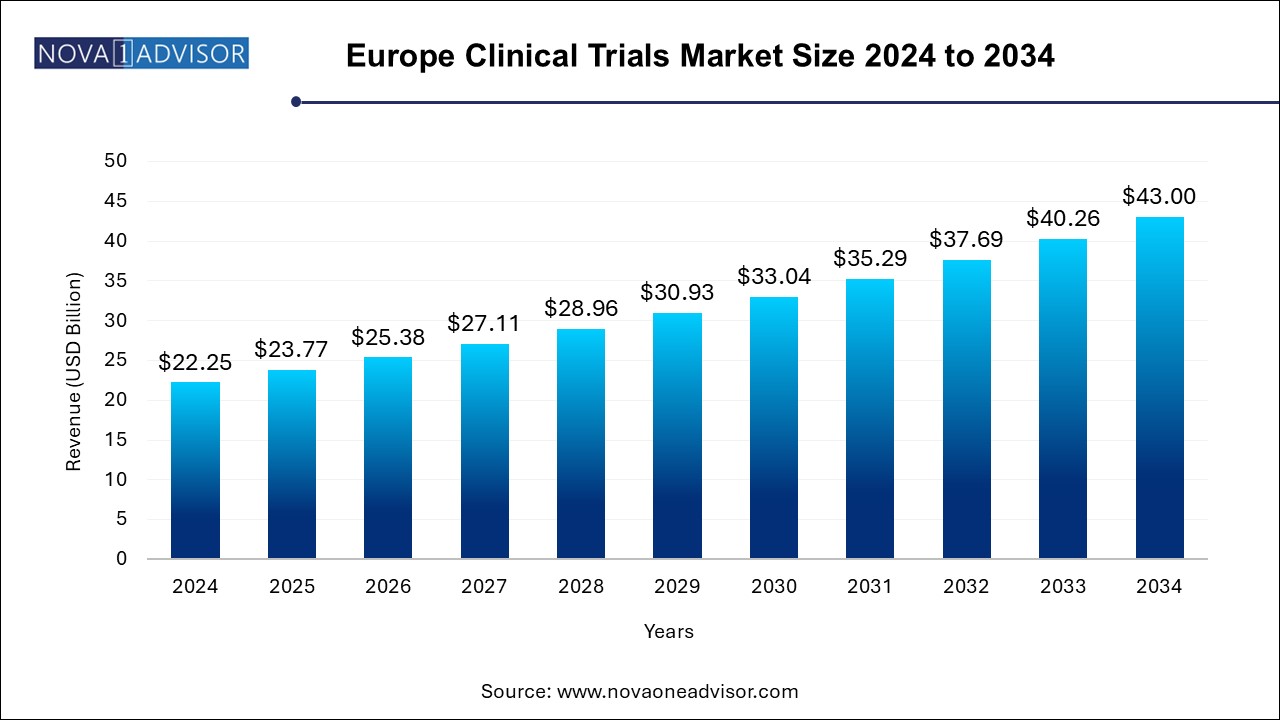

The Europe clinical trials market size was exhibited at USD 22.25 billion in 2024 and is projected to hit around USD 43.00 billion by 2034, growing at a CAGR of 6.81% during the forecast period 2024 to 2034.

The Europe clinical trials market has witnessed substantial growth due to an increasing number of pharmaceutical and biotechnology companies conducting trials within the region. With its advanced healthcare infrastructure, a strong regulatory framework, and a diverse patient population, Europe serves as an attractive destination for clinical trials. The market is bolstered by a growing focus on personalized treatments and precision medicine, which has prompted an increase in specialized trials targeting chronic diseases, cancer, autoimmune conditions, and rare diseases. Additionally, the integration of digital technologies and decentralized trials has further fueled the demand for clinical trial services in Europe.

| Report Coverage | Details |

| Market Size in 2025 | USD 23.77 Billion |

| Market Size by 2034 | USD 43.00 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 6.81% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Phase, Study Design, Indication, Service Type, Sponsor, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | Europe |

| Key Companies Profiled | IQVIA HOLDINGS, INC., PAREXEL International Corporation, Pharmaceutical Product Development, (PPD) LLC., Syneos Health Inc., Eli Lilly and Company, Novo Nordisk A/S, Pfizer, Inc., Dr. Notghi Contract Research GmbH, Charite Research Organisation GmbH, Janssen Global Services, LLC, Mondosano GmbH, KFGN, Clariness, and Invisio clinical studies consulting among others. |

Driver: Rising Demand for Personalized Medicine

The increasing focus on personalized medicine is one of the primary drivers of the clinical trials market in Europe. Personalized medicine uses genetic, molecular, and clinical information to tailor treatments to individual patients, offering the potential for better efficacy and fewer side effects. As more personalized treatments emerge, pharmaceutical and biotechnology companies are increasingly conducting clinical trials to test these innovative therapies. Europe, with its advanced healthcare system and regulatory frameworks, has become a leading region for conducting clinical trials in personalized medicine. This growing demand is propelling the need for specialized trials, boosting the overall market.

