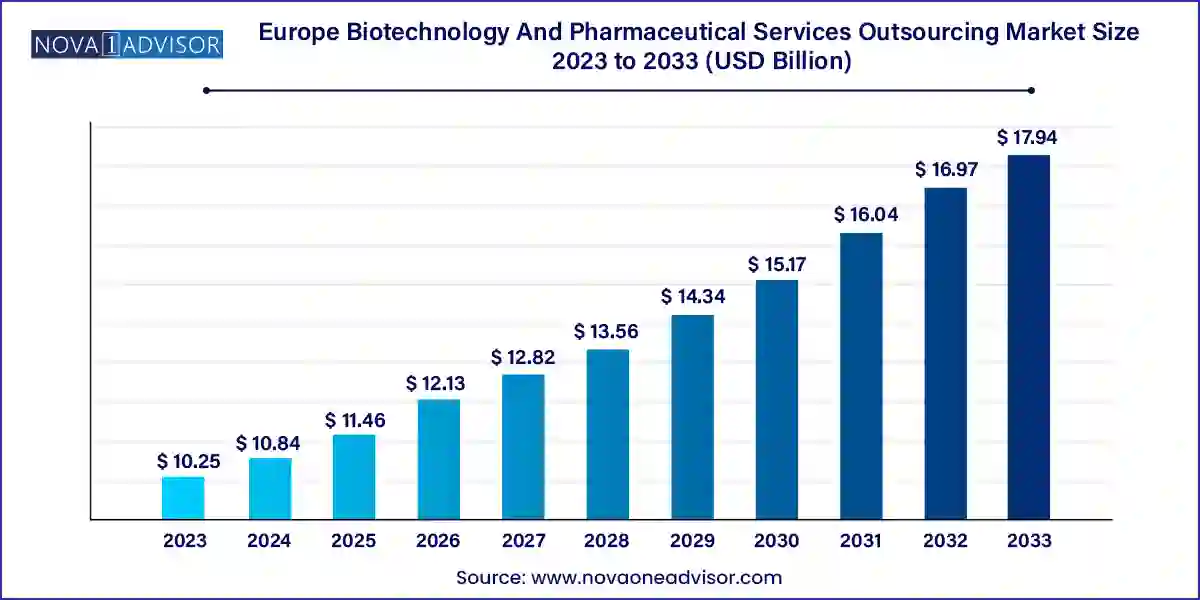

The Europe biotechnology and pharmaceutical services outsourcing market size was exhibited at USD 10.25 billion in 2023 and is projected to hit around USD 17.94 billion by 2033, growing at a CAGR of 5.76% during the forecast period 2024 to 2033.

The Europe biotechnology and pharmaceutical services outsourcing market has become a key pillar supporting innovation, compliance, and efficiency in the continent’s life sciences ecosystem. In an industry marked by increasing complexity, stringent regulatory frameworks, and growing pressure to reduce time-to-market, pharmaceutical and biotech companies are turning to outsourcing service providers to manage non-core but mission-critical functions. These include consulting, clinical development support, regulatory affairs, product design and development, auditing, training, and post-market services.

European pharmaceutical giants and innovative biotech startups alike rely on Contract Research Organizations (CROs), Contract Development and Manufacturing Organizations (CDMOs), and specialized regulatory consultants to manage workflows that are increasingly global in scope but highly localized in execution. The outsourcing market is further shaped by the continent’s rich talent pool, strong academic-industry collaboration, and regulatory sophistication under the European Medicines Agency (EMA).

Post-pandemic, outsourcing has become more strategic than operational. Companies no longer outsource just to save costs but to access niche expertise, expand geographic reach, and integrate new technologies such as decentralized trials, AI-powered data analytics, and e-submission systems. With a favorable R&D climate, public-private investments, and a growing emphasis on personalized medicine, the European outsourcing landscape is poised for continuous evolution and growth.

Adoption of decentralized and hybrid clinical trials across Europe: Sponsors are integrating digital tools and remote monitoring to support patient-centric research models.

Growing demand for regulatory consulting in response to EU MDR and IVDR: Companies require specialized support to align with new regulations and avoid market access delays.

Strategic expansions of CROs and CDMOs in Central and Eastern Europe: Cost advantages and untapped patient pools are attracting investments to Poland, Hungary, and Czechia.

Increasing outsourcing of pharmacovigilance and post-marketing surveillance: EMA’s strict safety monitoring guidelines are pushing companies to rely on expert outsourcing partners.

Rise in specialized service providers for orphan drugs and rare diseases: With a growing focus on personalized treatments, demand for niche regulatory and development consulting is accelerating.

Use of real-world evidence (RWE) in regulatory submissions: Companies are partnering with outsourcing firms to harness RWE for market access and payer engagement.

