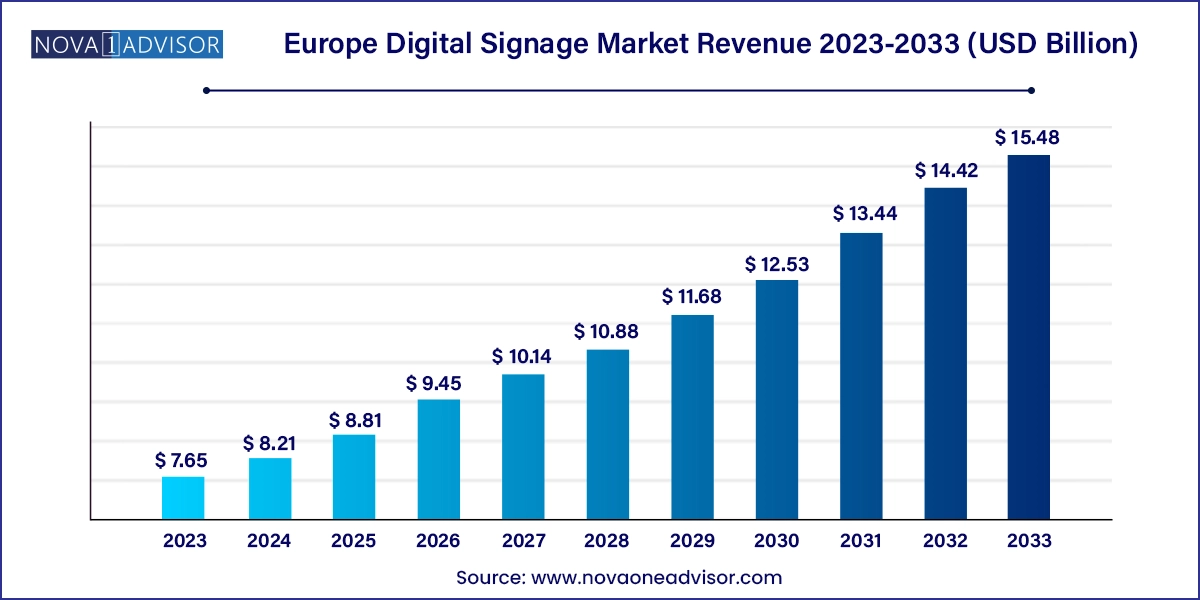

The Europe digital signage market size was exhibited at USD 7.65 billion in 2023 and is projected to hit around USD 15.48 billion by 2033, growing at a CAGR of 7.3% during the forecast period 2024 to 2033.

The digital signage market in Europe is undergoing rapid and dynamic transformation, reflecting broader trends in consumer engagement, technological evolution, and smart city infrastructure. Digital signage refers to the use of digital displays, such as LED, LCD, OLED, or projection, to convey information, advertisements, or interactive content in public and private settings. From retail storefronts and transport terminals to healthcare facilities and corporate boardrooms, these systems are now embedded into the visual and functional landscape of modern Europe.

As Europe transitions toward a more digitized and connected economy, businesses and governments are increasingly leveraging digital signage for its high-impact, customizable, and real-time communication capabilities. These solutions are used to advertise, inform, entertain, and guide—tailoring content based on audience demographics, time, weather, or promotional strategies. Integration with IoT, artificial intelligence, and cloud-based content management systems (CMS) has made modern digital signage systems smarter, more flexible, and increasingly cost-effective.

Furthermore, the COVID-19 pandemic accelerated demand for contactless information and digital wayfinding solutions in airports, hospitals, and corporate buildings. Post-pandemic, these trends have evolved to include interactive kiosks for self-service, QR code integration, and even touchless gesture-based controls. In highly urbanized markets like the UK, Germany, and France, adoption is further driven by smart retail strategies, public infrastructure modernization, and environmental sustainability goals that promote paperless communication.

The European Union’s investments in green and digital transitions, along with stricter advertising regulations, are also influencing the design and deployment of digital signage. As such, digital signage has become a strategic tool not just for marketing but for enhancing user experiences, accessibility, and operational efficiency across sectors.