Restraint: Regulatory Complexities and Approval Delays

One of the key challenges in the Europe clinical trials market is the complexity of regulatory approval processes. Different countries within the European Union have varying regulations, which can lead to delays and additional costs for pharmaceutical companies looking to conduct clinical trials across multiple European nations. Although efforts have been made to harmonize regulatory standards through initiatives like the European Medicines Agency (EMA), the diversity in national regulations and bureaucratic hurdles still pose significant barriers. These regulatory complexities can lead to longer timelines for clinical trials, impacting the overall efficiency of drug development processes.

Opportunity: Growth in Oncology and Rare Disease Trials

Europe presents a significant opportunity for growth in the clinical trials market, particularly within oncology and rare diseases. The region has seen increasing investment in clinical trials targeting cancer treatments, driven by the rising incidence of various cancers and advancements in immunotherapy and targeted therapies. Additionally, rare diseases, which affect a smaller population but often have limited treatment options, are gaining attention. As a result, pharmaceutical and biopharmaceutical companies are increasingly focusing on conducting trials for rare disease therapies in Europe. The need for specialized treatments in these areas creates a significant opportunity for growth in the clinical trials market.

The Phase III segment dominates the Europe clinical trials market. This phase involves large-scale trials to confirm the efficacy and safety of treatments, making it crucial for regulatory approval. With a high volume of new drug candidates entering Phase III trials, this phase represents the largest revenue share in the clinical trials market. As many drugs advance through clinical stages, Phase III trials, which typically involve thousands of participants, require extensive logistical and operational support, contributing to the dominance of this segment. This phase is also seeing an increase in the use of real-world evidence and adaptive trial designs to improve efficiency and outcomes.

The Phase I segment is projected to experience significant growth, driven by increased research and development investments from both public and private sectors in clinical trials. The rising demand for new treatments and biologics is also fueling the expansion of this segment. The approval of clinical trials for new therapies, such as the ABILITY-1 study for MDNA11, further underscores the growing focus on Phase I trials. These trials are critical for the development of advanced treatments, and the global push for innovative therapies, particularly in oncology, is expected to continue driving the demand for Phase I clinical trials in the coming years.Study Design Outlook

Interventional studies dominate the study design segment in the Europe clinical trials market. These studies involve actively administering treatments or interventions to study participants, making them crucial for testing new drugs, devices, and therapies. Interventional studies are essential for determining the safety and efficacy of new treatments, particularly for chronic conditions and cancer therapies. The demand for interventional studies is driven by the increasing focus on therapeutic innovations, particularly in oncology and autoimmune diseases, where new treatments are regularly being tested for efficacy.

Observational studies are the fastest-growing segment within the study design category. These studies are becoming increasingly popular as they allow researchers to gather valuable data about the real-world effectiveness of drugs without intervening in the treatment process. Observational studies are often used in the post-market phase to understand the broader population impact of new treatments. The increasing focus on real-world evidence, especially for chronic disease management, is driving the growth of observational studies in the Europe clinical trials market.

The oncology segment dominates the indication outlook for the Europe clinical trials market. Oncology is a major focus area for clinical trials, with a growing number of cancer therapies in development. The European Union is home to numerous oncology trials, focusing on innovative treatments such as immunotherapy and personalized cancer vaccines. With the increasing global cancer burden and the growing focus on targeted therapies, oncology is expected to remain the dominant therapeutic area for clinical trials in Europe.

The autoimmune/inflammation segment is expected to experience steady growth in the coming years. The rise in autoimmune diseases, driven by lifestyle changes and an aging population, has significantly contributed to this trend. The increasing prevalence of these conditions has led to a surge in research and development investments in this therapeutic area. The growing focus on finding effective treatments for autoimmune diseases highlights the expanding market potential. This shift towards dedicated R&D spending is expected to continue, leading to the development of innovative therapies and solutions for autoimmune and inflammatory conditions.Service Type Outlook

The laboratory services segment led the market due to its increasing importance in clinical trials and the growing need for strict adherence to quality control and regulatory requirements. The use of advanced technology and the integration of skilled expertise in laboratory services play a key role in supporting the effective execution of clinical trials. These services provide essential resources that enhance trial processes, ensuring compliance, quality assurance, and efficiency. The continuous evolution of tools and services in the laboratory sector further contributes to the streamlined and effective conduct of clinical trials, meeting the demands of a rapidly growing market.

