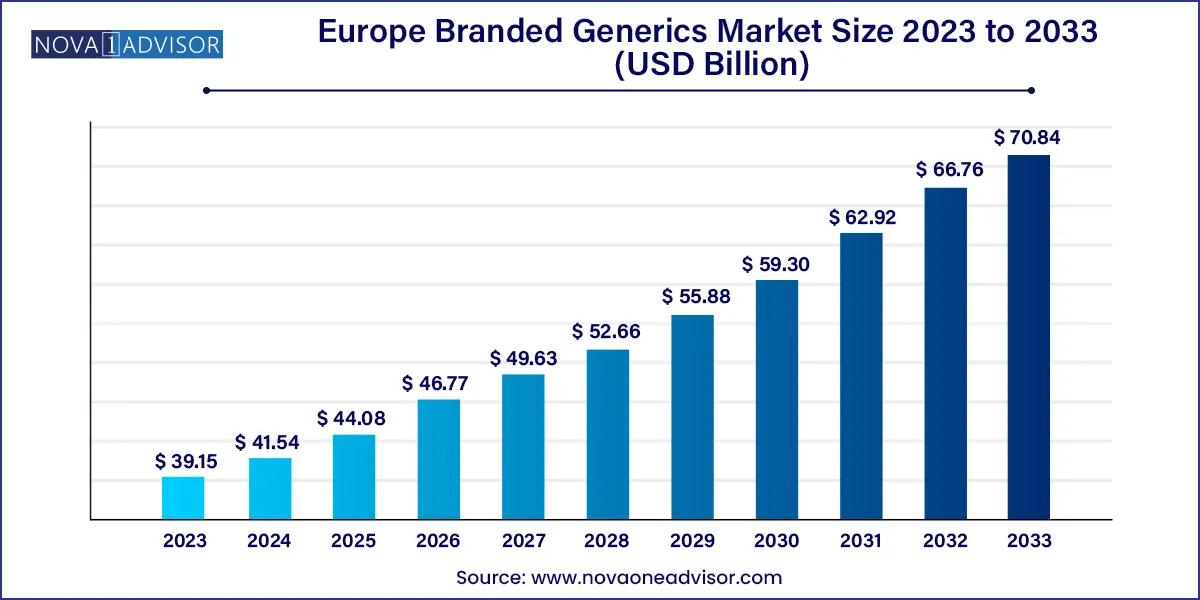

The Europe branded generics market size was exhibited at USD 39.15 billion in 2023 and is projected to hit around USD 70.84 billion by 2033, growing at a CAGR of 6.11% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 41.54 Billion |

| Market Size by 2033 | USD 70.84 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Drug Class, Application, Route of Administration, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.K.; Germany; France; Spain; Italy; Russia; Denmark; Sweden; Norway; Rest of Europe |

| Key Companies Profiled | Teva Pharmaceutical Industries Ltd; Lupin; Sanofi; Sun Pharmaceutical Industries, Ltd.; Dr. Reddy’s Laboratories Ltd; Endo International plc.; GlaxoSmithKline plc.; Wockhardt; Viatris, Inc.; Apotex, Inc. |

The rising prevalence of chronic diseases across the region is expected to contribute to market growth. The increasing burden of infectious & noninfectious diseases coupled with the growing geriatric population, which is more susceptible to chronic diseases, such as diabetes, hypertension, and obesity, is expected to positively impact market growth. In 2021, there were around 2.2 million people affected with HIV in WHO Europe Region, and around 57.0% of the newly diagnosed patients were from the Russian Federation. Competitive rivalry in the Europe branded generics market is likely to be high due to the various strategies adopted by the key players such as merger & acquisition and expansion of the business to strengthen their position in the market. Many established companies are engaged in the development of a generic version of branded drugs.

