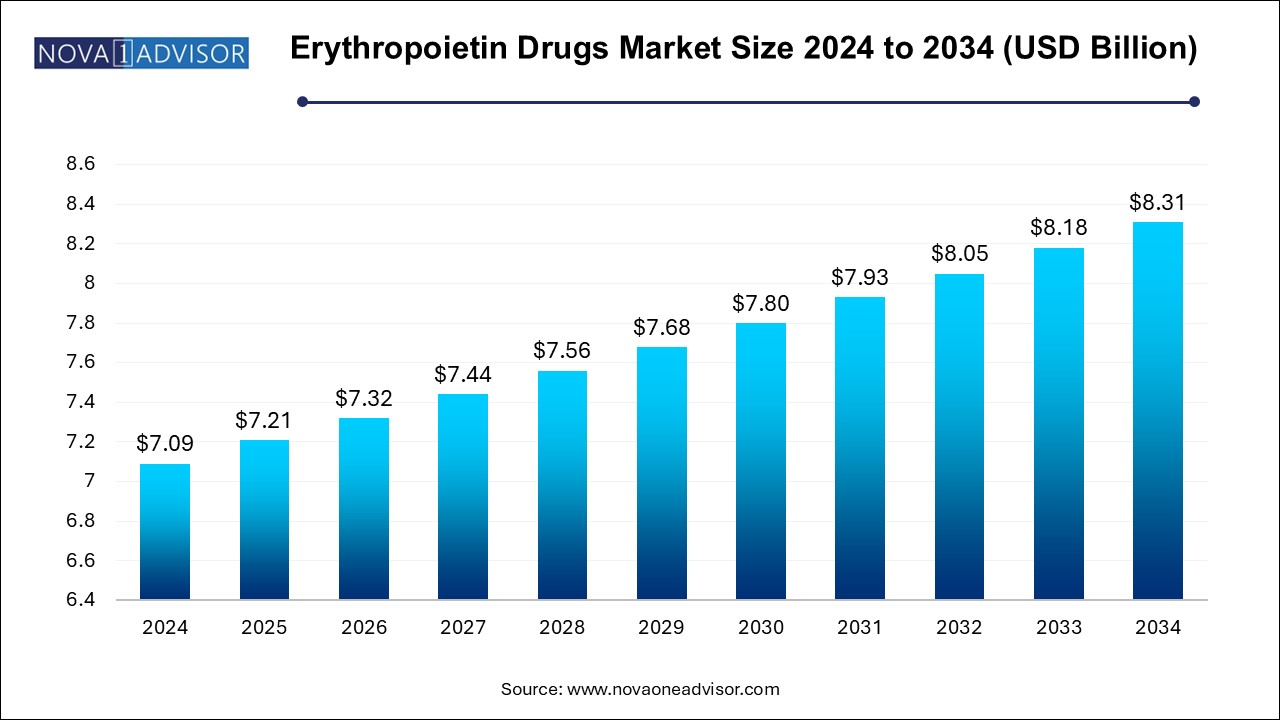

The erythropoietin drugs market size was exhibited at USD 7.09 billion in 2024 and is projected to hit around USD 8.31 billion by 2034, growing at a CAGR of 1.6% during the forecast period 2025 to 2034.