Patient Recruitment services is the fastest-growing in the market, as recruiting and retaining patients for clinical trials is a critical and challenging aspect of the trial process. Efficient patient recruitment strategies, such as digital platforms and patient registries, are crucial for the timely completion of trials. As more clinical trials are conducted, particularly for chronic and rare diseases, patient recruitment services will continue to be in high demand.

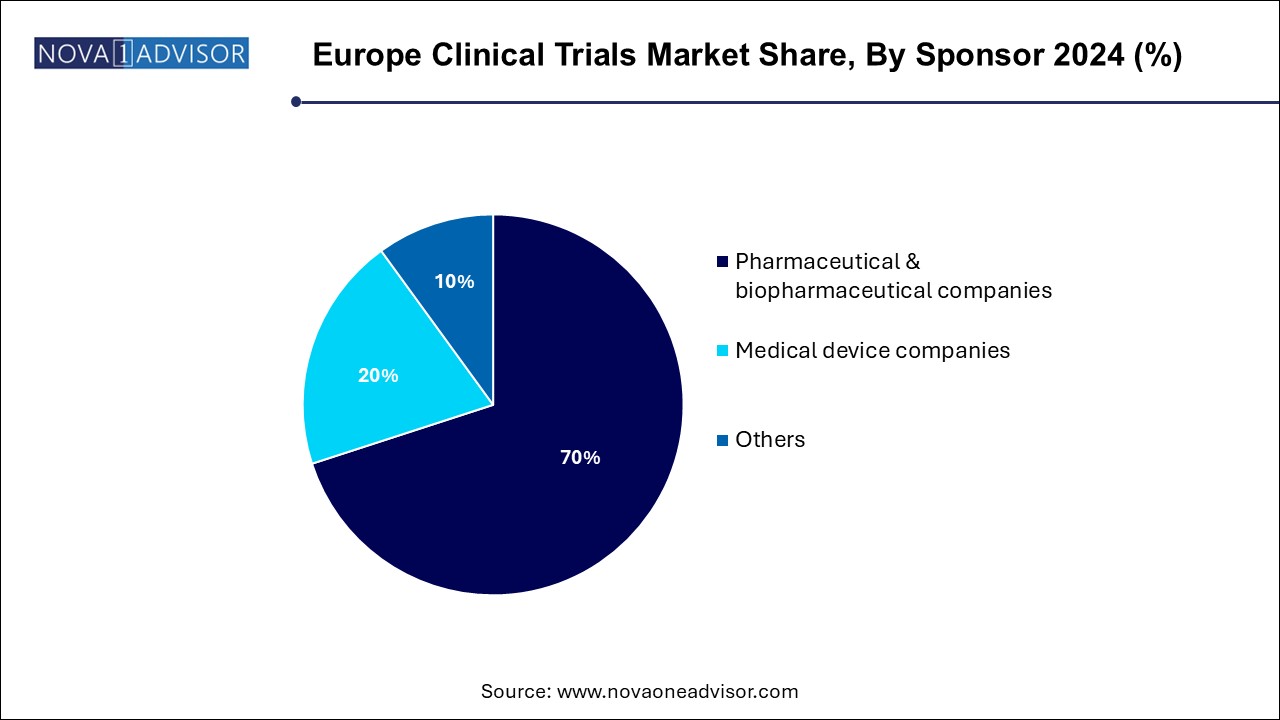

Pharmaceutical & biopharmaceutical companies dominate the sponsor segment in the Europe clinical trials market. These companies account for the largest share of clinical trial sponsorship, as they are primarily responsible for developing new drugs and therapies. The strong presence of pharmaceutical and biopharmaceutical companies in Europe is a key factor driving the growth of the clinical trials market.

Medical device companies are the fastest-growing sponsors of clinical trials. With the increasing focus on medical devices and diagnostics, companies in this sector are conducting more trials to evaluate the safety and effectiveness of their products. Regulatory changes in Europe, such as the MDR (Medical Device Regulation), are also driving this growth as medical device companies invest more in clinical trials to meet compliance requirements.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Europe clinical trials market

Phase

Study Design

Indication

Service Type

Sponsor

Regional