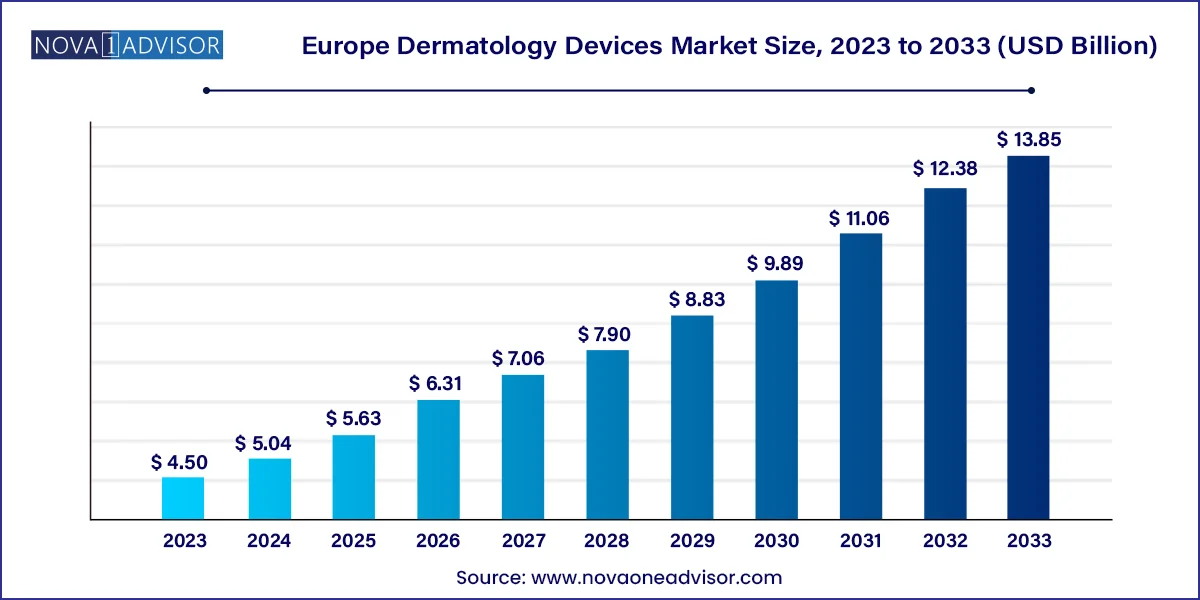

The Europe dermatology devices market size was exhibited at USD 4.50 billion in 2023 and is projected to hit around USD 13.85 billion by 2033, growing at a CAGR of 11.9% during the forecast period 2024 to 2033.

The Europe dermatology devices market is experiencing robust growth, propelled by rising incidences of skin disorders, increased demand for cosmetic procedures, and advancements in skin diagnostic technologies. With dermatology playing a pivotal role in both medical and aesthetic fields, there is growing demand for devices that enable faster, non-invasive, and more accurate detection and treatment of dermatological conditions. Europe’s aging population, coupled with lifestyle-induced skin issues such as acne, pigmentation, and skin cancer, further intensifies the need for technologically advanced dermatology equipment.

Medical tourism, especially for dermatological and cosmetic procedures, is thriving in countries like Spain, Germany, and Hungary due to high-quality services and cost advantages. At the same time, increasing awareness regarding early skin cancer diagnosis and routine skin check-ups has led to a surge in the adoption of diagnostic tools like dermatoscopes and imaging devices. Meanwhile, aesthetic applications including wrinkle removal, body contouring, and scar treatment are driving the demand for laser, light therapy, and microdermabrasion equipment.

The rise in outpatient dermatological clinics and the growing influence of social media on personal appearance are changing the dynamics of the market. Furthermore, the region's strong healthcare infrastructure, reimbursement policies for certain dermatological procedures, and emphasis on research and innovation collectively contribute to the expansion of the dermatology devices market across Europe.