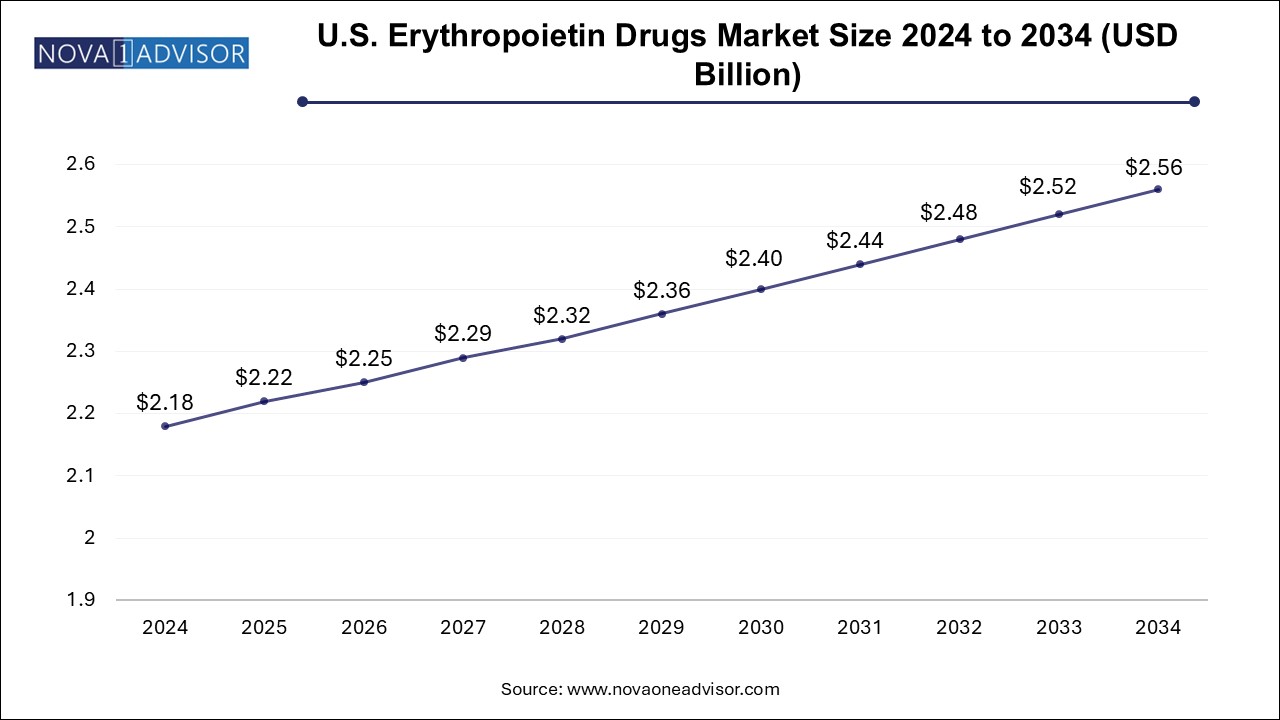

The U.S. erythropoietin drugs market size is evaluated at USD 2.18 billion in 2024 and is projected to be worth around USD 2.56 billion by 2034, growing at a CAGR of 1.47% from 2025 to 2034.

North America dominated the overall erythropoietin drugs market in terms of the revenue share of 40.35% in 2024. The regional market is anticipated to significantly benefit from local organizations that are actively engaged in advancing the development and use of erythropoietin drugs. Currently, there are five erythropoietin drugs available-NeoRecormon (epoetin beta), Dynepo (epoetin delta), Eprex (epoetin alfa), Aranesp (darbepoetin alfa), and Mircera (methoxy polyethylene glycol-epoetin beta). Biosimilars have been recently introduced in the U.S. market, which is expected to negatively impact market growth.

Asia Pacific is expected to witness a growth rate of 3.0% over the forecast period. The growth of the region is attributed to the presence of key players in the market and strategic initiatives undertaken by them to develop and commercialize new erythropoietin drug products to treat anemia patients. For instance, in September 2021, Wanbang Biopharma received approval for Yi Bao (Human Erythropoietin Injection) from NMPA (National Medical Products Administration). It is indicated to treat chemotherapy-associated anemia in patients with non-myeloid malignancies. All such strategic initiatives are expected to propel market growth in the Asia Pacific region.

| Report Coverage | Details |

| Market Size in 2025 | USD 7.21 Billion |

| Market Size by 2034 | USD 8.31 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 1.6% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Product, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Johnson & Johnson Services, Inc.; Novartis AG; Teva Pharmaceutical Industries Ltd.; Amgen, Inc.; F. Hoffmann-La Roche Ltd.; LG Chem; Biocon; Intas Pharmaceuticals Ltd.; Sun Pharmaceutical Industries Ltd; Dr. Reddy’s Laboratories Ltd |

The biologics segment dominated the drugs market with a revenue share of 55.14% in 2024. This can be attributed to their high usage rate in the U.S. due to the lesser penetration of biosimilars. Erythropoietin biologics include Procrit (Johnson & Johnson), NeoRecormon, Epogin, Mircera (F. Hoffmann La-Roche Ltd.), and Aranesp and Epogen from Amgen. However, this segment is losing its market share and is expected to exhibit a decline over the forecast period.

