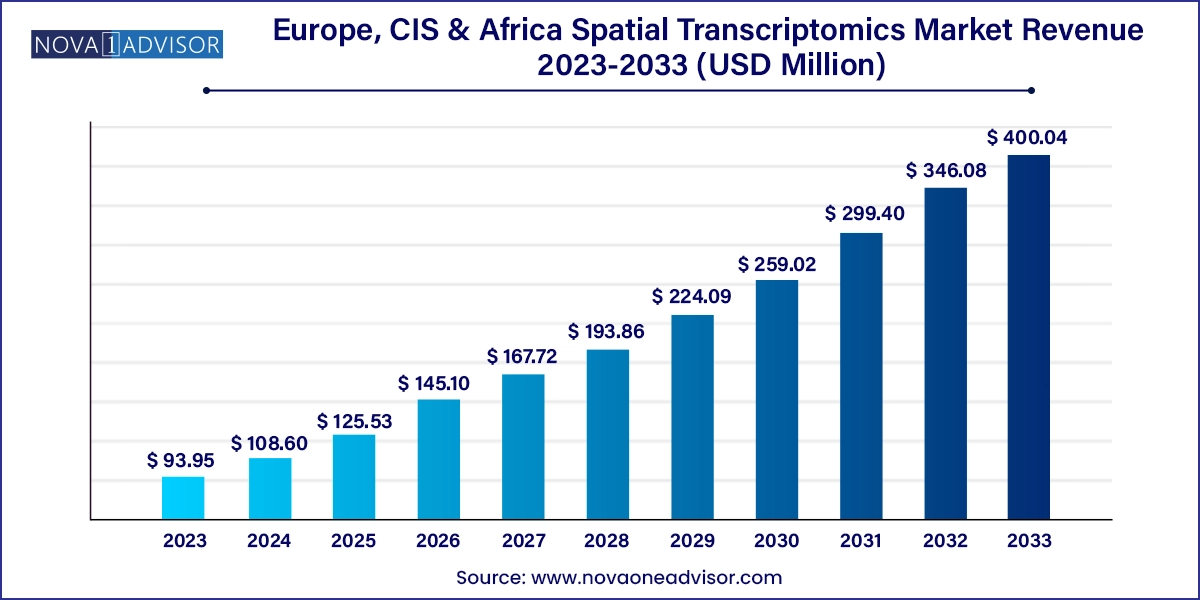

The Europe, CIS & Africa spatial transcriptomics market size was exhibited at USD 93.95 million in 2023 and is projected to hit around USD 400.04 million by 2033, growing at a CAGR of 15.59% during the forecast period 2024 to 2033.

The Europe, CIS (Commonwealth of Independent States), and Africa Spatial Transcriptomics Market is witnessing a transformative shift due to advancements in molecular biology and genomic mapping technologies. Spatial transcriptomics, a cutting-edge methodology that enables researchers to visualize and quantify gene expression within intact tissue samples, is revolutionizing biomedical research and clinical diagnostics. It bridges the gap between traditional histology and bulk RNA sequencing by preserving spatial information in molecular profiling. This spatial resolution enables researchers to understand gene function in the context of tissue architecture, thereby offering invaluable insights into diseases like cancer, neurodegenerative disorders, and inflammatory conditions.

In Europe, the technology is steadily being integrated into translational and clinical research initiatives, with numerous institutions adopting spatial transcriptomics for oncology and brain research. CIS nations are showing growing interest in developing life sciences infrastructure, creating fertile ground for market expansion. Africa, albeit nascent in this domain, is leveraging international partnerships to build genomic research capabilities, especially in countries like South Africa and Nigeria. The confluence of rising healthcare expenditures, growing awareness of personalized medicine, and expanding genomic research collaborations is fueling the adoption of spatial transcriptomics across the region.

Moreover, increased accessibility to single-cell analysis tools and high-throughput sequencing platforms, coupled with a declining cost of genomic workflows, is making spatial transcriptomics more feasible and scalable. The emergence of automated imaging platforms, sophisticated bioinformatics pipelines, and AI-powered data analytics tools is further accelerating the growth of the market, fostering innovation across academic, clinical, and pharmaceutical research landscapes.