Adoption of AI-integrated diagnostic devices for early detection of melanoma and other skin cancers is gaining traction.

Shift toward non-invasive and minimally invasive aesthetic procedures using laser and cryotherapy devices.

Growing popularity of at-home dermatology devices supported by tele-dermatology consultations.

Expansion of aesthetic clinics across urban and semi-urban areas to meet rising cosmetic dermatology demands.

Integration of augmented reality (AR) and imaging software for treatment planning and patient engagement.

Sustainable and eco-friendly device development initiatives led by European manufacturers to align with regional environmental goals.

Focus on multifunctional platforms that combine diagnostics and treatment capabilities in a single system.

Increase in dermatological clinical trials and collaborations between research institutions and device manufacturers.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.04 Billion |

| Market Size by 2033 | USD 13.85 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 11.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Germany; France; Italy; Spain; Switzerland; the Netherlands; Belgium; UK |

| Key Companies Profiled | Alma Lasers, Ltd.; Cutera, Inc.; Cynosure Inc.; Syneosite GmbH; Lumenis, Ltd.; Solta Medical; Bruker Corp.; Carl Zeiss; Candela Corp.; Genesis Biosystems, Inc.; TOOsonix A/S |

One of the key drivers of the Europe dermatology devices market is the rising incidence of skin cancer and other chronic skin conditions such as psoriasis, eczema, and acne. According to Eurostat, skin cancer is one of the most common cancers in Europe, with significant prevalence in Northern and Western European countries due to aging populations and high UV exposure. The growing awareness campaigns around early diagnosis and prevention, especially for melanoma and basal cell carcinoma, have propelled the use of diagnostic devices like dermatoscopes and digital imaging tools.

Additionally, dermatology clinics and hospitals are increasingly equipping themselves with advanced biopsy devices to obtain accurate tissue samples for timely cancer detection. These devices play a critical role not only in cancer diagnosis but also in monitoring treatment progress. The demand is further driven by dermatologists' preference for handheld, portable, and connected diagnostic tools that facilitate real-time data sharing and remote monitoring making dermatology care more accessible and efficient across the region.

Despite technological advancement, a major restraint hindering market growth is the high cost of dermatology equipment, especially treatment devices like lasers and cryotherapy systems. These devices come with steep initial investment costs, which often deter small clinics and independent dermatologists from adopting them. Moreover, recurring expenses related to maintenance, calibration, and staff training add to the operational burden.

For instance, aesthetic lasers used in hair removal and pigmentation correction require specialized handling and frequent component replacement to maintain precision and safety standards. Smaller facilities in countries like Belgium or rural areas of Spain may struggle to justify these expenses, especially if the patient volume is inconsistent. In addition, reimbursement for aesthetic dermatology treatments is limited in many European healthcare systems, putting the financial burden directly on patients and, by extension, influencing the procurement choices of service providers.

An emerging opportunity in the Europe dermatology devices market is the surging demand for cosmetic dermatology and aesthetic procedures. With a growing emphasis on physical appearance, particularly among millennials and Gen Z populations, there is an uptick in minimally invasive cosmetic procedures such as wrinkle reduction, skin tightening, and scar removal. This trend is fueled by social media influence and a wider cultural shift toward preventive aesthetics.

Laser devices, microdermabrasion tools, and light therapy equipment are witnessing a sharp rise in adoption across aesthetic clinics and wellness centers. Clinics are now investing in multi-functional treatment platforms that can handle a variety of applications, reducing the need for multiple devices. Furthermore, with increasing disposable incomes and the democratization of cosmetic procedures (especially in countries like Italy, France, and the UK), the aesthetic dermatology space is poised for rapid expansion. This creates significant growth avenues for manufacturers and service providers specializing in cosmetic-focused dermatology solutions.

