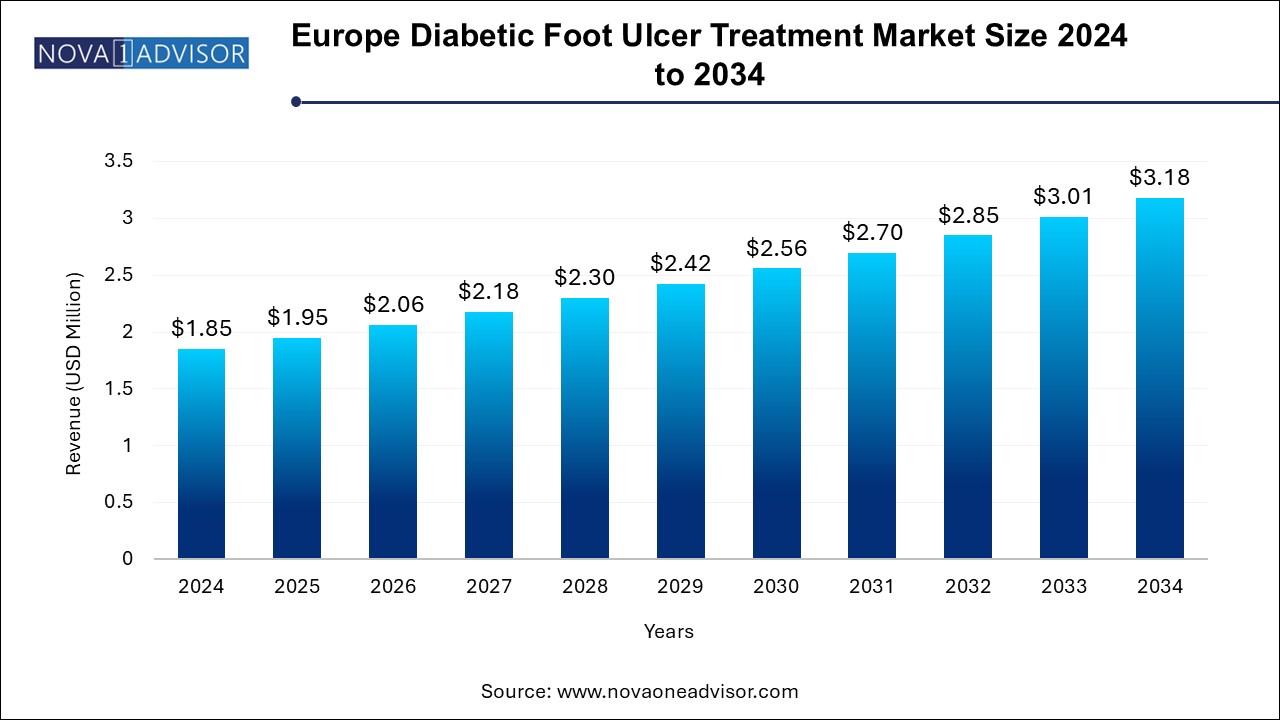

The Europe diabetic foot ulcer treatment market size was exhibited at USD 1.85 billion in 2024 and is projected to hit around USD 3.18 billion by 2034, growing at a CAGR of 5.55% during the forecast period 2025 to 2034.

The Europe Diabetic Foot Ulcer (DFU) Treatment Market is emerging as a critical frontier in diabetic care, underpinned by the rising prevalence of diabetes, aging populations, and increasing public healthcare expenditures. Diabetic foot ulcers, a serious complication of diabetes mellitus, result from peripheral neuropathy, vascular impairment, or a combination of both. If untreated, these chronic wounds can progress to infection, gangrene, and ultimately, amputation. In Europe, with diabetes affecting over 60 million people, the burden of diabetic foot complications is immense—clinically, socially, and economically.

The DFU treatment market in Europe encapsulates a broad range of interventions including wound care dressings, biologics, therapy devices (e.g., negative pressure wound therapy systems), antibiotics, and surgical debridement. Innovations such as bioengineered skin substitutes, antimicrobial dressings, and growth factor therapies are driving clinical progress. However, healthcare systems are grappling with cost constraints, uneven access across countries, and variations in treatment protocols.

An aging population across Europe, especially in countries like Germany, Italy, and the UK, is leading to a higher incidence of diabetes and related complications. Additionally, lifestyle factors such as sedentary behavior, obesity, and smoking are exacerbating the risk. Governments, hospitals, and private companies are thus intensifying focus on preventive care, early diagnosis, and integrated wound management strategies to reduce amputation rates and improve patient outcomes.