Growth of Smart and AI-Powered Signage: Real-time audience analytics, facial recognition, and AI-driven content scheduling are being integrated into signage systems.

Wider Adoption in Transportation and Smart Cities: Real-time traffic updates, wayfinding, and safety messaging are key applications across metro stations and airports.

Eco-Friendly and Energy-Efficient Displays: OLED and LED displays with lower energy consumption and longer lifespan are replacing traditional signage.

Rise of Interactive Kiosks and Self-Service Systems: Retailers, banks, and healthcare providers are adopting kiosks for check-ins, information access, and queue management.

Cloud-Based CMS for Remote Operations: Businesses are centralizing content updates through cloud platforms, enabling synchronized and scalable digital networks.

DOOH (Digital Out-of-Home) Advertising Expansion: Outdoor digital billboards are becoming more prevalent across urban European cityscapes.

Increased Use in Education and Healthcare: Universities and hospitals use digital signage for announcements, patient guidance, and emergency communication.

In-store Personalization and Dynamic Promotion: In retail, real-time promotions based on demographics, time-of-day, or stock levels are being enabled through integrated signage.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.21 Billion |

| Market Size by 2033 | USD 15.48 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Location, Type, Component, Application, Size, Content Type, Technology, and Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Japan; China; India; Australia; South Korea; RoAP |

| Key Companies Profiled | Samsung Display Solutions (Samsung Electronics Co. Ltd.); LG Display Co. Ltd.; Innolux Corp.; FocusNeo AB; Raystar Optronics Inc.; Adversign Media GmbH; OSRAM OLED GmbH; ST Digital; Winstar Display Co. Ltd.; Visionbox Co. Ltd. |

A key driver of the European digital signage market is the increasing digitization of consumer engagement strategies across multiple industries, particularly retail, hospitality, and transportation. As businesses strive to create immersive brand experiences, digital signage is replacing static communication with dynamic content tailored to user profiles and real-time inputs.

In retail, large-format displays, digital menu boards, and end-cap screens are used to influence purchasing decisions and elevate brand presence. For example, luxury boutiques in Paris and London utilize transparent OLED signage to project product details without obstructing window displays. Supermarkets like Tesco and Carrefour have adopted digital shelf labels and promotional signage that can be updated instantly.

In transport, airports such as Heathrow and Frankfurt use large-format displays and interactive kiosks to assist with passenger information, flight updates, and advertisements. Public buses and train stations are increasingly outfitted with LED screens for civic announcements, news feeds, and safety protocols.

This broad integration of digital signage is fundamentally transforming how consumers receive information, interact with services, and make decisions—making it a strategic imperative for modern business models.

Despite its long-term advantages, the adoption of digital signage faces resistance due to the high initial capital investment required. This includes the cost of displays, media players, mounting equipment, installation, and software licensing. Businesses must also account for ongoing maintenance, content creation, and periodic hardware upgrades.

Smaller enterprises and institutions with limited IT infrastructure or tight operational budgets may delay or avoid deployment altogether. Additionally, outdoor displays often require weatherproof enclosures, vandal-resistant housings, and higher brightness ratings, which add to cost.

Though the price of LCD and LED panels has declined significantly over the past decade, sophisticated systems like video walls, curved displays, or interactive kiosks remain relatively expensive. Cost constraints also limit adoption of advanced features such as AI-powered analytics or 4K/8K resolution, particularly in less-developed regions or secondary markets within Europe.

A growing opportunity for the digital signage market lies in its integration with Europe’s smart infrastructure and sustainability initiatives. The European Union is investing heavily in digital transformation, energy-efficient urban infrastructure, and smart mobility—areas where digital signage can play a central role.

For instance, in the UK’s smart city pilots, digital signage is being embedded in lamp posts, traffic systems, and public spaces to relay real-time data. These displays provide interactive wayfinding, environmental alerts, emergency notifications, and traffic diversions—making cities more responsive and citizen-friendly.

Digital signage is also being used in green building certifications, replacing paper posters with digital directories and dashboards for energy usage. As part of Europe’s "Green Deal," cities are increasingly mandating sustainable communication solutions in new construction and public facility retrofits.

