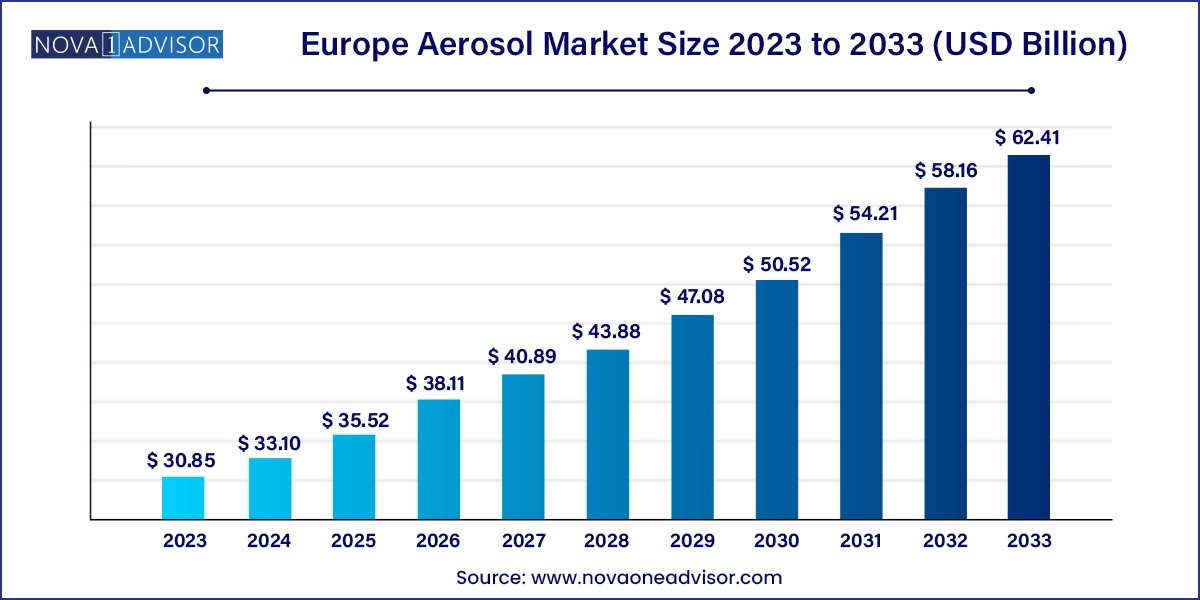

The Europe aerosol market size was exhibited at USD 30.85 billion in 2023 and is projected to hit around USD 62.41 billion by 2033, growing at a CAGR of 7.3% during the forecast period 2024 to 2033.

The Europe aerosol market stands as one of the most established and dynamic segments in the global packaging and dispensing industry. With its deep-rooted legacy in personal care and pharmaceutical product innovation, Europe has consistently led the global push toward sustainable aerosol technologies, regulatory compliance, and high-performance product development. The aerosol format a self-dispensing container system that delivers products in the form of mist, foam, spray, or gas is a preferred choice across diverse applications, including beauty, household care, industrial maintenance, food, and healthcare.

Aerosols are favored for their efficiency, controlled dosage, hygienic dispensing, and longer shelf life. These advantages are particularly aligned with European consumer expectations, where quality, safety, and sustainability converge. The region’s emphasis on eco-friendly lifestyles and stringent environmental regulations, especially around volatile organic compounds (VOCs), has accelerated the development and adoption of green aerosol alternatives.

Europe is also home to some of the world’s most recognizable aerosol-producing countries Germany, France, the UK, and Italy each contributing uniquely to innovation, volume, and category leadership. The industry benefits from mature production infrastructure, highly evolved recycling ecosystems, and a strong demand for personal grooming, home hygiene, and therapeutic sprays.

In a post-COVID world, the aerosol sector in Europe has not only rebounded but diversified further. Antiseptic sprays, dry shampoos, cooking sprays, sprayable supplements, and even aerosolized medicines have become more commonplace, reflecting the shift in both consumer behavior and industrial focus.