Demand for quality management consulting and audit preparation: With tighter scrutiny on GMP, GCP, and GDP compliance, firms are outsourcing quality assurance functions for readiness and risk mitigation.

| Report Coverage | Details |

| Market Size in 2024 | USD 10.84 Billion |

| Market Size by 2033 | USD 17.94 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.76% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | End-use, Service, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway |

| Key Companies Profiled | Concept Heidelberg GmbH; ICON PLC; Venus Pharma GmbH; Kindeva Drug Delivery; Midas Pharma GmbH; IQVIA Inc. |

One of the most significant drivers of the European biotechnology and pharmaceutical services outsourcing market is the growing complexity of regulatory requirements and clinical development protocols. Europe operates under unified yet evolving regulatory regimes such as the EU Clinical Trials Regulation (CTR), Medical Devices Regulation (MDR), and In Vitro Diagnostic Regulation (IVDR). These frameworks require comprehensive documentation, data transparency, and ethical standards, which create an operational burden on pharmaceutical and biotech firms.

Outsourcing providers help alleviate this complexity by offering deep expertise in local and pan-European regulatory navigation. For instance, companies often outsource regulatory writing, eCTD submissions, and legal representation for multi-country trials. Similarly, clinical development services such as site selection, trial logistics, and protocol design are delegated to experienced CROs. Organizations like ICON, Parexel, and Charles River offer integrated clinical-regulatory solutions tailored to EMA compliance. As therapeutic pipelines diversify especially with biologics and ATMPs outsourcing partners become indispensable for ensuring speed and regulatory rigor.

Despite growth momentum, data privacy and cross-border compliance risks continue to restrain the outsourcing market in Europe. The enforcement of the General Data Protection Regulation (GDPR) has placed strict controls on the collection, processing, and storage of personal health data. Pharmaceutical and biotech companies—especially those conducting clinical trials—must ensure full compliance with GDPR when working with outsourcing partners.

This makes vendor selection, contract structuring, and data governance more complex and expensive. Companies must conduct thorough due diligence to verify the capabilities of CROs and CDMOs in data anonymization, consent management, and secure cross-border data transfer. Even minor lapses in compliance can result in severe penalties and reputational damage. Additionally, Brexit has added further complexity, requiring separate authorization pathways and duplication of regulatory filings for the UK. These fragmented rules create an additional burden for global firms managing EU and UK submissions in parallel.

One of the most promising opportunities in Europe’s outsourcing market lies in the accelerating growth of cell and gene therapy (CGT) development. Europe is a leader in CGT innovation, supported by dedicated regulatory pathways from the EMA’s Committee for Advanced Therapies (CAT) and significant funding from Horizon Europe and other regional programs. However, the development of CGTs involves unique challenges complex manufacturing, tailored clinical protocols, and novel regulatory frameworks which most small and mid-size biotechs cannot handle in-house.

Outsourcing partners specializing in CGT support from viral vector manufacturing and aseptic fill-finish to regulatory strategy for advanced therapies—are in high demand. For instance, Lonza’s facilities in Switzerland and Belgium, as well as Charles River’s expansion in France, are serving this exact niche. These services are crucial to translating preclinical CGT research into scalable clinical and commercial-stage programs. As Europe’s gene therapy pipeline continues to grow, especially in rare diseases and oncology, outsourcing will play a central role in de-risking development and accelerating approvals.