The convergence of signage with IoT devices, edge computing, and environmental sensors creates a future-ready platform capable of adapting to the evolving needs of connected, data-driven urban life. For digital signage vendors, this presents a multi-billion-euro opportunity across public and private projects.

In-store signage dominates, offering point-of-purchase influence and immersive brand experiences. From digital menus in quick-service restaurants to promotional screens at supermarket ends, in-store signage directly influences buyer behavior.

Out-store signage is the fastest-growing, particularly digital billboards and building wraps used in urban advertising. The DOOH ecosystem in Europe is rapidly expanding, with companies investing in weatherproof, high-lumen displays to engage audiences on roads, in plazas, and on building exteriors.

Kiosks dominate the market, especially in their interactive and self-service forms. Interactive kiosks are heavily deployed in malls, airports, train stations, and healthcare institutions across Europe. Retailers such as Decathlon and Zara use kiosks for product lookup, stock checks, and digital fitting rooms. In healthcare, self-service kiosks are used for patient check-in, queue management, and information dissemination—reducing staff workload and improving patient experience.

Video walls are the fastest-growing segment, thanks to their application in transportation hubs, corporate headquarters, and entertainment venues. These large, seamless multi-panel displays offer an immersive experience ideal for brand storytelling, exhibitions, or mission-critical dashboards. Their popularity is surging in luxury showrooms and smart boardrooms that require high-resolution, large-format content.

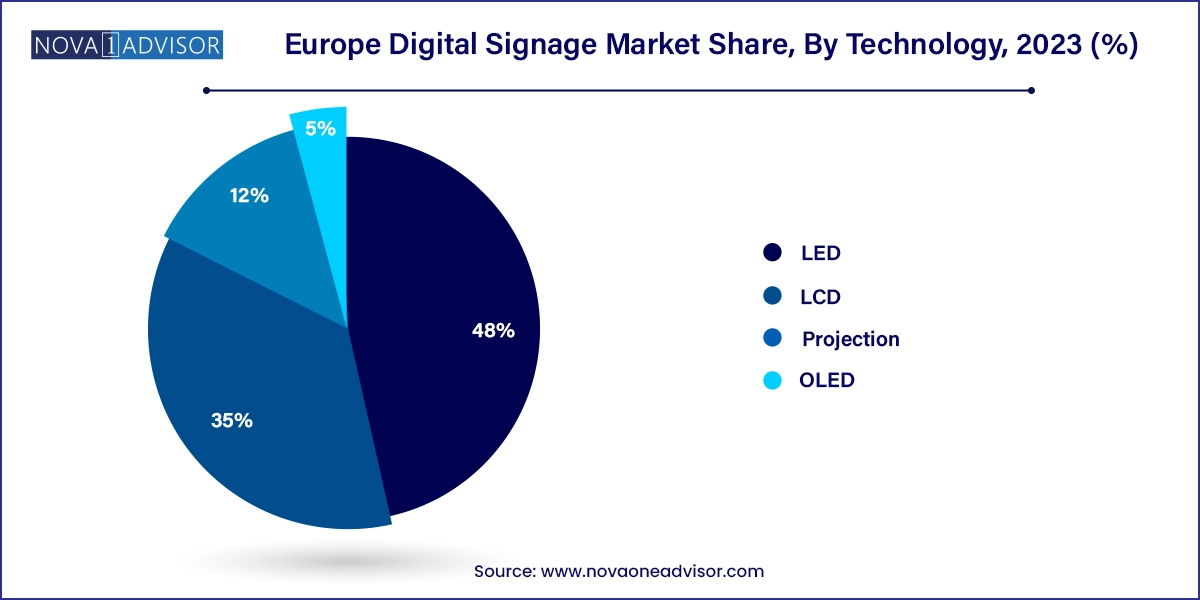

Hardware remains the largest component segment, driven by demand for displays, media players, and projectors. LCD and LED screens are most common, while OLED and 4K/8K displays are gaining ground in high-end applications. Media players have evolved to include AI-based rendering and analytics capabilities. European hardware vendors are collaborating with software developers to offer bundled solutions that simplify procurement and compatibility.

