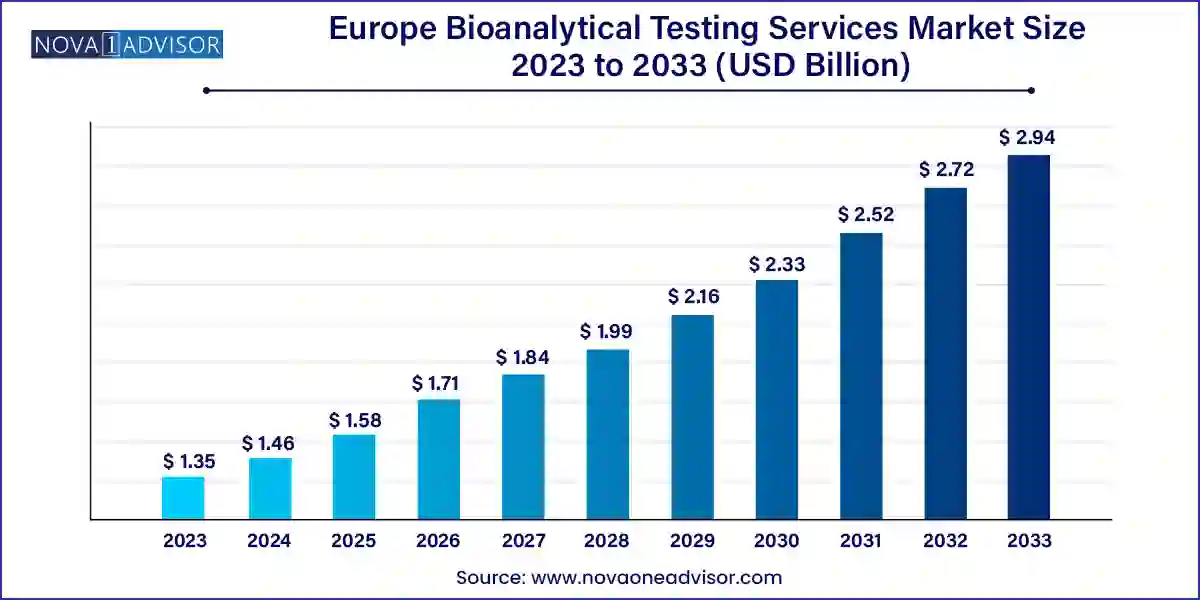

The Europe bioanalytical testing services market size was exhibited at USD 1.35 billion in 2023 and is projected to hit around USD 2.94 billion by 2033, growing at a CAGR of 8.11% during the forecast period 2024 to 2033.

The Europe Bioanalytical Testing Services Market is a critical segment within the continent’s growing contract research and pharmaceutical services industry. Bioanalytical testing encompasses a wide array of techniques used to quantify drugs, metabolites, and biomarkers in biological samples. These services are pivotal across every stage of the drug development cycle—ranging from preclinical trials to post-marketing surveillance and play an essential role in ensuring regulatory compliance, safety, and efficacy of pharmaceutical and biopharmaceutical products.

Europe’s robust clinical research infrastructure, regulatory harmonization through the European Medicines Agency (EMA), and presence of global pharmaceutical and biotech giants create a fertile environment for the growth of bioanalytical testing services. Outsourcing to specialized bioanalytical laboratories has become the norm, as it allows sponsors to access expertise, advanced technologies, and scalability without internal resource constraints.

The rise of biologics, biosimilars, and complex novel drug modalities (such as antibody-drug conjugates, gene therapies, and cell-based products) has further elevated the demand for sophisticated analytical support. Whether it's LC-MS/MS analysis for small molecules or ligand-binding assays for large molecules, bioanalytical labs in Europe are rapidly expanding their technical portfolios to support innovation.

Furthermore, the COVID-19 pandemic reshaped the drug development landscape, placing accelerated timelines and decentralized trials in the spotlight. As a result, Europe saw increased investment in agile, quality-driven bioanalytical services to support vaccine, antiviral, and therapeutic development. With regulatory frameworks becoming increasingly transparent and innovation-focused, Europe is emerging as a global hub for bioanalytical excellence.

