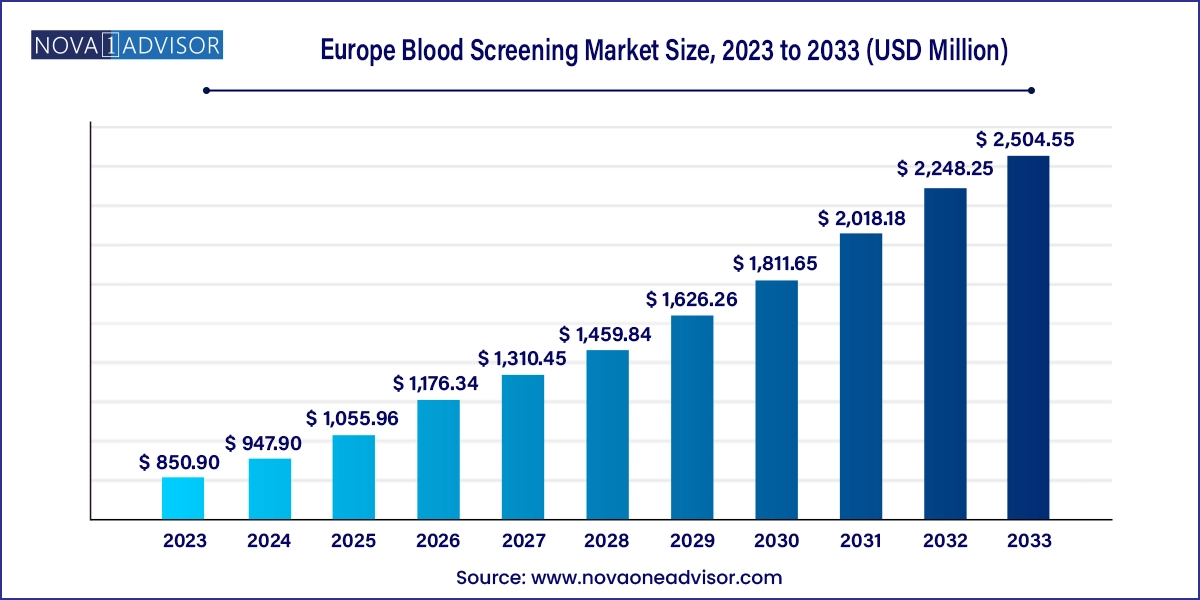

The Europe blood screening market size was exhibited at USD 850.90 million in 2023 and is projected to hit around USD 2,504.55 million by 2033, growing at a CAGR of 11.4% during the forecast period 2024 to 2033.

The Europe blood screening market plays a pivotal role in the region’s public health ecosystem. Blood screening encompasses the diagnostic testing of donated blood and plasma to detect transfusion-transmissible infections (TTIs), genetic abnormalities, and emerging pathogens. It ensures the safety of blood transfusion, supports disease surveillance, and provides essential information in clinical diagnostics, epidemiology, and donor selection.

Europe’s blood screening infrastructure is robust, with established regulatory frameworks such as EU Blood Directives, national hemovigilance systems, and coordinated donation policies. Screening technologies range from traditional serological methods to advanced molecular diagnostics like nucleic acid amplification tests (NAATs) and next-generation sequencing (NGS). Laboratories across the continent are integrating automated, high-throughput platforms to process large volumes of blood efficiently and accurately.

The COVID-19 pandemic reinforced the importance of pathogen testing, driving rapid innovation and policy adaptation across Europe. While the core focus remains on detecting infections like HIV, HBV, HCV, syphilis, malaria, and newer threats like Zika or emerging coronaviruses, the scope of testing is expanding to include personalized medicine, cancer biomarkers, and hereditary blood disorders.

With aging populations, increased demand for surgical procedures, chronic disease burdens, and growing organ transplant programs, the requirement for safe blood and plasma is rising. Furthermore, the European Union’s shift toward harmonized testing standards and public-private partnerships is encouraging investments in blood safety, digital transformation, and biobank development.