The biosimilars segment is expected to witness lucrative growth over the forecast period owing to the expiry of major patented drugs in the U.S. The European and APAC markets already have a higher penetration of biosimilars. Some of the major erythropoietin drugs whose patents will expire during the forecast include Aranesp (darbepoetin) and Mircera (PEG-EPO). The company may lose patent rights for this drug by May 2024 (U.S.). Thus, the patent expiration of this drug opens new opportunities for biosimilar manufacturers to develop and commercialize their products.

The erythropoietin segment dominated the erythropoietin drugs market with a revenue share of 77.78% in 2024. According to NCBI, a study was carried out to compare the therapeutic efficacy of Epoetin alfa and Epoetin -beta in hemodialysis patients. It was reported that Epoetin -beta was more effective in maintaining the hemoglobin concentration and that a higher dose of Epoetin -alfa was required to maintain the same hemoglobin concentration. Owing to this improved efficacy, the market for Epoetin -beta is expected to exhibit positive growth.

The Darbepoetin-alfa segment is expected to grow at a high growth rate over the forecast period. The growth of the segment can be attributed to initiatives undertaken by the company to provide financial assistance to patients for purchasing ARANESP (darbepoetin alfa). In the U.S., Amgen, Inc. offers financial assistance to uninsured patients through its Amgen Safety Net Foundation. It is up to public and private reimbursement providers whether they mandate to engage in schemes or not. This foundation also guides insured patients to avail and buy discount benefits associated with Aranesp.

The renal diseases segment dominated the erythropoietin drugs market with a revenue share of 44.0% in 2024. This dominance can be attributed to the fact that the wide availability of erythropoietin drugs for the treatment of patients suffering from different renal disease conditions. Some of the erythropoietin drugs used are Epogen, Aranesp, Venofer, and Ferrlecit. These drugs represent approximately 25% of the total payments of drugs that are used for the management of anemia patients with CKD as per the Medicare and Beneficiary report. Thus, the presence of well-developed reimbursement policies for renal transplants and related diseases is also expected to drive the erythropoietin drugs market.

The cancer segment is expected to witness the fastest growth over the forecast period owing to the disease burden. According to Globocan, the number of new cancer cases is anticipated to reach 28.4 million within the next two decades, with a rise of 47% from 2020, owing to the adoption of a western lifestyle, high consumption of alcohol, smoking, poor diet choices, and physical inactivity. Erythropoietin drugs majorly epoetin-alfa have been in use to increase the hemoglobin levels in cancer patients who have developed chemotherapy-associated anemia. Thus, a growing number of cancer cases is projected to propel the demand for erythropoietin drugs.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Erythropoietin Drugs Market

By Type

By Product

By Application

By Regional

Chapter 1 Methodology and Scope

1.1 Market Segmentation and Scope

1.1.1 Regional scope

1.1.2 Estimates and forecast timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased database

1.3.2 internal database

1.3.3 Secondary sources

1.3.4 Primary research

1.4 Information or Data Analysis

1.4.1 Data analysis models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis (Model 1)

1.6.1.1 Approach 1: Commodity Flow Approach

1.7 Research Assumptions

1.8 List of Secondary Sources

1.9 List of Abbreviations

1.10 Objectives

1.10.1 Objective 1

1.10.2 Objective 2

1.10.3 Objective 3

1.10.4 Objective 4

Chapter 2 Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Erythropoietin Drugs Market Variables, Trends, and Scope