Shift Toward Biologics and Biosimilars: Increased demand for large molecule testing, especially immunoassays and anti-drug antibody (ADA) evaluations.

Integration of Hybrid and Hyphenated Technologies: Combining chromatography with mass spectrometry or ligand-binding assays to enhance precision and versatility.

Rising Outsourcing of Complex Molecule Testing: Pharmaceutical and biotech companies increasingly prefer third-party labs to handle biologics testing due to required technical sophistication.

Decentralization and Remote Trial Monitoring: Increased adoption of remote sample collection, storage, and logistics for real-world bioanalytical studies.

Automation in Sample Preparation: Growing use of robotic platforms for sample extraction and purification to reduce manual error and improve reproducibility.

Customized Assay Development: Demand for tailored assays, especially for niche therapeutics and rare disease studies, is increasing among biotech firms.

Consolidation in CRO Market: Mergers and acquisitions are shaping the bioanalytical services landscape, offering clients bundled preclinical and clinical support.

Compliance with EU GCP and EMA Guidelines: Enhanced focus on quality assurance and regulatory data integrity, driving demand for accredited and audit-ready labs.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.46 Billion |

| Market Size by 2033 | USD 2.94 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Molecule, Test, Workflow, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.K.; Germany; France; Italy; Spain; Netherlands; Switzerland; Sweden; Denmark; Norway |

| Key Companies Profiled | Cerba HealthCare; Charles River Laboratories; Eurofins Scientific; ICON plc; Intertek Group plc; IQVIA Inc.; Labcorp Drug Development; SGS Société Générale de Surveillance SA; Syneos Health; Thermo Fisher Scientific Inc. (PPD, Inc.) |

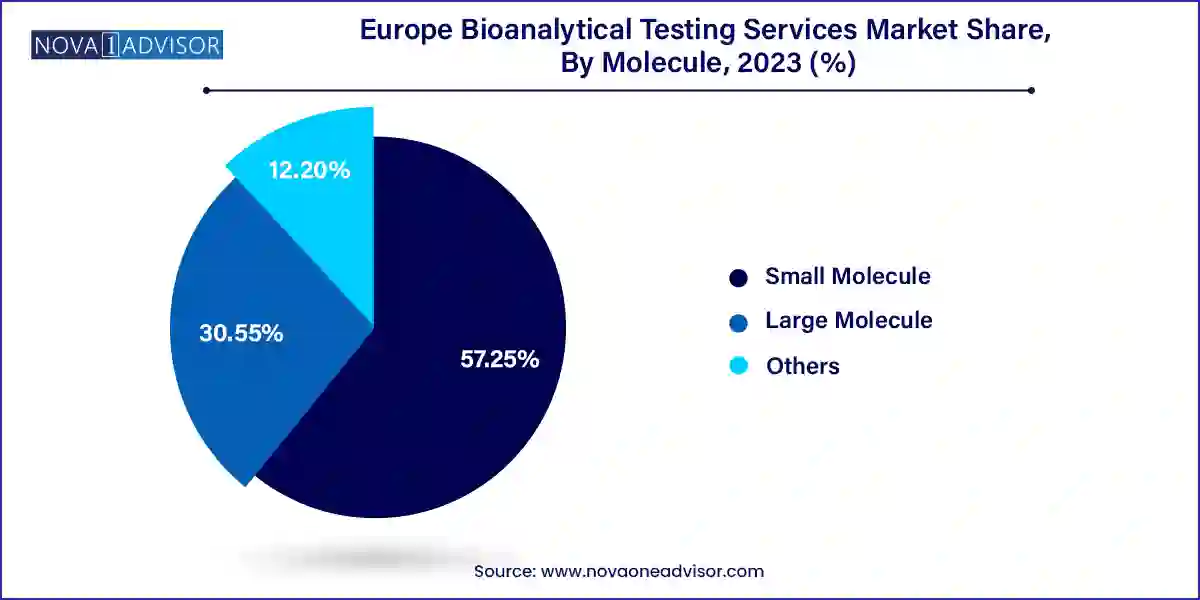

Small molecules dominated the Europe bioanalytical testing services market due to their historical prevalence in pharmaceutical development. Techniques such as LC-MS/MS and HPLC remain the gold standards for quantifying small molecule drugs and metabolites in plasma, serum, or urine. Most of Europe’s generic drug pipelines and numerous new chemical entities (NCEs) under development still fall within the small molecule category. The ease of characterization, faster development timelines, and established regulatory frameworks continue to drive demand for small molecule bioanalysis across phases I to IV of clinical trials.