Europe's sophisticated healthcare infrastructure, regulatory emphasis on quality of care, and proactive investment in chronic disease management position the region as a vital landscape for diabetic foot ulcer treatment innovation and adoption.

Surge in Adoption of Advanced Wound Care Dressings

Hydrocolloids, foam dressings, alginates, and silver-based dressings are increasingly being preferred over traditional gauze due to superior moisture retention, infection control, and healing acceleration.

Integration of Biologics and Growth Factor Therapies

The market is witnessing growing acceptance of platelet-derived growth factors, recombinant proteins, and bioengineered skin equivalents that actively stimulate tissue regeneration.

Rise of Negative Pressure Wound Therapy (NPWT)

NPWT systems are gaining momentum in hospital and homecare settings for their efficacy in promoting granulation tissue and reducing healing time.

Digital Health and Remote Monitoring for Ulcer Management

Mobile wound care apps and telemedicine platforms are being piloted in regions like Scandinavia, enabling remote tracking and timely intervention for high-risk patients.

Focus on Multidisciplinary Care Teams

Diabetic foot clinics are adopting a team-based approach—combining endocrinologists, vascular surgeons, podiatrists, and wound care specialists for holistic patient care.

Reimbursement Policy Reforms Across Europe

Countries are revamping reimbursement frameworks to include novel DFU treatments, driving faster adoption and accessibility.

Sustainability and Eco-conscious Manufacturing

European wound care companies are exploring biodegradable dressings and low-impact manufacturing in response to environmental regulations and green procurement policies.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.95 Billion |

| Market Size by 2033 | USD 3.18 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.55% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Treatment, Ulcer Type, End-use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | ConvaTec Group PLC; Acelity L.P. Inc.; 3M Health Care; Coloplast Corp.; Smith & Nephew Plc.; B. Braun SE; Medline Industries, LP; Organogenesis, Inc.; Molnlycke Health Care AB; Medtronic. |

A key driver of the Europe diabetic foot ulcer treatment market is the alarming rise in diabetes prevalence. The International Diabetes Federation (IDF) estimates that over 9% of Europe’s adult population lives with diabetes, and the figure is rising due to aging, obesity, and lifestyle changes. Among diabetics, up to 25% are expected to develop a foot ulcer in their lifetime, with recurrence rates remaining high even after healing.

This creates an urgent need for robust wound management solutions. DFUs are not only a major source of patient morbidity but also place substantial economic pressure on healthcare systems. For instance, diabetic foot care accounts for nearly one-third of diabetes-related spending in countries like the UK and Germany. The increasing burden has led to policy-level responses, with investments in early screening, education, and access to advanced wound treatment solutions. Public hospitals and private clinics are adopting cutting-edge products, including collagen-based wound dressings, oxygen therapy systems, and antimicrobial coatings, to reduce healing times and prevent amputations.

While advanced therapies such as skin substitutes, recombinant growth factors, and NPWT have proven efficacy, their high cost acts as a substantial barrier, particularly in budget-constrained public healthcare systems. Many DFU patients are elderly, retired, or from lower socio-economic groups, making out-of-pocket payment for premium treatments unfeasible.

Additionally, disparities in reimbursement policies across European countries compound the challenge. In some Eastern European regions, access to modern biologics or high-tech wound care devices is limited due to funding restrictions or regulatory delays. Hospitals and clinicians are often compelled to rely on conventional dressings, which may lead to suboptimal outcomes. Furthermore, lack of specialized wound care training among general practitioners results in inconsistent treatment approaches, delaying healing and increasing complication rates.

An emerging opportunity in the European diabetic foot ulcer treatment landscape is the shift toward home-based care models. With rising patient volumes, healthcare systems are prioritizing early discharge and outpatient wound management to reduce hospital burden. In this context, portable NPWT systems, antimicrobial dressings with extended wear time, and digital wound tracking platforms are gaining importance.

Remote monitoring tools, including AI-powered wound assessment apps and teleconsultation portals, are enabling clinicians to follow up with patients in real-time, without requiring in-person visits. Countries like Sweden, Denmark, and the Netherlands are leading in piloting such technologies. The combination of advanced dressings and connected care can significantly improve adherence, detect complications early, and personalize treatment regimens—improving outcomes while reducing long-term healthcare costs.

The neuro-ischemic ulcers segment held the largest market share of 53.10% in 2024. As vascular complications among diabetics are becoming more prevalent with aging populations. These complex ulcers involve both poor perfusion and neuropathy, leading to delayed healing and higher infection risk. Their management requires comprehensive approaches including vascular surgery, debridement, and advanced topical therapies. The rising burden of peripheral artery disease (PAD) in Europe is making neuro-ischemic ulcers a growing challenge in both clinical and community care settings.