Growing demand for sustainable and eco-friendly aerosol packaging (especially recyclable aluminum and bag-in-valve formats).

Strong consumer shift toward natural and organic aerosol-based personal care products.

Adoption of compressed and refillable aerosol technologies by top brands.

Expansion of medical aerosols in home-care and remote healthcare settings.

Introduction of smart and digitally trackable aerosol packaging.

Widening use of aerosols in food and beverage (e.g., cooking oil sprays and whipped cream).

Rise in premiumization of personal care aerosols across France, Italy, and the UK.

Government-backed initiatives in Germany and France promoting circular packaging economy.

| Report Coverage | Details |

| Market Size in 2024 | USD 33.10 Billion |

| Market Size by 2033 | USD 62.41 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Material, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Germany; France; Italy; UK |

| Key Companies Profiled | Lindal Group; Atlantic Zeiser; Cerulean; Citus Kalix; Leonhard Fischer GmbH; Act Aerosol Chemie Technik GmbH; Fenoplast Fügetechnik GmbH; Technima France; BM Aerosol. |

Aluminum dominated the material segment due to its lightweight, corrosion resistance, and recyclability, making it the preferred choice across personal care and food categories.

Aluminum's popularity in Europe is closely linked to its environmental credentials. With an efficient recycling infrastructure across the EU, aluminum cans are favored by brands looking to promote circular economy practices. The material's aesthetic appeal and compatibility with high-pressure systems also make it ideal for premium segments. Leading brands in Germany and the UK often promote their use of 100% recycled aluminum in aerosol packaging.

Steel is growing steadily in industrial and automotive applications, though slower than aluminum in consumer-facing segments.

Steel aerosol containers are typically used in industrial lubricants, anti-rust sprays, and certain household cleaners requiring high durability and pressure resistance. While less recyclable than aluminum, steel remains relevant due to its structural strength and low raw material cost. Countries like Italy and Eastern Europe, where automotive manufacturing is prominent, continue to use steel-based aerosols for equipment maintenance and workshop supplies.

Standard valve aerosols remained dominant in the European market due to their widespread presence in conventional personal care and household products.

Standard valve systems have long been a mainstay in Europe’s aerosol sector, particularly in hair sprays, deodorants, furniture polishes, and air fresheners. Their familiarity, cost-effectiveness, and mature manufacturing ecosystem have made them the default choice for brands targeting mass-market consumers. In countries like the UK and Italy, where daily grooming and household upkeep are culturally emphasized, standard valve products maintain a stronghold.

However, bag-in-valve aerosols are the fastest-growing segment due to their compatibility with eco-friendly, non-flammable, and sensitive formulations.

Bag-in-valve (BOV) systems offer notable advantages, such as reduced product wastage, the ability to dispense 360°, and safe compatibility with compressed air or nitrogen propellants. These systems are increasingly used in premium skincare, pharmaceutical sprays, and organic food products. In France and Germany, the BOV format is widely adopted for dermatological sprays, baby care products, and nasal sprays due to their air-tight, preservative-free capabilities. The shift toward natural ingredients is accelerating this growth further.