In October 2023, Aspire Pharma, a portfolio company of H.I.G. Capital, LLC acquired Morningside Pharmaceuticals and Morningside Healthcare, a leading provider of branded and generic specialty pharmaceuticals. Morningside has more than 80 product families of multiple therapeutic areas such as central nervous system (CNS), gastrointestinal diseases (GID), psychiatry, infectious, and endocrine. This acquisition is expected to drive Europe branded generics market.

Furthermore, in 2020, the EU strategically took steps to increase access to biosimilars and generic medicines. This included initiatives such as removing barriers that delay market entry of generics, increasing access to health systems, and digitalization of medicine regulatory systems to expedite processes ensuring ease of market entry. This initiative also boosted the production of branded generics by encouraging pharmaceutical companies to develop and manufacture these medicines and support the growth of Europe branded generics market.

The generic drug manufacturers have warned they may halt production of making low priced generic drugs due to surging electricity costs and the raising prices of drugs. For instance, in September 2023, Medicines for Europe sent an open letter to the Europe Union member states energy and health ministers regarding tackling Europe’s energy crisis, with a gas price cap on the table and a tax on profits of fossil fuel companies. This factor restrains the growth of the Europe branded generics market

According to NHS generic prescribing guidelines, the prescribing of generic drugs with an international proprietary name (INN) is mostly recommended, except in cases where a change to a different manufacturer’s product may have issues with safety and efficacy. The reimbursement price for similar ingredients containing generics is used as a criterion for setting the list prices for some branded generics. Currently, a pharmacist is forced to supply this drug, even if the same generic is available, if a specific brand name medicine is prescribed by the primary care physicians to the patients.

Other drug class segment dominated Europe branded generics market with a revenue share of 42.57% in 2023. The other segment includes infectious diseases such as HIV, malaria, hepatitis, influenza, Human Papillomavirus (HPV), tuberculosis, and respiratory diseases such as COPD, asthma, and pulmonary fibrosis among others. According to WHO Europe Surveillance Report 2021, around 260,000 new cases of tuberculosis reported across Europe. Thus, rising disease burden and increasing demand of the disease population may propel the market growth during the forecast period.

Hormone segment is also expected to witness lucrative growth throughout the forecast period. According to a report published in the NCBI, disease and disability observed among older women are closely related to loss of female sex hormones post menopause. According to the UK Parliament, approximately 51% of the population suffers from menopause, which accounts to 35.73 million as of November 2023. Growth in the geriatric population, along with increasing awareness for hormonal therapy is anticipated to further drive the market.

The others segment dominated Europe branded generics market with a revenue share of 26.02% in 2023. This segment includes eye-related diseases, such as glaucoma & cataract, macular degeneration, diabetic eye problems, respiratory diseases such as COPD, asthma, & pulmonary fibrosis, and metabolic diseases such as diabetes. According to WHO, around 950,000 people were affected by diabetic retinopathy in Europe as of April 2023. Rimexolone, loteprednol etabonate, and ketorolac are a few of the generic products used for eye surgeries. Thus, growing prevalence of other diseases, such as diabetic retinopathy and macular degeneration are impelling the demand for highly efficient & cost-effective medications.

The oncology segment is expected to grow at a high growth rate during the forecast period due to the launch of new branded generics and biosimilars. The Europe Medicines Agency (EMA), in August 2023, granted marketing authorization to Vegzelma developed by Celltrion Healthcare’s for the treatment of various cancers. Thus, an increasing number of cancer cases are anticipated to drive the demand for cheap medicines, thereby, driving Europe branded generics market.

The oral segment dominated the Europe branded generics market with a revenue share of 59.48% in 2023. This can be attributed to the entry of oral generic products into the market with substantially less prices and continued savings in subsequent years. Thus, price reductions in oral branded generic medicines compared to injectable often attract generic manufacturers, thereby driving growth of the market.