However, large molecules represent the fastest-growing segment, with applications spanning LC-MS studies, immunoassays, pharmacokinetics (PK), and anti-drug antibody (ADA) testing. The rise in monoclonal antibodies, fusion proteins, vaccines, and biosimilars—especially in immunology and oncology—requires sophisticated testing services that can capture immunogenicity, target engagement, and dose-response dynamics. CROs and testing labs are expanding their capabilities in ligand-binding assays, hybrid LC-MS platforms, and multiplex immunoassay systems to address this complex and growing demand. The biological complexity of these molecules demands not just testing, but scientific collaboration, thus fostering long-term partnerships between sponsors and service providers.

Sample analysis dominated the Europe bioanalytical testing services market, encompassing a range of techniques such as mass spectrometry, chromatography, ligand binding assays, and nuclear magnetic resonance (NMR). The complexity of drug candidates and biomarkers requires advanced analytical tools that can offer high sensitivity, reproducibility, and multiplexing capabilities. Labs across Europe are equipped with high-throughput LC-MS/MS systems, multiplex immunoassay platforms, and automated NMR instruments to meet growing analytical demands.

Within sample analysis, mass spectrometry and hyphenated techniques (e.g., LC-MS, GC-MS) are especially prominent for both qualitative and quantitative testing. These tools provide unmatched sensitivity and are widely used in both small and large molecule studies. However, sample preparation, particularly solid-phase extraction (SPE) and liquid-liquid extraction (LLE), is emerging as a critical and fast-growing segment. Automated preparation systems are being adopted to improve throughput and reduce variability in results. With increasing volumes of clinical samples, especially in multi-country trials, the need for robust and scalable sample preparation workflows is expanding.

Pharmacokinetics (PK) testing is the cornerstone of bioanalytical services and currently dominates the European market. PK analysis involves determining the absorption, distribution, metabolism, and excretion of drugs, and is essential in defining dosage regimens, bioavailability, and safety margins. Every new drug candidate—whether small or large molecule—must undergo PK testing as part of early-phase clinical studies. European CROs and bioanalytical labs offer a range of PK services, including population PK and compartmental modeling, which are crucial for regulatory submission and label optimization.

Simultaneously, bioequivalence (BE) and bioavailability (BA) studies are gaining traction, especially with the rising number of generic and biosimilar applications across Europe. With countries like Germany and the UK encouraging generic drug uptake to reduce healthcare costs, BE testing has become a priority. This segment benefits from high sample volume and the need for robust, validated analytical methods. As more biosimilars enter the pipeline, especially for high-cost biologics like rituximab and adalimumab, BE/BA testing tailored to protein drugs will witness rapid growth.

Within Europe, Germany holds the leading position in the bioanalytical testing services market. It benefits from a strong pharmaceutical manufacturing base, world-class research universities, and a large number of clinical trial sites. German laboratories and CROs are well-known for quality compliance, scientific rigor, and early adoption of advanced analytical techniques. Additionally, supportive government policies and investment in R&D create an environment conducive to market leadership.

The United Kingdom, meanwhile, is emerging as the fastest-growing country in this sector. Post-Brexit regulatory clarity, combined with investments in biotech, genomics, and advanced therapy medicinal products (ATMPs), is spurring demand for bioanalytical support. The UK's National Institute for Health and Care Research (NIHR) and private initiatives are funding early-phase clinical trials and translational research, fostering a surge in demand for PK/PD, immunogenicity, and biomarker testing. The presence of institutions like the Medicines and Healthcare products Regulatory Agency (MHRA) and a skilled labor force further enhance the UK's competitive edge.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe bioanalytical testing services market

Molecule

Test

Workflow

Country