Treatment devices dominated the Europe dermatology devices market, owing to their widespread use in aesthetic procedures and therapeutic interventions. Among them, laser-based devices lead the segment, widely utilized in hair removal, pigmentation correction, acne scar treatment, and vascular lesion removal. Their non-invasive nature and precise application make them a preferred option for both providers and patients. Electrosurgical equipment and cryotherapy devices are also in demand, especially in dermatological surgery and wart removal. Light therapy devices are gaining popularity in treating psoriasis and acne, as they provide a safer alternative to long-term medication. The rising popularity of non-invasive procedures across Europe’s wellness centers further boosts the demand for these technologies.

Meanwhile, diagnostic devices are witnessing the fastest growth, particularly due to technological innovation and increased emphasis on early disease detection. Dermatoscopes, for instance, are being integrated with AI-based image analysis software for more accurate melanoma diagnosis. Biopsy devices are gaining traction in clinical settings, especially in dermatology departments of hospitals. The rising skin cancer rates across Europe and greater awareness about skin screenings have led to broader adoption of these devices in both public and private healthcare systems. Imaging systems are being increasingly used for mole mapping, lesion tracking, and progress monitoring during treatments—expanding their role from diagnosis to prognosis.

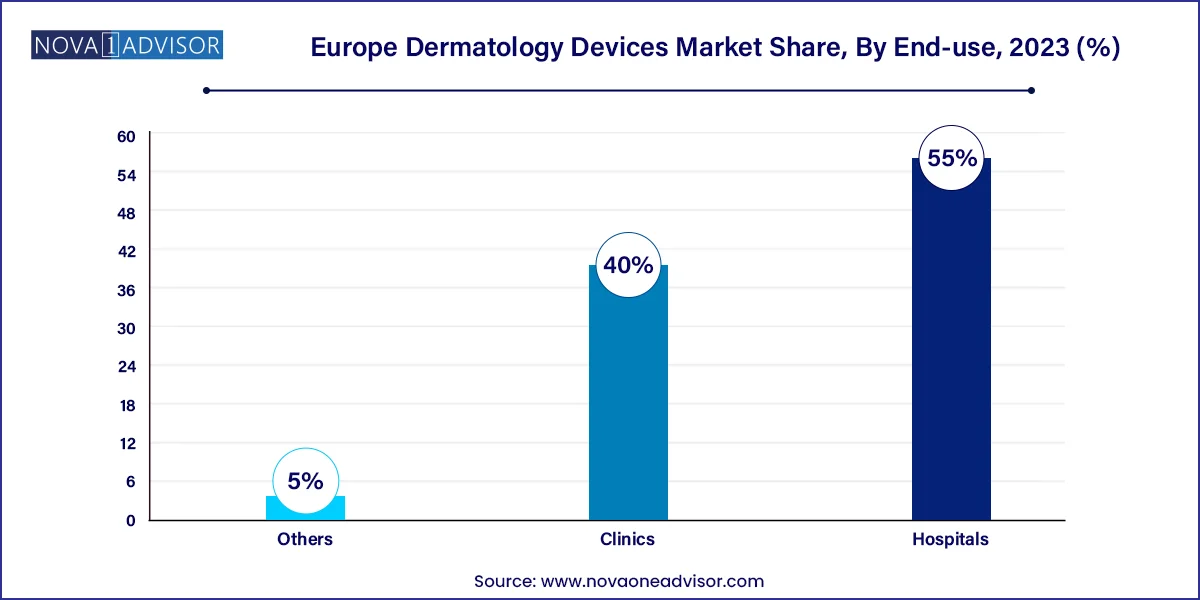

Hospitals dominated the end-use segment, driven by their comprehensive dermatology departments and capacity to invest in advanced medical devices. European hospitals are equipped with multidisciplinary teams that handle both diagnostic and therapeutic dermatology services, including surgeries, cancer screenings, and complex treatment procedures. Hospitals are often preferred for critical skin conditions due to their access to biopsy labs, imaging infrastructure, and trained professionals. Additionally, hospitals tend to participate in clinical trials and research collaborations, enhancing their capacity to use and evaluate emerging technologies.