Integration of AI and Machine Learning in Spatial Genomics Data Analysis

Rising Use of Spatial Transcriptomics in Oncology and Immuno-oncology Research

Collaborations Between Tech Firms and Research Institutions in Europe

Expansion of Bioinformatics Infrastructure Across CIS Countries

Increased Focus on Fresh Frozen Sample Processing Over FFPE

Shift Toward Automation in Spatial Imaging and Sequencing Platforms

Emergence of Low-Cost Spatial Analysis Tools in African Research Institutions

Development of Multi-omics Platforms Combining Proteomics and Transcriptomics

Growing Usage of IHC and smFISH for Neurological Tissue Profiling

| Report Coverage | Details |

| Market Size in 2024 | USD 108.60 Million |

| Market Size by 2033 | USD 400.04 Million |

| Growth Rate From 2024 to 2033 | CAGR of 15.59% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Technology, Workflow, Sample Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.K., Germany, France, Italy, Spain, Denmark, Sweden, Norway, Netherlands, Belgium, Finland, Switzerland, Poland, South Africa, Nigeria, Morocco |

| Key Companies Profiled | Illumina, Inc.; Bruker;10X Genomics; EdenRoc Sciences (Cantata Bio, LLC); Shimadzu Corporation; Waters Corporation; Bio-Techne; Vizgen Inc.; Spatial Genomics; Akoya Biosciences, Inc. |

A significant driver for the spatial transcriptomics market in the region is the increasing need for high-resolution spatial mapping in cancer diagnostics and therapeutics. Traditional methods often fail to capture the complex heterogeneity of tumors and their microenvironments. Spatial transcriptomics provides granular insights by enabling cell-type-specific expression mapping while preserving tissue context. This has vast implications for tumor microenvironment characterization, biomarker discovery, and therapeutic targeting.

For instance, institutions like the University of Oxford and the Karolinska Institute have integrated spatial transcriptomics into their oncology research programs to identify distinct tumor niches and predict therapy responses. As personalized oncology gains momentum, pharmaceutical companies are incorporating spatial transcriptomics into drug development pipelines, particularly for immune checkpoint inhibitors and CAR-T cell therapies. This trend is reinforcing market growth across research and commercial domains.

Despite its potential, the spatial transcriptomics market faces significant barriers related to the high cost of instruments and infrastructure required for advanced imaging, sequencing, and data analysis. Instruments such as high-resolution microscopes, laser capture devices, and advanced sequencers involve substantial capital investment. Moreover, the data generated is enormous and requires robust computational infrastructure and skilled personnel for interpretation.

This challenge is particularly acute in resource-limited settings across CIS and African nations. While some countries are establishing national genomic centers, many laboratories still rely on external collaborations or shared facilities, thereby restricting scalability. The lack of standardization and regulatory guidelines for clinical adoption also adds to the cost burden and impedes wider deployment.

A key opportunity lies in the strategic collaborations between global technology providers and local research institutions, backed by government-funded genomics initiatives. Countries across Europe, such as the UK and Germany, have national precision medicine and genomic mapping programs that actively support spatial transcriptomics research. For instance, the UK’s Genomics England initiative has spurred multiple collaborative studies incorporating spatial profiling tools.

In Africa, projects like H3Africa (Human Heredity and Health in Africa) are paving the way for genomic infrastructure development. By aligning spatial transcriptomics tools with such initiatives, companies can penetrate emerging markets and tap into a new customer base. Similar prospects exist in CIS countries where healthcare digitization and research collaborations are gaining political and financial support. These partnerships not only open access to new markets but also foster innovation tailored to region-specific health challenges.

Consumables dominated the market due to their recurring usage in every spatial transcriptomics workflow. Reagents, tissue slides, staining kits, and probes are indispensable for both sequencing-based and microscopy-based spatial analysis. The consumables segment sees high turnover owing to the single-use nature of most products and the growing frequency of high-throughput experiments. Academic institutions and pharma labs prefer commercial reagent kits optimized for specific applications such as oncology or neurobiology, which drives steady demand.

