectile Dysfunction Drugs Market Trends

The erectile dysfunction drugs market in Asia Pacific is anticipated to experience rapid growth over the forecast period due to the increasing prevalence of ED in Asian countries due to various factors such as aging populations, changing lifestyles, and the presence of comorbid conditions like diabetes & hypertension, which is fueling the demand for ED medications. Moreover, the rapidly increasing geriatric population in countries like China and Japan is expected to fuel market growth.

The erectile dysfunction drugs market in China is anticipated to grow at a lucrative growth rate over the forecast period. The demand for erectile dysfunction drugs in China is increasing due to factors such as an aging population, lifestyle changes, and chronic health conditions. Continuous innovation in the pharmaceutical industry, including the development of new and more effective ED drugs, contributes to the expansion of the market in China. Furthermore, in China, the regulation of pharmaceuticals, including drugs for ED, falls under the oversight of the China Food and Drug Administration (CFDA). The CFDA has recently been restructured into the National Medical Products Administration (NMPA), which is responsible for ensuring the safety, effectiveness, and quality of pharmaceutical products in China.

Latin America Erectile Dysfunction Drugs Market Trends

The erectile dysfunction drugs market in Latin America is anticipated to experience significant progress over the forecast period. As disposable incomes rise across Latin America, individuals are more willing to spend on healthcare services, including treatments for conditions like erectile dysfunction. Furthermore, the aging population in many Latin American countries is a significant driver of market growth, as age is a common risk factor for erectile dysfunction.

Middle East and Africa Erectile Dysfunction Drugs Market Trends

The erectile dysfunction drugs market in MEA is anticipated to experience steady growth over the forecast period. Conditions like diabetes, cardiovascular diseases, obesity, and hypertension are on the rise in the Middle East and Africa, all of which are risk factors for ED. Diabetes is recognized as a silent killer in the African continent. Furthermore, the launch and approval of new drug formulations in the region impacts market growth. For instance, in August 2023, Labatec Pharma obtained regulatory approval to distribute Futura Medical's gel-based topical medicine in Saudi Arabia.

The erectile dysfunction drugs market in Saudi Arabia is driven by instances such as the Saudi Arabian Monetary Agency (SAMA) reports that the number of people aged 60 years and more is projected to grow to 10 million by the end of 2050, contributing 25% to the total population, leading to a rise in healthcare expenditure. Furthermore, the advancement of healthcare infrastructure in Saudi Arabia has enhanced accessibility to medical care and treatment for erectile dysfunction.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.44 Billion |

| Market Size by 2034 | USD 7.55 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 9.14% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Mode of Administration, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Bayer AG, Lilly, GlaxoSmithKline PLC, Petros Pharmaceuticals, Inc., Pfizer Inc., Teva Pharmaceutical Industries Ltd, Lupin Limited, Futura Medical, Cure Pharmaceutical, 23andMe, Hims & Hers Health, Inc., RO, BlueChew, GoodRx, Inc. |

The Viagra (sildenafil citrate) segment dominated the market and accounted for the largest revenue share of 57.3% in 2024. Viagra (sildenafil citrate) was the first Phosphodiesterase 5 (PDE5) inhibitor drug approved for Erectile Dysfunction (ED). This drug was developed and commercialized by Pfizer Inc. The patent for the branded version of Viagra expired in 2020, and therefore, to fill the demand gap in the market, Pfizer Inc. launched a generic version of Viagra at half the retail price-USD 65. Generic version of Viagra has been available in Canada and Europe since 2012 and 2013. Some of the key companies offering generic versions of Viagra under different brands are Aurobindo Pharma USA, Lupin, Sunshine Lake Pharma, and Torrent Pharmaceuticals. Moreover, there are strategic initiatives such as research collaboration, partnerships, and agreements undertaken by key local players to expand their business footprint. Furthermore, the availability of supportive reimbursement policies for Viagra positively impacts market growth. For instance, Viagra is eligible for reimbursement through Flexible Spending Accounts (FSA), Health Reimbursement Accounts (HRA), and Health Savings Accounts (HSA), provided there is a prescription.