The parenteral segment is expected to expand at a high growth rate during the forecast period due to the high availability of injectable generic formulations and the immediate onset of action. Furthermore, injectable are highly preferred if the existing medicines are poorly absorbed and in case of medical emergencies. In April 2021, the EMA recommended approval for two generic drugs, Thiotepa Riemser (thiotepa) and Abiraterone Accord (abiraterone). These are chemotherapy treatment agents available in powder form to concentrate the solution, used for infusion.

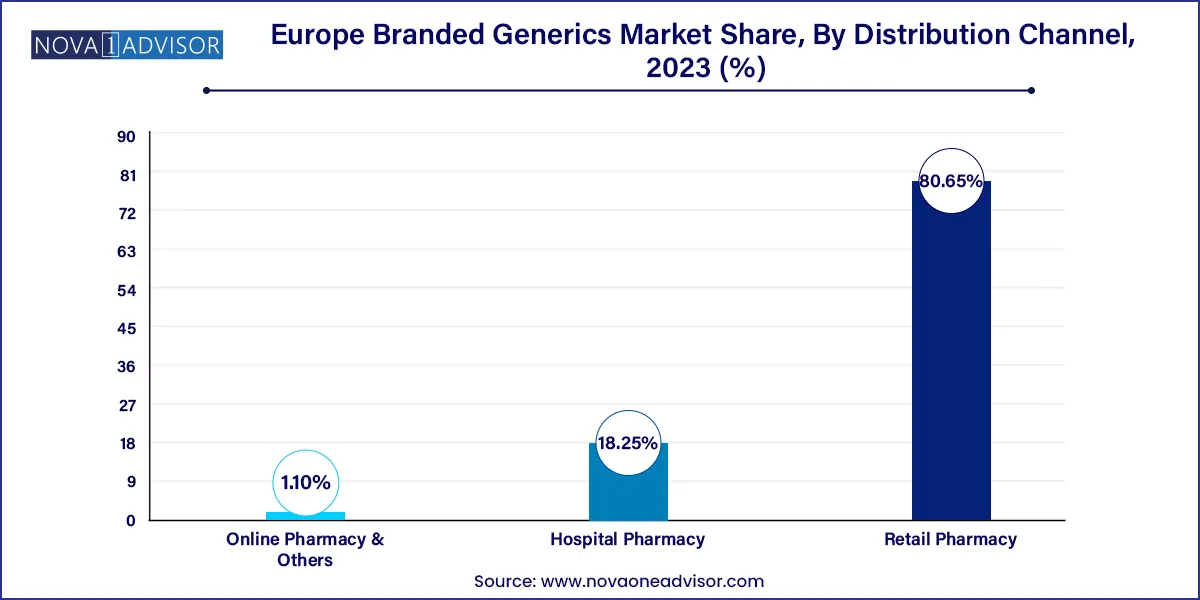

The retail pharmacy segment dominated Europe branded generics market with a revenue share of 80.65% in 2023.According to German Pharmacies Statistics, in 2023, there are around 142,000 community pharmacies in Europe that cater to medical needs. The availability of branded generics in retail pharmacy chains, such as Walgreens and Wal-Mart Stores, Inc., supports market growth. In addition, tie-ups of hospitals with these chains further contribute to market growth.

Hospital pharmacy segment is expected to witness significant growth during the forecast period. In November 2023, a new revised RPS professional standard for hospital pharmacy services was launched by the Royal Pharmaceutical Society (RPS) during a conference. The new standards are relevant for the providers of pharmacy services meant for mental health, prison, acute, ambulance settings, and private. This initiative supports hospital pharmacists and organizations working across healthcare services.

Country Insights

Germany dominated the Europe branded generics market with a revenue share of 20.08% in 2023. The presence of key players, such as Novartis AG, Sanofi, Johnson & Johnson Services, Inc., and Viatris, is positively influencing the market growth. For instance, in June 2023, Novartis AG launched Dimethyl fumarate HEXAL for the treatment of patients with Relapsing-Remitting Multiple Sclerosis (RRMS) in Germany. This strategic launch was aimed at commercializing Hexal in Germany and generating revenue.