3.1 Market Lineage Outlook

3.1.1 Parent market outlook

3.2 Penetration and Growth Prospect Mapping for Type, 2024

3.3 Market Dynamics

3.3.1 Market Driver Analysis

3.3.1.1 Increasing incidence of chronic diseases

3.3.1.2 Off-label use of Erythropoiesis stimulating agents (ESAs)

3.3.2 Market Restraint Analysis

3.3.2.1 Patent expiration of branded drugs

3.4 Market Analysis Tools

3.4.1 Industry Analysis: Porter’s Five Forces

3.4.1.1 Threat of new entrants: Moderate

3.4.1.2 Bargaining power of buyers: Moderate

3.4.1.3 Competitive rivalry: High

3.4.1.4 Threat of substitutes: High

3.4.1.5 Bargaining power of suppliers: Low

3.4.2 Industry Analysis: PESTEL

3.4.2.1 Political & Legal

3.4.2.2 Economical

3.4.2.3 Technological

3.5 Pipeline Analysis

Chapter 4 Erythropoietin Drugs Market: Segment Analysis, by Type, 2021 - 2034 (USD Million)

4.1 Erythropoietin Drugs Market: Type Movement Analysis

4.1.1 Biologics

4.1.1.1 Biologics Market Estimates and Forecast, 2021 - 2034 (USD Million)

4.1.2 Biosimilars

4.1.2.1 Biosimilars Market Estimates and Forecast, 2021 - 2034 (USD Million)

Chapter 5 Erythropoietin Drugs Market: Segment Analysis, by Product, 2021 - 2034 (USD Million)

5.1 Erythropoietin Drugs Market: Product Movement Analysis

5.1.1 Erythropoietin

5.1.1.1 Erythropoietin Market Estimates and Forecast, 2021 - 2034 (USD Million)

5.1.2 Darbepoetin-alfa

5.1.2.1 Darbepoetin Market Estimates and Forecast, 2021 - 2034 (USD Million)

Chapter 6 Erythropoietin Drugs Market: Segment Analysis, by Application, 2021 - 2034 (USD Million)

6.1 Erythropoietin Drugs Market: Application Movement Analysis

6.1.1 Cancer

6.1.1.1 Cancer Market Estimates and Forecast, 2021 - 2034 (USD Million)

6.1.2 Renal Diseases

6.1.2.1 Renal Diseases Market Estimates and Forecast, 2021 - 2034 (USD Million)

6.1.3 Neurology

6.1.3.1 Neurology Market Estimates and Forecast, 2021 - 2034 (USD Million)

6.1.4 Others

6.1.4.1 Others Market Estimates and Forecast, 2021 - 2034 (USD Million)

Chapter 7 Erythropoietin Drugs Market: Regional Estimates and Trend Analysis, by Type, Product, & Application