The other drugs segment is expected to emerge as the most lucrative segment and is likely to grow at a CAGR of 8.9% over the forecast period. Other medicines, such as Mirodenafil (Mvix), Helleva (lodenafil Carbonate), MAXON Forte, and Maxon Active, are also used to treat adult patients with ED. Helleva was developed by Cristalia and is prescribed to men suffering from ED. Initially, it was approved in Brazil. MAXON Forte and Maxon Active are OTC products of Adamed indicated for the treatment of adult patients with ED. These are composed of 25 mg sildenafil citrate and cost around USD 311.75 for ten tablets. Moreover, the approval of products for OTC sales is anticipated to fuel market growth.

The oral mode segment accounted for the largest market share of 85.0% in 2024. The oral mode of administration is a dominant segment in the market, driven by its convenience, non-invasive nature, and widespread patient preference. Oral ED drugs, including phosphodiesterase type 5 (PDE5) inhibitors such as sildenafil, tadalafil, and vardenafil, offer effective symptom management with proven clinical efficacy. The ease of administration, combined with rapid onset and extended duration of action in some formulations, enhances patient adherence and market demand. In addition, the continuous development of novel formulations, such as sublingual tablets and chewable tablets, further expands this segment’s appeal. However, market players must address potential side effects and drug interactions to maintain consumer confidence and regulatory compliance, ensuring sustained growth within the segment.

The other modes segment is projected to grow at a CAGR of 10.4% over the forecast period. Other modes of administration include topical and intraurethral. The rising incidence of erectile dysfunction and growing awareness about new topical and intraurethral drugs are anticipated to boost market growth during the forecast period. Some of the available topical drugs for the treatment of ED are alprostadil cream (Vitaros), nitroglycerin-based ointments, and Eroxon. In June 2023, the U.S. FDA granted permission to Future Medical for marketing and OTC selling of Eroxon medicine indicated to treat patients with ED in the U.S. Eroxon is a topical gel that offers an erection within 10 minutes compared to other drugs. Thus, the high safety and efficacy of the drug are anticipated to boost the demand for this topical gel for ED treatment over the forecast period.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the erectile dysfunction drugs market

By Product

By Route of Administration

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Segment Definitions

1.2.1. Product

1.2.2. Mode of Administration

1.2.3. Regional Scope

1.2.4. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Regional outlook

2.4. Competitive Insights

Chapter 3. Erectile Dysfunction Drugs Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing prevalence of erectile dysfunction

3.2.1.2. Rising geriatric population

3.2.1.3. Increasing research & development (R&D)

3.2.2. Market Restraint Analysis

3.2.2.1. Lack of healthcare infrastructure and manufacturing errors

3.2.2.2. Lack of awareness about erectile dysfunction

3.3. Erectile Dysfunction Drugs Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of suppliers

3.3.1.2. Bargaining power of buyers

3.3.1.3. Threat of substitutes

3.3.1.4. Threat of new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Economic landscape

3.3.2.3. Social landscape

3.3.2.4. Technological landscape

3.3.2.5. Environmental landscape

3.3.2.6. Legal landscape

Chapter 4. Erectile Dysfunction Drugs Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Erectile Dysfunction Drugs Market: Product Movement Analysis

4.3. Erectile Dysfunction Drugs Market by Product Outlook (USD Million)

4.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

4.5. Viagra (sildenafil citrate)

4.5.1. Viagra (sildenafil citrate) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6. Cialis (Tadalafil)

4.6.1. Cialis (Tadalafil) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.7. Stendra/Spedra (avanafil)

4.7.1. Stendra/Spedra (avanafil) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.8. Zydena (udenafil)

4.8.1. Zydena (udenafil) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.9. Other Drugs

4.9.1. Other Drugs Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Erectile Dysfunction Drugs Market: Mode of Administration Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Erectile Dysfunction Drugs Market: Mode of Administration Movement Analysis

5.3. Erectile Dysfunction Drugs Market by Mode of Administration Outlook (USD Million)

5.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

5.5. Oral Mode of Administration

5.5.1. Oral Mode of Administration Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.6. Injectable Mode of Administration

5.6.1. Injectable Mode of Administration Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.7. Other Modes of Administration

5.7.1. Other Modes of Administration Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Erectile Dysfunction Drugs Market: Regional Estimates & Trend Analysis