Software, especially bioinformatics tools, is the fastest-growing product segment. With the exponential growth in data generation from spatial sequencing and imaging workflows, there is a dire need for sophisticated analytical platforms. Tools that can perform data deconvolution, visualization, and spatial clustering are becoming essential. Imaging tools integrated with AI algorithms for cell segmentation and pattern recognition are also in high demand. Additionally, databases that facilitate efficient storage and management of large datasets are gaining adoption, particularly in academic and pharmaceutical R&D.

Sequencing-based methods, particularly In Situ Sequencing, have dominated the market. These methods allow high-resolution mapping of gene expression directly on the tissue, offering quantitative and qualitative insights. In situ sequencing is particularly favored in studies requiring high multiplexing and spatial fidelity. Laser Capture Microdissection (LCM) and Transcriptome In Vivo Analysis (TIVA) are also widely used in specialized cancer and neuroscience studies, providing targeted and cell-type-specific gene expression data.

Microscopy-based RNA imaging techniques are witnessing the fastest growth. These include smFISH and branched DNA probes that offer single-molecule resolution with minimal sample processing. They are especially valuable in identifying rare cell populations and understanding intercellular interactions in complex tissues like brain and tumors. The user-friendliness and comparatively lower cost of microscopy-based techniques make them attractive to emerging markets and smaller research labs.

Sample Preparation leads the workflow segment. Efficient sample prep, including fixation, sectioning, staining, and probe hybridization, is critical for preserving spatial integrity and enabling accurate transcriptomic analysis. This stage is particularly significant in FFPE and frozen tissue samples where RNA degradation risk is high. Newer protocols focusing on multiplex compatibility and reduced processing times have further strengthened this segment.

Data Analysis is growing at the fastest rate within the workflow category. As spatial transcriptomics generates vast datasets, researchers are relying heavily on computational tools for transcript alignment, spatial mapping, and data interpretation. The introduction of cloud-based platforms and AI-integrated software solutions has lowered entry barriers, enabling more researchers to explore complex spatial data without requiring in-house bioinformatics expertise.

Fresh frozen samples dominate the sample type segment. These samples offer superior RNA integrity compared to FFPE (Formalin-Fixed, Paraffin-Embedded) tissues, making them ideal for spatial transcriptomics. Their widespread use in research settings across Europe stems from their compatibility with most sequencing and imaging techniques.

FFPE samples are gaining momentum as the fastest-growing sample type. Despite challenges in RNA degradation, recent technological advancements have enabled spatial transcriptomic profiling in FFPE samples, unlocking access to extensive biobanks and archived clinical specimens. This is particularly beneficial for retrospective studies and for expanding spatial transcriptomics into clinical diagnostics.