7.1 North America

7.1.1 SWOT Analysis

7.1.1.1 North America Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.1.2 U.S.

7.1.2.1 Key Country Dynamics

7.1.2.2 Target Disease Prevalence

7.1.2.3 Competitive Scenario

7.1.2.4 Regulatory Framework

7.1.2.5 Reimbursement Scenario

7.1.2.6 U.S. Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.1.3 Canada

7.1.3.1 Key Country Dynamics

7.1.3.2 Target Disease Prevalence

7.1.3.3 Competitive Scenario

7.1.3.4 Regulatory Framework

7.1.3.5 Reimbursement Scenario

7.1.3.6 Canada Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2 Europe

7.2.1 SWOT Analysis:

7.2.1.1 Europe Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.2 Germany

7.2.2.1 Key Country Dynamics

7.2.2.2 Target Disease Prevalence

7.2.2.3 Competitive Scenario

7.2.2.4 Regulatory Framework

7.2.2.5 Reimbursement Scenario

7.2.2.6 Germany Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.3 UK

7.2.3.1 Key Country Dynamics

7.2.3.2 Target Disease Prevalence

7.2.3.3 Competitive Scenario

7.2.3.4 Regulatory Framework

7.2.3.5 Reimbursement Scenario

7.2.3.6 UK Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.4 France

7.2.4.1 Key Country Dynamics

7.2.4.2 Target Disease Prevalence

7.2.4.3 Competitive Scenario

7.2.4.4 Regulatory Framework

7.2.4.5 Reimbursement Scenario

7.2.4.6 France Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.5 Italy

7.2.5.1 Key Country Dynamics

7.2.5.2 Target Disease Prevalence

7.2.5.3 Competitive Scenario

7.2.5.4 Regulatory Framework

7.2.5.5 Reimbursement Scenario

7.2.5.6 Italy Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.6 Spain

7.2.6.1 Key Country Dynamics

7.2.6.2 Target Disease Prevalence

7.2.6.3 Competitive Scenario

7.2.6.4 Regulatory Framework

7.2.6.5 Reimbursement Scenario

7.2.6.6 Spain Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.7 Denmark

7.2.7.1 Key Country Dynamics

7.2.7.2 Target Disease Prevalence

7.2.7.3 Competitive Scenario

7.2.7.4 Regulatory Framework

7.2.7.5 Reimbursement Scenario

7.2.7.6 Denmark Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.8 Sweden

7.2.8.1 Key Country Dynamics

7.2.8.2 Target Disease Prevalence

7.2.8.3 Competitive Scenario

7.2.8.4 Regulatory Framework

7.2.8.5 Reimbursement Scenario

7.2.8.6 Sweden Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.9 Norway

7.2.9.1 Key Country Dynamics

7.2.9.2 Target Disease Prevalence

7.2.9.3 Competitive Scenario

7.2.9.4 Regulatory Framework

7.2.9.5 Reimbursement Scenario

7.2.9.6 Norway Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.9.7 Rest of Europe Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3 Asia Pacific

7.3.1 SWOT Analysis:

7.3.1.1 Asia Pacific Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.2 Japan

7.3.2.1 Key Country Dynamics

7.3.2.2 Target Disease Prevalence

7.3.2.3 Competitive Scenario

7.3.2.4 Regulatory Framework

7.3.2.5 Reimbursement Scenario

7.3.2.6 Japan Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.3 China

7.3.3.1 Key Country Dynamics

7.3.3.2 Target Disease Prevalence

7.3.3.3 Competitive Scenario

7.3.3.4 Regulatory Framework

7.3.3.5 Reimbursement Scenario

7.3.3.6 China Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.4 India

7.3.4.1 Key Country Dynamics

7.3.4.2 Target Disease Prevalence

7.3.4.3 Competitive Scenario

7.3.4.4 Regulatory Framework

7.3.4.5 Reimbursement Scenario

7.3.4.6 India Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.5 Australia

7.3.5.1 Key Country Dynamics

7.3.5.2 Target Disease Prevalence

7.3.5.3 Competitive Scenario

7.3.5.4 Regulatory Framework & Reimbursement Scenario

7.3.5.5 Australia Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.6 Thailand

7.3.6.1 Key Country Dynamics

7.3.6.2 Target Disease Prevalence

7.3.6.3 Competitive Scenario

7.3.6.4 Regulatory Framework & Reimbursement Scenario

7.3.6.5 Thailand Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.7 South Korea

7.3.7.1 Key Country Dynamics

7.3.7.2 Target Disease Prevalence

7.3.7.3 Competitive Scenario

7.3.7.4 Regulatory Framework & Reimbursement Scenario

7.3.7.5 South Korea Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.3.7.6 Rest of Asia Pacific Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4 Latin America

7.4.1 SWOT Analysis:

7.4.1.1 Latin America Erythropoietin Drugs market estimates and forecasts, 2021 - 2034 (USD Million)

7.4.2 Brazil

7.4.2.1 Key Country Dynamics

7.4.2.2 Target Disease Prevalence

7.4.2.3 Competitive Scenario

7.4.2.4 Regulatory Framework

7.4.2.5 Reimbursement Scenario

7.4.2.6 Brazil Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4.3 Mexico

7.4.3.1 Key Country Dynamics

7.4.3.2 Target Disease Prevalence

7.4.3.3 Competitive Scenario

7.4.3.4 Regulatory Framework

7.4.3.5 Reimbursement Scenario

7.4.3.6 Mexico Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4.4 Argentina

7.4.4.1 Key Country Dynamics

7.4.4.2 Target Disease Prevalence

7.4.4.3 Competitive Scenario

7.4.4.4 Regulatory Framework

7.4.4.5 Reimbursement Scenario

7.4.4.6 Argentina Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4.4.7 Rest of Latin America Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.5 Middle East & Africa (MEA)