Italy is expected to witness a growth rate of 7.4% during the forecast period. The growth of the region is attributed to initiatives undertaken by the government to support the approval and reimbursement of the new drugs. For instance, in October2020, the Italian Medicines Agency (AIFA) published a new simplified reimbursement and pricing procedure for biosimilars and generics. As per the new procedure, the company must submit a dossier supporting the reimbursement application, price, and classification in accordance with the guidelines of the AIFA. This new procedure accelerates the process of reimbursement for drugs and the availability of generic drugs in market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe branded generics market.

Drug Class

Application

Route of Administration

Distribution Channel

Country

Chapter 1 Methodology and Scope

1.1 Market segmentation

1.1.1 Estimates and Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details of Primary Research

1.3.6 List of Primary Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis

1.6.1.1 Approach 1: Commodity Flow Approach

1.6.1.2 Approach 2: Country-wise market estimation using bottom-up approach

1.7 Market: CAGR Calculation

1.8 Research Assumptions

1.9 List of Secondary Sources

1.10 List of Abbreviations

1.11 Objectives

1.11.1 Objective 1

1.11.2 Objective 2

1.11.3 Objective 3

1.11.4 Objective 4

Chapter 2 Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Snapshot

Chapter 3 Market Variables, Trends, & Scope

3.1 Parent Market

3.1.1 Europe Branded Generics Market

3.2 Penetration and Growth Prospect Mapping

3.3 Regulatory Landscape

3.4 Europe Branded Generics Market Dynamics

3.4.1 Market Driver Analysis

3.4.1.1 Patent expiry of branded products

3.4.1.2 Increasing marketing approval and launch of branded generic products

3.4.1.3 Increasing disease burden and rising geriatric population

3.4.2 Market Restraint Analysis

3.4.2.1 Pricing pressure

3.4.3 Market Opportunity Analysis

3.4.3.1 Government initiatives promoting usage of generics

3.5 SWOT Analysis, By Factor (Political & Legal, Economic, and Technological)

3.6 Porter’s Five Forces Analysis

Chapter 4 Europe Branded Generics Market - Segment Analysis, By Drug Class, 2021 - 2033

4.1 Europe Branded Generics Market: Drug Class Movement Analysis

4.2 Alkylating Agents

4.2.1 Alkylating Agents Market Estimates and Forecast, 2021 - 2033

4.3 Antimetabolites

4.3.1 Antimetabolites Market Estimates and Forecasts, 2021 - 2033

4.4 Hormones

4.4.1 Hormones Market Estimates and Forecasts, 2021 - 2033

4.5 Anti-hypertensive & Lipid lowering drugs

4.5.1 Anti-hypertensive & lipid lowering drugs market estimates and forecasts, 2021 - 2033

4.6 Anti-depressants

4.6.1 Anti-depressants Market Estimates and Forecasts, 2021 - 2033

4.7 Anti-psychotics

4.7.1 Anti-Psychotics Market Estimates and Forecasts, 2021 - 2033

4.8 Anti-epileptics

4.8.1 Anti-epileptics Market Estimates and Forecasts, 2021 - 2033

4.9 Others

4.9.1 Others Market Estimates and Forecasts, 2021 - 2033

Chapter 5 Europe Branded Generics Market: Segment Analysis, by Application, 2021 - 2033

5.1 Europe Branded Generics Market: Application Movement Analysis

5.2 Oncology

5.2.1 Oncology Market Estimates and Forecast, 2021 - 2033

5.3 cardiovascular diseases

5.3.1 Cardiovascular Diseases Market Estimates and Forecast, 2021 - 2033

5.4 Neurological Diseases

5.4.1 Neurological Diseases Market Estimates and Forecast, 2021 - 2033

5.5 Acute and Chronic Pain

5.5.1 Acute and Chronic Pain Market Estimates and Forecast, 2021 - 2033

5.6 Gastrointestinal Diseases

5.6.1 Gastrointestinal Diseases Market Estimates and Forecast, 2021 - 2033

5.7 Dermatological Diseases

5.7.1 Dermatological Diseases Market Estimates and Forecast, 2021 - 2033

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2021-2033

Chapter 6 Europe Branded Generics Market: Segment Analysis, by Route of Administration, 2021 - 2033