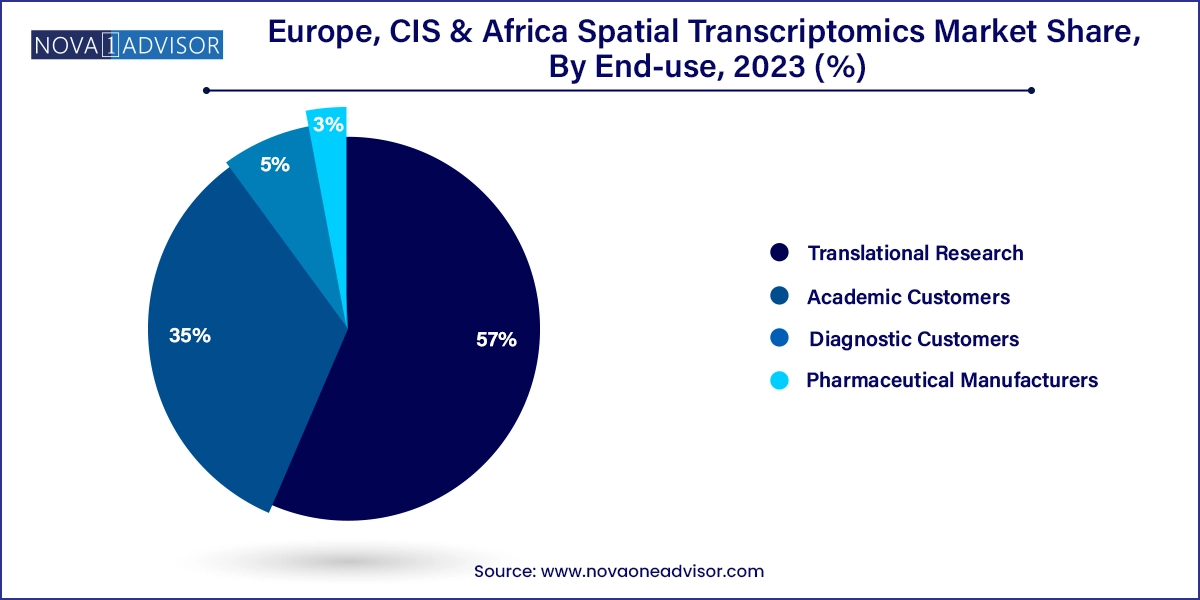

Academic customers held the dominant share in 2024. Universities and research institutions are the primary drivers of innovation in spatial transcriptomics. They engage in foundational research and method development and are the earliest adopters of new spatial platforms. European universities, such as ETH Zurich and Cambridge, have established dedicated spatial omics labs, often supported by government grants and collaborative partnerships.

Pharmaceutical manufacturers are the fastest-growing end users. The ability of spatial transcriptomics to elucidate mechanisms of drug resistance, discover new targets, and validate biomarkers is attracting significant interest from pharma companies. From early-stage drug discovery to translational research, spatial data is enhancing the precision and efficacy of therapeutic development pipelines. Companies are investing in dedicated spatial transcriptomics teams or partnering with specialized research organizations to accelerate drug innovation.

Germany leads the spatial transcriptomics market in Europe, owing to its robust biotechnology infrastructure, well-funded academic institutions, and early adoption of high-throughput spatial technologies. The country is home to several leading research centers such as the Max Planck Institutes and Helmholtz Centers that have integrated spatial transcriptomics into disease biology and tissue architecture research. In 2024, the German Federal Ministry of Education and Research launched initiatives to support omics-based healthcare innovation, further catalyzing market growth.

The UK is another prominent market, driven by national genomic programs and advanced healthcare research ecosystems. Institutions like the Wellcome Sanger Institute and University College London have been early adopters of spatial transcriptomics for cancer and brain research. The UK's investment in health data infrastructure and collaborations with industry players create a conducive environment for market expansion.

Among CIS countries, Russia is emerging as a frontrunner, with efforts to modernize its healthcare and research sectors. Institutions like the Skolkovo Institute of Science and Technology are conducting spatial biology research, although the market is still at a nascent stage. Funding constraints and regulatory bottlenecks limit rapid adoption, but strategic partnerships with European firms are helping bridge the gap.

South Africa is the most advanced spatial transcriptomics market in Africa. The country has a well-established genomics ecosystem through initiatives like the South African National Bioinformatics Institute (SANBI) and participation in the Human Heredity and Health in Africa (H3Africa) project. Researchers are leveraging spatial transcriptomics to study infectious diseases, cancer, and neurological disorders in the African population.

Europe, CIS & Africa Spatial Transcriptomics Market Recent Developments

March 2025: 10x Genomics announced a partnership with the UK-based Francis Crick Institute to expand spatial transcriptomics research in cancer immunotherapy.

February 2025: NanoString Technologies launched its new CosMx Spatial Molecular Imager across selected labs in Germany and Sweden, enhancing multi-modal analysis capabilities.

January 2025: Akoya Biosciences entered into a collaboration with Heidelberg University Hospital to support advanced tissue profiling in neurodegenerative diseases.

December 2024: Bio-Techne introduced a new FFPE-compatible spatial transcriptomics panel in collaboration with the European Molecular Biology Laboratory (EMBL).

November 2024: Fluidigm Corporation signed a distribution agreement with a South African genomics consortium to deploy Imaging Mass Cytometry platforms in cancer research centers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe, CIS & Africa spatial transcriptomics market

Product

Technology

Workflow

Sample Type

End Use

Regional