Automation and high-throughput systems are streamlining blood testing workflows

Nucleic acid testing (NAT) is becoming the gold standard for detecting low-titer infections

Blood banks are integrating AI and digital recordkeeping for donor tracking and lab analytics

NGS-based pathogen and genomic screening is emerging for rare diseases and oncology

Expansion of voluntary blood donation campaigns is improving supply and quality

European Commission efforts are harmonizing testing standards across member states

Rising adoption of multiplex assays is enhancing testing cost-efficiency

Bio-surveillance programs and centralized repositories are gaining prominence

| Report Coverage | Details |

| Market Size in 2024 | USD 947.90 Million |

| Market Size by 2033 | USD 2,504.55 Million |

| Growth Rate From 2024 to 2033 | CAGR of 11.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Technology, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway |

| Key Companies Profiled | Danaher Corporation; Beckman Coulter, Inc.; Abbott Laboratories; Thermo Fisher Scientific Inc.; Becton, Dickinson and Company; Grifols; Ortho Clinical Diagnostics; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Siemens AG |

One of the primary drivers of the Europe blood screening market is the increasing emphasis on blood safety to prevent the transmission of infectious diseases through transfusions. Diseases such as HIV, hepatitis B and C, and syphilis can be transmitted via infected blood, posing significant public health risks. To address this, European governments and regulatory bodies have mandated rigorous blood screening protocols for all blood and plasma donations.

The implementation of nucleic acid testing (NAT) across most European countries has significantly reduced the diagnostic window, allowing for early detection of viral infections. For instance, Germany, France, and the UK have adopted dual testing systems (serological + NAT) for increased sensitivity. European standards also emphasize hemovigilance, ensuring not only initial screening but ongoing monitoring post-transfusion.

Furthermore, the emergence of pandemics (e.g., SARS-CoV-2, Zika) has highlighted the need for adaptable, broad-spectrum pathogen testing capabilities in blood screening facilities. Public pressure, ethical responsibilities, and medical liability have made it essential for healthcare systems to invest in cutting-edge screening platforms, reinforcing the market’s upward trajectory.

A significant restraint limiting widespread adoption of newer blood screening technologies is the high cost associated with advanced testing instruments and reagents. Molecular diagnostics like NAAT and NGS, though more accurate and rapid, require significant capital investment in instrumentation, skilled personnel, and ongoing quality assurance protocols.

In less affluent regions of Europe or smaller blood banks in rural areas, cost barriers limit the transition from conventional enzyme-linked immunosorbent assays (ELISAs) to molecular diagnostics. Moreover, maintaining stringent temperature controls, contamination-free lab conditions, and automation modules incurs recurring operational expenses.

Reimbursement disparities across healthcare systems in Europe also mean that not all providers or national programs offer full funding for state-of-the-art testing, especially in countries like Eastern European members. This restricts uniform adoption, causing inequalities in blood safety standards across the continent.

An emerging opportunity lies in expanding the application of blood screening into personalized and preventive medicine, especially through genomic and proteomic profiling. Europe is experiencing growing demand for early detection of hereditary conditions, oncology biomarkers, and immune-related diseases using blood-based diagnostic tools.

Advancements in liquid biopsy and cell-free DNA (cfDNA) analysis allow for non-invasive screening of cancers, prenatal anomalies, and cardiovascular risk, moving beyond the traditional infection-focused screening paradigm. Projects such as Europe’s ‘1+ Million Genomes’ initiative are driving integration of genomics into public health policy, offering a supportive ecosystem for NGS-based blood testing.

Additionally, clinical trials, pharmacogenomics, and personalized therapy planning require blood-based biomarker profiling. Diagnostic labs and biotech companies are collaborating to develop multiplex testing kits capable of detecting hundreds of genetic and molecular markers from a single sample, unlocking scalable opportunities across research and clinical use.

Reagents held the dominant share in the European blood screening market. Reagents are crucial for conducting serological and molecular assays and represent a high-consumption component in routine diagnostics. These include buffers, primers, probes, detection dyes, antigens, and antibodies, which are used repeatedly in every screening cycle.