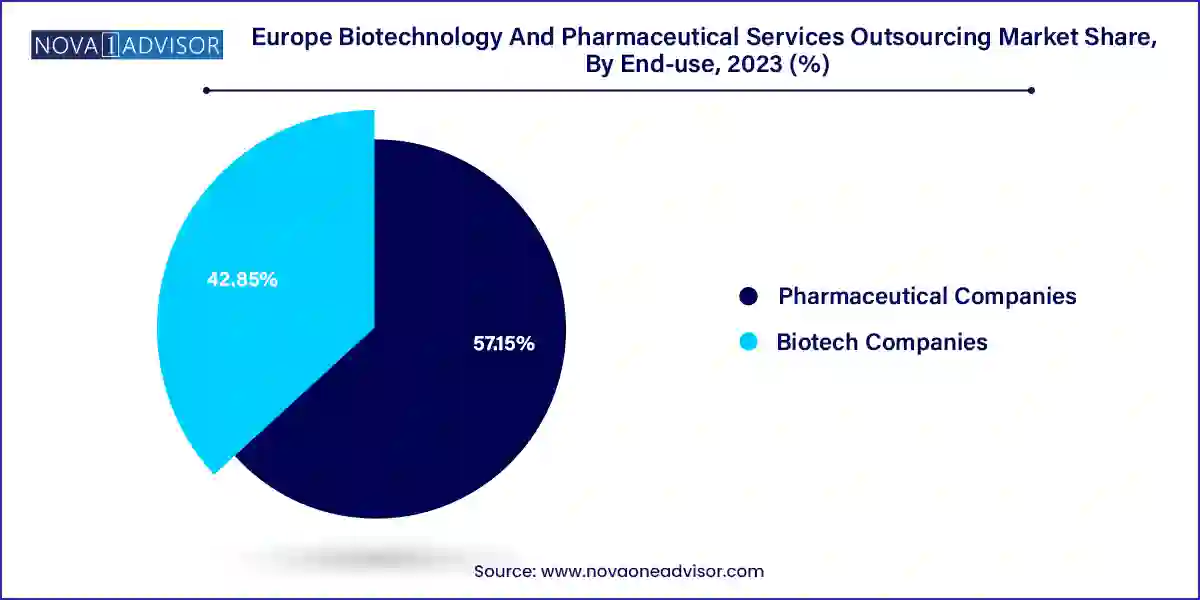

Pharmaceutical companies are the dominant end-user segment, accounting for the largest share of the Europe outsourcing market. With robust pipelines and global footprints, these companies rely heavily on external partners for regulatory consulting, clinical development, and product lifecycle management. The complexity of European submissions and the cost pressures associated with long development cycles make outsourcing an essential component of pharmaceutical strategy. Notably, many big pharma firms operating in Germany, France, and the UK have long-standing contracts with top-tier CROs such as IQVIA, ICON, and Parexel for Phase I–IV trials, pharmacovigilance, and market access planning.

Biotech companies are the fastest-growing end-users, particularly early-stage and virtual biotechs that lack in-house capabilities. These firms are emerging across hotspots such as Cambridge (UK), Paris, Basel, and Stockholm, and are focused on advanced modalities including RNA therapeutics, microbiome-based treatments, and CRISPR gene editing. Outsourcing provides them with the strategic agility to access specialist regulatory consultants, biomarker validation services, and decentralized trial management. Biotech firms are also more likely to explore multi-country trials early in development, creating greater reliance on full-service CROs.

Regulatory affairs dominated the European outsourcing market, due to the intricacies involved in regulatory filings, renewals, labeling, and post-approval variation management. Services such as regulatory writing and publishing, product registration, and submissions management are mission-critical for both pharmaceutical and biotech clients. With increasing scrutiny from EMA, national competent authorities, and health technology assessment (HTA) bodies, the demand for region-specific regulatory intelligence and hands-on execution is rising. Providers like Syneos Health, ICON, and Eurofins have built dedicated regulatory affairs teams with deep EU expertise.

Consulting services are the fastest-growing segment, as clients demand more than just transactional support. Services such as strategic planning, clinical development consulting, and business development advisory are growing in importance. With rapid changes in therapeutic science and evolving reimbursement landscapes, companies seek expert guidance on how to design trials, build access pathways, and meet quality benchmarks. In January 2024, Parexel expanded its strategic consulting team in Switzerland to provide specialized support for ATMPs and rare disease programs across Europe. The increasing complexity of innovation makes consulting services indispensable to the outsourcing value chain.

Germany – Dominant Market

Germany holds the largest share of the biotechnology and pharmaceutical services outsourcing market in Europe. As home to pharmaceutical powerhouses such as Bayer, Merck KGaA, and Boehringer Ingelheim, as well as a growing biotech startup ecosystem, Germany generates continuous demand for outsourced services. Regulatory excellence, a highly skilled workforce, and a well-structured healthcare system attract both domestic and foreign outsourcing providers. The country’s central location also makes it a logistics hub for multicenter trials and pharmaceutical manufacturing.

Notably, in March 2024, ICON plc announced the launch of a new R&D center in Germany, expanding its capabilities in biometrics, regulatory writing, and real-world evidence support. The move reflects the strategic importance of Germany not just as a customer base but also as an operational anchor for pan-European delivery.

France – Fastest Growing Market

France is emerging as the fastest-growing outsourcing destination, driven by the rise in innovative biotech startups, government investment in health innovation, and increasing adoption of advanced therapies. Paris and Lyon are becoming key nodes for clinical research and life science services, thanks to proximity to academic research centers and hospitals. The Plan France 2030 initiative includes significant funding for biotechnology and digital health, indirectly fueling the growth of outsourcing partnerships.

Companies such as Charles River Laboratories and Labcorp are expanding operations in France to meet demand from both French and global biopharma companies. Additionally, France’s efficient ethics committee process and patient-friendly environment support faster clinical trial initiation, creating momentum for outsourced clinical services.

March 2024 – ICON plc expanded its European presence by opening a new R&D and consulting center in Germany, focused on regulatory affairs, market access, and decentralized trials.

February 2024 – Parexel announced the creation of a strategic advisory division in Switzerland dedicated to advanced therapy medicinal products (ATMPs) and rare diseases, offering integrated clinical and regulatory support.

January 2024 – Eurofins Scientific launched a regulatory intelligence platform in France to support pharmaceutical clients with multi-country compliance tracking and submission management under EU CTR.

December 2023 – Lonza expanded its cell and gene therapy services facility in Visp, Switzerland, adding new process development suites and capacity for early-phase clients.

November 2023 – Syneos Health entered into a long-term collaboration with a UK-based biotech for end-to-end trial management and EMA submission strategy for an RNA-based therapeutic.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe biotechnology and pharmaceutical services outsourcing market

End-use

Service

Country