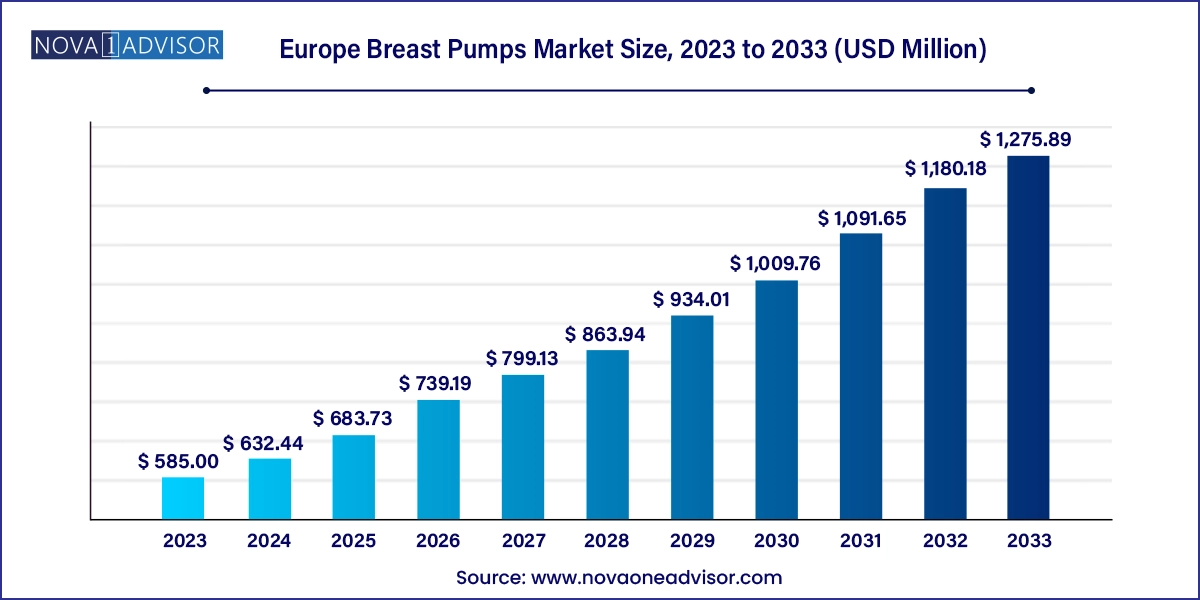

The Europe breast pumps market size was exhibited at USD 585.00 million in 2023 and is projected to hit around USD 1,275.89 million by 2033, growing at a CAGR of 8.11% during the forecast period 2024 to 2033.

The Europe breast pumps market is undergoing dynamic transformation, spurred by changing socio-economic patterns, increasing awareness of breastfeeding benefits, and advancements in healthcare technology. Breast pumps are mechanical devices used by lactating women to extract milk, either for storage and later use or to maintain or increase milk supply. As more women in Europe enter or re-enter the workforce post-childbirth, the demand for breast pumps is rising significantly. Government initiatives promoting breastfeeding, along with the normalization of breast milk expression in workplaces and public spaces, have enhanced product acceptance.

This market is also benefiting from heightened health awareness among new mothers, coupled with rising disposable incomes and access to advanced healthcare facilities. A growing preference for electric and hospital-grade breast pumps in countries like Germany, France, and the UK reflects increasing sophistication and customization of maternal care. Moreover, the integration of app-based tracking systems, smart pumping technology, and ergonomically designed accessories is redefining the user experience and expanding the consumer base for breast pumps in Europe.

Increasing adoption of electric and smart breast pumps for convenience and automation

Rising employment of women and support for breastfeeding in workplaces

Surge in hospital-grade pump rentals and purchases for neonatal care and postpartum recovery

Introduction of mobile-compatible breast pumps with Bluetooth and app connectivity

Expansion of e-commerce platforms facilitating access to a wide range of pump models

Growing emphasis on comfort, hygiene, and noise reduction in pump design

National health policies and maternity benefit schemes supporting breastfeeding

Greater collaboration between hospitals and pump manufacturers for clinical integration

| Report Coverage | Details |

| Market Size in 2024 | USD 632.44 Million |

| Market Size by 2033 | USD 1,275.89 Million |

| Growth Rate From 2024 to 2033 | CAGR of 8.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Technology, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway |

| Key Companies Profiled | Koninklijke Philips N.V.; Pigeon Corporation; Chiaro Technology Limited; Ardo Medical Ltd.; Ameda (Magento, Inc.); Medela AG; Albert; Mayborn Group Limited |

The strongest driver in the Europe breast pumps market is the rise in female workforce participation and concurrent advocacy for breastfeeding rights and support. Countries across Europe, including the UK, Germany, France, and the Nordic region, are witnessing steady increases in the number of working mothers. To support their return to the workforce without compromising infant nutrition, breast pumps have become essential maternal health tools.

At the same time, public health campaigns by organizations such as the World Health Organization (WHO) and European Commission encourage exclusive breastfeeding for the first six months. These campaigns emphasize the immunity-boosting, developmental, and emotional benefits of breast milk, thereby reinforcing the need for solutions that make breastfeeding more flexible and sustainable. Employers are increasingly accommodating lactating employees through on-site nursing rooms and break policies, thereby driving breast pump demand across industries.