Clinics represent the fastest-growing end-use segment, especially those focused on cosmetic dermatology. Private dermatology and aesthetic clinics are proliferating across urban areas in the UK, Germany, and Italy, offering specialized services in skin rejuvenation, laser hair removal, and anti-aging therapies. These clinics are more agile than hospitals, often quicker to adopt the latest laser and microdermabrasion equipment. The trend of boutique dermatology centers is particularly strong in countries like France and Switzerland, where consumers are willing to pay a premium for personalized skincare services and advanced cosmetic treatments.

Germany

Germany leads the Europe dermatology devices market, attributed to its advanced healthcare infrastructure, large population base, and high awareness of skin health. The country sees high demand for both diagnostic and cosmetic dermatology services. Leading hospitals and clinics in cities like Berlin, Munich, and Frankfurt are equipped with state-of-the-art laser and light therapy devices, and the country’s strong reimbursement system supports skin cancer screenings and treatments.

France

France boasts a strong presence in cosmetic dermatology, with Paris being a global hub for aesthetic procedures. French clinics are highly competitive, investing in the latest treatment devices such as fractional lasers and cryotherapy tools. Moreover, France is home to several dermatology device manufacturers and cosmetic brands, fostering innovation and integration of skincare and technology.

Italy

Italy is rapidly emerging in the aesthetic dermatology space, particularly in cities like Milan and Rome. There is growing consumer demand for skin rejuvenation and anti-aging treatments, spurring adoption of microdermabrasion and light therapy devices. Italian dermatologists are increasingly embracing new diagnostic tools like high-resolution dermatoscopes for routine checks.

Spain

Spain is a leading destination for medical tourism, including dermatological and cosmetic treatments. The country’s coastal regions experience high UV exposure, increasing the prevalence of skin disorders and the demand for diagnostic tools. Aesthetic centers across Madrid and Barcelona are expanding service offerings using energy-based devices.

Switzerland

Known for its precision medicine and high-quality healthcare services, Switzerland has a growing market for dermatology devices, especially in private clinics. Swiss clinics emphasize non-invasive cosmetic treatments and have high adoption rates of the latest aesthetic lasers and cryotherapy equipment.

The Netherlands

The Netherlands is investing in digital health, and dermatology is no exception. Dutch dermatologists are leveraging smart dermatoscopes and remote diagnostic tools to serve patients efficiently. Light-based acne therapies and cryosurgical procedures are common in both public hospitals and private clinics.

Belgium

Belgium has a strong clinical dermatology ecosystem, with several academic hospitals conducting dermatology research and trials. The country sees growing use of biopsy and imaging tools for cancer detection, while also witnessing increased demand for aesthetic dermatology in cities like Brussels and Antwerp.

United Kingdom

The UK dermatology devices market is driven by a mix of NHS-funded dermatology care and a booming private aesthetic market. While NHS hospitals focus on skin cancer diagnosis and chronic condition treatment, private clinics are investing heavily in microdermabrasion and light therapy systems. London, in particular, is a hotspot for cosmetic dermatology innovations.

Lumenis, a key player in dermatological lasers, announced in February 2025 the expansion of its M22 multi-application platform across clinics in Germany and the UK, supporting procedures like vascular lesion treatment and skin rejuvenation.

Fotona introduced its next-gen StarWalker MaQX laser system in October 2024, which has been adopted by aesthetic clinics in France and Italy for tattoo removal and melasma treatment.

In January 2025, Canfield Scientific partnered with a leading dermatology group in the Netherlands to deploy its AI-powered Vectra WB360 imaging system for full-body skin analysis.

Cutera Inc., in December 2024, launched a new clinic-centric training program across European cities to facilitate the use of its xeo aesthetic platform, including IPL and Nd:YAG lasers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe dermatology devices market

Product

End-use

Country