Software is the fastest-growing segment, particularly content management systems (CMS) that allow remote, cloud-based scheduling and analytics. As networks scale, businesses prefer centralized control over localized updates. AI-enabled software is also being used for real-time content adaptation based on viewer demographics and location-specific data. Subscription-based SaaS models are making advanced capabilities accessible to SMEs.

Retail remains the largest application sector, where digital signage is integral to branding, promotion, product information, and customer engagement. Supermarkets use digital shelf displays for dynamic pricing, while fashion retailers offer smart mirrors and virtual try-ons powered by digital displays. European high streets are increasingly adopting signage as a replacement for traditional posters and window cards.

Transport is the fastest-growing application, especially with the modernization of train networks, airports, and urban mobility solutions. Real-time information on arrivals, departures, delays, and wayfinding is now standard in hubs such as Paris Charles de Gaulle, Heathrow, and Berlin Brandenburg Airport. Bus shelters and metro stations also deploy digital signage for advertising and public messaging.

32 to 52 inches displays dominate, offering a practical balance between visibility and affordability. These sizes are used in store aisles, reception desks, bank counters, and corporate hallways.

More than 52 inches is the fastest-growing segment, used in video walls, stadiums, auditoriums, and high-traffic transport areas. Large format signage enhances visibility, engagement, and information retention—making it ideal for impact-driven communication.

Non-broadcast content accounts for the largest share, comprising targeted promotions, instructional messages, branding, and interactive experiences. Retailers and corporate offices use customized non-broadcast content to influence engagement and behavior in real-time.

Broadcast content, particularly news and weather, is increasingly integrated into signage systems, especially in public venues, banking, and healthcare. Digital signage platforms now syndicate feeds from licensed media sources to keep audiences informed while promoting brand content alongside.

LED technology dominates the market, offering superior brightness, energy efficiency, and outdoor visibility. It’s the preferred technology for DOOH advertising, stadium screens, and retail display façades. European cities like Berlin, Milan, and Amsterdam are adorned with high-brightness LED installations for public and promotional content.

OLED is the fastest-growing technology, known for its thin, flexible, and vibrant displays. Retailers and car showrooms are adopting OLED for premium branding, while museums and luxury hotels use transparent OLEDs for content layering and aesthetic enhancement. Although cost remains high, its visual appeal and design flexibility are driving adoption in niche applications.

The UK leads the European digital signage market with mature retail, finance, and hospitality sectors. London’s underground, airports, and shopping districts like Oxford Street showcase cutting-edge DOOH and interactive kiosks. UK-based retailers like Tesco and Boots use advanced CMS platforms for real-time promotion updates. Additionally, smart city initiatives are integrating signage into urban planning for sustainable communication.

Germany is a strong contender due to its robust manufacturing, corporate, and public infrastructure sectors. Airports like Frankfurt and Munich use extensive signage systems for navigation and advertising. German car manufacturers deploy OLED signage in showrooms and exhibitions, enhancing brand appeal. Regulatory focus on green buildings is also encouraging use of digital directories and eco-friendly displays.

France is emerging as a vibrant market, particularly in the luxury retail, arts, and hospitality sectors. Parisian shopping avenues, museums, and hotels use digital signage for immersive storytelling and brand elevation. Additionally, the French government is funding smart infrastructure development across provinces, which includes real-time transit signage and civic communication systems.

April 2025 – LG Electronics unveiled its Transparent OLED Signage in collaboration with a luxury retailer in Paris, showcasing its high-end use in window displays.

March 2025 – Samsung Electronics Europe launched its XHB Series outdoor signage in Germany, offering 4,000-nit brightness for ultra-sunny environments.

February 2025 – Scala (a STRATACACHE company) expanded its CMS platform integration with NEC displays in UK-based smart retail pilot programs.

January 2025 – ViewSonic Europe released its new all-in-one LED solution for conference rooms and classrooms, targeting education and corporate clients in France and Germany.

November 2024 – Philips Professional Display Solutions introduced a new green signage initiative in collaboration with eco-labeled display manufacturers in Scandinavia.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Europe digital signage market

Type

Component

Technology

Application

Location

Content Category

Size

Country