6.1. Regional Dashboard

6.2. Market Size, & Forecasts Trend Analysis, 2021 to 2034:

6.3. North America

6.3.1. U.S.

6.3.1.1. Key country dynamics

6.3.1.2. Regulatory framework/ reimbursement structure

6.3.1.3. Competitive scenario

6.3.1.4. U.S. market estimates and forecasts 2021 to 2034 (USD Million)

6.3.2. Canada

6.3.2.1. Key country dynamics

6.3.2.2. Regulatory framework/ reimbursement structure

6.3.2.3. Competitive scenario

6.3.2.4. Canada market estimates and forecasts 2021 to 2034 (USD Million)

6.3.3. Mexico

6.3.3.1. Key country dynamics

6.3.3.2. Regulatory framework/ reimbursement structure

6.3.3.3. Competitive scenario

6.3.3.4. Mexico market estimates and forecasts 2021 to 2034 (USD Million)

6.4. Europe

6.4.1. UK

6.4.1.1. Key country dynamics

6.4.1.2. Regulatory framework/ reimbursement structure

6.4.1.3. Competitive scenario

6.4.1.4. UK market estimates and forecasts 2021 to 2034 (USD Million)

6.4.2. Germany

6.4.2.1. Key country dynamics

6.4.2.2. Regulatory framework/ reimbursement structure

6.4.2.3. Competitive scenario

6.4.2.4. Germany market estimates and forecasts 2021 to 2034 (USD Million)

6.4.3. France

6.4.3.1. Key country dynamics

6.4.3.2. Regulatory framework/ reimbursement structure

6.4.3.3. Competitive scenario

6.4.3.4. France market estimates and forecasts 2021 to 2034 (USD Million)

6.4.4. Italy

6.4.4.1. Key country dynamics

6.4.4.2. Regulatory framework/ reimbursement structure

6.4.4.3. Competitive scenario

6.4.4.4. Italy market estimates and forecasts 2021 to 2034 (USD Million)

6.4.5. Spain

6.4.5.1. Key country dynamics

6.4.5.2. Regulatory framework/ reimbursement structure

6.4.5.3. Competitive scenario

6.4.5.4. Spain market estimates and forecasts 2021 to 2034 (USD Million)

6.4.6. Norway

6.4.6.1. Key country dynamics

6.4.6.2. Regulatory framework/ reimbursement structure

6.4.6.3. Competitive scenario

6.4.6.4. Norway market estimates and forecasts 2021 to 2034 (USD Million)

6.4.7. Sweden

6.4.7.1. Key country dynamics

6.4.7.2. Regulatory framework/ reimbursement structure

6.4.7.3. Competitive scenario

6.4.7.4. Sweden market estimates and forecasts 2021 to 2034 (USD Million)

6.4.8. Denmark

6.4.8.1. Key country dynamics

6.4.8.2. Regulatory framework/ reimbursement structure

6.4.8.3. Competitive scenario

6.4.8.4. Denmark market estimates and forecasts 2021 to 2034 (USD Million)

6.5. Asia Pacific

6.5.1. Japan

6.5.1.1. Key country dynamics

6.5.1.2. Regulatory framework/ reimbursement structure

6.5.1.3. Competitive scenario

6.5.1.4. Japan market estimates and forecasts 2021 to 2034 (USD Million)

6.5.2. China

6.5.2.1. Key country dynamics

6.5.2.2. Regulatory framework/ reimbursement structure

6.5.2.3. Competitive scenario

6.5.2.4. China market estimates and forecasts 2021 to 2034 (USD Million)

6.5.3. India

6.5.3.1. Key country dynamics

6.5.3.2. Regulatory framework/ reimbursement structure

6.5.3.3. Competitive scenario

6.5.3.4. India market estimates and forecasts 2021 to 2034 (USD Million)

6.5.4. Australia

6.5.4.1. Key country dynamics

6.5.4.2. Regulatory framework/ reimbursement structure

6.5.4.3. Competitive scenario

6.5.4.4. Australia market estimates and forecasts 2021 to 2034 (USD Million)

6.5.5. South Korea

6.5.5.1. Key country dynamics

6.5.5.2. Regulatory framework/ reimbursement structure

6.5.5.3. Competitive scenario

6.5.5.4. South Korea market estimates and forecasts 2021 to 2034 (USD Million)

6.5.6. Thailand

6.5.6.1. Key country dynamics

6.5.6.2. Regulatory framework/ reimbursement structure

6.5.6.3. Competitive scenario