The neuropathic ulcer segment is expected to grow rapidly over the forecast period. These ulcers typically occur on weight-bearing areas of the foot, resulting from pressure points and unnoticed trauma due to loss of sensation. Neuropathic DFUs are frequently seen in type 2 diabetic patients with long-standing disease and poor glycemic control. They are often easier to manage compared to ischemic or mixed ulcers, provided early intervention and offloading strategies are implemented.

The biologics segment dominated the market, with a 36.37% share in 2024, As clinicians seek more targeted and regenerative options for complex or non-healing ulcers. Biologics include growth factor therapies, extracellular matrix proteins, and skin substitutes derived from human or animal sources. Though initially limited to specialized settings due to high cost, broader clinical acceptance and growing evidence of efficacy are expanding their use. Biologics offer promising results in chronic and infected DFUs where conventional dressings fail, particularly in high-risk patients with ischemic complications or severe neuropathy.

The therapy devices segment is expected to register the fastest CAGR from 2025 to 2034. Foam, hydrocolloid, hydrogel, and silver dressings are used to maintain a moist wound environment, absorb exudate, and promote faster healing. These dressings are frontline therapies for both outpatient and inpatient care, with manufacturers like Mölnlycke and Smith & Nephew introducing advanced variants that deliver antimicrobial action and pressure relief. The segment benefits from high clinician familiarity and broad reimbursement across most European markets.

The homecare segment accounted for a share of 52.85% in 2024 and is expected to grow fastest during the forecast period. Patients with stable ulcers are increasingly managed through home visits by wound care nurses or through self-care with remote oversight. Manufacturers are responding with patient-friendly devices and dressings that are easier to apply, monitor, and remove. In countries like the UK and Sweden, digital wound care platforms are being trialed to provide real-time support and early complication alerts, making home-based care both feasible and effective.

Hospitals and clinics dominate the end-use channel segment, largely due to the complexity of DFU management and the need for multidisciplinary care. Most initial diagnoses, severe infections, and surgical interventions (such as debridement or revascularization) are conducted in hospital settings. European hospitals are typically equipped with dedicated diabetic foot clinics or podiatry departments, often supported by national health services. These facilities also serve as key access points for biologics and NPWT devices under insurance coverage.

Germany Dominates the European DFU Treatment Market

Germany is the largest market in Europe for diabetic foot ulcer treatments, attributed to its high diabetes prevalence, robust healthcare infrastructure, and widespread adoption of advanced medical technologies. With over 8 million diagnosed diabetics and a well-established system of podiatry and endocrinology clinics, the country has institutionalized preventive and curative diabetic foot care. Reimbursement frameworks under statutory health insurance cover a wide range of wound care products, therapy devices, and biologics, encouraging both physicians and patients to opt for optimal treatments. Furthermore, Germany is home to leading companies such as B. Braun and Lohmann & Rauscher, which continue to innovate in the wound care segment.

Sweden is the Fastest-Growing Country in the Region

Sweden is rapidly emerging as a growth hub in the diabetic foot ulcer treatment market due to its progressive adoption of digital health technologies and structured chronic disease programs. With a smaller yet highly coordinated healthcare system, Sweden is piloting digital wound care applications that allow remote tracking, documentation, and image-based assessments of DFUs. Additionally, the country’s commitment to early intervention, patient education, and interdisciplinary clinics has led to a measurable decline in amputation rates. Investments in personalized care and sustainability-focused healthcare innovations are propelling Sweden into a leadership role in diabetic wound care modernization.

Smith & Nephew, in January 2024, announced the launch of its next-generation negative pressure wound therapy (NPWT) device, PICO 7Y, in select European markets, targeting outpatient DFU management.

Mölnlycke Health Care, headquartered in Sweden, introduced a biodegradable antimicrobial dressing line under the name Mepilex Eco in October 2023, focusing on sustainability in wound care.

Organogenesis, a biologics company, expanded its presence in Europe in December 2023 by partnering with regional distributors to promote its Apligraf and Dermagraft skin substitute products for chronic wound applications.

Essity (BSN medical), in March 2024, launched a DFU-specific educational platform across the UK and Germany aimed at improving clinical practices and product knowledge among wound care professionals.

Convatec Group, in November 2023, rolled out its revamped Aquacel Ag+ Extra range with improved exudate management and infection control targeting diabetic foot ulcers and surgical wounds.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe diabetic foot ulcer treatment market

Treatment

Type

End-use Channel

Country