The repeat purchase nature of reagents ensures recurring revenue streams, and innovation in multiplex reagent kits, lyophilized panels, and room-temperature-stable formulations has further boosted their use across centralized and decentralized testing sites. Vendors offering reagents optimized for automation platforms or rapid turnaround assays enjoy high market traction, particularly in regional blood centers and hospitals.

Instruments are the fastest-growing product category, owing to the rapid deployment of automated, modular blood screening systems across Europe. These include PCR platforms, immunoassay analyzers, ELISA readers, chemiluminescence platforms, and microfluidic lab-on-chip systems.

Countries like France, Germany, and the UK are investing in next-generation instruments that integrate sample processing, amplification, and detection in single devices, minimizing manual errors and turnaround time. Emerging technologies, such as digital PCR, fully integrated NAT systems, and robotic pipetting stations, are becoming staples in high-volume donor centers and biobanks.

NAAT dominates the technology segment due to its superior sensitivity, rapid pathogen detection capabilities, and ability to identify infections during the window period. Techniques such as RT-PCR, transcription-mediated amplification (TMA), and loop-mediated isothermal amplification (LAMP) are widely used for detecting HIV, HCV, HBV, and other RNA/DNA viruses.

European regulators and transfusion safety protocols have increasingly mandated the use of NAT alongside serological tests. Centralized donor screening centers often rely on multiplex NAT platforms to process thousands of samples daily, especially in Germany, the Netherlands, and Scandinavia.

NGS is the fastest-growing sub-segment, driven by its capacity to provide deep sequencing of multiple pathogens, genetic mutations, and bloodborne anomalies. Though still in nascent adoption for frontline blood donor screening, NGS is widely used in research, personalized diagnostics, and pharmacogenomic trials.

As cost per genome declines and bioinformatics tools become more user-friendly, NGS will find increasing adoption in oncology blood screening, donor-recipient compatibility testing, and rare disease diagnostics. Pilot programs in Italy and the UK are exploring NGS for antibody repertoire analysis and post-transfusion reaction surveillance.

Germany dominates the blood screening market in Europe due to its comprehensive healthcare infrastructure, well-funded public blood donation systems, and strict regulatory enforcement for transfusion safety. Germany’s blood centers use automated, high-throughput NAT and serology systems, and collaborate with research institutions for biobanking, hemovigilance, and molecular diagnostics.

Germany’s Paul-Ehrlich-Institut and Federal Institute for Drugs and Medical Devices (BfArM) oversee compliance and have mandated progressive screening standards. Furthermore, German donors are among the most frequent in Europe, leading to high volumes of blood units screened annually. Investment in local diagnostics manufacturing and partnerships with biotech firms also drives innovation.

France is the fastest-growing country in the European blood screening market, driven by government efforts to improve voluntary blood donation rates, modernize blood banks, and digitize lab networks. The French Blood Establishment (EFS) operates as a centralized authority managing all aspects of donor collection, testing, and distribution.

France is investing in robotic automation, real-time data analytics, and AI-assisted hemovigilance to enhance blood safety. It is also participating in multi-country projects aimed at genomic screening and pandemic preparedness, which increases the demand for high-tech instruments and NGS tools.

April 2025 – bioMérieux launched a multiplex blood screening panel in Europe that simultaneously detects HIV, HCV, and HBV using TMA-based NAT technology.

March 2025 – Roche Diagnostics expanded its Cobas 6800 platform with improved workflow features tailored to blood screening for high-volume labs in France and Italy.

February 2025 – Grifols received CE mark for its new chemiluminescence-based blood pathogen detection kit designed for European blood banks.

January 2025 – Siemens Healthineers introduced an AI-powered hematology module for blood donation centers to automate donor eligibility and pathogen screening.

December 2024 – Eurofins Scientific announced a strategic investment in a next-gen sequencing facility in Denmark to support genomic blood screening services across Northern Europe.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe blood screening market

Product

Technology

Regional