6.5.6.4. Thailand market estimates and forecasts 2021 to 2034 (USD Million)

6.6. Latin America

6.6.1. Brazil

6.6.1.1. Key country dynamics

6.6.1.2. Regulatory framework/ reimbursement structure

6.6.1.3. Competitive scenario

6.6.1.4. Brazil market estimates and forecasts 2021 to 2034 (USD Million)

6.6.2. Argentina

6.6.2.1. Key country dynamics

6.6.2.2. Regulatory framework/ reimbursement structure

6.6.2.3. Competitive scenario

6.6.2.4. Argentina market estimates and forecasts 2021 to 2034 (USD Million)

6.7. MEA

6.7.1. South Africa

6.7.1.1. Key country dynamics

6.7.1.2. Regulatory framework/ reimbursement structure

6.7.1.3. Competitive scenario

6.7.1.4. South Africa market estimates and forecasts 2021 to 2034 (USD Million)

6.7.2. Saudi Arabia

6.7.2.1. Key country dynamics

6.7.2.2. Regulatory framework/ reimbursement structure

6.7.2.3. Competitive scenario

6.7.2.4. Saudi Arabia market estimates and forecasts 2021 to 2034 (USD Million)

6.7.3. UAE

6.7.3.1. Key country dynamics

6.7.3.2. Regulatory framework/ reimbursement structure

6.7.3.3. Competitive scenario

6.7.3.4. UAE market estimates and forecasts 2021 to 2034 (USD Million)

6.7.4. Kuwait

6.7.4.1. Key country dynamics

6.7.4.2. Regulatory framework/ reimbursement structure

6.7.4.3. Competitive scenario

6.7.4.4. Kuwait market estimates and forecasts 2021 to 2034 (USD Million)

Chapter 7. Competitive Landscape

7.1. Market Participant Categorization

7.2. Recent Developments & Impact Analysis by Key Market Participants

7.3. Company Market Share Analysis, 2024

7.4. Key Company Profiles

7.4.1. Bayer AG

7.4.1.1. Company overview

7.4.1.2. Financial performance

7.4.1.3. Product benchmarking

7.4.1.4. Strategic initiatives

7.4.2. Lilly

7.4.2.1. Company overview

7.4.2.2. Financial performance

7.4.2.3. Product benchmarking

7.4.2.4. Strategic initiatives

7.4.3. GlaxoSmithKline PLC

7.4.3.1. Company overview

7.4.3.2. Financial performance

7.4.3.3. Product benchmarking

7.4.3.4. Strategic initiatives

7.4.4. Petros Pharmaceuticals, Inc.

7.4.4.1. Company overview

7.4.4.2. Financial performance

7.4.4.3. Product benchmarking

7.4.4.4. Strategic initiatives

7.4.5. Pfizer Inc.

7.4.5.1. Company overview

7.4.5.2. Financial performance

7.4.5.3. Product benchmarking

7.4.5.4. Strategic initiatives

7.4.6. Teva Pharmaceutical Industries Ltd

7.4.6.1. Company overview

7.4.6.2. Financial performance

7.4.6.3. Product benchmarking

7.4.6.4. Strategic initiatives

7.4.7. Lupin Limited

7.4.7.1. Company overview

7.4.7.2. Financial performance

7.4.7.3. Product benchmarking

7.4.7.4. Strategic initiatives

7.4.8. Futura Medical

7.4.8.1. Company overview

7.4.8.2. Financial performance

7.4.8.3. Product benchmarking

7.4.8.4. Strategic initiatives

7.4.9. Cure Pharmaceutical

7.4.9.1. Company overview

7.4.9.2. Financial performance

7.4.9.3. Product benchmarking

7.4.9.4. Strategic initiatives

7.4.10. 23andMe

7.4.10.1. Company overview

7.4.10.2. Financial performance

7.4.10.3. Product benchmarking

7.4.10.4. Strategic initiatives

7.4.11. Hims & Hers Health, Inc.

7.4.11.1. Company overview

7.4.11.2. Financial performance

7.4.11.3. Product benchmarking

7.4.11.4. Strategic initiatives

7.4.12. RO

7.4.12.1. Company overview

7.4.12.2. Financial performance

7.4.12.3. Product benchmarking

7.4.12.4. Strategic initiatives

7.4.13. BlueChew

7.4.13.1. Company overview

7.4.13.2. Financial performance

7.4.13.3. Product benchmarking

7.4.13.4. Strategic initiatives

7.4.14. GoodRx, Inc.

7.4.14.1. Company overview

7.4.14.2. Financial performance

7.4.14.3. Product benchmarking

7.4.14.4. Strategic initiatives