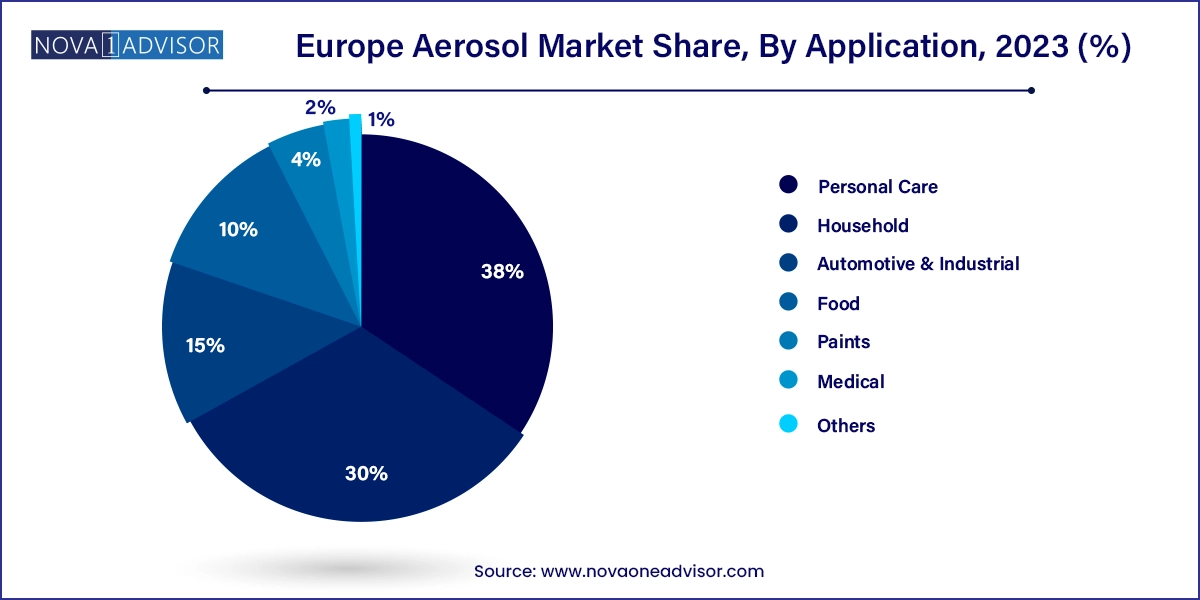

Personal care remained the largest application segment in Europe, driven by the continued demand for grooming and skincare products.

Europe’s rich tradition in personal grooming, particularly in France, Italy, and the UK, sustains a robust demand for aerosol-based beauty products. Deodorants, hair sprays, shaving foams, and body mists are daily essentials, while innovations like texture-enhancing dry shampoos and spray serums have gained traction. European consumers favor compact and elegant packaging, further reinforcing the aerosol format’s appeal in this category.

The medical segment is emerging as the fastest-growing, particularly with the rise of home-care treatments and pharmaceutical-grade aerosols.

Inhalers, wound care sprays, topical anesthetics, and disinfectant sprays have witnessed increased demand across Europe’s aging population. Bag-in-valve technologies are instrumental in the growth of this category, offering sterile, preservative-free delivery for sensitive users. The surge in demand for self-administered health products and post-pandemic preparedness has made aerosolized medical products a core growth area across Germany and France.

Germany

Germany is Europe’s largest aerosol market, underpinned by its industrial might, disciplined consumer behavior, and strong environmental consciousness. The country leads in production volume and recycling infrastructure, with aluminum aerosols used extensively in both consumer and industrial segments. Germany also drives innovation in sustainable packaging, aided by its government-backed initiatives for plastic and carbon reduction.

France

France is renowned for its premium personal care and fragrance products, many of which are packaged in high-end aerosol formats. The country’s cosmetic heritage has led to increased demand for dermatological sprays, organic perfumes, and luxury haircare mists. French consumers prioritize efficacy, safety, and sensory experience, which pushes brands to innovate with BOV and aluminum-based packaging.

Italy

Italy’s aerosol usage is heavily driven by its grooming culture and household cleaning traditions. The country also exhibits significant production capabilities in the food and paint aerosol segments. Spray-based olive oils, whipped creams, and varnishes are popular both domestically and for export. Italian brands are also actively adopting refillable and compressed aerosol technology in their packaging.

United Kingdom

The UK’s aerosol market is heavily influenced by grooming trends, high product turnover, and rising sustainability expectations. Brands are increasingly switching to eco-aerosols and investing in consumer education around recycling. The market has seen increased penetration of store-brand and private-label aerosol products in supermarkets, offering affordability without sacrificing performance. The UK is also a leader in clinical aerosol sprays and over-the-counter healthcare solutions.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe aerosol market

Type

Material

Application

Country