Despite growing popularity, the adoption of high-end breast pumps in Europe is restrained by their relatively high cost, especially in lower-income or rural regions. Electric and hospital-grade pumps with advanced features such as variable suction levels, closed systems, and smart tracking are priced significantly higher than manual pumps. While this premium is justified by performance and comfort, affordability remains a barrier for a significant segment of potential users.

This issue is particularly pronounced in Southern and Eastern European countries where national reimbursement policies for maternal care products are limited or inconsistent. Moreover, many health systems do not classify breast pumps as essential medical devices, which further limits public funding. The cost disparity has led to uneven market penetration and a reliance on rentals or second-hand products in some areas, potentially compromising hygiene and performance.

A promising opportunity in the Europe breast pumps market lies in the integration of smart technologies and personalized user experiences. Modern mothers seek not only functionality but also discretion, portability, and seamless data tracking. This has led to the emergence of smart breast pumps equipped with app connectivity, Bluetooth tracking, automated expression settings, and usage analytics. These innovations allow users to customize pumping cycles, monitor milk output, and track feeding history.

Smart features cater to tech-savvy consumers and align with the broader trend of digital health monitoring. Companies offering companion mobile apps that provide lactation tips, usage reminders, and community forums are creating comprehensive support ecosystems. As wearable and silent breast pumps become more prevalent, the market is expected to attract a broader demographic of users, including those who previously considered pumping inconvenient or intimidating.

Closed system pumps dominated the European breast pumps market, favored for their hygienic design and reduced contamination risk. These pumps feature a barrier that prevents milk from entering the motor or tubing, ensuring better sanitation and ease of cleaning. Closed systems are particularly recommended in hospitals and for mothers with premature or immunocompromised infants. Their design reduces the risk of mold or bacteria buildup, making them a safer choice for long-term use.

On the other hand, open system pumps are witnessing moderate adoption, primarily due to their lower cost and availability. These pumps, while effective, require more frequent and thorough cleaning to maintain hygiene. Open systems are more common among occasional pump users or those with limited budgets. However, increasing awareness of safety and infection control is gradually shifting preference toward closed system alternatives across urban European markets.

Electric breast pumps dominate the market, driven by their convenience, efficiency, and technological adaptability. These pumps offer automated suction cycles, dual-phase expression, and adjustable speed settings, which significantly reduce pumping time and effort. Electric pumps are particularly popular among working mothers who require reliable and frequent milk expression, as well as in hospital and clinical settings for high-demand use.

Meanwhile, battery-powered pumps are emerging as the fastest-growing technology segment, owing to their portability and convenience. These pumps cater to the needs of mobile users, travelers, or mothers without constant access to electrical outlets. Lightweight designs, rechargeable battery features, and noise-reducing components make battery-powered pumps ideal for discreet and on-the-go usage. As modern lifestyles demand greater flexibility, this segment is poised for continued expansion.

Personal use breast pumps account for the largest share of the market, reflecting increasing self-care and parenting independence among European mothers. The growth of e-commerce and direct-to-consumer models has made breast pumps more accessible for personal purchase. Women increasingly choose personal pumps to enable exclusive breastfeeding, support milk donation, or manage irregular feeding schedules. This segment benefits from broad product availability and growing social acceptance of breast pumping in public spaces.

Hospital-grade pumps represent the fastest-growing application, particularly in NICUs, maternity wards, and postpartum recovery units. These pumps are typically stronger, more durable, and optimized for frequent use. Hospitals invest in such equipment to support lactating mothers recovering from childbirth or those with premature infants who cannot yet breastfeed directly. As partnerships between hospitals and pump manufacturers grow, this segment is expected to see greater adoption and innovation.

Germany leads the European breast pumps market, driven by robust healthcare infrastructure, progressive maternity policies, and high breastfeeding awareness. The country has a strong network of baby-friendly hospitals and midwifery support programs that emphasize breastfeeding, often providing breast pump access to new mothers through insurance or healthcare providers. The presence of leading domestic and international breast pump brands also contributes to Germany’s market leadership.

The UK and France follow closely, benefiting from large consumer bases, awareness campaigns, and support from national health systems. In the UK, initiatives by the NHS to support breastfeeding and maternal mental health have indirectly boosted pump usage. France promotes parental leave policies and supports breastfeeding education in public hospitals. Meanwhile, Nordic countries like Sweden and Norway show high per-capita adoption, driven by cultural acceptance, government-funded health services, and strong focus on maternal wellness.

March 2025: Medela launched its latest wearable SmartPump Duo with integrated app connectivity in Germany and France, aiming to target tech-savvy mothers seeking hands-free pumping options.

February 2025: Elvie announced a partnership with several UK hospitals to supply silent wearable breast pumps for new mothers during postpartum recovery.

November 2024: Philips Avent expanded its European distribution channels through a partnership with leading online pharmacies in Spain and Italy.

September 2024: Lansinoh introduced a Bluetooth-enabled closed-system pump featuring AI-based suction rhythm personalization, launched across Scandinavia.

July 2024: Spectra Baby Europe announced an extended rental program for hospital-grade pumps in collaboration with public health clinics across France and Belgium.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe breast pumps market

Product

Technology

Application

Regional