7.5.1 SWOT Analysis:

7.5.1.1 Middle East & Africa Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.5.2 South Africa

7.5.2.1 Key Country Dynamics

7.5.2.2 Target Disease Prevalence

7.5.2.3 Competitive Scenario

7.5.2.4 Regulatory Framework

7.5.2.5 Reimbursement Scenario

7.5.2.6 South Africa Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.5.3 Saudi Arabia

7.5.3.1 Key Country Dynamics

7.5.3.2 Target Disease Prevalence

7.5.3.3 Competitive Scenario

7.5.3.4 Regulatory Framework

7.5.3.5 Reimbursement Scenario

7.5.3.6 Saudi Arabia Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.5.4 UAE

7.5.4.1 Key Country Dynamics

7.5.4.2 Target Disease Prevalence

7.5.4.3 Competitive Scenario

7.5.4.4 Regulatory Framework

7.5.4.5 Reimbursement Scenario

7.5.4.6 UAE Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.5.5 Kuwait

7.5.5.1 Key Country Dynamics

7.5.5.2 Target Disease Prevalence

7.5.5.3 Competitive Scenario

7.5.5.4 Regulatory Framework

7.5.5.5 Reimbursement Scenario

7.5.5.6 Kuwait Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

7.5.5.7 Rest of MEA Erythropoietin Drugs Market Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 8 Competitive Landscape

8.1 Recent Developments & Impact Analysis, by Key Market Participants

8.1.1 New Product Launch

8.1.2 Merger and Acquisition

8.1.3 Licensing Agreements

8.1.4 Conferences and Campaigns

8.2 Company Categorization

8.2.1 Innovators

8.2.2 Market Leaders

8.3 Vendor Landscape

8.3.1 List of Key Distributors and Channel Partners

8.3.2 Key Customers

8.4 Public Companies

8.4.1 Key Company Market Share Analysis, 2022

8.4.2 Company Market Position Analysis

8.4.3 Heat Map Analysis

8.4.4 Competitive Dashboard Analysis

8.4.4.1 Market Differentiators

8.5 Private Companies

8.5.1 List of Key Emerging Companies

8.5.2 Regional Network Map

8.6 Company Profiles

8.6.1. Johnson & Johnson Services, Inc.

8.6.1.1 Company Overview

8.6.1.2 Financial Performance

8.6.1.3 Product Benchmarking

8.6.1.4 Strategic Initiatives

8.6.2 Novartis AG

8.6.2.1 Company Overview

8.6.2.2 Financial Performance

8.6.2.3 Product Benchmarking

8.6.2.4 Strategic Initiatives

8.6.3 Teva Pharmaceutical Industries Ltd.

8.6.3.1 Company Overview

8.6.3.2 Financial Performance

8.6.3.3 Product Benchmarking

8.6.3.4 Strategic Initiatives

8.6.4 Amgen, Inc.

8.6.4.1 Company Overview

8.6.4.2 Financial Performance

8.6.4.3 Product Benchmarking

8.6.4.4 Strategic Initiatives

8.6.5 F. Hoffmann-La Roche Ltd.

8.6.5.1 Company Overview

8.6.5.2 Financial Performance

8.6.5.3 Product Benchmarking

8.6.5.4 Strategic Initiatives

8.6.6 LG Chem

8.6.6.1 Company Overview

8.6.6.2 Financial Performance

8.6.6.3 Product Benchmarking

8.6.6.4 Strategic Initiatives

8.6.7 Biocon

8.6.7.1 Company Overview

8.6.7.2 Financial Performance

8.6.7.3 Product Benchmarking

8.6.7.4 Strategic Initiatives

8.6.8 Intas Pharmaceuticals Ltd.

8.6.8.1 Company Overview

8.6.8.2 Financial Performance

8.6.8.3 Product Benchmarking

8.6.8.4 Strategic Initiatives

8.6.9 Sun Pharmaceutical Industries Ltd.

8.6.8.1 Company Overview

8.6.9.2 Financial Performance

8.6.9.3 Product Benchmarking

8.6.9.4 Strategic Initiatives

8.6.10 Dr. Reddy’s Laboratories Ltd

8.6.10.1 Company Overview

8.6.10.2 Product Benchmarking

8.6.10.3 Strategic Initiatives