6.1 Europe Branded Generics Market: Route of Administration Movement Analysis

6.2 Topical

6.2.1 Topical Market Estimates and Forecast, 2021 - 2033

6.3 Oral

6.3.1 Oral Market Estimates and Forecast, 2021 - 2033

6.4 Parenteral

6.4.1 Parenteral Market Estimates and Forecast, 2021-2033

6.5 Others

6.5.1 Others Market Estimates and Forecast, 2021 - 2033

Chapter 7 Europe Branded Generics Market - Segment Analysis, By Distribution Channel, 2021 - 2033

7.1 Europe Branded Generics Market: Distribution Channel Movement Analysis

7.2 Hospital Pharmacy

7.2.1 Hospital Pharmacy Market Estimates and Forecast, 2021 - 2033

7.3 Retail Pharmacy

7.3.1 Retail Pharmacy Market Estimates and Forecast, 2021-2033

7.4 Online Pharmacy

7.4.1 Online Pharmacy Market Estimates and Forecast, 2021 - 2033

Chapter 8 Europe Branded Generics Market: Regional Estimates and Trend Analysis, by Drug Class, Application, Route of Administration, & Distribution Channel

8.1 Europe

8.1.1 SWOT Analysis:

8.1.1.1 Europe Branded Generics Market Estimates and Forecasts, 2021 - 2033

8.1.2 Germany

8.1.2.1 Key Country Dynamics

8.1.2.2 Target Disease Prevalence

8.1.2.3 Competitive Scenario

8.1.2.4 Regulatory Framework

8.1.2.5 Reimbursement Scenario

8.1.2.6 Prescription and Dispensing Scenario

8.1.2.7 Germany Branded Generics Market Estimates and Forecasts, 2021 - 2033

8.1.3 UK

8.1.3.1 Key Country Dynamics

8.1.3.2 Target Disease Prevalence

8.1.3.3 Competitive Scenario

8.1.3.4 Regulatory Framework

8.1.3.5 Reimbursement Scenario

8.1.3.6 UK Branded Generics Market Estimates and Forecasts, 2021 - 2033

8.1.4 France

8.1.4.1 Key Country Dynamics

8.1.4.2 Target Disease Prevalence

8.1.4.3 Competitive Scenario

8.1.4.4 Regulatory Framework

8.1.4.5 Reimbursement Scenario

8.1.4.6 France Branded Generics Market Estimates and Forecasts, 2021 - 2033

8.1.5 Italy

8.1.5.1 Key Country Dynamics

8.1.5.2 Target Disease Prevalence

8.1.5.3 Competitive Scenario

8.1.5.4 Regulatory Framework

8.1.5.5 Reimbursement Scenario

8.1.5.6 Italy Branded Generics Market Estimates and Forecasts, 2021 - 2033

8.1.6 Spain

8.1.6.1 Key Country Dynamics

8.1.6.2 Target Disease Prevalence

8.1.6.3 Competitive Scenario

8.1.6.4 Regulatory Framework

8.1.6.5 Reimbursement Scenario

8.1.6.6 Spain Branded Generics Market Estimates and Forecasts, 2021 - 2033

8.1.7 Russia

8.1.7.1 Key Country Dynamics

8.1.7.2 Target Disease Prevalence

8.1.7.3 Competitive Scenario

8.1.7.4 Regulatory Framework

8.1.7.5 Reimbursement Scenario

8.1.7.6 Russia Branded Generics Market Estimates and Forecasts, 2021 - 2033

8.1.8 Denmark

8.1.8.1 Key Country Dynamics

8.1.8.2 Target Disease Prevalence

8.1.8.3 Competitive Scenario

8.1.8.4 Regulatory Framework

8.1.8.5 Reimbursement Scenario

8.1.8.6 Denmark Branded Generics Market Estimates and Forecasts, 2021 - 2033

8.1.9 Sweden

8.1.9.1 Key Country Dynamics

8.1.9.2 Target Disease Prevalence

8.1.9.3 Competitive Scenario

8.1.9.4 Regulatory Framework

8.1.9.5 Reimbursement Scenario

8.1.9.6 Sweden Branded Generics Market Estimates and Forecasts, 2021 - 2033

8.1.10 Norway

8.1.10.1 Key Country Dynamics

8.1.10.2 Target Disease Prevalence

8.1.10.3 Competitive Scenario

8.1.10.4 Regulatory Framework

8.1.10.5 Reimbursement Scenario

8.1.10.6 Norway Branded Generics Market Estimates and Forecasts, 2021 - 2033

8.1.11 Rest of Europe

Chapter 9 Europe Branded Generics Market: - Competitive Landscape

9.1 Recent Developments & Impact Analysis, by Key Market Participants

9.1.1 New Product Launch

9.1.2 Merger and Acquisition

9.1.3 Licensing Agreements

9.1.4 Conferences and Campaigns

9.2 Company Categorization

9.2.1 Innovators

9.2.2 Market Leaders

9.3 Vendor Landscape

9.3.1 List of key distributors and channel partners

9.3.2 Key customers

9.4 Public Companies

9.4.1 Key company market share analysis, 2021

9.4.2 Company market position analysis

9.4.3 Heat map analysis

9.4.4 Competitive Dashboard Analysis

9.4.4.1 Market Differentiators

9.5 Private Companies

9.5.1 List of key emerging companies

9.5.2 Regional Network Map

9.6 Company Profiles

9.6.1 Teva Pharmaceutical Industries Ltd.

9.6.1.1 Company overview

9.6.1.2 Financial performance

9.6.1.3 Product benchmarking

9.6.1.4 Strategic initiatives

9.6.2 LUPIN

9.6.2.1 Company overview

9.6.2.2 Financial performance

9.6.2.3 Product benchmarking

9.6.2.4 Strategic initiatives

9.6.3 Sanofi

9.6.3.1 Company overview

9.6.3.2 Financial performance

9.6.3.3 Product benchmarking

9.6.3.4 Strategic initiatives

9.6.4 Sun Pharmaceutical Industries Ltd.

9.6.4.1 Company overview

9.6.4.2 Financial performance

9.6.4.3 Product benchmarking

9.6.4.4 Strategic initiatives

9.6.5 Dr. Reddy’s Laboratories Ltd.

9.6.5.1 Company Overview

9.6.5.2 Financial Performance

9.6.5.3 Product benchmarking

9.6.5.4 Strategic initiatives

9.6.6 Endo International plc

9.6.6.1 Company overview

9.6.6.2 Financial performance

9.6.6.3 Product benchmarking

9.6.6.4 Strategic initiatives

9.6.7 GlaxoSmithKline Plc

9.6.7.1 Company Overview

9.6.7.2 Financial Performance

9.6.7.3 Product Benchmarking

9.6.7.4 Strategic Initiatives

9.6.8 Wockhardt

9.6.8.1 Company overview

9.6.8.2 Financial Performance

9.6.8.3 Product benchmarking

9.6.8.4 Strategic initiatives

9.6.9 Viatris, Inc.

9.6.9.1 Company Overview

9.6.9.2 Financial Performance

9.6.9.3 Product Benchmarking

9.6.9.4 Strategic Initiatives

9.6.10 Apotex, Inc.

9.6.10.1 Company overview

9.6.10.2 Product benchmarking

9.6.10.3 Strategic initiatives